Mining & Metals 2023: Lifting the fog of uncertainty

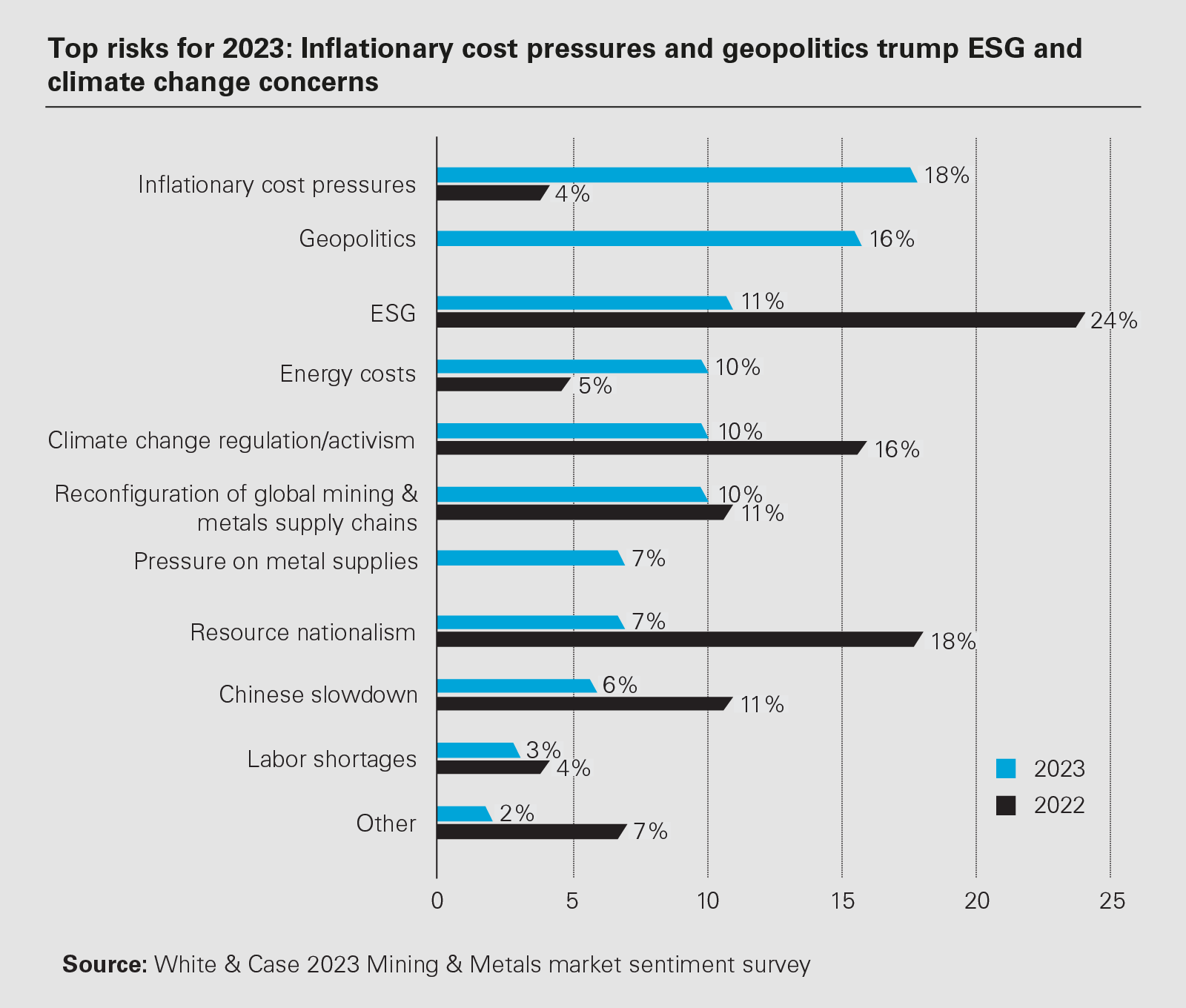

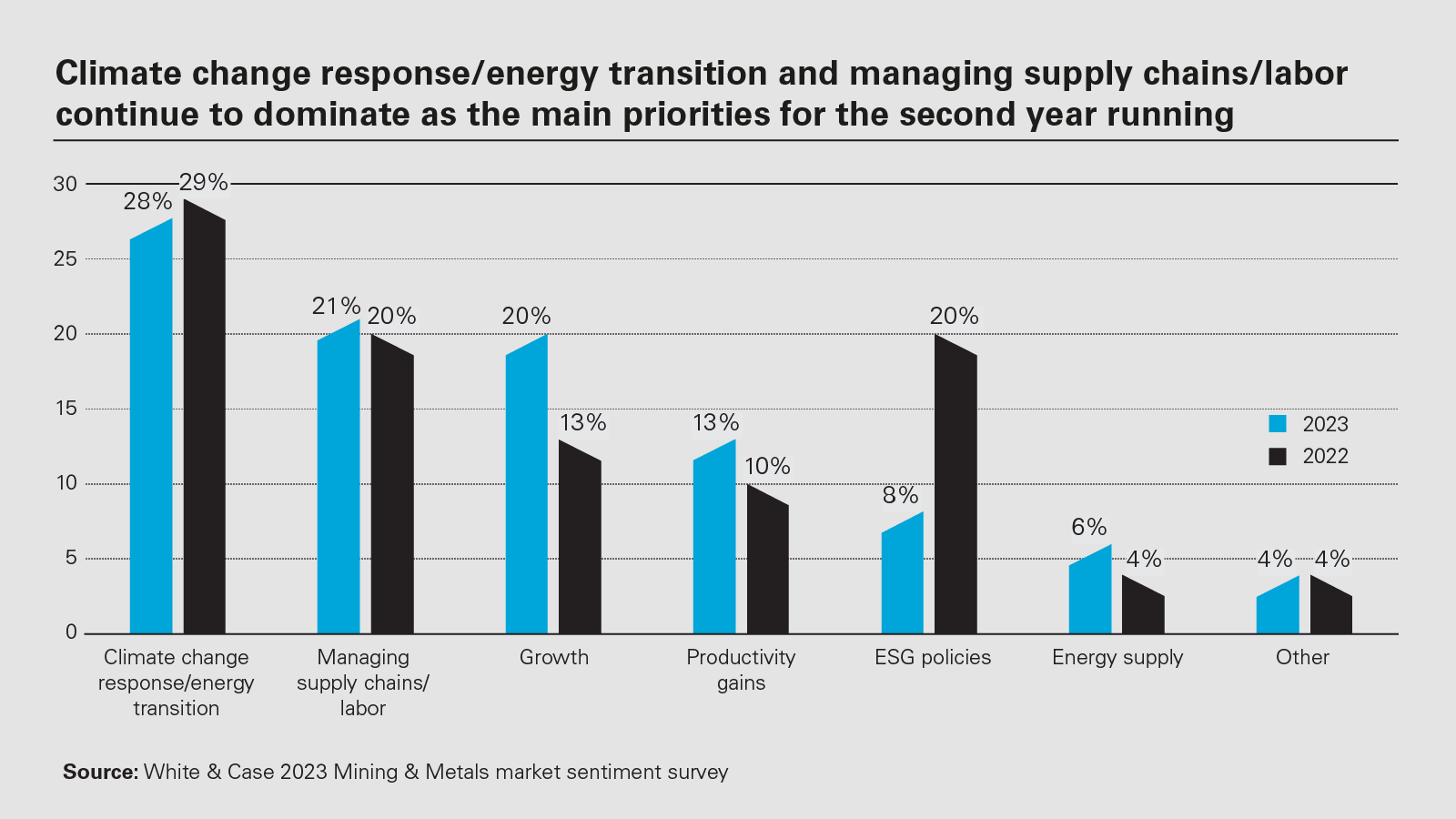

Geopolitical risks and inflationary pressures may have overtaken ESG as the top concerns for the mining & metals sector, but there is little expectation that ESG factors will diminish for investors and firms in 2023.

16 min read

Mining companies continue to make acquisitions and investments knowing that whatever turbulence they face today, the material demands of the energy transition and risk of supply deficits are stark

2022 proved remarkably tumultuous for commodities markets. Will 2023 offer more certainty? To get an idea, White & Case has conducted its seventh annual survey of industry participants, with 156 senior decision-makers sharing their thoughts for the year ahead. The respondents paint a mixed picture of what the industry expects. Inflation and geopolitics have overtaken ESG as the biggest concerns for 2023, while higher energy costs, shifting supply chains, and climate-related regulation and activism still worry firms. Despite shared concerns, there is surprisingly little agreement on what the economic outlook is, how market players will respond, or what will be the pervasive theme for the year ahead.

And yet, even with the high degree of uncertainty facing the industry, 4Q 2022 saw the largest amount of M&A activity in a decade, nearly matching the total volume of deals for 1-3Q last year. Mining companies continue to make acquisitions and investments knowing that whatever turbulence they face today, the material demands of the energy transition and risk of supply deficits are stark.

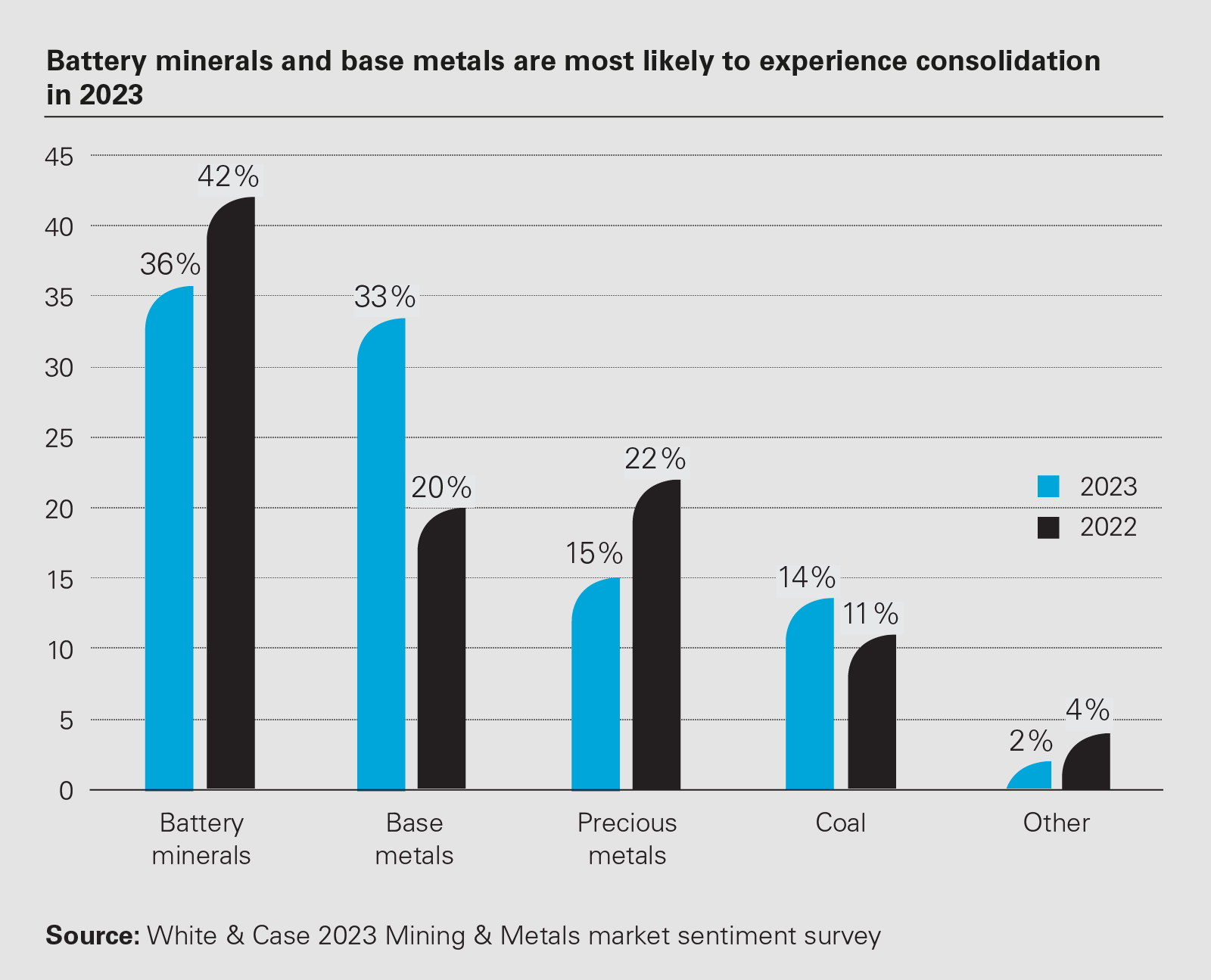

Striking in the survey responses is the link of areas perceived in high demand to the EV supply chain. Copper and lithium ranked materially higher as likely big winners in 2023, with battery minerals and base metals as the most likely areas for consolidation. It seems that everything EV-linked is perceived to be where the opportunities are for 2023.

As the energy transition, decarbonization, and shifting consumer and policy preferences accelerate, we can no longer talk about a unified price-and-market cycle for mineral products with confidence (if we ever could). New entrants and longstanding participants alike need increasingly refined understandings and plans for specific segments of minerals and metals markets whose traditional correlations and intra-sector relationships are rapidly evolving in a difficult economic environment. Uncertainty in any industry cannot be good—but who in the mining & metals sector can manage it best?

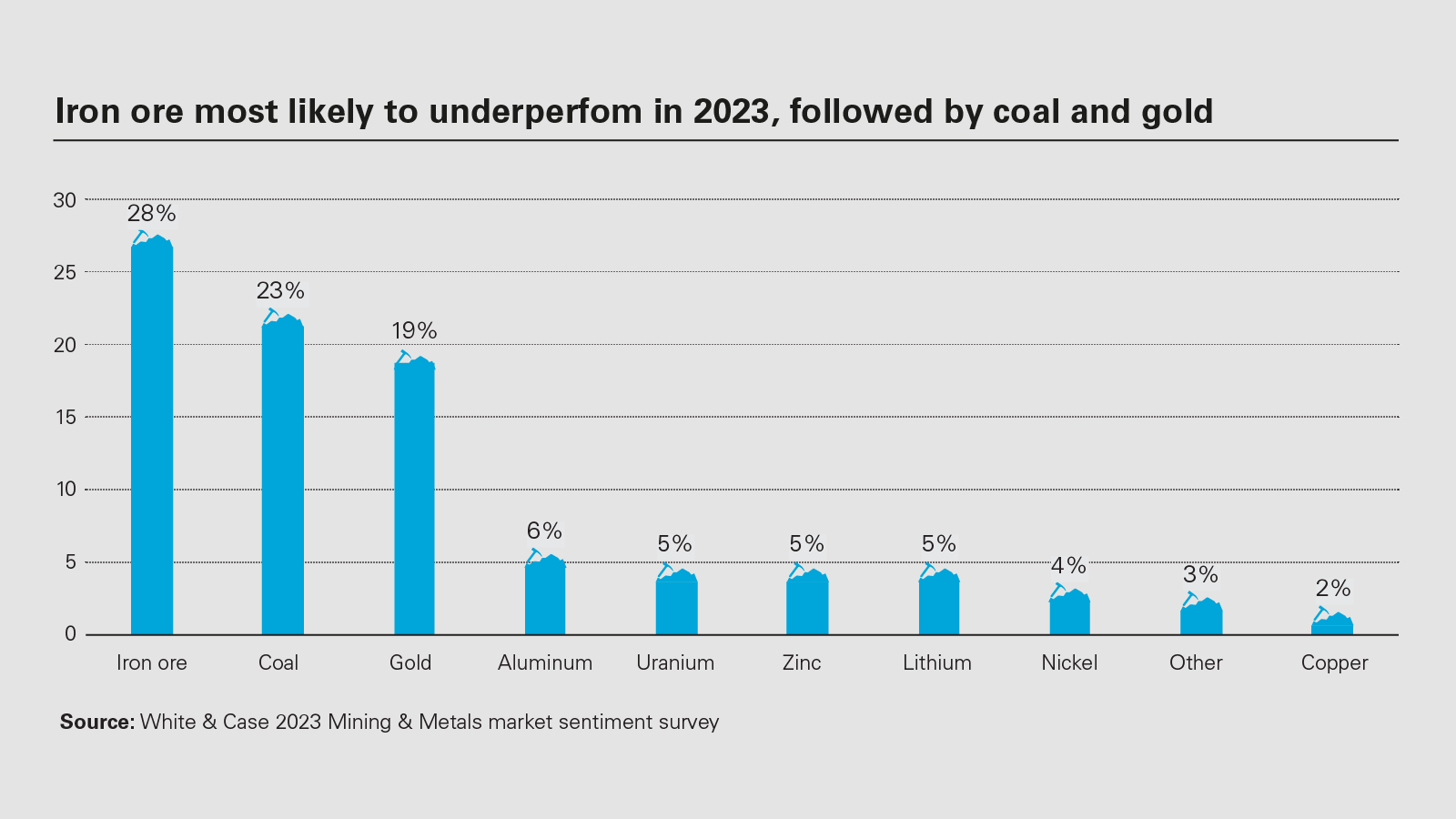

The lack of clarity regarding the global macroeconomic outlook is belied by the commodities considered most likely to underperform in 2023 by our respondents: iron ore, coal and gold.

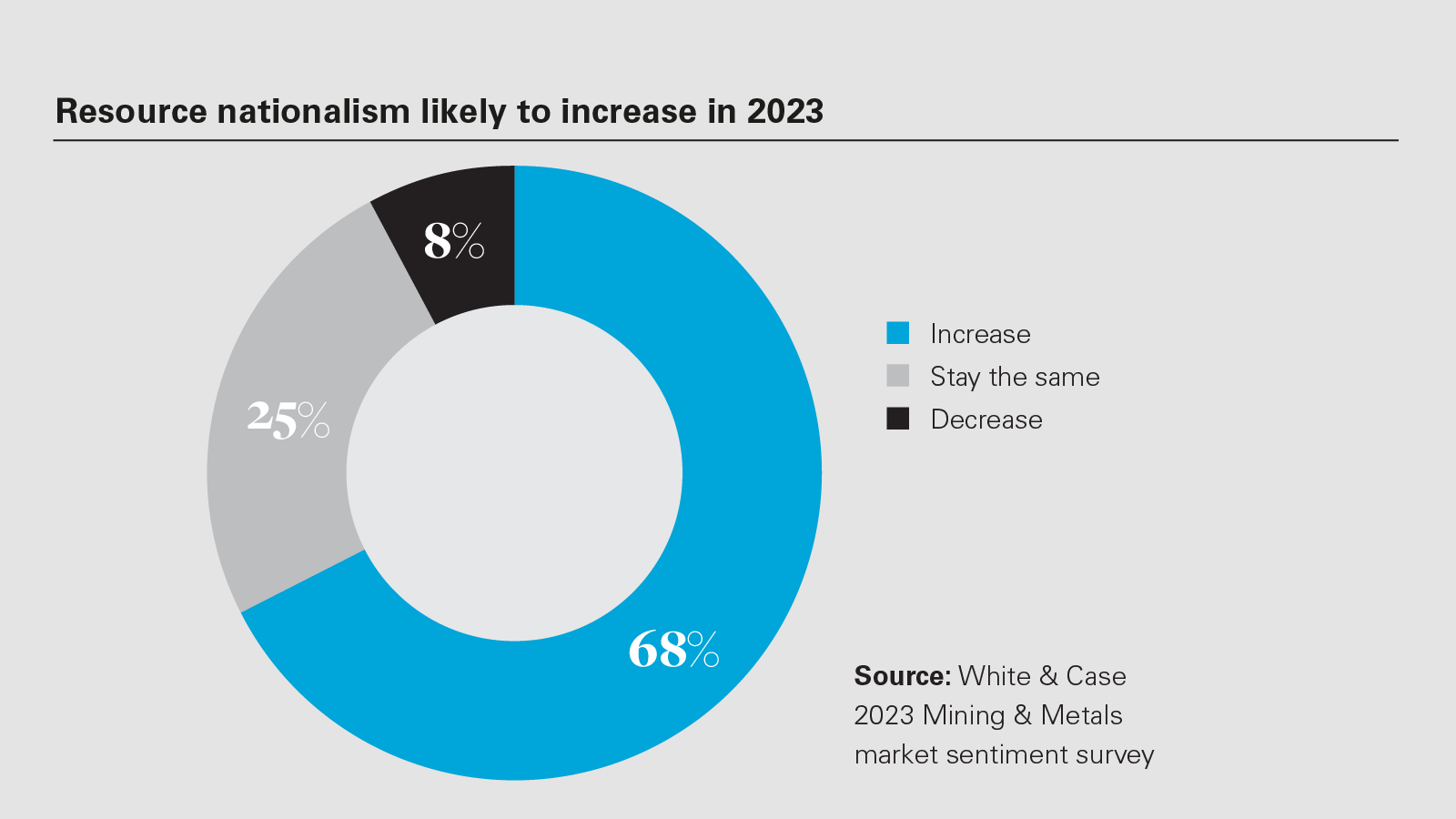

All three point to deflationary expectations despite continued concerns about inflation. The implications for the mining & metals sector—either way—are far-reaching. Costs normally fall far more slowly than commodity prices, further weakening profit margins and compounding the negative effects of a market pullback. Nor have market shocks in recent history during the Global Financial Crisis, 2013 – 2014, and initial COVID shock in 2020, seen interest rates rise anywhere close to the levels seen now, as the Federal Reserve and other leading central banks resorted to monetary policy measures to dampen high inflation. Since the invasion of Ukraine in February 2022 and the imposition of zero-COVID measures in China, the markets faced a perfect storm of competing pressures unlikely to fully subside in 2023. On top of this, miners face intensifying pressures from investors, local communities and national governments to meet ESG criteria, and the social strain of high inflation is now pushing an emerging wave of resource nationalism.

Heading into 4Q 2022, the dominant question was whether the mining & metals sector was prepared for a global downturn. Looking ahead in 2023, the mining & metals sector and its stakeholders have to be ready for anything in 2023, downturn or not.

The inflationary case

US$10,400

per tonne Copper prices reached highest level on record in March 2022, averaging at US$8,800 per tonne in 2022

US$9.9bn

Total metals & mining industry M&A deals worth US$9.9bn were announced globally in Q3 2022

Source: Mining Technology

Despite recent declines in major inflation indices pointing to an easing of inflationary pressures across major economies, there's reason to believe an inflation upside remains for the year ahead. The end of zero-COVID policies in China brought on by public pressure offers a short-term downside for commodity prices as infection and mortality rates spike, before likely offering demand upside in the second half of the year. China's property sector is a leading bellwether for metals, as construction provides the single-largest source of demand for iron ore, steel and nickel, which is used as an input for stainless steel globally; and the real estate sector continues to weigh on sentiment and the economy, with house prices falling for the sixth month in a row in December 2022. But support measures reducing the cost of credit and encouraging mortgage borrowing are likelier to have a more positive effect in the event that consumer confidence improves after the initial peak of infections. Reopening in China should improve consumer confidence, and with it spending and borrowing for commodity-intensive goods and housing.

China's potential upside for commodities coincides with a persistently strong labor market in the United States, and excess savings among American households worth an estimated US$1.7 trillion heading into 2023. Rapidly rising interest rates have yet to significantly cool jobs and wages figures, boosting the odds of a "soft landing." Growth in 3Q outpaced expectations with limited evidence of a consumer slowdown in 4Q. European economies have also weathered punishingly high energy prices linked to Russia's cutoffs of piped natural gas exports surprisingly well. Eurozone unemployment reached a record low of 6.5 percent at the end of November and increases from the consumer price index in Germany, the most important economy for European Central Bank policy, fell more than expected in December to 9.6 percent in annualized terms, a steep decline from the 11.3 percent figure recorded in November. Though many European economies face significant recession risks in the year ahead, the Eurozone and EU more broadly enter 2023 in a stronger position than expected for much of 2022.

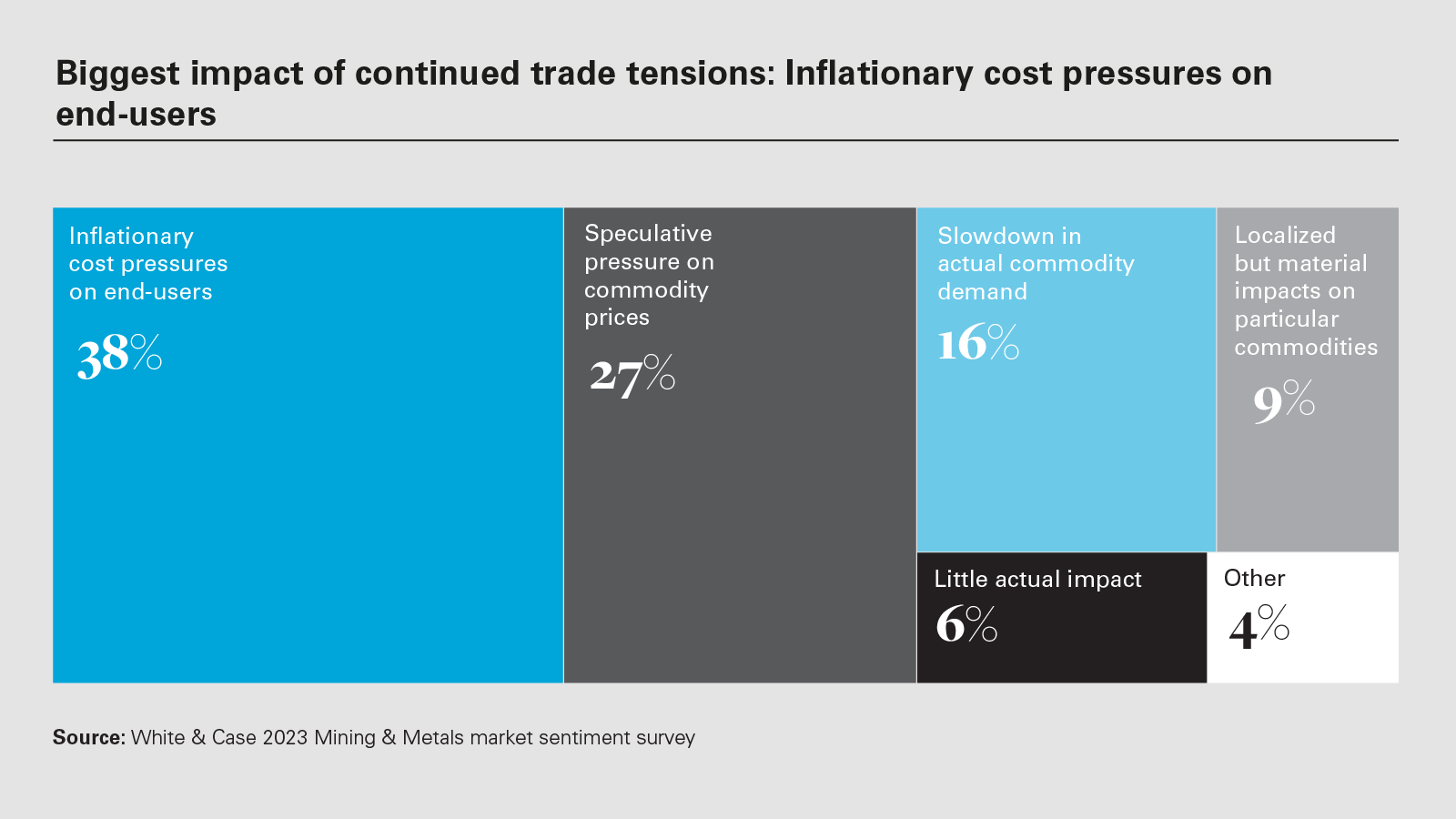

Our survey respondents expect costs to remain higher for longer despite signs of relief first seen among metallurgical firms last autumn, with energy costs coming in fourth for our respondents among the biggest risks for 2023. Anglo American saw unit costs rise 16 percent in 2022 while production dropped 3 percent. Rio Tinto's iron ore cost guidance for 2023 notes an expected 7.7 percent increase respectively with production, the company's largest source of profits, remaining flat. Rio's copper cost guidance expects a 6.7 percent increase for next year, with output growth driven by the acquisition of Turquoise Hill. Even as inflation moderates, cost levels remain elevated relative to 2019, with miners like BHP warning of continued inflation risks in 2023. Our respondents similarly note that trade tensions will likely increase inflationary pressures for end-users, feeding into their own operating costs and markets more generally.

A stronger than expected demand and price environment in 2023 could provide more cushion for earnings and spending, but would likely increase cost-side pressures and constraints on financing. It could also alter firms' ESG exposure.

US$11bn

S&P Commodity Insights expects the aggregate global capex across major mined minerals, excluding coal, to decline in nominal terms by US$11 billion

The deflationary case

A granular understanding of the market is now more necessary than ever to remain competitive; we can no longer accept as a given the relatively unified price cycle across the mining & metals sector

A host of deflationary drivers is equally important to consider. The Federal Reserve has not undertaken a hiking cycle this aggressive since the Volcker Shock in 1980, dramatically strengthening the US dollar against most currencies and increasing the currency costs of commodity imports and debt denominated in US dollars globally. Rising interest rates in the US have decimated demand in the US housing market, nearly 17 percent of US GDP alone, made auto loans increasingly expensive for households, and driven up the cost of interest on credit cards, a dynamic buoyed until now by the excess savings accumulated over the course of the pandemic. However, excess savings are likely to be run down in the first half of 2023, driven by rising interest rates. Higher costs of issuing US dollar-denominated debt hurt emerging markets. The IMF estimates that 60 percent of low-income developing countries are at risk of debt crises in the year ahead. The US and Eurozone face greater recession risks the longer interest rates and inflation levels remain elevated, which could drag down growth and commodities demand across emerging markets if rate hikes continue. Even China is likely to see softer consumer demand as its export orders fall.

The generous financial support and spending across developed markets, led by the US in 2020 and 2021, provide a rapidly diminishing tailwind for consumers. Targeted support for surges in energy prices in Europe, for instance, has a net deflationary impact by reducing the inflationary effects of high energy prices across the economy without generating demand for other goods and services. Instead, households are running down their excess savings from the past three years, which should lead to a downward correction in demand. Respondents cite geopolitics and trade tensions as leading concerns for 2023 with good reason. The Biden administration continues to oppose the reconstitution of the Appellate Body of the WTO, maintains steel tariffs first imposed by the Trump administration, and raised the ire of European metallurgical firms with energy subsidy provisions included in the Inflation Reduction Act. Russia's invasion of Ukraine, following cutoffs of piped natural gas supplies to Europe, the imposition of western import bans and a G-7 price ceiling on Russian crude exports, and the EU's recently negotiated carbon tariff (CBAM) have introduced an unprecedented degree of political volatility to commodities markets. The net effect of these will be to hold costs for businesses higher for longer despite an easing of inflation, thereby passing on costs to consumers and accelerating the exhaustion of savings generated by pandemic policies.

Finally, producers globally have begun to report relative declines in cost or, at minimum, significant slowdowns in the rate of cost increases. European producers struggling to adapt to surging energy prices saw producer price inflation (PPI) peak in August-September at 43.4 percent year-on-year, only to decline to 30.8 percent for the November reading. That figure was 7.4% in the US. Producers in China have registered a net decrease year-on-year in costs since October. Rather than crash the energy transition, the surge in energy prices accelerated it. Investments in efficiency, accelerated deployments of renewable energy, heat pump installations and campaigns to encourage conservation have led to declines in producer price inflation since H2 2022 began. Lower price levels for metals since May of 2022 point to demand weakness, whether from property market troubles or over-ordering inventory from pandemic supply chain shocks. Recession or not, upward price pressures are fading.

Planning for risks

Mining majors enter 2023 in a much stronger position than previous downturns

US$182bn

Bloomberg estimates lithium-ion battery market size to be worth $182.53 billion by 2030

This year's survey results make clear that mining & metals sector participants are immensely unsure of what to expect in 2023.

The novel synchronization of the commodities cycle with the global macroeconomic cycle parallels a decoupling of price and demand expectations between traditionally correlated minerals and metals. Sector participants need to maintain the long view to put themselves in the best strategic position possible regardless of where the global economy goes in the next 12 to 18 months. A granular understanding of the market is more necessary than ever to remain competitive and capture value. We can no longer accept as a given the relatively unified price cycle across the mining & metals sector. Optionality is important, but there are still opportunities for growth even amid so much uncertainty.

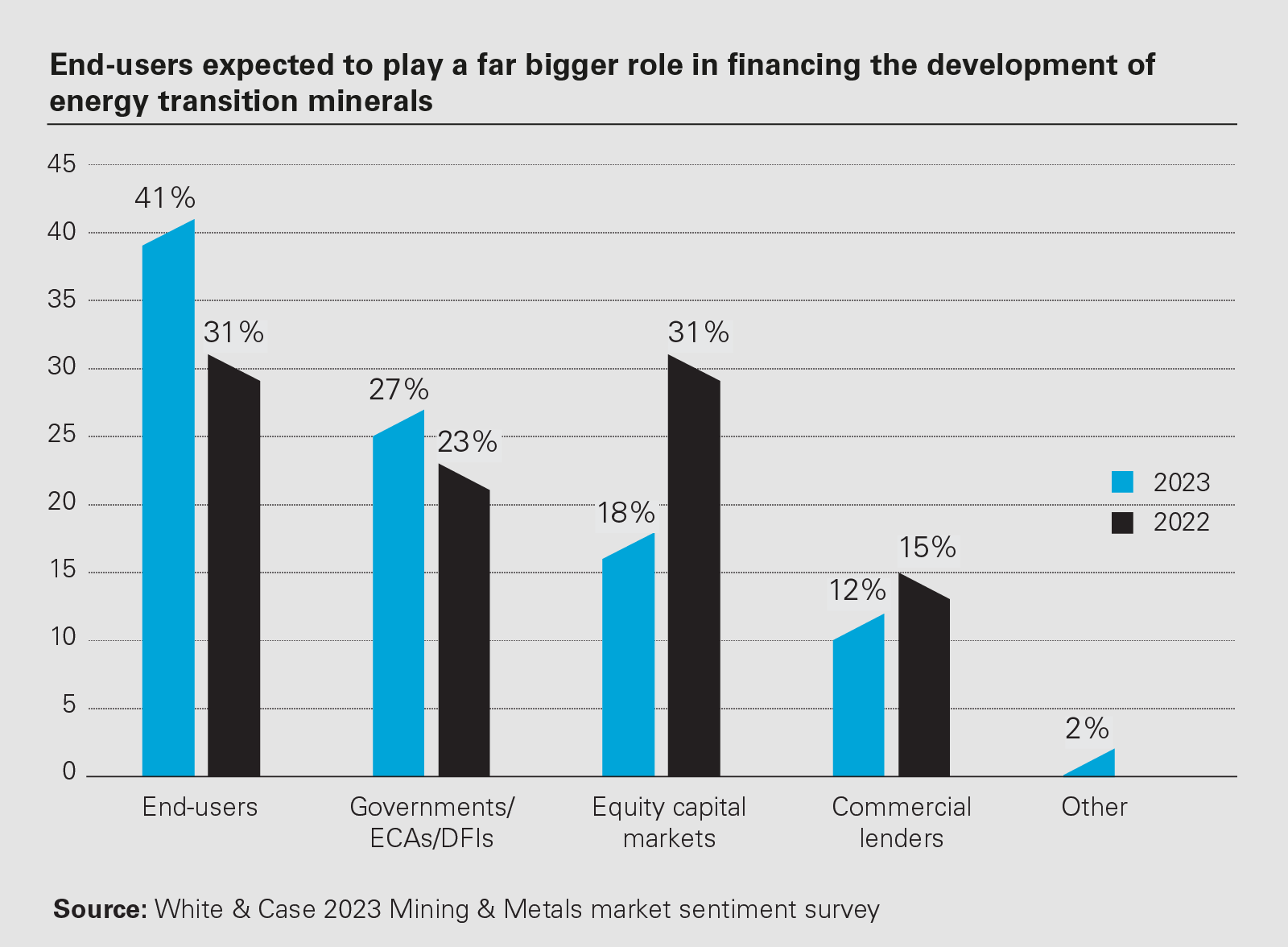

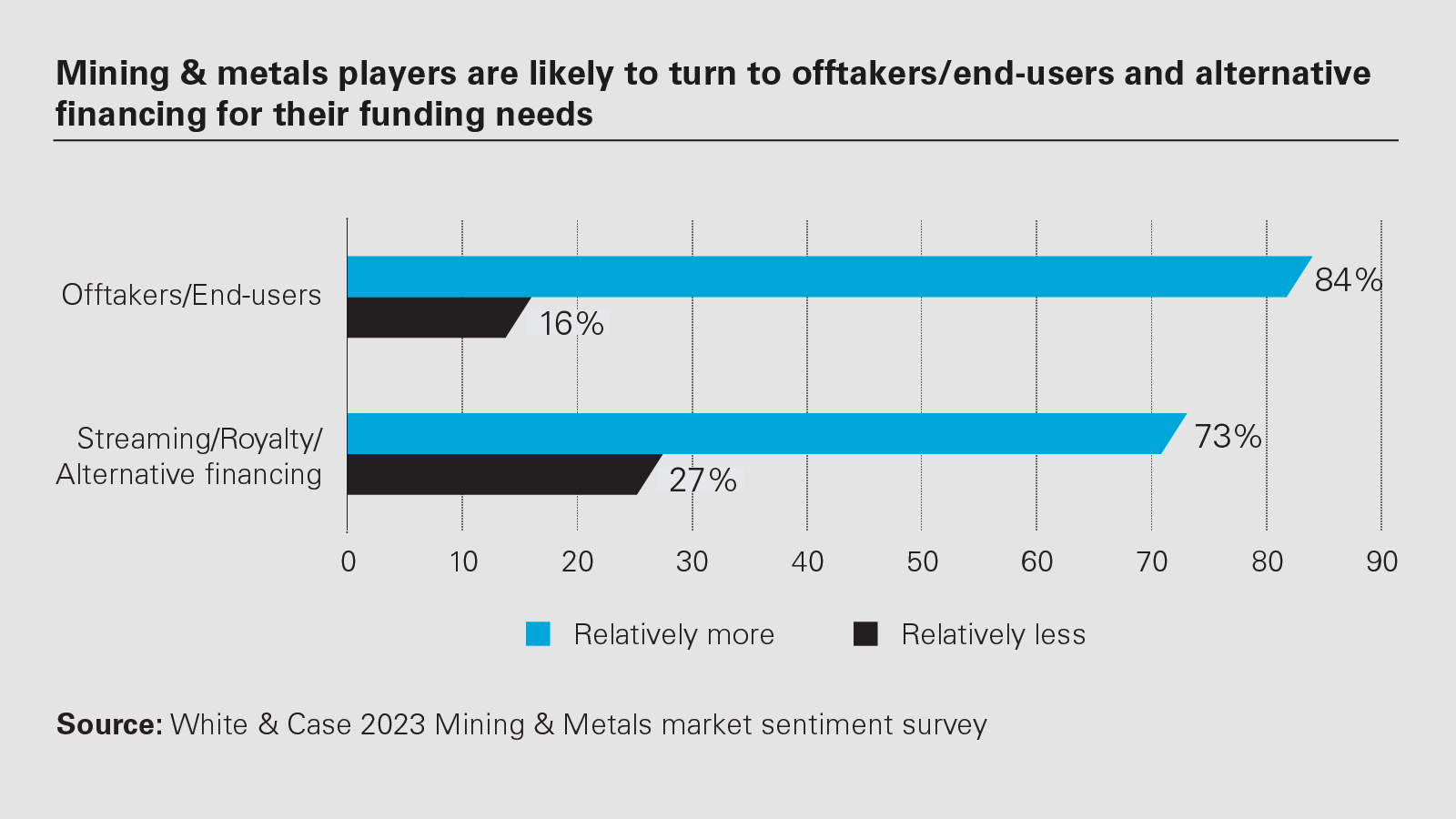

Mining majors enter 2023 in a much stronger position than previous downturns. Respondents were divided over whether or not majors will increase their merger & acquisition activity. 2014 instilled discipline among mining majors, punishing those who'd overleveraged and neglected cost-cutting. The largest mining companies have since shied away from developing their own projects, instead allowing junior miners to do so until they're ripe for M&A activity. That approach comes with considerable risks, particularly as junior miners have good reason to consolidate among themselves, seek out joint ventures with downstream consumers, or otherwise explore alternative financing arrangements to pursue growth more aggressively than majors do. Since few projects are developed by majors and firms more generally have struggled to finance via capital markets in 2022, junior miners, end-users and traders have turned to joint ventures, direct financing and long-term offtake agreements to secure supply. Junior miners may be better placed for growth despite financial conditions in the event that majors don't shell out. Our respondents expect that end-users, governments, export credit agencies and development finance institutions will lead the way, financing critical minerals projects for these reasons, with conflicting views on whether or not majors are willing to spend.

S&P Commodity Insights expects the aggregate global capex across major mined minerals, excluding coal, to decline in nominal terms by US$11 billion, while inflation lifts aggregate capex costs for the sector. Anglo American is managing cost inflation with relatively flat capex levels by deferring discretionary spending. By contrast, Rio Tinto has committed to increasing its growth and decarbonization spending for 2023-2025 while holding capex relatively flat to sustain existing operations. Spending is still going ahead, but increasingly targeted at battery and decarbonization minerals, with considerable caution given varied demand expectations across commodities as the energy transition accelerates. BHP has made a binding offer of US$6.4 billion to OZ Minerals to acquire the company's copper portfolio in anticipation of a large supply deficit. The acquisition follows on Rio's decision to invest US$3.3 billion to acquire Turquoise Hill, giving it majority control of the world's largest prospective copper-gold project at Oyu Tolgoi in Mongolia. But our respondents and the market are unsure as to whether these big ticket acquisitions will spur competitors to grab critical mineral assets, especially given the difficulty reaching agreements over the market value of assets whose value rose significantly between 2020 and 2022, current declines notwithstanding. Respondents note that pressures are mounting to vertically integrate between the upstream and downstream of the mining & metals sector and its end-users as protection against supply chain disruptions. The various bullwhip effects triggered by the pandemic and pandemic responses in 2020 have clearly reshaped business strategies among end-users of mining & metals products.

Predictions of worsening supply deficits for copper, nickel, lithium and other transition metals also rest on assumptions about economic growth, demand intensity and efficiency of use that are highly uncertain. These conditions put additional pressure on project finance and M&A activity, as miners, lenders, private equity investors and end-users frequently disagree over the proper valuation of a given asset amid so much uncertainty. Financing and corporate transactions are likely to continue to evolve toward alternative arrangements, including streaming and royalty financing, as well as direct partnerships between miners and end-users, as firms insulate themselves from uncertainty through proactive investments.

Market trends are expected to vary within the mining sector, further complicating the outlook depending on economic conditions. Demand for battery minerals is likely to be the largest driver of consolidation in 2023, rather than price declines.

US$80.5bn

The global battery materials market size is projected to reach $80.5 billion by 2030, growing at a CAGR of 5.9% from 2021 to 2030 according to Allied Market Research

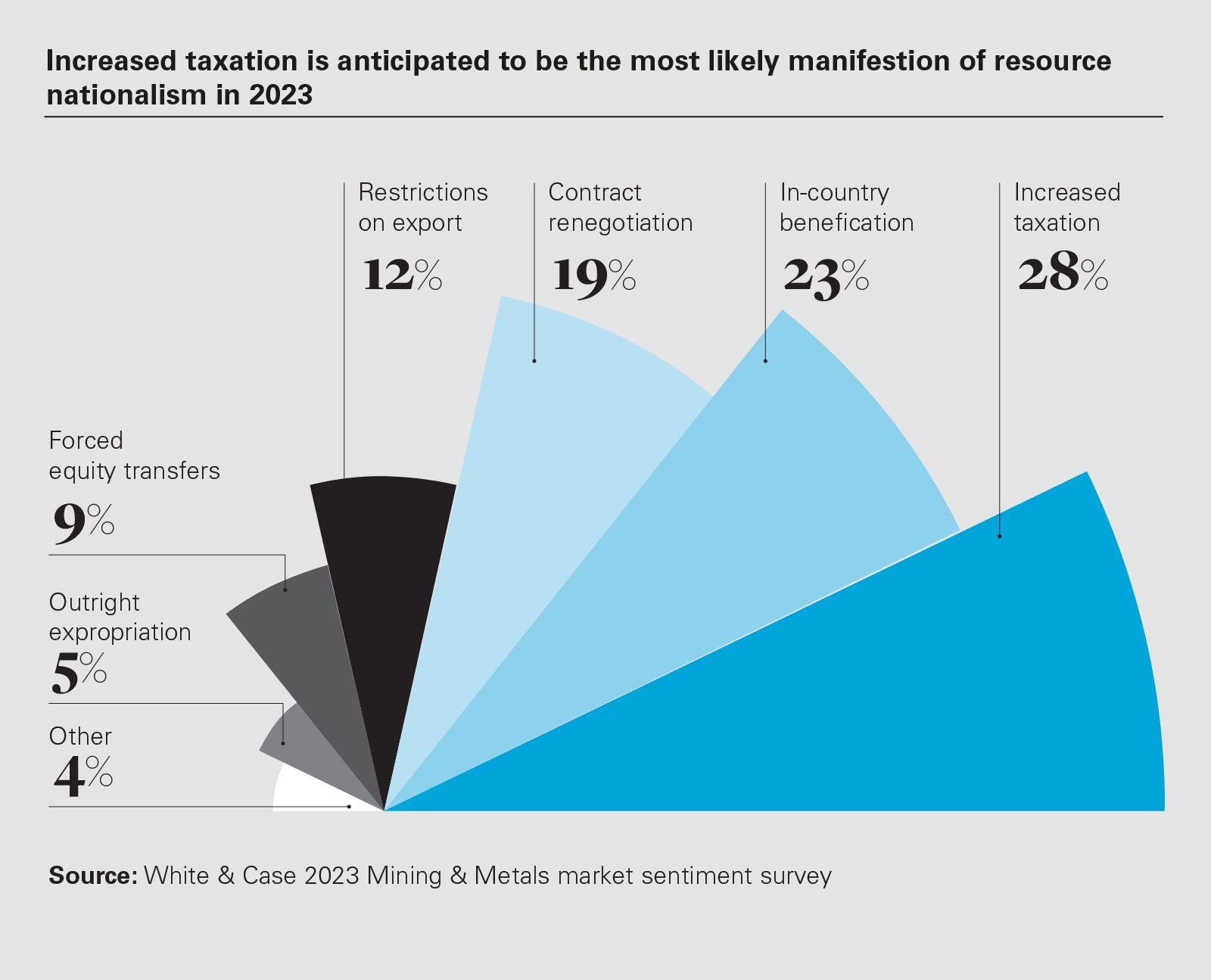

Though respondents ranked base metals ahead of battery minerals, base metals include copper and nickel, which are essential inputs for electric vehicles and electrification. By contrast, iron ore has struggled from the slowdown in China's construction demand, lower steel throughput and expanding efforts to recycle supply. Coal enjoyed a resurgence in 2022 that seems likely to be short-lived, as renewables deployments accelerate and alter global supply/demand balances of piped natural gas and LNG. These two commodities account for the bulk of the volume of global minerals production, pointing to a structural decline in sector value amid surging critical minerals demand. Shifts in consumer relationships with the mining sector fall downstream from these trends. Automakers and battery manufacturers are now securing needed minerals in concert with junior and mid-sized miners through financing deals, joint ventures, equity raises and offtake agreements. Similarly, miners that have divested out of coal portfolios are expected to seek out deals in the battery and base metals space as well, meanwhile Fortescue, Glencore, BHP, Hancock Prospecting, and other iron ore miners are expected to seek new revenues from blue and green hydrogen, investments into potash, or other decarbonization of steel mill operations. Political risks are also heightened in the current climate. The combination of price levels that remain elevated compared to pre-pandemic trends, persistently high inflation, rising costs of US dollar-denominated borrowing, and hot demand for battery minerals and metals are encouraging governments to raise mining sector taxes and actively intervene in mining markets through export restrictions and local beneficiation requirements. Typically, resource nationalism rises when prices are surging or expected to trend higher in the future, both of which currently depend on considerably uncertain outlooks for demand amid ongoing underinvestment into new supply, particularly for copper, as a result of the structural shift toward junior miners for project development. Our respondents primarily focused on risks of tax increases, a net negative for profitability and project development, but still express concerns about contract renegotiations and potential disputes with sovereign governments.

Miners and metallurgical firms are therefore stuck navigating simultaneous pro-cyclical and counter-cyclical trends during a period when traditional avenues for financing are expensive and policy risks are increasingly supportive of investment on developed markets such as Australia, Canada and the US, riskier on emerging markets in Latin America and sub-Saharan Africa, and subject to growing trade tensions, including the adoption of carbon import levies by the EU. The successful reconstitution of the Reko Diq copper-gold project in Pakistan, one of the largest finds in the world, speaks to the importance of reaching mutually beneficial agreements with governments keen to profit off of the emerging demand landscape.

The one thing our respondents made clear is the near total lack of certainty and confidence about where the market is headed. Respondents offered a wide range of diverging views about the themes that will dominate 2023, with some citing high prices and good supply/demand fundamentals, others citing policy support from local governments, inflation and cost pressures, or a deepened focus on climate resilience. None confidently predicted growth or recession. Deal types, structure of financing and risks for mining are all rapidly evolving without a clear picture of what's to come. Shifts in US trade policy against the WTO, the passage of the Inflation Reduction Act, and the EU's recently agreed carbon border adjustment mechanism (CBAM) all create new risks of disputes and commercial litigation for metals firms as well as opportunities to invest. The growing overlap between ESG concerns and structural market trends is driving relatively novel approaches to vertical integration and the shortening of supply chains. These changes will push more firms to look at carbon credits and trading schemes or seek to minimize risks from their assets of future trade disputes, where possible, while preparing for them in the event they arise. 2023 is likely to surprise us as much as 2022 did. Being knowledgeable, nimble, adaptable and forward-thinking matter more than ever. There are still many avenues to invest into prospective projects and profit off of the energy transition, even with surprises surely in store over the next 12 months.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2023 White & Case LLP

View full image: Top risks for 2023: Inflationary cost pressures and geopolitics trump ESG and climate change concerns

View full image: Top risks for 2023: Inflationary cost pressures and geopolitics trump ESG and climate change concerns

View full image: Iron ore most likely to underperfom in 2023, followed by coal and gold

View full image: Iron ore most likely to underperfom in 2023, followed by coal and gold

View full image: Resource nationalism likely to increase in 2023

View full image: Resource nationalism likely to increase in 2023

View full image: Biggest impact of continued trade tensions: Inflationary cost pressures on end-users

View full image: Biggest impact of continued trade tensions: Inflationary cost pressures on end-users

View full image: Climate change response/energy transition and managing supply chains/labor continue to dominate as the main pri

View full image: Climate change response/energy transition and managing supply chains/labor continue to dominate as the main pri

View full image: End-users expected to play a far bigger role in financing the development of energy transition minerals

View full image: End-users expected to play a far bigger role in financing the development of energy transition minerals

View full image: Mining & metals players are likely to turn to offtakers/ end-users and alternative financing for their funding

View full image: Mining & metals players are likely to turn to offtakers/ end-users and alternative financing for their funding

View full image: Battery minerals and base metals are most likely to experience consolidation in 2023

View full image: Battery minerals and base metals are most likely to experience consolidation in 2023

View full image: Increased taxation is anticipated to be the most likely manifestion of resource nationalism in 2023

View full image: Increased taxation is anticipated to be the most likely manifestion of resource nationalism in 2023