On August 25, 2022, the Securities and Exchange Commission (the "SEC") adopted new rules1 implementing the pay versus performance disclosure mandated by Congress in the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the "Dodd-Frank Act").2 The new rules detail new requirements for U.S. registrants to disclose the relationship between executive compensation and the financial performance of the registrant in their proxy and information statements.

Applicability of New Rules

The new rules apply to U.S. registrants that file proxy and information statements requiring executive compensation disclosure under Item 402 of Regulation S-K ("Item 402") for fiscal years ending on or after December 16, 2022. Accordingly, this disclosure will be required in proxy and information statements filed in 2023 for calendar year companies.

Notably, emerging growth companies ("EGCs"), foreign private issuers ("FPIs") and registered investment advisers are exempt from the new rules, but smaller reporting companies ("SRCs") that have ceased to be EGCs are required to comply with the new rules.

The new rules do not require the new disclosure in Annual Reports on Form 10-K and registration statements, as the SEC intended that the disclosure only be provided in conjunction with a shareholder vote. Additionally, the new disclosure will not be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act, except to the extent that the registrant specifically incorporates it by reference.

Significance of New Rules

The new rules, which represent the most fundamental change to the executive compensation rules since 2006 when the current regime for Compensation Discussion & Analysis ("CD&A") and compensation tables required by Item 402 was established, signify a continuation of the SEC's recent approach towards prescriptive and expansive rulemaking and impose significant new disclosure requirements for U.S. public companies. As such, the new rules will require companies to prepare for the new disclosure well ahead of the upcoming 2023 proxy season.

Among other items, the new rules create an entirely new methodology for calculating executive compensation, departing from the well-established Summary Compensation Table ("SCT") approach and require companies to re-calculate new fair values for their equity awards.

Moreover, the new rules create entirely new requirements—beyond the existing requirements for CD&A disclosure—for disclosure of company performance targets by requiring (1) a tabular list of at least three and up to seven financial performance measures that, in the company's assessment, represent the "most important" measures used to determine executive compensation, and (2) "clear descriptions" (either graphically, narratively or a combination of the two) of the relationship between the compensation actually paid to NEOs and certain specified financial performance measures, including total shareholder return and net income.

Overview of New Rules

New Item 402(v) of Regulation S-K provides for three new core requirements: (1) a new table with five years of information on "actually paid" compensation to the CEO and other NEOs, as well as metrics such as Total Shareholder Return ("TSR"), net income and other performance measures, as described below (the "Pay for Performance Table"); (2) new narrative disclosure explaining the relationship between compensation "actually paid" and the performance measures disclosed in the Pay for Performance Table (the "Pay for Performance Descriptive Disclosure"); and (3) a tabular list of at least three and up to seven financial performance measures used by the registrant to link to compensation "actually paid" to NEOs for the last fiscal year (the "Tabular List"). Each of these three requirements is described in further detail below.

1. Pay for Performance Table

The new table requires disclosure of specified executive compensation and financial performance measures for the registrant's five most recently completed fiscal years ("FYs"), or, in the case of an SRC, the registrant's three most recently completed FYs, subject to the phase-in rules described below.3 Notably, this is more than the three years required in the SCT. See Appendix A for the format of the new table.

Compensation-Related Columns

In the new table, registrants must disclose:

| For a non-SRC, for a five-year period (for an SRC, for a three-year period) | |

|---|---|

| Column (a) | CEO total compensation as reported in the SCT for each applicable FY in the table. If more than one person served as the CEO during the FY covered, each CEO's compensation as reported in the SCT must be shown. |

| Column (b) | CEO compensation "actually paid" using a specified formula described further below. If more than one person served as the CEO during the FY covered, the registrant must provide the information for each CEO in separate columns. |

| Column (c) | The average total compensation of all other named executive officers (the "Other NEOs"), other than CEO, as reported in the SCT. |

| Column (d) | The average of Other NEOs' "compensation actually paid."4 |

Compensation that is "actually paid" has a specific formula under the new rule, which requires taking the total compensation for each of the CEO and the Other NEOs as reported in the SCT and adjusting the amounts used for equity awards and pension values. Unlike the SCT (which requires registrants to show the grant date fair value of equity awards granted during the covered FY) or the Options Exercised and Stock Vested Table (which requires registrants to show the dollar value of equity awards realized upon vesting), the Pay for Performance Table requires registrants to calculate the value of equity awards by calculating the end-of-year value of awards granted in the covered FY plus, among other things, the change in the fair value of unvested awards granted in prior years, regardless of if, when or at which intrinsic value they will actually vest.5 See Appendix B for a detailed description of the calculation requirements for "compensation actually paid."

Performance-Related Columns

The table must also include the following financial performance measures:

| For a non-SRC, for a five year period: | ||

| Column (e) | Registrant's multi-year TSR | TSR is calculated similarly to the TSR calculation presented in the performance graph required by Item 201(e) of Regulation S-K (i.e., typically found in Item 5 of the Form 10-K), with a few modifications.6 |

| Column (f) | Multi-year TSR of registrant's peer group | This is based either on (i) the same peer group used for purposes of Item 201(e) of Regulation S-K or (ii) a peer group used in the CD&A for purposes of disclosing registrants' compensation benchmarking practices.7 |

| Column (g) | Registrant's net income | This is the registrant's total revenues minus total expenses for the fiscal year, calculated in accordance with U.S. GAAP. |

| Column (h) | "Company-Selected Measure" | This is the financial performance measure8 that the registrant considers most important in linking its performance for the most recently completed FY to the compensation "actually paid" to the registrant's NEOs.9 This measure must also appear in the Tabular List (defined below). If the registrant's most important financial measure is its own or its peer group's TSR or net income, the registrant must select its next-most important measure as its "Company-Selected Measure."10 If a non-GAAP financial measure is disclosed, it will not be subject to Regulation G and Item 10(e) of Regulation S-K; however, disclosure must be provided as to how the number is calculated from the registrant's audited financial statements. |

| For an SRC, for a three-year period11 | ||

| Column (e) | Registrants multi-year TSR | See above |

| Column (f) | Registrants net income | See above |

2. Pay versus Performance Descriptive Disclosure

Registrants must provide the following descriptive disclosure, either graphically, narratively, or a combination of the two:12

(1) Relationship between financial performance and executive compensation: A clear description of the relationships between each of the financial performance measures in the Pay for Performance Table and the compensation "actually paid" as disclosed in the Pay for Performance Table.

(2) Total Shareholder Return: A description of the relationship between the registrant's TSR and its peer group's TSR.

3. Tabular List of Performance Measures

The rules further require registrants, other than SRCs, to disclose a tabular list of at least three, and up to seven, financial performance measures that it determines are its most important measures for its last FY (using the same approach as taken for the "Company-Selected Measure"). Note that the rules do not require any further description or explanation of the measures on the Tabular List.

- If fewer than three financial performance measures were used by the registrant to link compensation "actually paid" to the registrant's NEOs to company performance for the most recently completed FY, the Tabular List must include all such measures that were used (regardless of number or importance).

- Registrants are permitted, but not required, to include non-financial measures in the Tabular List if they consider such measures to be among their three to seven "most important" measures and they have disclosed at least three (or fewer, if the registrant only uses fewer) most important financial performance measures.

- The measures on the Tabular List are not required to be ranked in order of importance.

- The Tabular List may be presented using one list that includes all the important performance measures used for all NEOs or separate lists.13

- Registrants may also cross-reference other disclosures in the proxy or information statement that describe the registrant's processes and calculations for determining NEO compensation as it relates to these performance measures.14

4. Additional Requirements

Inline XBRL Tagging

Registrants will be required to use Inline XBRL to tag their pay versus performance disclosures, subject to a phase-in period noted below for SRCs.

Voluntary Supplemental Disclosures:

Given the potential divergence between how compensation committees evaluate company performance to determine executive compensation and how compensation and performance is required to be presented under the new rules, some registrants may want to include additional disclosures that reflect their view of the connection between realized/realizable executive compensation and corporate performance. Under the new rules, registrants may voluntarily provide supplemental measures of compensation or financial performance (in the table or in other disclosure), and other supplemental disclosures, so long as any such disclosure is clearly identified as supplemental, not misleading and not presented with greater prominence than the required disclosure. For example, a registrant could elect to show, in conjunction with its Pay for Performance Table, additional amounts for executive compensation to reflect their view of realizable or actual pay, as long as it followed the above requirements.15 Notably, if a registrant opts to include supplemental measures in the Pay for Performance Table, each additional measure must also be accompanied by a clear description of the relationship between the compensation "actually paid" and that measure.

Phase-In

The rule provides the following phase-in periods:

| Proxy or Information Statement | Number of Years for which Disclosure Must Be Provided | Inline XBRL Tagging Required? |

| Registrants (other than SRCs) | ||

| First filing providing disclosure | Three years | Yes |

| Second filing providing disclosure | Four years | Yes |

| Third filing providing disclosure | Five Years | Yes |

| SRCs | ||

| First filing providing disclosure | Two years | No |

| Second filing providing disclosure | Three years | No |

| Third filing providing disclosure | Three years | Yes |

Placement of Disclosure

The rules give registrants flexibility in determining where to place the required disclosure in the proxy or information statement, without specifically requiring it in the CD&A. Since the CD&A and other required compensation tables are covered by the compensation committee report, a registrant may find that the new "pay vs. performance" disclosure fits best outside (e.g., after) those two sections, insofar as its compensation committee does not give weight to TSR and net income (required disclosures in the Pay for Performance Table) or the SEC's new "actually paid" calculation when designing and awarding NEO pay. Registrants may also conclude that the required disclosures will not strongly influence the result of "say on pay" votes, and decide to place them after the CD&A, which is specifically subject to the say on pay vote under Rule 14a-21.16

On the other hand, to the extent that a registrant already discloses the link between pay and performance in its CD&A (i.e., in an executive summary or its disclosure of performance-based incentive pay), it may determine that it is appropriate to integrate aspects of the required Pay for Performance Descriptive Disclosure or Tabular List into the CD&A.

In deciding on placement, registrants that provide voluntary disclosure should consider the SEC's requirement that any "supplemental disclosures" on pay versus performance not "obscure the required disclosures, place the required disclosures in a less prominent position, or otherwise mislead or confuse investors."

Observations and Conclusions

- Begin to Plan Now for Next Year's Disclosure: Given the impact the new rules will have on the 2023 proxy statements, companies should begin preparing for these new disclosures right away. Companies should begin coordinating with their human resources ("HR") and legal teams to assess how their existing pay for performance disclosure aligns with the new rules. This initial assessment will provide registrants insights into the resources needed to build the new disclosures for their upcoming proxy statements.

- Nail Down Your "Company-Selected Measure" and Tabular List Disclosures and TSR Early: Companies will need to consider, among other items, which "Company-Selected Measure" is most relevant to executive compensation for the most recent FY, and which additional three to seven measures to include in the Tabular List. Companies should consider consulting their compensation committee and independent compensation consultant to help determine the appropriate performance measures for the Company-Selected Measure and the Tabular List.

- Create Processes for Collecting the Required Data: Important consideration should be given to what steps will be necessary to collect and validate the required data, particularly for the calculation of equity awards and pension values under the new compensation "actually paid" formula. Companies should first coordinate internally with their accountants and HR teams, perform "dry runs" of the recalculations and prepare mock tables (including required footnotes17) of the new required disclosure. Companies must also consider what, if any, additional internal controls and processes they may need to put in place regarding these valuations, including the assumptions used in determining fair value of existing equity awards. Given the SRCs' reduced disclosure requirements regarding CD&As, they may find it particularly challenging and time-consuming to build the pay for performance discussion required by the new rules, so an early start to compliance is key.

- Consider Getting a Head-start on Narrative Disclosures: Companies may want to get a head start on drafting the narrative disclosures explaining the relationship between compensation actually paid and financial performance, particularly where there may be perceived misalignments between pay and performance. Registrants will want to consider how they want to justify their executives' compensation and which metrics are best suited to do so, in light of industry norms and the metrics used by the registrant's peer group. Registrants should bear this in mind when planning for their upcoming CD&A disclosures, so that the proxy or information statement conveys one unified message as to the bases for executive compensation decisions made and what was paid. Over time, consideration should also be given to how this new disclosure may be used by proxy advisors and others to measure performance in the future.

- Build XBRL Tagging Into Your Proxy Timeline: Registrants often put the finishing touches on their proxy statements shortly before filing. Under the new rules, registrants should be sure to coordinate with their EDGARizing teams to ensure sufficient time for XBRL tagging ahead of the final proxy filing. This is especially true for registrants choosing to use notice and access, which imposes a strict requirement that the proxy statement be filed (and all notices of internet availability be mailed) by the 40th day before the meeting.

- Impact of New Rules on "Say on Pay" Voting Still Unclear: The effect the new required disclosures may have on investor voting remains to be seen. So far, there is no indication that Institutional Investor Services ("ISS"), whose recommendations influence many investors, will change its practices based on the new rules. In recommending on "say on pay" votes, ISS compares pay and performance, using a detailed set of quantitative18 and qualitative19 tests. These are relatively idiosyncratic, use periods and criteria that are different from those prescribed by the SEC's new rules. ISS also compares the last three years of a CEO's "granted pay" and "realizable pay," which, while based in part on the value of unvested equity as of the end of the year, varies from the SEC's required compensation "actually paid" formula.20 Large institutional investors also run their own pay vs. performance analyses using data throughout the CD&A, which tend to be principles-based, focus on industry- and registrant-specific performance measures.21 Time will tell whether ISS or any institutional investors take the SEC disclosure into account in making their say on pay votes. Some institutional investors' comment letters to the SEC on the original 2015 rule proposal—if at all revealing—criticized an overly prescriptive approach, citing concerns with mandatory disclosures and an undue focus on TSR.22 On the other hand, large public investors and pension funds may use the new disclosures in a more impactful way, as indicated by their prior comment letters.23

- Even So, the SEC Can Comment, and Disclosure Remains Subject to Liability: Regardless of the impact of the new rules and disclosures on investor voting, the new disclosures will be subject to SEC review and the new pay versus performance disclosure may also result in the SEC issuing additional comments on a registrant's CD&A, particularly in cases where the dual disclosures raise questions about consistency and a company's true pay for performance story. Finally, while the new disclosures are not deemed incorporated by reference into any Securities Act or Exchange Act filing, they are still subject to "proxy fraud" liability under Rule 14a-9 and other liability-based provisions of the U.S. federal securities laws, as are all other proxy-specific disclosures.

Appendix A

Sample Pay for Performance Table

| Year1 | Summary Comp. Table Total for CEO | Comp. Actually Paid to CEO | Average Summary Comp. Table Total for Non-CEO NEOs | Average Comp. Actually Paid to Non-CEO NEOs | Value of Initial Fixed $100 Investment Based On: | Net Income | Company-Selected Measure* | |

| TSR | Peer Group TSR* | |||||||

| 1 | ||||||||

| 2 | ||||||||

| 3 | ||||||||

| 4* | ||||||||

| 5* | ||||||||

* As noted throughout the alert, these elements are not required for SRCs.

1 State the name of each named executive officer included as a CEO or in the calculation of the average remaining NEO compensation, and the fiscal years for which such persons are included.

Appendix B

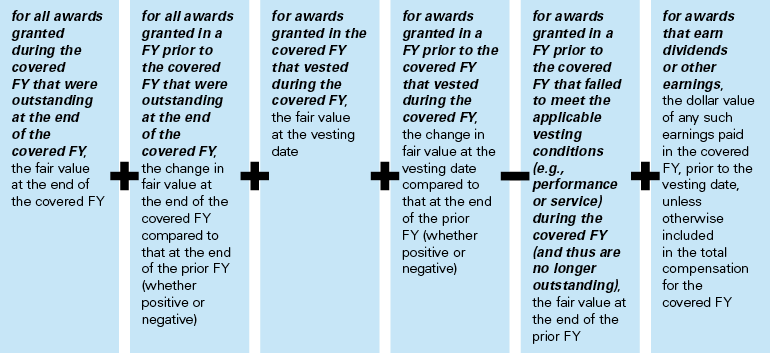

The rule prescribes the calculation of "actually paid" compensation, as follows:

Compensation "actually paid" = total compensation for NEO as reported in the SCT, adjusted for the following, which adjustments must be disclosed by footnote to the table:

- Equity Awards – (i) deduct from the SCT total the fair value as of the grant date reported in the SCT, and (ii) add the aggregate sum of:

For awards granted in the covered FY that were scheduled to vest during the covered FY but did not due to a failure to meet the applicable vesting conditions, no adjustment is required, because there was no fair value as of the prior FY and so "compensation actually paid" for these awards is considered to be zero.

Presentation and calculation of fair value

The fair value calculation process described above is nuanced and complicated, taking into account the following requirements and considerations:

- Fair value (including the use of any assumptions) must be computed in a manner consistent with the fair value methodology used to account for share-based payments in the registrant's financial statements under GAAP (i.e., ASC Topic 718).24

- For performance-based equity awards, as in the Summary Compensation Table and Grants of Plan-Based Awards Table, the fair value as of a particular measuring date should be based on the probable outcome as of that date.

- Assumptions made in the fair value valuation that differ materially from those used in grant date fair value must be disclosed by footnote to the table.

- Registrants must calculate several new fair values for all applicable executive officers and periods, not currently required to be disclosed in other sections of the proxy statements:

- For option awards, the fair value as of the end of a particular FY will be a new calculation, distinct from that in the Summary Compensation Table and Grants of Plan-Based Awards Table, which currently only require disclosure of fair value as of a grant date.25

- For options that vested and became exercisable during the covered FY, the fair value as of the vesting date will be a new calculation, distinct from that in the column "value realized upon exercise" in the Options Exercised and Stock Vested Table, which only shows value upon exercise, not vesting.

- For full-value awards, the fair value as of the end of a particular FY will presumably be the same as that reported in the "market value or payout value" columns of the Outstanding Equity Awards at Fiscal Year-End Table, except that for performance-based full-value awards, registrants may in some cases determine that the fair value as of the end of the FY, based on probable outcome as of that date, is distinct from the value expressed in the "market value or payout value" column of the Outstanding Equity Awards at Fiscal-Year End Table.26

- For full-value awards, it is not clear whether "fair value as of the vesting date" is intended to be the same as the amount in the SEC's prescribed "value realized upon vesting" in the Options Exercised and Stock Vested Table,27 given that fair value is based on GAAP rather the SEC's prescribed formula in that section. However, there will likely be many cases where these amounts are eth same.

Pension Benefits – (i) deduct from the SCT total "the aggregate change in the actuarial present value of all defined benefit and actuarial pension plans" (to the extent the change was positive) and (ii) add back the aggregate of: (1) actuarially determined service cost for services rendered by the executive during the applicable year; and (2) the entire cost of benefits granted in a plan amendment (or initiation) during the covered fiscal year that are attributed by the benefit formula to services rendered in periods prior to the plan amendment or initiation, in each case, calculated in accordance with U.S. GAAP. This requirement does not apply to SRCs, because they are not required to present pensions data in their Summary Compensation Tables.

The following White & Case attorneys authored this alert: Maia Gez, Scott Levi, Laura McDaniels, Henrik Patel, Jonathan P. Rochwarger, Victoria Rosamond, Michelle Rutta, Melinda Anderson and Danielle Herrick.

1 The final rule is available here. The SEC's fact sheet is available here. The SEC's press release is available here.

2 Section 14(i) of the Securities Exchange Act of 1934 was added by the Dodd-Frank Act in 2010 and required the SEC to adopt rules requiring a registrant to disclose the relationship between executive compensation actually paid and the financial performance of that registrant. In April 2015, the SEC proposed amendments to Item 402 of Regulation S-K to implement the pay versus performance disclosure requirement. In January 2022, the SEC reopened the comment period for the 2015 proposed rules and provided the public with the opportunity to comment further and to address certain additional requirements the SEC was considering in connection with the reopening of the comment period.

3 A registrant is required to provide pay-versus-performance disclosure only for years that it was an SEC reporting company.

4 In addition, registrants are required to include footnote disclosure regarding the individual NEOs whose compensation amounts are included in the average for each year so that investors can consider whether changes in average compensation reflect changes in the composition of the NEOs.

5 A footnote to the table must disclose any assumption made in the valuation that differs materially from those disclosed as of the grant date.

6 The TSR amounts disclosed in the table assume a fixed investment of $100, and the relevant "measurement period" for any given year presented is the market close on the last trading day before the registrant's earliest fiscal year presented in the table (e.g., [x] date for [y] year for fiscal 2023 for calendar companies), through and including the end of the fiscal year for which cumulative TSR is being calculated. In addition, the TSR for the earliest year in the table will represent the TSR over that "first" year while the TSR for the next earliest year will represent the cumulative TSR over the first and the second years.

7 If the peer group is not a published industry or line-of-business index, the identity of the issuers composing the group must be disclosed in a footnote. A registrant that has previously disclosed the composition of issuers in its peer group in prior SEC filings would be permitted to comply with this requirement by incorporation by reference to those filings. If a registrant changes the peer group from the one used in the previous fiscal year, it will only be required to include in the Pay for Performance Table the peer group TSR for that new peer group (for all years in the table), but must explain, in a footnote, the reason for the change, and compare the registrant's TSR to that of both the old and the new group.

8 A financial performance measure must be either (i) determined and presented in accordance with the accounting principles used in preparing the issuer's financial statements (as would be the case with GAAP financial measures), (ii) wholly or partly derived from such measures (as would be the case with non-GAAP financial measures), or (iii) stock price or TSR. The measure need not appear in other SEC filings of the registrant.

9 A registrant does not need to include a "Company-Selected Measure" if the registrant does not use any performance measures or only uses measures already required by the table.

10 A "Company-Selected Measure" that is not a financial measure under GAAP will not be subject to Regulation G or Item 10(e) of Regulation S-K. However, consistent with the SEC's current treatment of non-GAAP performance measures presented as target levels in the CD&A (rather than in a standalone discussion of corporate performance in the CD&A, such as in an executive summary), disclosure must be provided as to how the number is calculated from the registrant's audited financial statements.

11 SRCs are not required to provide a TSR for the registrant's peer group (consistent with their exemption from the performance graph requirements of Item 201(e) of Regulation S-K) or a "Company-Selected Measure."

12 The SEC provided the following examples of what the disclosure could include: "a graph providing executive compensation actually paid and change in the financial performance measure(s) (TSR, net income, or ‘Company-Selected Measure') on parallel axes and plotting compensation and such measure(s) over the required time period. Alternatively, the required relationship disclosure could include narrative or Pay for Performance Table showing the percentage change over each year of the required time period in both executive compensation actually paid and the financial performance measure(s) together with a brief discussion of how those changes are related."

13 The permitted format options for the Tabular List are as follows:

1.One list, with the most important performance measures used for all NEOs, including the CEO.

2.Two separate lists: one for the CEO and one for the remaining NEOs.

3.Separate lists for the CEO and each NEO.

14 The SEC notes that "registrants likely already disclose these measures in the CD&A under existing requirements. However … the Tabular List may provide new information relative to the baseline in the form of any insight gained based on the registrant's choice of which of the measures reported in the CD&A were deemed to be the most important with respect to the last completed fiscal year."

15 In this situation, to avoid a misleading disclosure, the registrant might want to highlight the differences in calculation between the additional compensation amounts and the SEC-required "compensation actually paid."

16 See "Observations and Conclusions" section below for more commentary on this.

17 A footnote to the table must disclose any assumption made in the valuation that differs materially from those disclosed as of the grant date.

18 For more information, see ISS's Compensation Policies: Frequently Asked Questions (questions 15 to 43). These include relative degree of alignment (comparison of the percentile ranks of a company's CEO pay and TSR performance, relative to an ISS-developed comparison group, over the prior two-year or three-year period), multiple of median (the prior year's CEO pay as a multiple of the median CEO pay of its comparison group for the most recently available annual period), pay-TSR alignment and financial performance assessment), pay-TSR alignment (comparison of the trends of the CEO's annual pay and the change in the value of an investment in the company over the prior five-year period) and financial performance assessment (comparison of the percentile ranks of a company's CEO pay and financial performance across four Economic Value Added metrics, relative to an ISS-developed comparison group, over the prior two-year or three-year period).

19 For more information, see ISS's Compensation Policies: Frequently Asked Questions (questions 15 to 43). ISS looks at, among many other factors, the ratios of performance-based based compensation to discretionary pay and/or time-based compensation, the quality and clarity of disclosure, the rigor of performance goals, the and financial and operational results.

20 For more information, see question 27 of ISS's Compensation Policies: Frequently Asked Questions.

21See, e.g., Blackrock, Vanguard and State Street.

22 See, e.g., Blackrock's comment letter here.

23 Several were generally supportive of the SEC's originally proposed 2015 rules. See CalPERS' comment letter here, OPERS' comment letter here and TIAA-CREF's comment letter here.

24 The SEC notes that "comparability [among issuers] may be somewhat reduced by the assumptions that are included in fair value calculations, which…may differ from issuer to issuer." However, "[b]ecause investors are already familiar with fair value as the measurement approach for equity awards under U.S. GAAP, they are aware of the reduced comparability that may occur due to the use of different assumptions from issuer to issuer," and "the use of a consistent measurement approach to equity compensation in the Summary Compensation Table, the financial statements, and the calculation of compensation ‘actually paid,'… allows for comparability with respect to an individual issuer's disclosures from year to year."

25 Currently, the Outstanding Equity Awards Table required by Items 402(f) (for non-SRCs) and 402(p) (for SRCs) of Regulation S-K, the value of outstanding equity awards is only required for full-value awards, and not options.

26 Under Items 402(f) (for non-SRCs) and 402(p) (for SRCs) of Regulation S-K, the market value or payout value of an unvested performance-based full-value award must be expressed at the threshold value, unless the performance for the threshold value was exceeded at FY end, in which case the next highest performance measure must be used.

27 Under Item 402(g) of Regulation S-K (applicable only to non-SRCs), "value realized upon vesting" is the market value of the stock on the date of vesting, multiplied by the number of shares vested.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2022 White & Case LLP

View full image (PDF)

View full image (PDF)