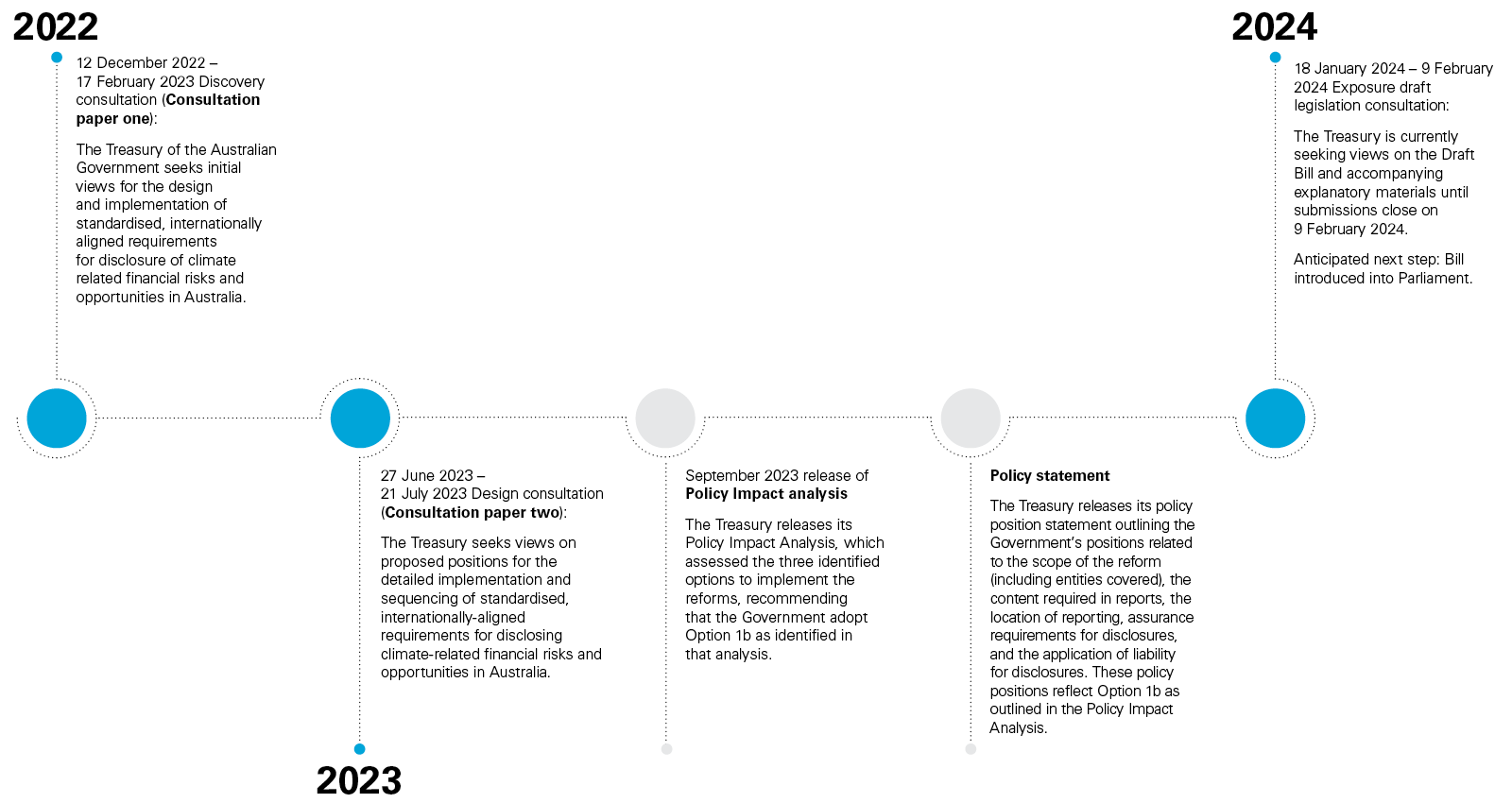

Following two rounds of consultation, the Australian Government has released an exposure draft of the Treasury Laws Amendment Bill 2024: Climate related financial disclosure (Draft Bill) which would introduce mandatory, internationally-aligned climate-related financial disclosures from the 2024/25 financial year. The Draft Bill has been released for consultation until 9 February 2024.

Context

If passed, the Draft Bill will establish a regime that requires entities that meet statutory sustainability reporting thresholds to report and maintain records regarding climate-related financial risks and opportunities, including in respect of greenhouse gas emissions, governance, risk management and emissions reduction targets.

Key elements of the Draft Bill

Who must report, and when?

Simply put, if enacted the Draft Bill would require a company, disclosing entity, registered scheme and registerable superannuation entity to prepare an annual sustainability report for every financial year in which it satisfies the sustainability reporting thresholds set out in the Bill.

The Draft Bill proposes to introduce this reporting obligation in three groups, or phases, over a four-year period based on revenue, assets, number of employees and whether the entity has reporting obligations under the National Greenhouse and Energy Reporting Act 2007 (NGERA).

The sustainability reporting thresholds for each group or phase are set out below:

| Phase | Applicable period | Eligible entities |

| First Group | First reporting year is the financial year commencing between 1 July 2024 and 30 June 2026 |

A company, disclosing entity, registered scheme or registerable superannuation entity that meets one of the following thresholds: 1. The entity satisfies at least 2 of the following three criteria: a. the consolidated revenue for the financial year of the applicable entity and any entities it controls is AUD$500 million or more; b. the value of the consolidated gross assets at the end of the financial year of the applicable entity and any entities it controls is AUD$1 billion or more; c. the applicable entity and any entities it controls have 500 or more employees at the end of the financial year; or 2. The entity is a registered corporation and meets the reporting thresholds for for a financial year under the NGERA. |

| Second Group | First reporting in the financial year commencing between 1 July 2026 and 30 June 2027 |

A company, disclosing entity, registered scheme or registerable superannuation entity that meets one of the following thresholds: 1. The entity satisfies at least two of the following three criteria: a. the consolidated revenue for the financial year of the entity and any entities it controls is AUD$200 million or more; b. the value of the consolidated gross assets at the end of the financial year of the entity and any entities it controls is AUD$500 million or more; or c. the entity and any entities it controls (if any) have 250 or more employees at the end of the financial year; or 2. The entity is a registered corporation (or is required to make an application to be registered) under the NGERA; or 3. The entity controls assets at the end of the financial year of the entity and the entities of AUD$5 billion or more. |

| Third Group | First reporting year is the financial year commencing on or after 1 July 2027 |

A company, disclosing entity, registered scheme or registerable superannuation entity that meets one of the following thresholds: 1. The entity satisfies at least two of the following three criteria: a. The consolidated revenue for the entity and any entities it controls is AUD$50 million or more; b. the value of the consolidated gross assets at the end of the financial year of the entity and the entities it controls is AUD$25 million or more; or c. the entity and the entities it controls has more than 100 employees; or 2. The entity is a registered corporation (or is required to make an application to be registered) under the NGERA. |

The Draft Bill also enables regulations to be made that empower the Minister to set different sustainability reporting thresholds for Group 3 entities, and a different threshold asset value amount for Group 2 asset managers.

There are a couple of important observations to make about these sustainability reporting thresholds.

- Relevance of accounting standards: whether an entity controls another entity, or the consolidated revenue, consolidated gross assets and the value of assets of an entity, are to be determined in accordance with accounting standards in force for the financial year under the Corporations Act.

- Consolidated group reporting: if accounting standards require an entity to prepare financial statements on behalf of consolidated entities (group head) and the group head elects to prepare a sustainability report for the consolidated entities for the financial year, the group head is the only entity in the consolidated group that must prepare a sustainability report for that financial year.

- Asset owners: the inclusion of assets owners with a value of AUD$5 billion or greater in Group 2 is a change to the regime proposed in the Government's second consultation paper, reflecting the potential sustainability and climate risk profile of registered superannuation entities and registered schemes.

- Implications for NGERA entities: the inclusion of NGERA reporting entities within Groups 1 and 2 will likely capture smaller entities that do not meet any of the other sustainability reporting thresholds. This may present challenges for some smaller NGERA entities that need to comply with the proposed sustainability reporting requirements from 1 July 2024.

- Smaller entities: Group 3 entities whose climate statements report that they do not have material climate-related risks and opportunities will not need to prepare climate statements and notes and director's declarations in the manner summarised below.

What needs to be reported? The contents of annual sustainability reports

The Draft Bill proposes that the sustainability report for a financial year must include:

- The climate statements for the year;

- any notes to the climate statements, including any notes required by the sustainability standards in relation the preparation of the climate statement and notes containing any other information necessary to ensure all the required disclosures are made (see below What does a climate statement need to disclose? And Sustainability standards).

- the directors' declaration which provides:

- an explicit and unreserved statement of compliance with international sustainability reporting standards; and

- whether, in the directors' opinion, the climate statements, the statements relating to matters concerning environmental sustainability (if required), and the notes to the climate statements are in accordance with this Act.

The Minister may also direct that the annual sustainability report contains statements relating to 'matters concerning environmental sustainability'. While the Draft Bill does not define 'environmental sustainability,' the Government's first consultation paper acknowledged that the reporting regime may need to adapt to international developments in sustainability reporting. This power was clearly included to expand the scope of sustainability reports in the future to meet international market expectations and government priorities, as they evolve.

What does a climate statement need to disclose?

A reporting entity's climate statement and notes to the climate statement must disclose the following:

- any material climate risks and opportunities the entity has for the financial year (if any), as established in accordance with the sustainability standards;

- any climate change-metrics and targets that are required to be disclosed by the sustainability standards, including metrics and targets relating to scope 1, 2 and 3 emissions of greenhouse gases;

- any of the entity's governance policies related to climate risk and opportunities and any climate metrics and targets of the entity (if any) that are required to be disclosed by the sustainability standards; and

- the entity's greenhouse gas emissions for the entity for any period specified by a sustainability standard, or otherwise for a financial year.

Transitional arrangements for statements about scope 3 emissions

To reduce the initial reporting burden for reporting entities, the Draft Bill proposes that sustainability reports are exempt from the obligation to report scope 3 greenhouse gas emissions for the first reporting period.

The Draft Bill also proposes limited immunity from any action, suit or proceeding against an entity that makes disclosures in its sustainability reports about scope 3 emissions or scenario analysis for the purpose of complying with a sustainability standard between the transitional period of 1 July 2024 and 30 June 2027. Notably, this protection does not apply to statements about scope 3 emissions made outside the sustainability report, nor does it apply to criminal proceedings or to certain civil proceedings brought by the Australian Securities and Investments Commission.

Obligations to maintain sustainability records

Eligible entities must keep written sustainability records that explain and report its preparation of the suitability report, and these records must be retained for 7 years.

Liability Framework and auditing

Climate disclosures will be subject to the existing liability framework under the Corporations Act 2001 (Cth) (Corporations Act) and Australian Securities and Investments Commission Act 2001 (Cth) (ASIC Act) including: director's duties, misleading and deceptive conduct provisions, auditing and assurance, and general disclosure obligations.

Annual sustainability reports are proposed to be audited in accordance with auditing standards, although the financial years prior to 1 July 2030 the auditor is only required to review and report on climate statements relating to scope 1 and 2 emissions of greenhouse gases. These reviews must also be conducted in accordance with auditing standards.

Sustainability standards

The Draft Bill empowers the Australian Accounting Standards Board (AASB) to make sustainability standards for the purpose of the Corporations Act and the ASIC Act.

The AASB has released an exposure draft of ED SR1 Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information for comment until Friday, 1 March 2024. ED SR1 includes three draft Australian Sustainability Reporting Standards (ASRS) that, once finalised, are proposed to be the 'sustainability standards' under the Draft Bill. These three standards are:

- ASRS 1 General requirements for Disclosure of Climate-related Financial Information;

- ASRS 2 Climate-related Financial Disclosures; and

- ASRS 101 References in Australian Sustainability Reporting Standards.

The first two of these draft standards are based on the equivalent International Financial Reporting Standards (IFRS), subject to a number of modifications adapted to the Australian context. More information about the review and how to make submissions on the draft standards can be sourced here.

Where to from here?

Consultation for the Draft Bill is currently open, and submissions will close on 9 February 2024. It is anticipated that Bill will be introduced into Federal parliament later this year. While organisations that already report against TCFD or ISSB Standards are likely to be reasonably well placed to prepare to comply with the new legislation, it will be very important for organisations to establish whether they would be required to comply with the new reporting regime and start implementing the systems and capabilities to comply with the new laws.

Casey Guilmartin (White & Case, Associate, Melbourne) contributed to the development of this publication.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2024 White & Case LLP

View full image: Draft Bill timeline (PDF)

View full image: Draft Bill timeline (PDF)