BEIS starts to bite: a look at the first NSIA prohibition and BEIS’ new NSIA guidance

10 min read

On 20 July 2022, the Secretary of State for Business, Energy and Industrial Strategy issued the first prohibition under the National Security and Investment Act 2021. We consider the lessons learned from this milestone and BEIS' new guidance on markets and energy transactions.

Prohibition

The National Security and Investment Act 2021 ("NSIA") regime has been in place since 4 January 2022, overhauling the way in which the UK government deals with transactions that may raise national security concerns. On 20 July 2022, the Secretary of State for Business Energy and Industrial Strategy ("SoS") issued the first prohibition under the new regime.

The transaction at issue was the intended conclusion of a licence agreement between the University of Manchester and Beijing Infinite Technology Company Ltd (the "Acquirer"), to enable the Acquirer to use certain intellectual property related to the University's SCAMP-5 and SCAMP-7 vision sensing technology.1 The final order reflects the SoS's conclusions that the technology in question could have dual-use applications and thus "could be used to build defence or technological capabilities", which might present a national security risk to the UK if the IP were transferred to the Acquirer.

Interestingly, this first prohibition under the NSIA was made in respect of a transaction that was not subject to the mandatory notification requirement. The final order published by the SoS details that the relevant trigger event in this case was the Acquirer's gaining control of a "qualifying asset" under Section 9(1) of the NSIA. This section of the NSIA establishes that trigger events can arise in situations where an investor acquires rights or interests that would enable an acquirer to use a qualifying asset, as would be the case under a licence agreement. However, mandatory notifications are not required for this class of trigger event. The notification, therefore, was made on a voluntary basis.

Although a University of Manchester spokesperson has said that the parties intend to abide by the decision, ordinarily the parties would have 28 days from the date of the final order to file an appeal via a claim for judicial review.

Lessons Learned

The prohibition demonstrates three important aspects of the NSIA regime:

- BEIS' powers to review transactions that fall outside the scope of the mandatory notification regime. Here the transaction was voluntarily notified but had it not been, it could nevertheless have been susceptible to call-in review for up to five years post-completion;

- The NSIA can and does capture transactions that do not involve classic share acquisitions, or acquisitions of outright control: licencing and other arrangements that grant acquirers the power to use or control qualifying assets can fall within its review powers; and

- The importance of considering the potential applications of target activities and assets well in advance: in this case the technology at issue, the SCAMP vision sensor, is advertised as having potential applications in areas such as "robotics, Virtual Reality, automotive industries, toys and surveillance".2 Even so, the SoS considered its potential defence applications sufficient to merit prohibition.

The Prohibition in Context

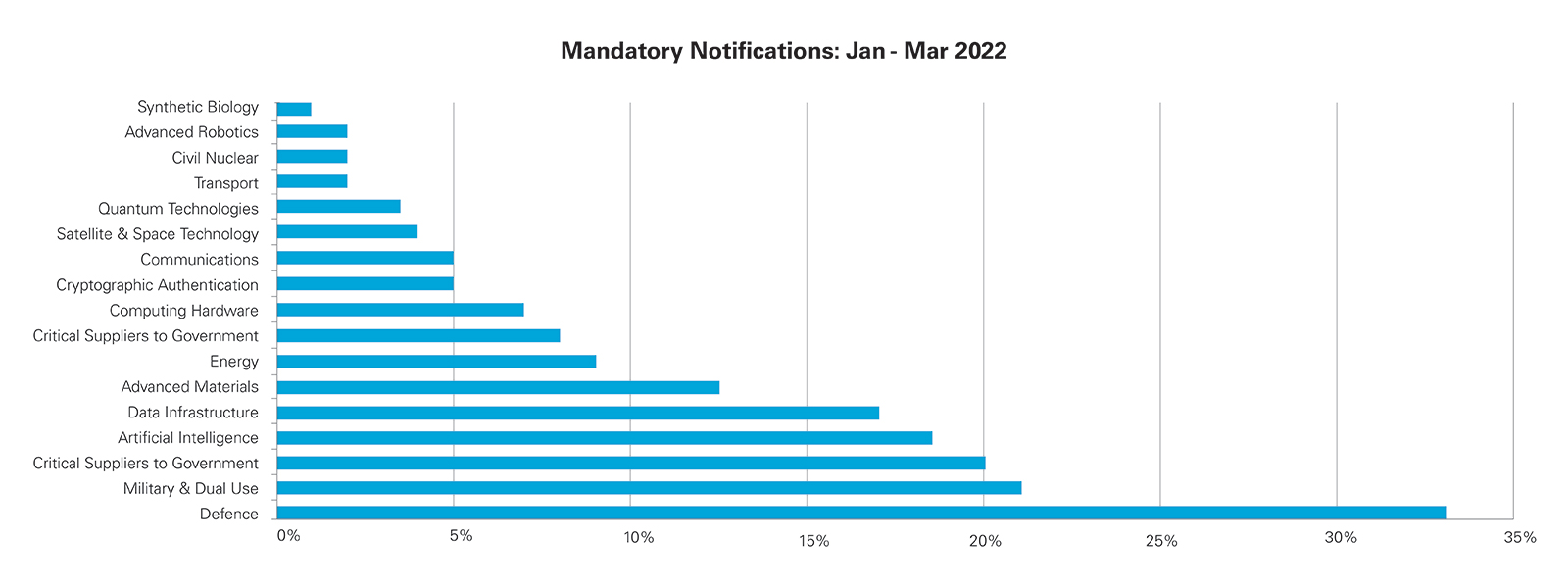

Whilst this is the first prohibition under the NSIA, BEIS' first Annual Report on the NSIA, which covered the first three months of its operation, until the end of March 2022, shows that the dual use and defence transactions represent the majority of mandatory notification submitted to the Investment Screening Unit:

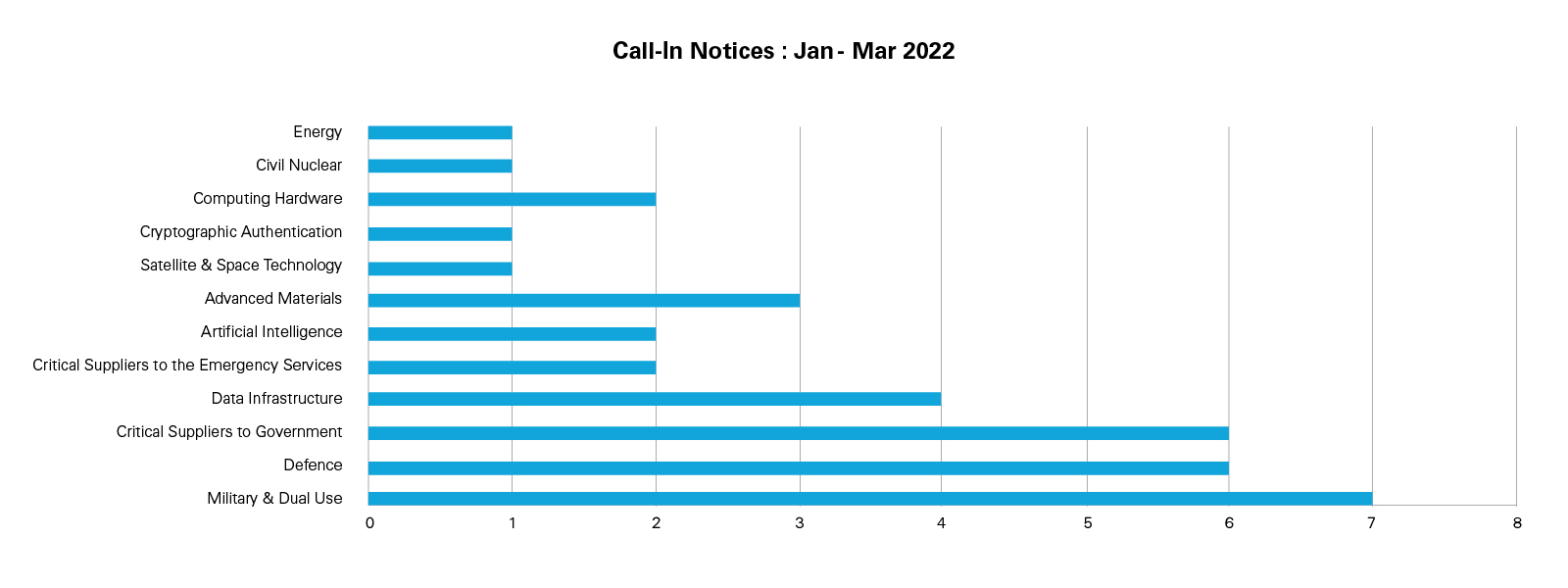

The preponderance of military, dual use, and defence notifications, is in no doubt in part because of the particularly broad approach the NSIA takes to defence acquisitions, capturing targets that are not merely government contractors but those that may be in a "chain of sub-contractors" that provides goods or services to government. Indeed, BEIS Sensitive Sector Guidance makes clear that this can extend to subcontractors who provide goods or services without ‘clear' military applications, such as catering or cleaning. Also of interest, however, is the number of sectors shown in the call-in statistics: 17 call-in notices were issued in the period between January and March 2022 – 13 for mandatory applications and 4 for voluntary notifications. Yet, the call-in statistics in the Annual Report, extracted below, show that cases subjected to call-in have involved targets active in more than one sector.

Dedicated higher education institution advice and guidance

With other transactions involving the licensing or transfer of intellectual property rights it is worth noting that the NSIA architecture includes a dedicated team, the Research Collaboration Advice Team ("RCAT"), that is available to assist researches who believe their work may be caught by the wide reach of the NSIA. There is also dedicated Guidance on the higher education and research-intensive sectors available. Higher education institutions looking to partner with investors should pre-emptively engage with these resources to understand their NSIA risk at an early stage, and prospective investors and partners should encourage higher education institutions to seek as much guidance as possible from RCAT before notifying.

New NSIA Guidance

New Guidance on new build downstream gas and electricity assets

Perhaps in light of growing concern about energy security since the NSIA came into force in January, on 20 July 2022 BEIS released new guidance "to help developers of new build downstream gas and electricity infrastructure" to understand the scope of the NSIA. This guidance is intended to set out circumstances where investors can "voluntarily notify" the government about acquisitions in this sector. The guidance confirms that new build transmission, generation, distribution, gas processing, gas import, gas export and energy storage infrastructure are "qualifying assets" for the purposes of the NSIA. It gives the following examples of transactions that, whilst not subject to mandatory notification requirements, may be subject to call-in:

- Application for a generation licence in respect of a windfarm that is yet to be constructed: the application for a licence means that "arrangements are in progress which, if carried into effect, will result in an acquisition of control over the asset once built". In other words, for NSIA purposes, the licence grant will be deemed an acquisition of control over what may be a qualifying asset (depending on generation capacity);

- Application for a network connection agreement in respect of an energy storage project that is yet to be constructed. Likewise, in this scenario, the application means that arrangements are in contemplation that will grant the investor control over what may be a qualifying asset; and

- For the same reasons, successful participation in a tender round that will result in the grant of a licence or contract that will allow the investor to build, own or operate an asset on the electricity network. Although the guidance does not go into details, successful participation in a CfD or Capacity Mechanism allocation round is likely what is contemplated by this example.

This new guidance does not change the scope of the NSIA Regulations, or create any requirement to notify in respect of these examples. However, its publication can be taken as an indication of the circumstances in which BEIS' interests in this sector may well be piqued. In other words, a delineation of the circumstances in which investors should seriously consider a voluntary notification or face a potential call-in.

New Market Guidance Notes

On 19 July 2022, BEIS also published Market Guidance Notes aimed at answering questions and providing advice based on the first 6 months of the NSIA's operation. The guidance provides practical tips on ensuring that notification will be accepted as complete, with examples of acceptable and unacceptable responses to questions on the notification form, as well as more generic advice on the regime's operation. The most notable clarifications and advice are set out below.

Notifying multiple acquisitions

The guidance confirms that the acquisition of multiple qualifying targets by a single acquirer from the same seller at the same time can all be notified together. Simultaneous acquisition of multiple qualifying entities from different seller groups cannot be amalgamated. Conversely, if an acquirer wishes to submit a mix of mandatory and voluntary notifications for different entities acquired from one seller, these can be amalgamated into a single mandatory notification form – there is no need for a separate voluntary notification.

Temporary acquisition of control: liquidators and other insolvency measures

Schedule 1 of the NSIA does not treat rights that are exercisable by an administrator or other creditors while a qualifying entity is in insolvency proceedings as being held by the administrator or creditor. However, this general approach does not include rights held by liquidators or receivers who are overseeing the winding up of an entity or the enforcement of security over secured assets. The Market Guidance Notes gives examples of circumstances where rights exercised during insolvency would be subject to mandatory notification in respect of qualifying entities, namely the receipt of voting rights over shares in a solvent company previously held by a liquidated entity or the transfer of shares in such an entity to a trustee in bankruptcy.

Internal corporate reorganisations

BEIS made clear in the government response to the consultation on sensitive sectors published in November 2020, that in formulating the NSIA it had specifically considered suggestions to exclude internal/intra-group reorganisations from the NSIA's scope and rejected them. The Market Guidance Notes, provide a little more colour to this decision. While recognising that most acquisitions of this kind will "simply be a product of internal corporate restructuring and efficiency", it seems BEIS focus is on potential acquisitions of control by another "link" in the corporate structure, particularly in situation where the ultimate beneficial owner is passive. This clarification does not remove the requirement for simple reorganisations to be notified if they qualify, but should at least allow investors to understand and scope the risk of potential call-in review where there is no substantive change in the nature of the entities in control.

Contractual rights

One particularly welcome clarification in the Market Guidance Notes comes in the treatment of contractual rights. The NSIA treats the acquisition of voting rights that can secure or prevent the passing of any class of resolution in a qualifying entity as a trigger event for notification purposes. The Market Guidance Notes clarify that the acquisition of contractual rights that may have the same effect, often taken by minority investors providing early-stage investment, will not be considered equivalent for NSIA purposes. It may be the case that contractual rights amount to material influence, but material influence, unlike the acquisition of voting rights, is not subject to mandatory notification.

Publication policy and information-sharing with the CMA

The Guidance confirms that BEIS will not publish information about the receipt of individual notifications, or information on whether notifications have been accepted or rejected. That said, the government can exercise its discretion to publish information about the issue of call-in notices or clearances following a call-in review. This will be determined on a case-by-case basis; the Government announced the call-in of Nexperia/Newport Wafer Lab and Altice/BT, for example.

In terms of the confidentiality of NSIA transaction, parties should also be aware that BEIS entered into a Memorandum of Understanding ("MOU") with the Competition and Markets Authority ("CMA") on 16 June 2022. The MOU establishes a framework for cooperation, coordination and information-sharing between the authorities for transactions of interest to both agencies. The MOU confirms that BEIS and the ISU will share information, where appropriate, on transactions before them. Importantly, however, in terms of their market monitoring functions, the MOU confirms that neither BEIS nor the CMA intends to rely on the other to identify transactions of interest to either statutory regime.

1 "SCAMP" stands for "SIMD Current-mode Analogue Matrix Processor".

2 https://www.uominnovationfactory.com/projects/pixel-perfect-scamp-vision-sensor/

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2022 White & Case LLP

View full image: Mandatory Notifications: Jan - Mar 2022 (PDF)

View full image: Mandatory Notifications: Jan - Mar 2022 (PDF)

View full image: Call-In Notices: Jan - Mar 2022 (PDF)

View full image: Call-In Notices: Jan - Mar 2022 (PDF)