Dawn Raid Analysis Quarterly: 2023 Q3

White & Case Dawn Raid Analysis Quarterly (DRAQ) is an information resource on surprise on-the-spot inspections (dawn raids) across Europe. Here, we guide you through the latest updates and legal developments for 2023 Q3.

15 min read

The White & Case Dawn Raid Analysis Quarterly (DRAQ) is an information and discussion resource regarding surprise on-the-spot inspections by antitrust authorities (dawn raids) across Europe. DRAQ provides updates on recent case law, enforcement activity and trends.

Q3 2023 at a glance

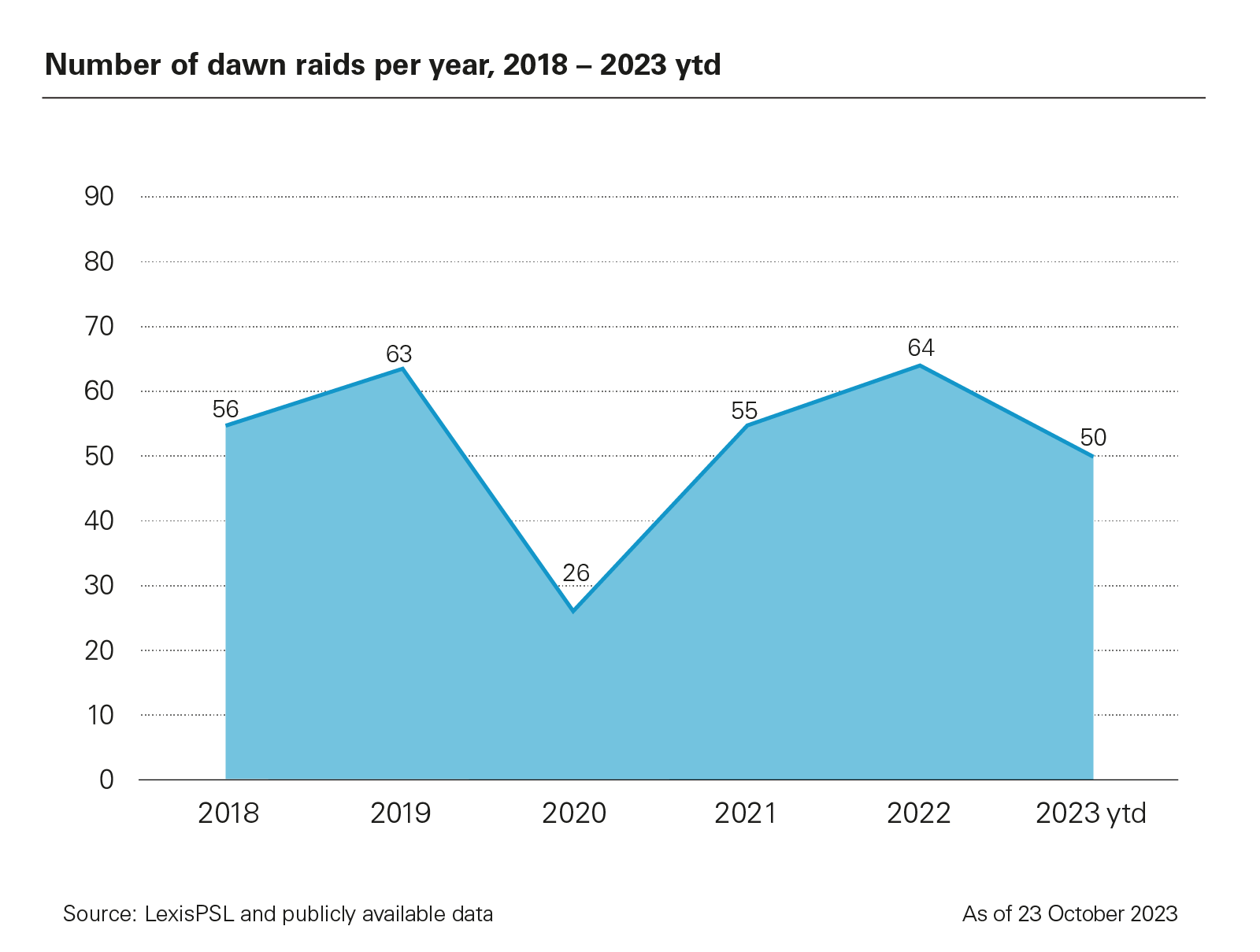

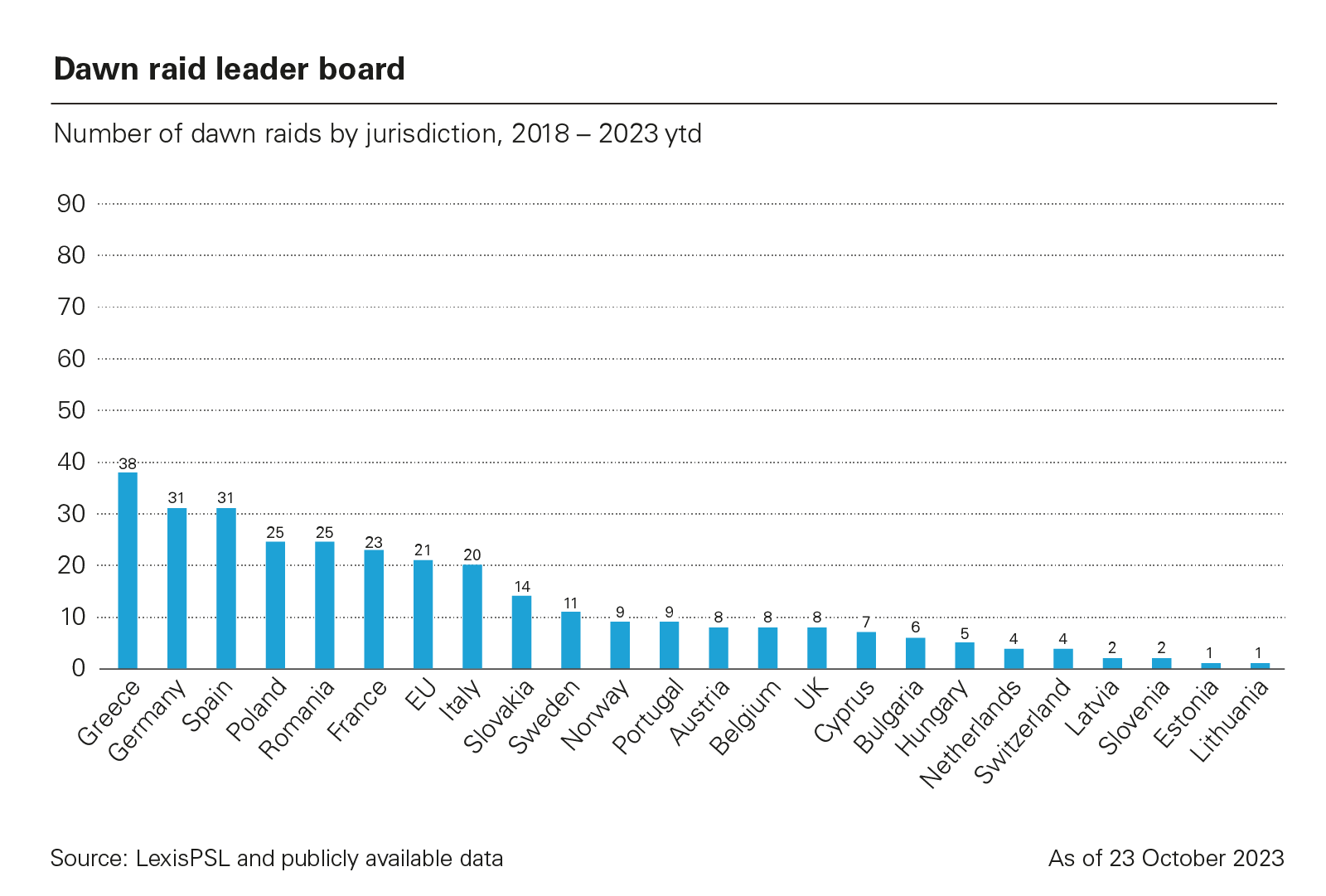

European competition regulators carried out in Q3 2023 a total of 12 dawn raids. This number is slightly higher than the number of dawn raids carried out in Q3 2022 (with ten inspections). The main enforcer for Q3 2023 was Poland (with three dawn raids), followed by Romania and Italy (with two dawn raids each).

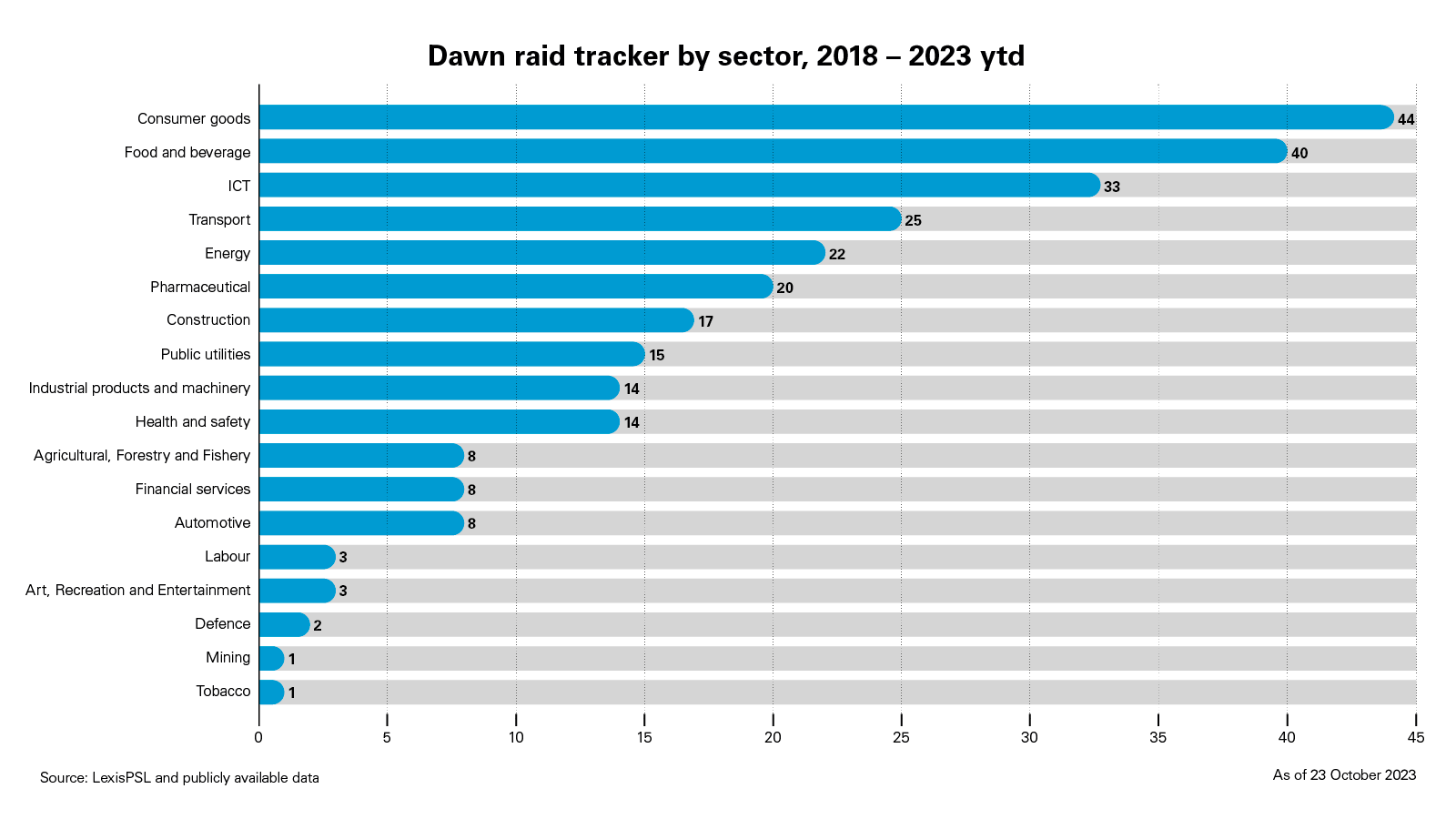

The sectors most hit during Q3 2023 were consumer goods and food and beverage (three dawn raids each). Both sectors had the most inspections in the period between January and September 2023, with 11 dawn raids each. It is interesting to note that the food and beverage sector has been more in the focus of the antitrust authorities in 2023 than in previous years. During the years 2021 and 2022, eight and nine dawn raids occurred in this sector respectively. The authorities that carried out the most inspections related to the food and beverage sector were Poland, Greece, Romania and Hungary.

Noteworthy for Q3:

- The dawn raid by the European Commission of a company active in medical devices for cardiovascular applications on grounds of an alleged abuse of dominance. (September 2023).

Looking at the overall number of dawn raids carried out by European competition authorities between Q1 and Q3, the numbers are in line with figures for 2022: In both years, the number of inspections carried out between January and September were approximately 40.

Finally, watch out for Q4, which is looking active. In October 2023, the European Commission carried out dawn raids of construction chemical companies in cooperation with the UK, Turkish and US competition authorities. This is the second coordinated dawn raid in 2023, following the European Commission’s dawn raid on fragrances manufacturers coordinated with the UK, US and Swiss competition authorities in March 2023. This evidences that cross-border enforcement is very much alive.

We provide more statistics below on the number of raids and the sectors impacted, including a country-by-country list, available through our Interactive Dawn Raid map.

Key Q3 2023 legal developments

Below is a selection of key developments in Q3 2023:

- Hellenic Competition Commission imposes €1 million fine on an individual for obstructing a dawn raid

- Preliminary ruling requests regarding search and seizure of emails in Portugal

- The CCPC publishes a protocol establishing safeguards for material that may be the subject of either privacy or legal professional privilege

- France proposes to extend legal professional privilege to in-house lawyers' consultations in civil, commercial and administrative matters

- GC rejects Red Bull's request for interim measures

Hellenic Competition Commission imposes €1 million fine on an individual for obstructing a dawn raid

In September 2023, the Hellenic Competition Commission (HCC) fined an individual €1 million for obstruction during a dawn raid. The company, of which the individual is allegedly a major shareholder, was fined significantly less—€200,000. The fine is one of the highest-ever penalties imposed on an individual outside of the United States for obstruction of a dawn raid.

Fining individuals in the context of antitrust dawn raids is unusual. Unlike the HCC, the European Commission does not have powers to fine individuals. It can fine undertakings or associations of undertakings a fixed fine of up to 1 per cent of the total turnover of the undertakings in the preceding business year, and/or a daily periodic penalty of up to 5 per cent of the average daily turnover of the undertaking.1 By way of illustration, in the past the European Commission has fined undertakings for, e.g., tampering with access to email accounts during a dawn raid,2 tampering with a seal placed on an office door overnight,3 denying the inspection officials access to a director's office,4 not allowing the inspection officials to enter the company's premises until legal counsel arrives5, or refusing to provide requested documents.6

Preliminary ruling requests regarding search and seizure of emails in Portugal

The Court of Justice of the European Union (CJEU) has recently received three requests for preliminary rulings sent by Portuguese courts related to the search and seizure of emails carried out by the Portuguese Competition Authority (PCA). These requests follow a ruling by the Portuguese Constitutional Court that may have unprecedented effects in pending competition cases.

Since its creation in 2003, the PCA has conducted dawn raids mainly on the basis of warrants issued by the Public Prosecutor's Office. For years, companies have challenged this practice, arguing that the seizure of emails during dawn raids should not be admitted at all—since emails should be deemed "correspondence" and, as such, be protected—or, at least, should be authorised by a judge and not merely by a Public Prosecutor.

Until recently, the Portuguese case law backed this practice, stating that while unread emails should be protected as "correspondence", open emails were mere "documents" and could be seized based on a warrant granted by the Public Prosecutor.

As we reported in the previous issue of DRAQ's newsletter, a groundbreaking development occurred in March this year, when the Portuguese Constitutional Court ruled that the search and seizure of emails should always be authorised by a judge. Later in July 2023, a second ruling by the Constitutional Court confirmed this understanding.

The impact of these rulings by the Constitutional Court is still uncertain, but it can be an important precedent that may apply to numerous pending cases, possibly leading to the annulment of the PCA's decisions and its significant fines imposed on companies.

Meanwhile, the Competition Court issued requests for preliminary rulings in three pending cases7, in which dawn raids were conducted on the basis of warrants granted by the Public Prosecutor. Those requests mainly intend to confirm whether the search and seizure of emails carried out on the basis of warrants granted by a Public Prosecutor complies with Article 7 of the Charter of Fundamental Rights of the European Union protecting people's right to private and family life, home and communications. The extent to which a possible ruling by the CJEU may have any effect in overturning or at all affecting the rulings issued by the Constitutional Court is so far unclear.

Provided by Sara Estima Martins, SRS Legal

The CCPC publishes a protocol establishing safeguards for material that may be the subject of either privacy or legal professional privilege

Earlier this year, the Irish Competition and Consumer Protection Commission (CCPC) published a protocol establishing safeguards for material that may be the subject of either privacy or legal professional privilege claims during a dawn raid.

The 2023 protocol contains five principles to be followed by the CCPC:

- Legality: Search operations must be conducted lawfully, in line with the rights of the search target

- Proportionality: The CCPC must strike a balance between its duty to seek, obtain and preserve evidence against the rights of the search target

- Necessity: The CCPC must take steps to focus the scope of the search operation. However, potentially extraneous material may nevertheless be seized and retained

- Fairness: The search target's right to fair procedures must be considered in light of the CCPC's legitimate interest in investigating potential breaches of EU/Irish competition rules

- Transparency: The CCPC must document its procedures with due regard to the rights of the search target. However, some information may be withheld in order to protect certain investigations

Once a search warrant is granted by a District Court judge, the CCPC will authorise its officials to carry out a dawn raid. The warrant will, at the beginning of the raid, be presented to the search target who is given time both to review the warrant and, also, to contact its legal representatives. The CCPC will also provide copies of both an explanatory note relating to the search and a copy of the protocol to the search target. On completion of the dawn raid, the CCPC must provide the search target with a copy of the "site exhibits chart", containing a list of all items seized.

When raising claims that material is protected by privacy rights, the search target must identify the relevant seized material and give reasons as to why this raises privacy rights. Therefore, blanket privacy claims will not be considered. The CCPC must examine the identified material on a case-by-case basis, in line with the five principles. If circumstances prevent it from dealing with the claim onsite, the CCPC will specify an alternative method for review and communicate this to the search target.

The procedure for dealing with material claimed to be the subject of LPP will depend on the material's format when it was seized. If the information is in ‘hard copy', the CCPC may request this material be placed in a sealed envelope. If the information is in ‘soft copy', this regulator may request that the relevant material is stored separately. The CCPC will then explain the protections put in place to ensure confidentiality of either format of material pending the determination of its status (which is a decision for the CCPC and, if the search target disagrees with the CCPC's decision, ultimately, the Courts).

The 2023 protocol ensures certainty, transparency and respect for search targets' rights in the conduct of dawn raids. It follows the recommendations of the Irish Supreme Court in https://ie.vlex.com/vid/crh-plc-irish-cement-793659213CRH v. CCPC [2017] IESC 34 which criticised the CCPC for seizing the entire email account of a senior executive of a search target without adequate protection for both privacy rights and LPP.

The adoption of the 2023 protocol is timely, as the CCPC's enforcement powers have been increased with the recent commencement of the Competition (Amendment) Act 2022.

Provided by Cormac Little SC, Partner, William Fry LLP (Dublin)

France proposes to extend legal professional privilege to in-house lawyers' consultations in civil, commercial and administrative matters

In October 2023, the French Parliament adopted a bill comprising provisions aiming to protect, under certain conditions, the confidentiality of certain in-house legal consultations. In contrast, under EU law legal professional privilege covers only legal advice communication between an EEA-qualified external lawyer and his/her client.

The provisions of the bill are not yet in force. They must first be validated by the French Constitutional Council that has been seized on 16 October 2023, and then promulgated by the French President. The referral of the bill to the French Constitutional Council could potentially lead to further debate on the "legal professional privilege" provisions, meaning the current text may change.

If the bill comes into force, France will therefore join other European jurisdictions that extend legal professional privilege to legal advice communication with a company's in-house lawyers. The list already includes countries such as the UK, the Netherlands and Belgium.

The current text provides that "legal consultations drawn up by an in-house lawyer or, at his request and under his supervision, by a member of his team placed under his authority, for the benefit of his employer are confidential".

These new provisions aim to facilitate the work of French in-house counsel who are required to implement an increasing number of compliance obligations and to alert companies to legal risks, while avoiding the risk of self-incrimination.

Conditions required for the legal privilege to apply

Three conditions will need to be met for in-house counsel's consultations to benefit from legal privilege:

- The in-house counsel (or the member of the team placed under its authority) must (i) have a master's degree in law or an equivalent French or foreign diploma and (ii) be able to prove that he or she has completed initial and ongoing training in professional ethics

- The consultations must be marked "confidential—in-house counsel consultation" and must be specifically identified and traceable in the company's files

- The consultations must be intended exclusively for "the legal representative, his or her delegate, any other management, administrative or supervisory body of the company employing the lawyer, or any entity controlling one of these bodies".

If the above conditions are met, the consultations are covered by legal privilege and cannot, in the context of civil, commercial or administrative proceedings, be seized or required to be handed over to a third party, including a French or foreign administrative authority, nor be used against the company.

The draft text expressly provides that the legal privilege for in-house counsel's consultations is not applicable to criminal or tax procedures.

While the final bill does not exclude competition matters from the scope of the legal professional privilege, the French competition authority's General Case Handler, Stanislas Martin, has stated that the FCA will not apply the extension of legal professional privilege to in-house lawyers as it would be contrary to EU law. The FCA's position is questionable. EU law does not prevent the application of an in-house legal privilege in the context of investigations by French authorities. Other EU Member States (see above) already have a similar mechanism for in-house legal consultations, which they have been applying in the context of investigations by national competition authorities.

GC rejects Red Bull's request for interim measures

As we reported previously (see Q2 here), in May 2023 Red Bull lodged an appeal before the General Court to challenge the European Commission's inspection at its premises in March 2023. In July 2023, in addition Red Bull submitted an application for interim relief seeking the suspension of the execution of the contested dawn raid decision. On 29 September 2023, the General Court dismission this application for interim measures (T-306/23).

During the inspection the European Commission inspectors seized a number of documents after assessing their relevance. However, on the last day of the inspection, the inspectors made a "bulk" copy of a large number or electronic documents (approximately 5 terabytes) for which the officials were not able to assess definitively relevance. The officials also requested 16.6 terabytes of additional electronic data to be provided subsequent to the dawn raid.

Red Bull claimed that it would suffer serious and irreparable damage as a result of violations of Article 7 of the Charter of Fundamental Rights of the European Union. It argued that it was highly probable that inspectors would become aware of data of a personal nature. In particular, Red Bull argued that the inspectors should have ensured that all the documents removed from the premises did not contain personal data, and that employees should have been given the opportunity to examine the data or object.

The General Court concluded that Red Bull had not demonstrated the necessary condition of urgency as it had not demonstrated that it or its employees would suffer serious and irreparable damage if the interim measures were not granted. It held that the occurrence of the damage alleged had not been established with a sufficient degree of probability. The General Court pointed to the fact that:

- Only European Commission officials in charge of the investigation can become aware of the personal data, and that these officials are subject to strict obligations of professional secrecy under the TFEU, Regulation 1/2003, and the Staff Regulations

- Red Bull's representatives were present during the entire examination of the documents by European Commission officials, and were able to challenge the inclusion of certain documents in the investigation file on the grounds that they contained personal data unrelated to the investigation

- The inspectors adopted a procedure for examining documents containing sensitive personal data that involved the use of a restricted circle comprised equally of European Commission officials and Red Bull representatives

- There was an arbitration procedure in the event of disagreement regarding the relevance of documents in the investigation

The General Court also rejected arguments concerning the need for an unreasonably long time to carry out the inspection in view of the quantity of data and unsuitable methods being used. The General Court considered this argument to be hypothetical, noting that the European Commission had planned a period of six weeks for the examination of the remaining documents which could not be considered disproportionate.

1 Articles 23 and 24 of Regulation 1/2003

2 Case T-272/12 Energeticky prumysl and EP Investment Advisors v Commission.

3 C-89/11 P, E.ON Energie v Commission

4 T-357/06 Koninklijke Wegenbouw Stevin v Commission

5 T-357/06 Koninklijke Wegenbouw Stevin v Commission

6 Commission Decision 92/500/EEC – CSM NV

7 See Cases C-260/23 - SIBS - Sociedade Gestora de Participações Sociais and Others, C-258/23 - Imagens Médicas Integradas and C-259/23 - Synlabhealth II

Interactive Dawn Raid map

Hover over the highlighted countries to get a closer look at the enforcement activity of the respective National Competition Authorities since 2021.

Austria2024

2023

2022

2021

Belgium2025

2024

2023

2022

2021

Bulgaria2025

2024

2023

2022

2021

Croatia2025

2024

2023

2022

2021

Cyprus2023

2022

2021

Czech Republic2025

2024

2023

2022

2021

Denmark2025

2023

2022

2021

Estonia

Finland2025

2024

2023

2022

2021

France2025

2024

2023

2022

2021

Germany2024

2023

2022

2021

Greece2025

2024

2023

2022

2021

Hungary2025

2023

2022

2021

Ireland2025

2024

2023

2022

2021

Italy2025

2024

2023

2022

2021

Latvia2025

No dawn raids for the period 2021 – 2023 Lithuania

Luxembourg2025

2024

2023

2022

2021

Netherlands2025

2023

2022

2021

Norway2025

2023

2022

2021

Poland2025

2024

2023

2022

2021

Portugal2024

2023

2022

2021

Romania2025

2024

2023

2022

2021

Slovakia2025

2024

2023

2022

2021

Slovenia2024

2023

2022

2021

Spain2025

2024

2023

2022

2021

Sweden2023

2022

2021

Switzerland2025

2024

2023

2022

2021

United Kingdom2023

2022

2021

EU2025

2024

2023

2022

2021

|

A look at the statistics

The information below has been sourced from LexisPSL, and is based on dawn raids that have been publicly announced by competition authorities. The LexisPSL information was supplemented from public sources in jurisdictions where further information was available. Since not all competition authorities announce every dawn raid, the data below likely underestimate the number of raids. The sector charts reflect dawn raids in which the sectors were identified by the competent authorities. In some jurisdictions (e.g., Germany), the authority publishes the number of raids without identifying the sector. As a result, the statistics in the charts below may underestimate the actual number of dawn raids by sector and country.

Dawn raids in the EEA and the UK, 2018 – 2023

As of 23 October 2023

Source: LexisPSL and publicly available data

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

View full image: Number of dawn raids per year, 2018 – 2023 ytd (PDF)

View full image: Number of dawn raids per year, 2018 – 2023 ytd (PDF)

View full image: Dawn raid leader board (PDF)

View full image: Dawn raid leader board (PDF)

View full image: Number of dawn raids per year, 2018 – 2023 ytd (PDF)

View full image: Number of dawn raids per year, 2018 – 2023 ytd (PDF)

View full image: Dawn raid tracker by sector, 2018 – 2023 ytd (PDF)

View full image: Dawn raid tracker by sector, 2018 – 2023 ytd (PDF)

View full image: Most recent sector trends: Dawn raids by sector in 2022 and Q1 – Q4 2023 (PDF)

View full image: Most recent sector trends: Dawn raids by sector in 2022 and Q1 – Q4 2023 (PDF)