Belt and Road Initiative (BRI)

Belt and Road Initiative (BRI) overview

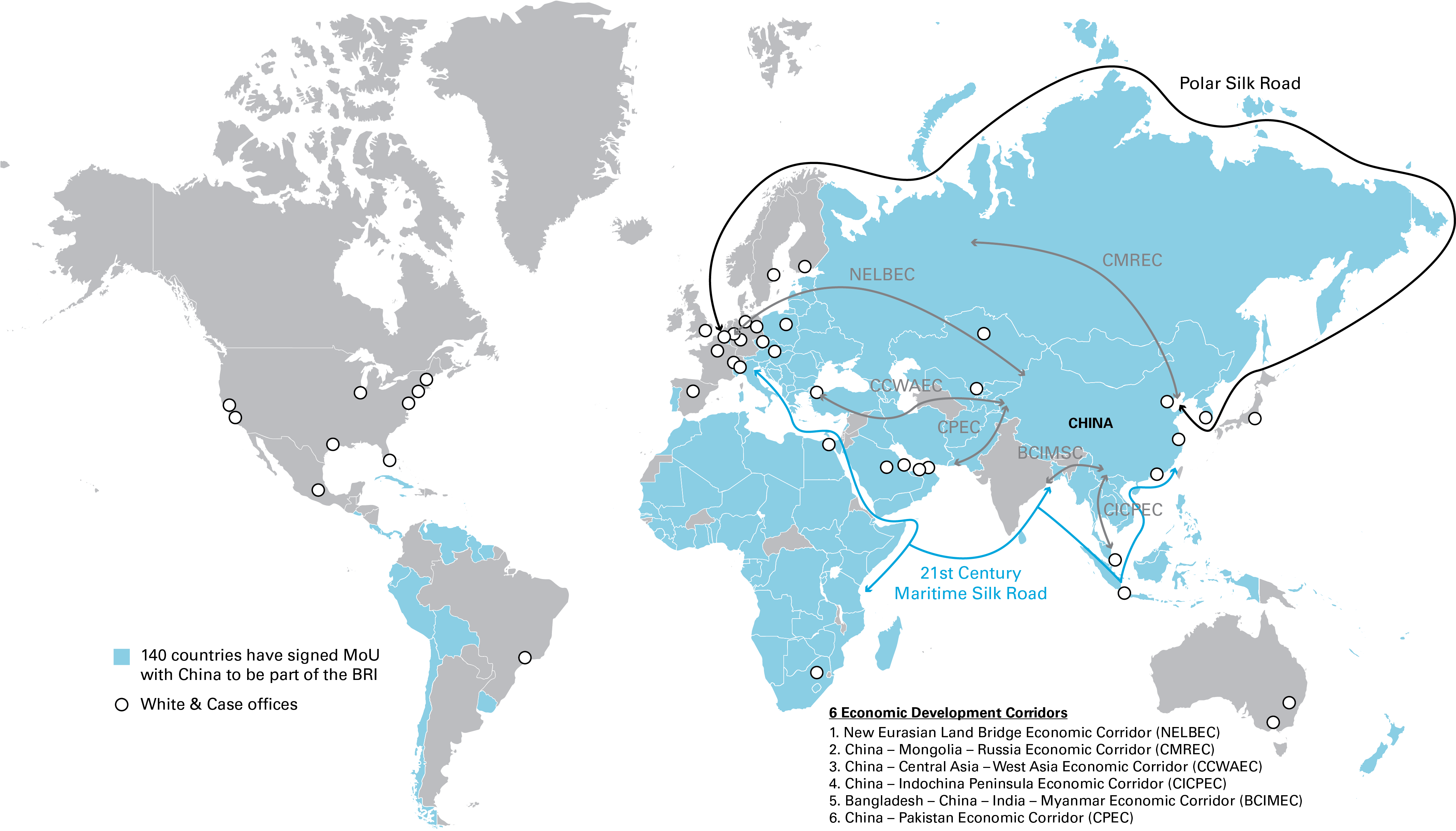

The Belt and Road Initiative (BRI) is a multibillion-dollar infrastructure connectivity plan initiated by China. It aims to promote trade, infrastructure and industrial development across a network of countries via a "New Silk Road" comprising a "belt" of overland corridors of railways and highways, as well as a maritime "road" of ports and shipping lanes.

The BRI primarily connects China with the rest of Asia, Europe, the Middle East and Africa. It is also an inclusive arrangement where all countries are welcome to participate. To date, more than 140 countries, including Latin American and Caribbean countries, have participated in the BRI.

White & Case, a truly global law firm with a longstanding presence in the major cities across all continents along the Belt and Road route, is uniquely positioned to guide clients through the complex and varied legal landscapes across jurisdictions.

Our lawyers have deep expertise across a broad spectrum of industries, including construction & engineering, oil & gas, mining & metals, energy & renewables, telecommunications and international law. Our clients rely on our breadth of experience to address the full range of their needs, from financing or constructing a BRI project, managing risks, and working to resolve disputes that may arise.

China

As one of the first US-based law firms to establish an office in the Greater China region, we have more than 40 years of experience practicing in the region. We have more than 70 lawyers and legal professionals based in Beijing, Shanghai and Hong Kong, and are one of the largest teams among international law firms in the Greater China region. We have the deep experience and capacity to help our clients meet their objectives.

Our team comprises English, Hong Kong and US-qualified lawyers, as well as lawyers trained in PRC law and the majority of our lawyers are fluent in Mandarin, English and other Chinese dialects. This combination of qualifications ensures that while we are deeply connected to the local business community, we have the knowledge and expertise to help our clients achieve their strategic objectives in both Chinese and international markets.

Our practice offering is comprehensive, covering capital markets, corporate/mergers & acquisitions, banking and finance (including RMB financing), competition/antitrust, intellectual property, international trade, dispute resolution, real estate and investment funds. We work with both local and multinational corporations in China in their business activities across a broad spectrum of industries.

With the increasing expansion of trade, finance and investment flows between China and various BRI countries, the strength of our China practice means we have the resources to help our clients navigate the complexities of executing their cross-border strategies.

For more information, please visit our Mainland China page.

Construction & Engineering

The BRI presents a wide array of opportunities in the construction industry, from railways, highways and ports, to power plants, oil refineries and petrochemical projects. As a leading construction law firm, White & Case offers the necessary expertise to service clients' construction needs on any BRI project in any jurisdiction.

Our Construction & Engineering group advises our clients on all stages of projects across all sectors, including transport, infrastructure, power, oil & gas, chemicals/petrochemicals, mining & metals and utilities. We support our clients on projects with counsel on project financing and development, contract negotiation and administration, project advice and dispute resolution.

Having played a major role in some of the most significant projects and transactions in the world over the past several decades, White & Case brings a deep understanding of the key commercial drivers and business, regulatory and market risks in the global construction sector to address our clients' needs.

For more information, please visit our Construction and Infrastructure pages.

International Arbitration

The BRI creates both opportunities and risks in a variety of sectors and industries, including construction & infrastructure, oil & gas, energy & renewables and public international law. Risks associated with BRI projects include economic, social, political or environmental concerns that can cause project disruptions, cash flow uncertainty and weakened investor sentiment.

International arbitration is an ideal dispute resolution option given the inherent cross-border nature of BRI projects, which necessarily involve contracting parties from different geographical locations and cultural backgrounds operating in jurisdictions where they may have little or no previous experience. We guide our clients who wish to provide for international arbitration in the event of disputes that may arise and also advise on structuring transactions to maximize legal protection at the outset of projects.

White & Case’s International Arbitration Practice is well equipped to advise on any disputes arising out of BRI projects. Our Practice is widely recognized as preeminent in its field; ranked "Number One International Arbitration Practice" globally for six years by Global Arbitration Review and Band 1 for International Arbitration globally by Chambers. We represent our clients in disputes that arise in jurisdictions across the world, spanning every industry sector. We support them with advice and guidance under multiple laws, in diverse languages, and in all major jurisdictions and arbitral fora.

For more information, please visit our International Arbitration page.

Belt and Road Initiative (BRI) experience

Post M&A dispute – oil & gas exploration and production company

Advising a leading exploration and production company listed on the Hong Kong Stock Exchange in connection with a dispute arising out of the purchase of an upstream oil & gas company operating in Iraq.

JOA and PSA dispute - North Asian energy company

Advising a major North Asian energy company on various JOA and PSA issues concerning an African oil & gas project.

Damages claim - System construction company

Advising a system construction company listed in the TecDax in SIAC arbitration proceedings against Chinese parties over a US$96 million damages claim.

Telecommunications infrastructure dispute – Chinese contractor

Acting for a major Chinese contractor in a dispute with a leading Asian telecommunications infrastructure provider with respect to a potential HKIAC arbitration relating to a telecommunications infrastructure project in Southeast Asia.

Loan agreement dispute - Private equity group

Representing a Southeast Asian private equity group in a dispute against a Chinese borrower and Chinese co-guarantor in a potential SIAC Singapore-seated arbitration.

Insurance dispute - Chinese bank

Representation of a Chinese bank in a potential SIAC arbitration with respect to a dispute arising out of an insurance claim. The claim related to a loan provided to an Indonesia-based iron mining company

Construction dispute - hydropower plant

Representation of an African state in a multibillion-dollar arbitration with a Chinese partner relating to a contract to build a hydropower plant.

Key contacts

Related services

White & Case has an outstanding group with an excellent track record in high-stakes commercial and investor-state arbitrations.

Band 1: International Arbitration, Global Market Leaders

Chambers Global 2025

Band 1: International Arbitration, Europe-wide

Chambers Global 2025

Band 1: Dispute Resolution, Africa-wide

Chambers Global 2025

Band 1: International Arbitration, Latin America-wide

Chambers Global 2023

Ranked No. 1 in the World for International Arbitration

Global Arbitration Review 2015 – 2019, 2021

"Legal Firm of the Year"

FIDIC Contract Users' Awards 2023

Band 1 – Banking & Finance in China

Chambers Greater China 2025

"Strong resources and capabilities"; "thorough knowledge of the commercial law arena in China."

"White & Case has an outstanding group with an excellent track record in high-stakes commercial and investor-state arbitrations."

"Impressive global practice renowned for its activities in high-profile international construction disputes…Active on a broad spectrum of contentious and non-contentious matters in key industries including oil and gas, energy and transport."

"Outstanding group with an excellent track record in high-stakes commercial and investor-state arbitrations. Offers longstanding experience of disputes under all major institutional rules and is particularly lauded for its expertise in the construction and energy sectors. Maintains an impressive client roster of sovereign states and market-leading corporations."

"Especially noted for its mastery of construction sector disputes and frequent involvement in oil and gas sector arbitrations."

"Respected arbitration group with a focus on high-stakes international cases, drawing upon the support and expertise of its international network. Favoured by an extensive portfolio of large multinationals and Asian corporations."

"Draws strength from its international network to advise on outbound investments and international project development, with particular capability in Africa, the Middle East and the Americas."

Chambers

Click here to view the full image of Belt and Road (BRI) Map

Click here to view the full image of Belt and Road (BRI) Map