Sandra Rafferty

Biography

Overview

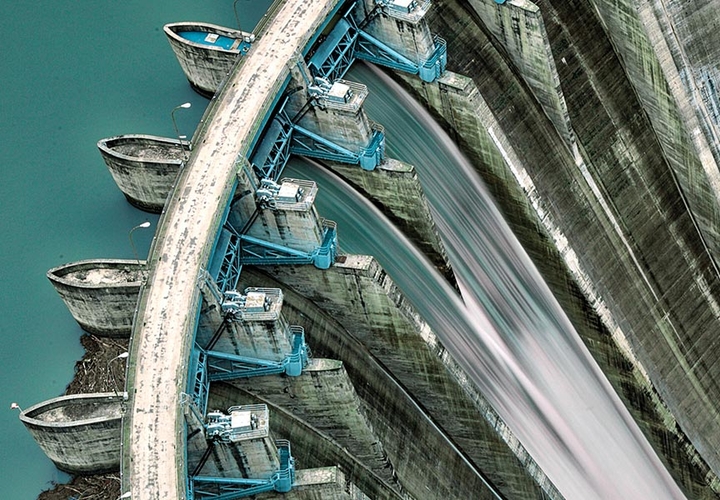

Sandra is a partner in our global M&A and Corporate practice in London and a member of the EMEA Private Equity team and specializes in the infrastructure, energy, energy transition and renewables sectors. She is highly experienced across the range of corporate work advising a mixture of infrastructure funds, pension funds and other financial investors. Major areas of work include mergers and acquisitions, where Sandra is particularly strong in cross-border M&A, post-acquisition integration, disposals, joint ventures, consortium agreements, co-investments, restructuring and corporate governance.

Sandra is recommended by Legal 500 for corporate/ M&A and attracts high praise, being described as "excellent" and energetic". Sandra is also ranked in the top tier of Chambers for Infrastructure: PFI/PPP and is described as "very commercial and very solution driven". She is also rated as having a "wealth of experience in the sale and acquisition of a wide range of infrastructure assets".

Experience

Representation of Hermes Infrastructure on the acquisition of a 74 percent stake in a €950 million Spanish toll road concession from ACS Group*

Representation of Octopus Renewables Infrastructure Trust plc on the acquisition of a portfolio of solar PV assets with a capacity of 122.8MW for a consideration of up to £150 million*

Representation of Universities Superannuation Scheme ("USS") on its acquisition of a further 12.5 percent shareholding (to increase its interest to 37.5 percent) from Macquarie in a company holding a portfolio of offshore wind projects including the Galloper, Westermost Rough and Rampion wind farms*

Representation of Columbia Threadneedle Sustainable Infrastructure Fund on the entering into of its partnership agreement with Smart Metering Systems plc ("SMS") to develop SMS's pipeline of carbon reduction asset opportunities*

Representation of Basalt Infrastructure Partners on the follow-on investment into North Star Holdco Limited for the acquisition of Boston Putford Offshore Safety Ltd from SEACOR Marine Holdings Inc.*

Representation of Basalt Infrastructure Partners on the disposal of the McEwan Power portfolio comprising 10 solar parks to Arjun Infrastructure Partners, and acting on the original acquisitions of all the solar parks*

Representation of BBGI in relation to its bid for the Beatrice OFTO*

Representation of First State Investments on its bid for Gdańsk Port*

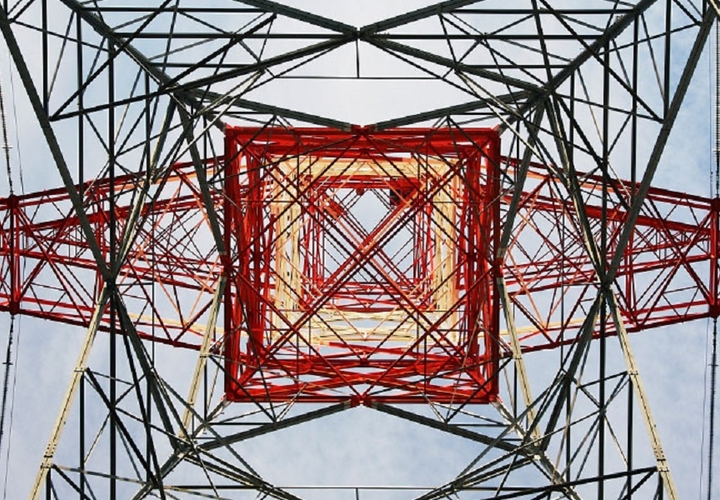

Representation of a bidder seeking to acquire a stake in Spain's Telecom Castilla-La-Mancha S.A., the third largest independent TowerCo in Spain and no.1 provider of telecommunication and broadcasting services across the Castilla-La Mancha region*

Representation of Quad Gas consortium (comprising MIRA, Allianz Capital Partners, QIA, Amber, Dalmore, Hermes and CIC) on its purchase of a 61 percent stake in National Grid's £13.8 billion UK gas distribution business and on the consortium agreement for the Quad Gas Group*

* Experience prior to joining White & Case

Bank 1 ranking, Chambers Infrastructure: PFI/ PPP UK 2019