Foreign direct investment reviews 2021: United Kingdom

The National Security and Investment Act introduces a mandatory obligation to secure clearance for certain types of transactions

8 min read

The NSIA is not limited to foreign investors, nor do target entities need to be UK-registered in order to be notifiable

On January 4, 2021, the long-anticipated National Security and Investment Act 2021 (NSIA) entered into force in the UK. The NSIA creates, for the first time in the UK, a mandatory obligation to secure clearance for certain types of transactions before they can be completed.

NSIA: KEY FEATURES

The NSIA takes a sector-based approach to assessing potential national security risks related to investment in (or acquisition of) businesses with activities in the UK, requiring notifications from investors acquiring stakes in entities active in "sensitive sectors" in the UK.

The NSIA defines 17 sensitive sectors:

- Advanced materials

- Artificial intelligence

- Autonomous robots

- Civil nuclear

- Communications

- Computing hardware

- Critical suppliers to government

- Critical suppliers to the Emergency Services

- Cryptographic authentication

- Data infrastructure

- Defense

- Energy

- Engineering biology

- Military and dual-use technologies

- Quantum technologies

- Satellite and space technologies

- Transportation

Within these sensitive sectors are specific qualifying criteria. For example, under communications, there is a target turnover threshold of at least £50 million. All of the headings specify precisely in which activities within each sector the target will need to be engaged to trigger the notification obligation. Certain types of transactions within each of the sensitive sectors will require mandatory notification, but the government can investigate transactions in the sensitive sectors that are not subject to mandatory notification requirements.

If the Secretary of State concludes that a transaction does indeed pose a national security risk, the deal can be unwound or blocked

WHO MUST NOTIFY

Unusually for such regimes, the NSIA is not limited to foreign investors, nor do target entities need to be UK-registered in order to be notifiable. Even UK-on-UK investments require a notification if the NSIA mandatory notification criteria are satisfied. The obligation to notify lies with the prospective investor. Qualifying acquisitions are those that involve:

- An acquisition wherein an investor's shares or voting rights will exceed 25 percent, 50 percent or 75 percent. A minority stake taking an investor from 24 percent to 26 percent, for example, would satisfy this test, whereas an increase from 80 percent to 90 percent would not do so

- An acquisition wherein the investor acquires sufficient voting rights to secure or prevent the passage of any class of resolution governing the affairs of the target

- An acquisition wherein the transaction will enable the investor to materially influence the policy of the target. This is the same standard used in the UK in the context of the merger control regime. The reference to an investor's ability to materially influence target policy includes the management of its business, ability to control the target's strategic direction, and ability to define and achieve its commercial objectives

REVIEW PROCESS AND TIMELINE

Notifications must be submitted to the Investment Screening Unit (ISU) at the Department of Business, Energy and Industrial Strategy (BEIS) via an online notification service.

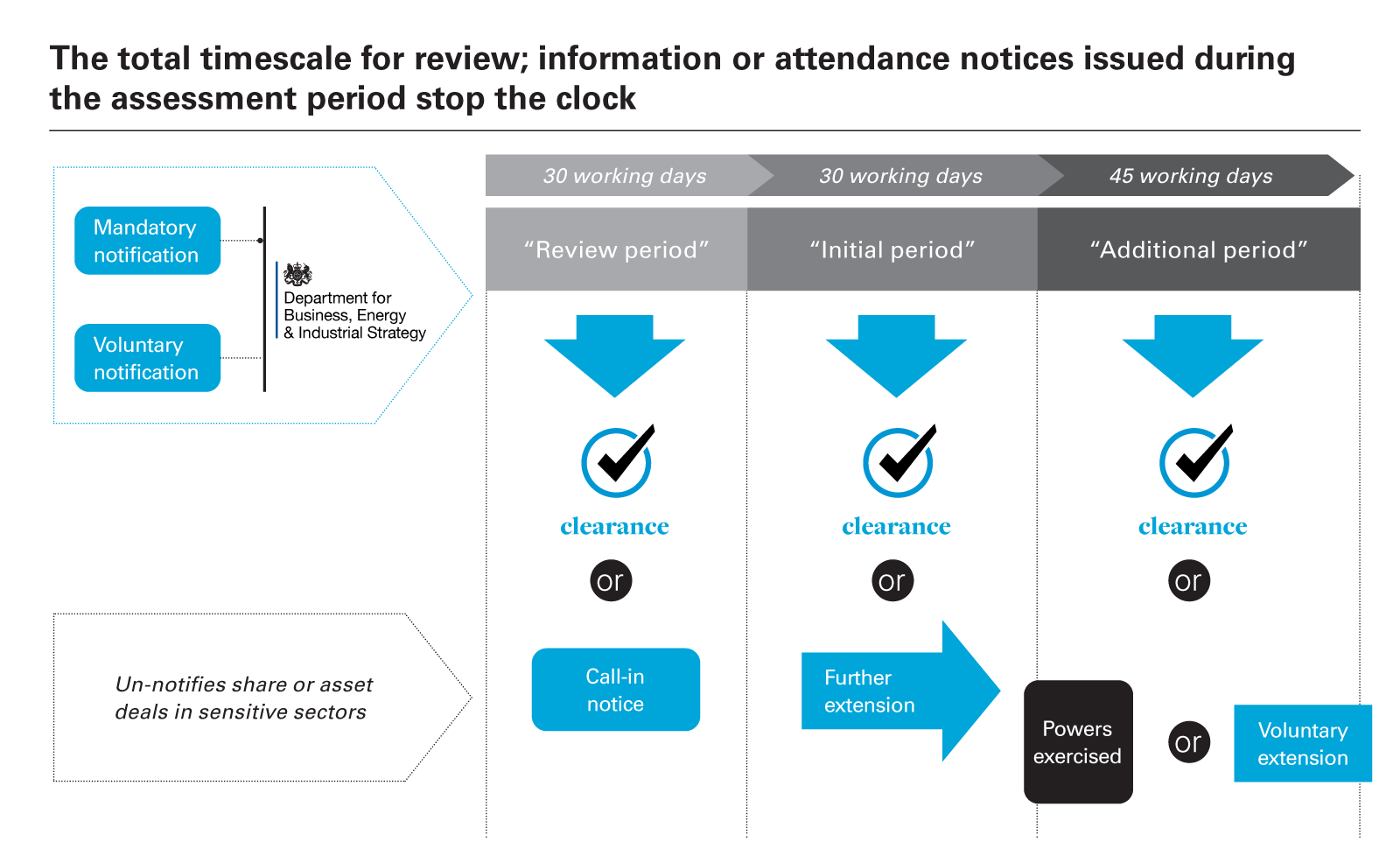

Once a notification is accepted, its consideration can be divided into two parts:

- The review period, applicable to all notifications

- The assessment period, applicable only if a transaction is "called-in"

BEIS's working assumption is that the most notifications will be cleared during the initial review period. Once a notification is confirmed as complete, this period lasts for 30 working days. During this period, the ISU can issue information notices (to request further detail to assist with completing the assessment) and attendance notices (requiring attendance at a meeting with the authorities).

Information/attendance notices issued during the review period do not stop the clock on the 30-working-day timescale. At the end of that period, the authorities will either clear the transaction or issue a "call-in notice."

If the authorities determine that the transaction may pose a risk to national security, then a call-in notice will be issued; the call-in notice brings the deal into the "assessment review" phase, which is initially set to 30 working days, although it can be extended by a further 45 working days. Information or attendance notices issued during the assessment review period, however, will stop the clock and so could push timelines further out.

During the assessment review period, authorities will assess whether the deal could pose a national security risk in the UK. BEIS has indicated that it will consider three factors in making this determination, although ultimately all reviews will be conducted on a case-by-case basis:

- Target risk, where the entity or asset in question could be used to undermine national security. BEIS has given the example of targets that are close to sensitive sites, but ultimately any target falling within the defined sensitive sectors will be considered more likely to raise target risks

- Acquirer risk, where the investor has characteristics that suggest there is a risk to national security from the investor gaining control of the target. Such characteristics would include sectors of activity, technological capabilities and links to entities that are considered a risk to the UK. This assessment will involve consideration of the acquirer's ultimate controller. On the positive side, a history of passive or long-term investments can be considered indicative of lower acquirer risk

- Control risk: The higher the level of control that is being acquired, the greater the control risk, in the eyes of the BEIS

One of the more novel features of the NSIA regime is the potential for retrospective review.

The Secretary of State is empowered to issue a call-in notice for any deal closed from November 12, 2020. This general power to issue call-in notices is restricted to six months from the day the Secretary of State became aware of the transaction, or five years from the date of the acquisition. This limitation of the prospective period of issue of call-in notices, from five years to six months, is one of the reasons investors may wish to consider a voluntary notification.

POST-REVIEW POWERS AND PENALTIES

If the Secretary of State concludes that a transaction does pose a national security risk, the deal can be unwound or blocked, or subject to appropriate conditions. These conditions could include targeted divestments, undertakings with respect to management and key staff, or sensitive information ring-fencing, although ultimately conditions will be determined on a case-by-case basis.

Closing a notifiable transaction without approval is an offense that can carry both criminal and civil penalties. Potential fines for breach of the obligation to secure clearance before closing are set at the higher of 5 percent of total turnover (both in and outside the UK) and £10 million. A notifiable transaction completed without Secretary of State approval is also rendered void under the NSIA.

Other penalties can be imposed for failure to comply with interim or final orders, failing to comply with information or attendance notices or breaching the disclosure of information provisions.

INTERACTION WITH THE ENTERPRISE ACT

Prior to the NSIA's entry into force, the UK government's powers to intervene were restricted to transactions that raised certain "public interest" considerations under the Enterprise Act 2002 (EA02).

The EA02 regime empowered the Secretary of State to issue a "public interest intervention notice" (PIIN) for transactions that might concern national security, media plurality, the stability of the UK's financial system and, in the wake of the COVID-19 pandemic, the capacity of the UK to combat a public health emergency. PIIN cases to date have focused significantly on national security, with roughly a quarter of cases focusing on media plurality and a small number on financial stability.

The "national security" heading has fallen away from the EA02 regime in favor of the NSIA, although it continues to apply to cases in the other three categories. The EA02 public interest regime will now be confined to transactions related to media plurality, financial stability and public health emergencies. Under the EA02 system, there is no obligation, nor indeed any option, for parties to pre-notify transactions for approval; it is up to the government to choose to intervene.

In terms of the interaction of the two regimes, the retrospective call-in review power will be inapplicable to transactions that have already been subject to a national security intervention under the EA02. In practice, that is unlikely to occur.

LESSONS LEARNED

- Potential issues should be considered as early in the planning process as possible. The NSIA is very broad, and certainly extends beyond the scope of classic "defense" deals. The better-prepared investors are, the easier the process will be

- Throughout 2020, investors in sensitive sectors have been pre-engaging with the ISU to get an indication of whether their transactions may be subject to the retrospective call-in review power. For deals that have received such indications but not closed by January 4, 2022, a formal notification will still be required when the notification criteria are met, even if BEIS indicated the deal was unlikely to pose a national security threat

- Investors not strictly required to notify because, for example, they are planning an asset acquisition rather than a share acquisition, might still benefit from a voluntary notification to eliminate the risk of post-closing call-in review

- If a prospective deal is caught by the mandatory notification regime under NSIA, it will no longer be possible to sign and close deals simultaneously

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2021 White & Case LLP

View full image: Total timescale for review (PDF)

View full image: Total timescale for review (PDF)