On June 16, 2022, the Federal Energy Regulatory Commission (FERC) issued a Notice of Proposed Rulemaking (NOPR) entitled 'Improvements to Generator Interconnection Procedures and Agreements.' The reforms aim to address interconnection queue backlogs, provide greater certainty, and prevent undue discrimination against renewable technologies to ensure that pro forma generator interconnection procedures are just and reasonable, in accordance with FERC's jurisdiction under section 206 of the Federal Power Act. Comments on the NOPR are due by October 13, 2022, 100 days following publication in the Federal Register.

Primer on generator interconnection queues

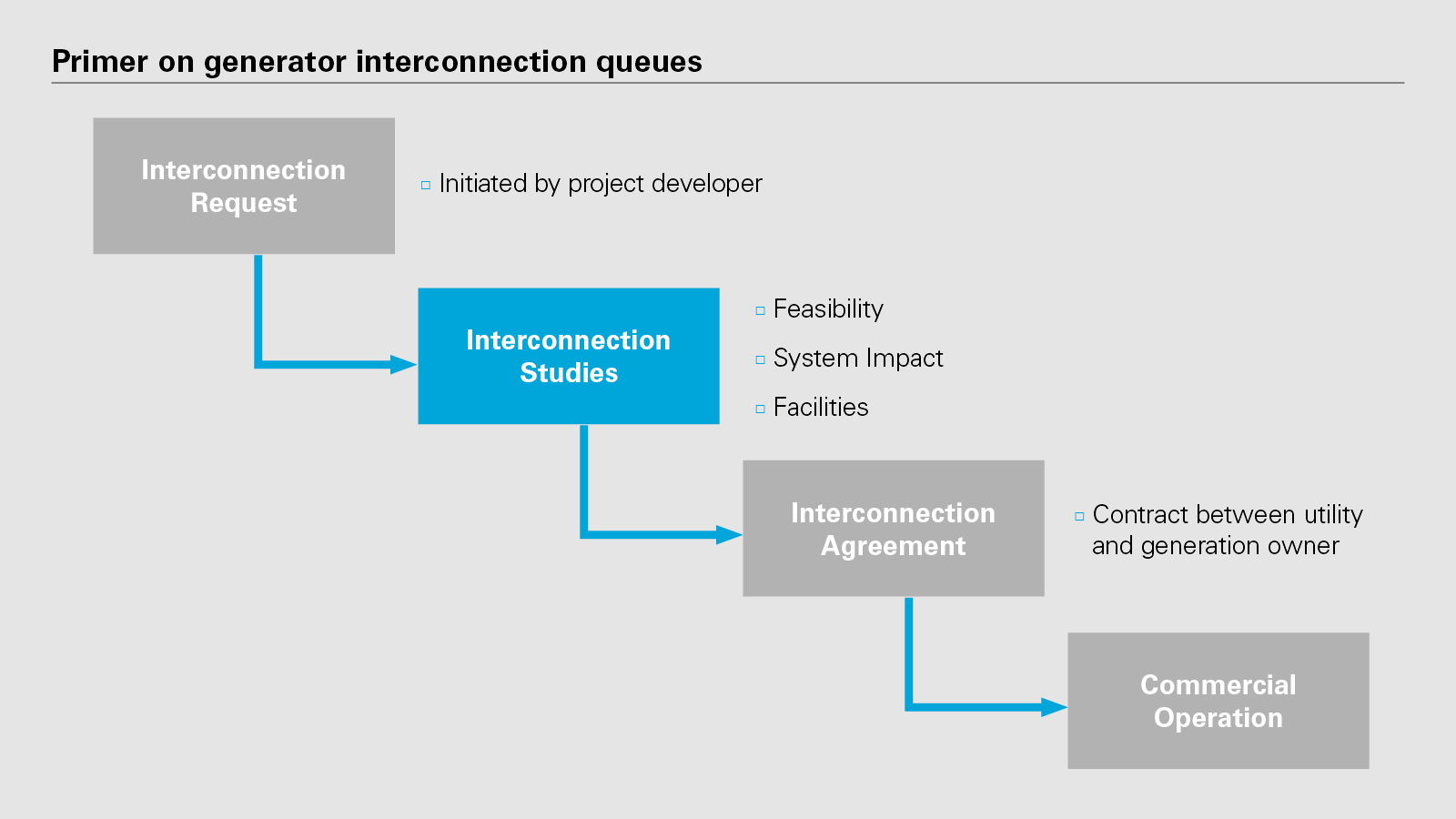

Amid the backdrop of fast-paced domestic energy transition, the regional grid operators under FERC's purview are facing significant interconnection backlogs and are quickly losing ground in timely approving generator interconnection requests. The corresponding queue has reached nearly 1,900 projects1 awaiting interconnection studies necessary for review pursuant to Tariff-mandated deadlines. In a generator interconnection queue, each proposed project undergoes a system impact study, which models and assesses how the new project would affect the balance and operation of existing grid infrastructure.

Governed by the regional grid operators, this process establishes what new equipment, upgrades, or retrofits may be required before a project can interconnect to the system and assigns the costs of that equipment. Transmission providers perform technical studies such as short circuit analysis, stability analysis, and power flow analysis during the system impact study phase. In a facilities study, the transmission provider build upon the findings of the system impact study by identifying the physical infrastructure and associated procurement that would be required to integrate the proposed project.

The regional entities may also appraise the suitability of a proposed project based on its existing resource mix, reliability factors, and other parameters that reflect how a new or modified interconnection point would alter broader grid operations.

Governed by the regional grid operators, this process establishes what new equipment, upgrades, or retrofits may be required before a project can interconnect to the system and assigns the costs of that equipment. Transmission providers perform technical studies such as short circuit analysis, stability analysis, and power flow analysis during the system impact study phase. In a facilities study, the transmission provider build upon the findings of the system impact study by identifying the physical infrastructure and associated procurement that would be required to integrate the proposed project.

The regional entities may also appraise the suitability of a proposed project based on its existing resource mix, reliability factors, and other parameters that reflect how a new or modified interconnection point would alter broader grid operations.

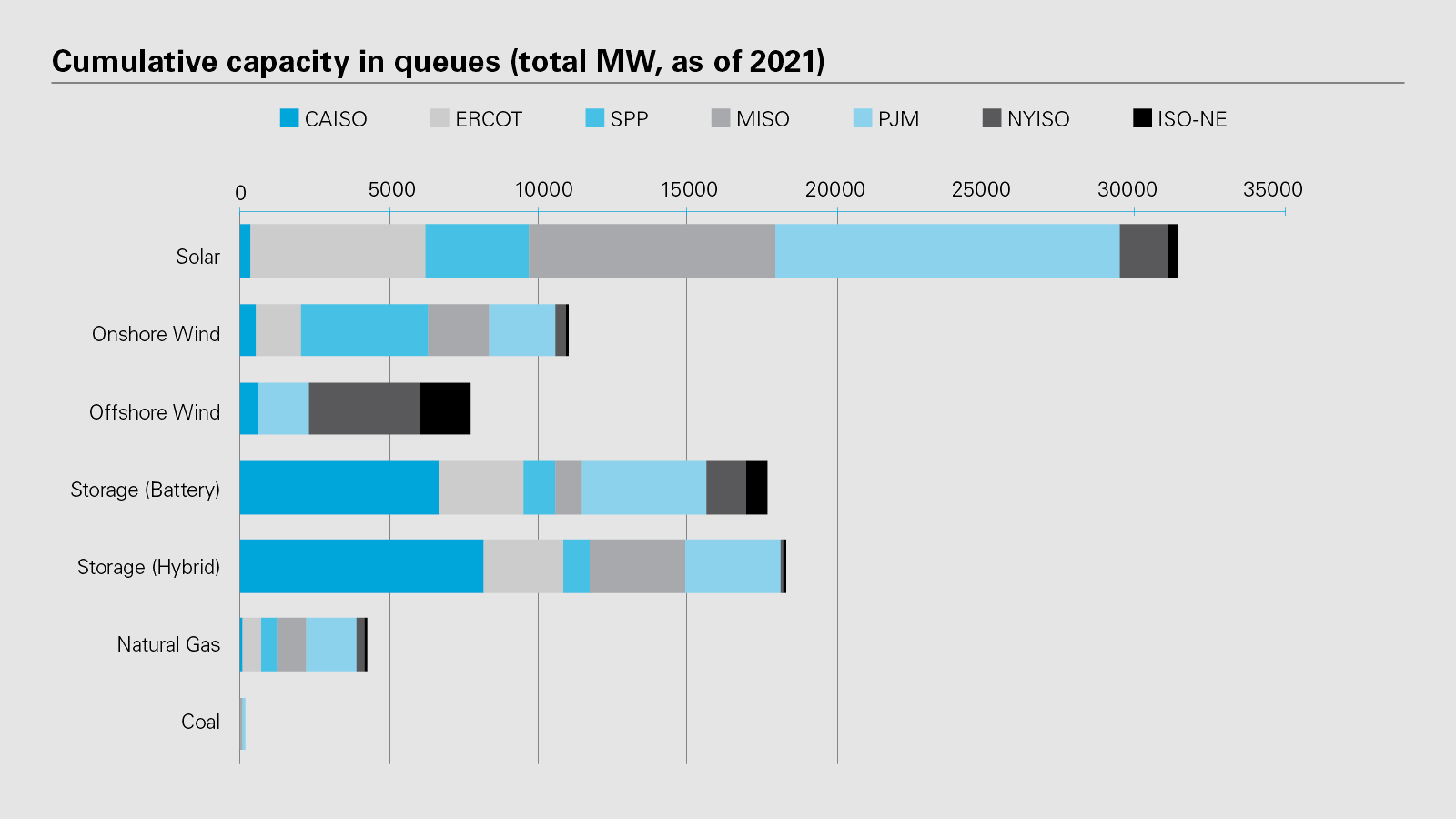

Most proposed projects mired in interconnection queues are renewable energy generation and storage projects, which may have the unintentional effect of disrupting headway in meeting state and federal renewable portfolio goals. As of 2021, renewable projects (including electric storage, both as standalone batteries and as hybrid facilities attached to solar or wind generation) comprised approximately 1357 gigawatts (GW) of the estimated total 1444 GW in interconnection queues.2 Over 600 GW in interconnection requests were added in the year 2021 alone, indicating a substantial uptick in market activity particularly given the high proportion of renewable projects in the queues.

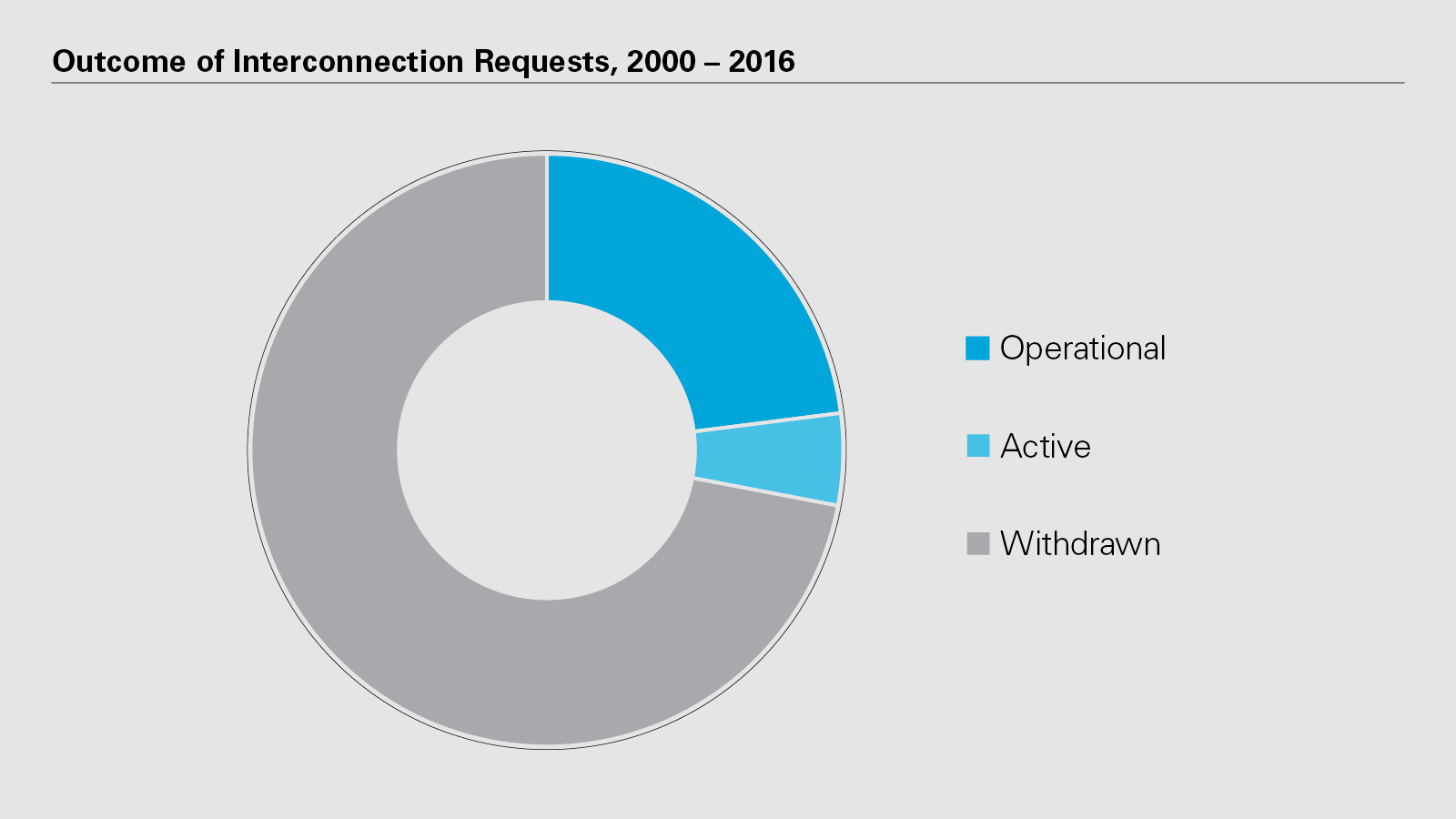

For projects that ultimately achieve operation, the time to conduct a full interconnection study has increased significantly from 2.1 years in 2010 to 3.7 years in 2021. Approximately 73 percent of projects currently in the queue requested to come online before 2025, which presents a clear mismatch between finishing the interconnection study process and adhering to such commercial deadlines. Among those projects, 13 percent have executed an interconnection agreement.

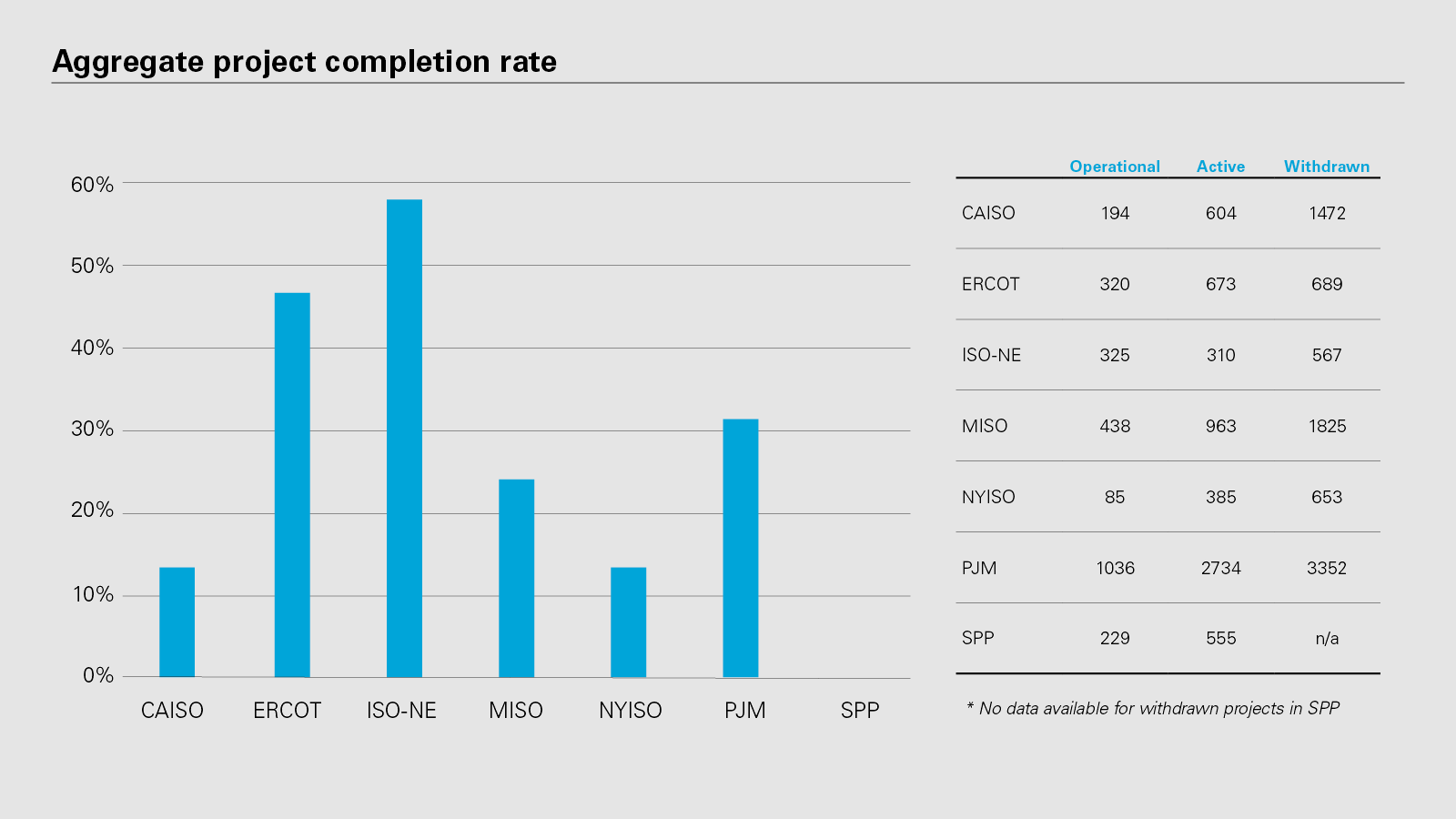

In sum, the total capital expenditures attributed to the potential renewable generation in the queue could generate $2 trillion USD in investment.3 However, given that only 23 percent of those projects reach commercial operation — even less for solar (16 percent) and wind (20 percent) respectively — the magnitude of future investment may be impacted by whether, and how, the proposed reforms ultimately optimize the study process and reduce delays.

Overview of the NOPR

FERC proposes addressing the interconnection queue backlog and expediting the process in three primary ways:

Implementing a 'first-ready, first-served' cluster study process

The current regime for undertaking system impact studies and, consequently, the overall queue process, is a 'first-come, first-served' approach. However, the NOPR suggests that prioritizing proposals based only on the timing of submission as opposed to actual readiness or transparency has been a driving force in accumulating delays and stymying efficient project review.

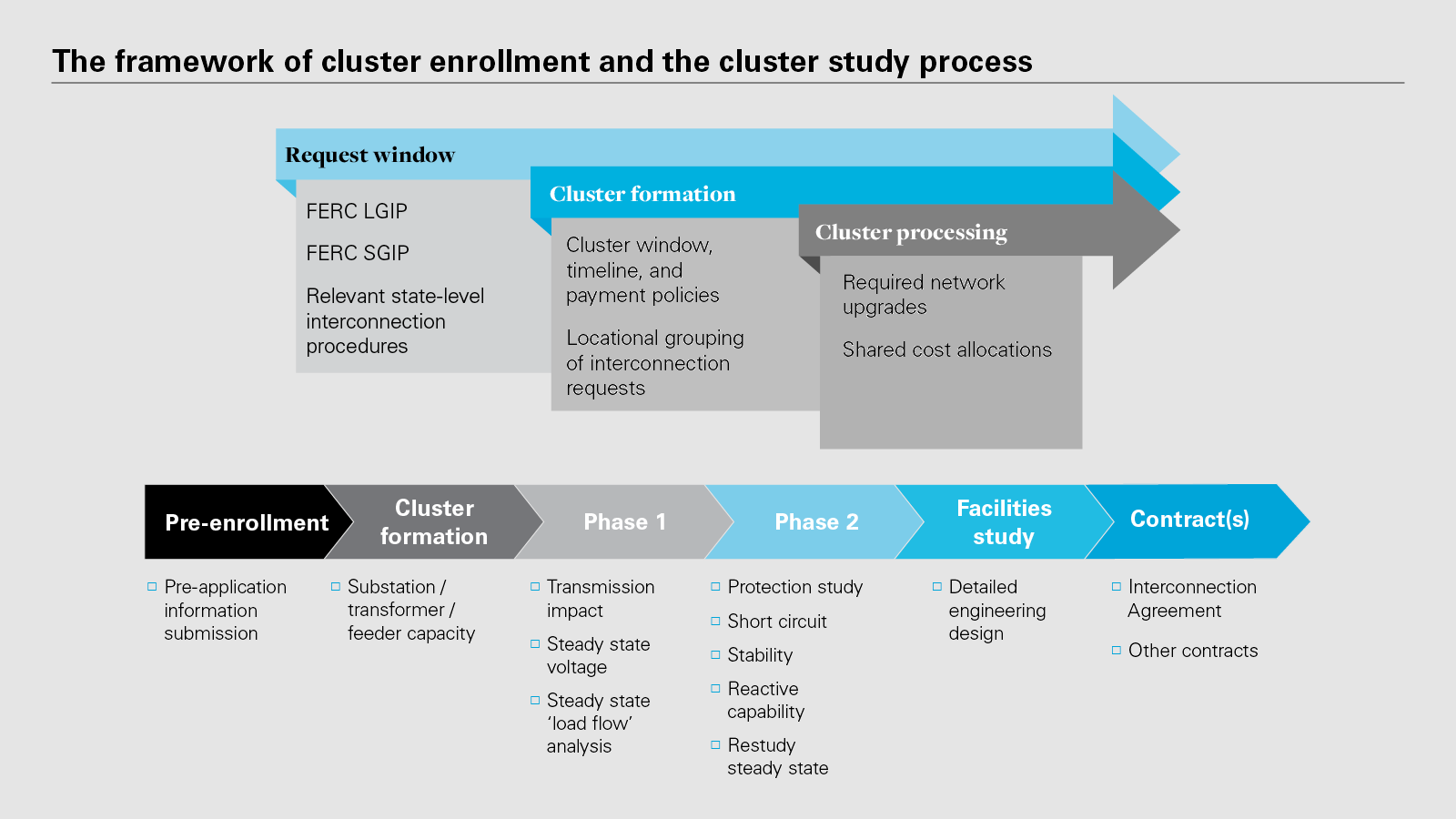

Since 2018, FERC has approved proposals from five non-independent transmission providers to switch from the existing process — as stipulated in the pro forma Large Generator Interconnection Agreement (LGIA) on file with FERC — to a cluster study process.4 In this context, a 'cluster' consists of multiple proposed generating facilities that would be subject to the study processes undertaken by transmission providers and regional grid operators in a simultaneous, rather than sequential, manner. By adopting a cluster study process, and pivoting from the 'first-come, first-served' method, FERC intends to increase efficiency and enable more project developers to gain the information needed to contemplate moving forward with their proposed generating unit.

The following figures illustrate the framework of cluster enrollment and the cluster study process, respectively.

The proposals alluded to prior — from the five non-independent transmission providers — asked FERC to impose progressively stringent readiness requirements on projects in order to advance through the study phase. The lack of information initially available to prospective interconnection customers, and the commensurate financial commitments, has hampered progress in the queue, as any unforeseen delay to soliciting additional information (and the subsequent review of such disclosures) will cascade along the entire backlog and result in a longer timeframe for all projects in line. According to the NOPR, "interconnection customers face limited financial commitments to enter and stay in the interconnection queue and few requirements to prove the commercial viability of proposed generating facilities."5

For instance, the total cost of interconnection studies under the pro forma Large Generator Interconnection Procedures (LGIP) is often under $500,000. This relatively low financial barrier may inadvertently serve to incentivize behavior that is ultimately detrimental to the effective and efficient operation of the queue.

For example, in some instances, a developer may submit multiple interconnection requests for the same proposed generating facilities, but at various interconnection points, in order to obtain valuable information and analysis that will then help clarify the most commercially-viable location for the project. The resources dedicated to conducting multiple studies for what will result in the development of only one operational project may lead to regulatory inefficiencies, an issue the NOPR aims to address.

| Deposit comparison by phase6 | Pro forma LGIP | Cluster study process (proposed reforms) |

| Interconnection request, used for feasibility study agreement | $10,000 | $5,000 application fee plus: $35,000 + $1,000/MW (> 20 MW < 80 MW); or $150,000 (> 80 MW < 200 MW); or $250,000 (> 200 MW) |

| System impact study agreement | $50,000 | Same amount within 20 days of cluster study report meeting |

| Facilities study agreement | $100,000 | Same amount prior to executing an interconnection agreement |

Instituting rigorous site control and commercial readiness requirements

The NOPR establishes site control deposits — in the circumstance where an interconnection customer does not possess site control due to a regulatory limitation — at a rate of $10,000 per MW, subject to a floor of $500,000 and a ceiling of $2,000,000. FERC stipulates that the site control deposit would be applied toward any interconnection studies or withdrawal penalties. In any case, prior to any facilities study, the interconnection customer must affirmatively demonstrate that it has secured site control for the proposed project.

Citing concern with commercial readiness, FERC outlines that non-viable projects that have previously lingered in the queues have done so due to "minimal requirements" for submitting interconnection requests.7 Traditionally, interconnection customers have not proceeded to construct and operate a generating facility — especially for renewable resources — if an off-take agreement had not been reached. Without a contract for the sale of electric energy or capacity from the proposed facility, the interconnection customer has been unlikely to move forward with the proposed project. FERC pointed to the paucity of commercial readiness provisions in the pro forma LGIP — only a $10,000 deposit in lieu of site control — as a direct link to the bloated queues in bilateral market areas. As such, the NOPR contains a number of new criteria that could be used to demonstrate commercial readiness, ranging from an executed contract or term sheet, evidence that the project would be selected in a resource plan, or a provisional LGIA filed to FERC.

As alluded to above, the NOPR sets forth withdrawal penalties to be levied against interconnection customers. The amount would be calculated in accordance with a number of factors, such as the phase of the cluster study to the commercial readiness of the proposed project. The total penalty would range from one to five times the actual allocated cost of all studies performed to that point and — contingent on the circumstances and timing of the withdrawal — capped at sums of $1 million, $1.5 million, and $5 million, respectively.

Given that cost allocation has emerged as a key component in many transmission-related proceedings under FERC's oversight, the NOPR provides clarification on how to proceed under a cluster design. Namely, FERC proposes to allocate any upgrade costs on a proportional method basis.8 By implementing a proportional impact method, FERC expects that this reform "will reduce the frequency of an individual customer being allocated a large network upgrade that benefits subsequent interconnection customers, reduce the incentive to submit multiple speculative requests, and reduce the amount of cascading withdrawals and re-studies." In justifying the deployment of this proposal, FERC points to a number of grid operators and utilities — including CAISO, MISO, SPP, NYISO, Public Service Commission of Colorado, Dominion Energy, Duke Energy, and Tri-State Generation & Transmission — that have adopted the proportional impact method by performing a distribution factor analysis.9

Additionally, FERC proposed to allocate 90 percent of the applicable study costs to interconnection customers on a pro rata basis (derived from the requested MWs included in the cluster) and the remaining 10 percent to interconnection customers for the cluster study costs.10 The NOPR delineates a revision to network upgrade cost allocation, whereby interconnection customers in earlier cluster studies as well as interconnection customers in subsequent cluster studies (that benefit from the same network upgrade) would bear a commensurate cost relative to the benefits received.

Increasing the speed of interconnection queue processing

The pro forma LGIP do not set forth specific transmission provider timelines, or penalties, for not meeting deadlines. As such, the lack of requirements around the timely completion of interconnection studies fail to compel transmission providers to proceed in an efficient manner during the study process. According to the NOPR, "transmission providers are only required to use 'reasonable efforts11' to complete interconnection studies on time."12

In practice, these studies (by providers)often lag behind those completed by the host transmission owner and are sometimes completed at a very late juncture in the process, generating cost uncertainty as well as additional delays. Even while fielding and contemplating complaints lodged by customers, FERC has not yet found that any transmission provider has deliberately circumvented the 'reasonable effort' principle, even in instances where the studies had been completed months or years late. This incongruity illustrates the new stance of the NOPR: without stricter deadlines, deposit amounts, and withdrawal penalties, ascribing a 'reasonable effort' to a transmission provider is insufficient and will not expedite study processes. While interconnection customers can be removed from the queue for failure to comply with deadlines throughout the generator interconnection process, transmission providers face no consequences for failure to comply with study deadlines.

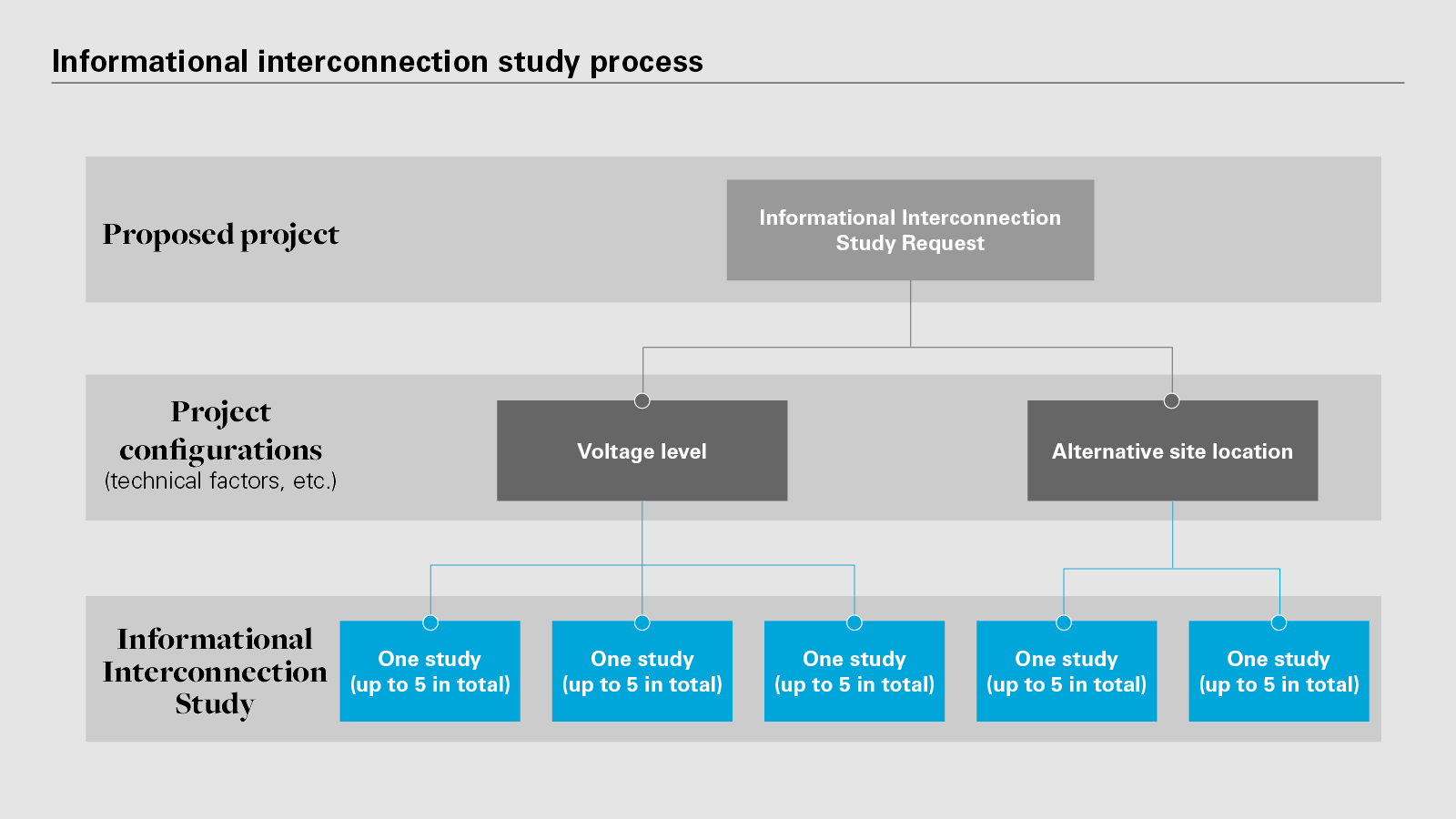

FERC proposes in the NOPR to create an informational interconnection study process,13 as illustrated below.

In the NOPR, this new process intends to improve preemptive exchanges of information. By doing so, FERC hopes to enable project developers to forecast potential upgrade costs and available capacity before securing any contracts or moving forward in the interconnection study process. For each informational study request, the interconnection customer would be required to remit a $10,000 deposit. Within 7 business days of the informational interconnection study request the transmission provider must provide an informational interconnection study agreement. The prospective interconnection customer would have 10 business days to execute the agreement and deliver it, along with the relevant technical data and study deposit. The transmission provider would then have 45 days to complete the study.

Incorporating technological advancements into the interconnection process

In the NOPR, FERC determined that the pro forma LGIP, pro forma LGIA, pro forma SGIP, and pro forma SGIA are unjust and unreasonable, unduly discriminatory with respect to non-synchronous resources such as wind, solar, and electric storage projects, all of which have operating characteristics that were not anticipated when the Commission issued Order No. 2003. Further exacerbating the problem, the generator interconnection queues are mostly comprised of these resources, which is blunting progress toward renewable energy deployment and climate change initiatives across states and regional markets.

Electric storage projects have fared particularly poorly while languishing in interconnection queues, as operating assumptions as well as the complex nature of co-located components (e.g., solar-plus-storage generating facilities) have not sufficiently accounted for the unique characteristics of storage. FERC outlined in the NOPR that certain network upgrades have been unnecessary but improperly flagged in the past due to erroneous methodologies or inaccuracies pertaining to electric storage.

Further, the NOPR contains proposed revisions to the pro forma LGIP to define co-located resources as more than one resource located behind the same point of interconnection, that such resources can share the same interconnection request, and modify the definition of site control to allow interconnection customers to demonstrate shared land-use for generating facilities that include more than one resource. In sum, co-located electric storage facilities should benefit greatly from the enhanced language. FERC also carves out a new consideration to add new generating facilities to existing interconnection requests, reflecting the "common occurrence" that electric storage components may be deemed viable during the queue process.14 In the NOPR, evaluating the proposed addition of generation should not trigger any other burdens if the new facility would not change the (existing) interconnection service level. However, due to the prospective transition to a cluster model, FERC will solicit comments on if this proposed revision may impact other aspects of an interconnection request unrelated to the new generating unit.

Continuing issues and outlook

Some regional grid operators have initiated reforms to their interconnection queue processes independent of FERC's recent NOPR. Most notably, PJM recently submitted a filing to FERC requesting approval of such revisions that would implement the 'first-ready, first-served' cluster method.15 In PJM, nearly 2,500 proposed projects lingered in the interconnection queue — the vast majority (more than 95 percent) were renewable energy generation. PJM detailed several key components in expediting planning studies, including:

- Establishing a 'fast-lane' process for approximately 450 existing projects to clear the existing backlog

- Adding requirements such as readiness deposits and improving site control procedures

- Analyzing cost responsibility of individual projects in the cluster

- Expediting the process to memorialize interconnection agreements for projects that do not require network upgrades or further studies

While the PJM proposal demonstrates an acknowledgment of perceived avenues for improving the interconnection queue process, FERC conceded that "many of the transmission providers that have implemented some of the reforms [proposed in the] NOPR, such as a first-ready, first-served cluster study process, still often fail to meet interconnection study deadlines."16 FERC stated, however, that enacting stricter deadlines in its proposed rule might ameliorate this stubborn issue across markets.

FERC has yet to establish a mechanism to allocate costs of network upgrades, a contentious topic in electric transmission in recent years. Cost allocation will become even more critical as renewable resources penetrate the grid due to locational mismatches with demand centers. The new 'cluster' approach may spread costs among individual project developers, but does not eliminate the incumbent 'participant' model of cost allocation to expand beyond to other entities, such as utilities and ratepayers, that may benefit from such facilities being deployed on the grid.

In the NOPR, FERC imposes more stringent burdens on project developers to secure land rights and attendant permits (e.g., construction activities), which may lead to more competitive bidding for parcels of resource-rich areas in regions that are not, at present, hotbeds of activity. One such unintended consequence may befall smaller or newer renewable project developers that do not possess either the capital for such preemptive expenses — also a risk amplified by the proposed withdrawal penalties — or the legal expertise to navigate a typically hyper-local endeavor.

Further, it remains to be seen if FERC has cleared the path for new projects that may have only existed in an exploratory fashion before. By creating the 'informational connection study' process in the NOPR, FERC ostensibly will enhance information sharing and enable project developers to more accurately forecast potential upgrade costs and available capacity prior to effectuating any binding agreements or proceeding in the interconnection study process. In general, FERC has demonstrated that transparency — and improved data accessibility — has been a priority in recent years across the gamut.

Dovetailing with other proposed rulemakings in the past year on the subject, the NOPR signals that FERC continues to prioritize transmission. FERC is ostensibly balancing the specter of new renewable generation deployed to the grid while accounting for pragmatic modernization efforts to transmission systems — as well as ensuring ratepayers are shielded from unnecessary costs and reliability concerns. While this rulemaking would represent a key step forward, it will also be imperative for the grid operators under FERC purview to synergize efforts in regional transmission planning. Comments on the NOPR are due by October 13, 2022, 100 days following publication in the Federal Register17, with reply comments due by November 14, 2022, 30 days following initial comments.

1 179 FERC ¶ 61,194, "Improvements to Generator Interconnection Procedures and Agreements," Federal Energy Regulatory Commission (issued on June 16, 2022 in Docket No. RM22-14-000). Available at: https://www.ferc.gov/media/rm22-14-000. ("NOPR") at P 19.

2 QUEUED UP: CHARACTERISTICS OF POWER PLANTS SEEKING TRANSMISSION INTERCONNECTION AS OF THE END OF 2021, Lawrence Berkeley National Laboratory (April 2022).

3 Id.

4 NOPR at P 21.

5 Id. at 24.

6 See pro forma LGIP sections 3.4.1, 6.1, 7.2, 8.1 (providing for: $10,000 for the Interconnection Feasibility Study, $50,000 for the Interconnection System Impact Study, and $100,000 for the Interconnection Facilities Study).

7 NOPR at P 127.

8 Id. at P 88.

9 Id. at P 87.

10 Id. at P 82.

11 Reasonable efforts are defined as "actions that are timely and consistent with Good Utility Practice and are substantially equivalent to those a Party would use to protect its own interests." Order No. 2003, 104 FERC ¶ 61,103 at P 67; pro forma LGIP section 1.

12 NOPR at P 28.

13 NOPR at P 43.

14 NOPR at P 246.

15 See, e.g., PJM Interconnection, L.L.C., Filing, Docket No. ER22-2110 (filed June 14, 2022).

16 NOPR at P 166

17 https://www.govinfo.gov/content/pkg/FR-2022-07-05/pdf/2022-13470.pdf

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2022 White & Case LLP

View full PDF: Primer on generator interconnection queues (PDF)

View full PDF: Primer on generator interconnection queues (PDF)

View full image: Cumulative capacity in queues (total MW, as of 2021) (PDF)

View full image: Cumulative capacity in queues (total MW, as of 2021) (PDF)

View full image: Framework of cluster enrollment and the cluster study process (PDF)

View full image: Framework of cluster enrollment and the cluster study process (PDF)

View full image: Outcome of Interconnection Requests, 2000 – 2016 (PDF)

View full image: Outcome of Interconnection Requests, 2000 – 2016 (PDF)

View full image: Informational interconnection study process (PDF)

View full image: Informational interconnection study process (PDF)

View full image: Aggregate project completion rate (PDF)

View full image: Aggregate project completion rate (PDF)