FPSOs: Overcoming challenges to unlock potential

FPSOs have revolutionized deep-water oil extraction but these technically complex vessels are a fertile ground for uncertainty, spiraling costs and long delays

16 min read

Subscribe

Stay current on your favorite topics

20 FPSO

awards are currently forecast in 2021 and 2022Source: Rystad Energy

Following a challenging 2020, the FPSO market is off to a booming start in 2021, with more contracts awarded in the second quarter of 2021 alone than during the entire 2020. But FPSOs have traditionally been a fertile ground for uncertainty, and the pandemic has only exacerbated the risks inherent in these highly complex vessels.

FPSOs—the floating production storage offloading facilities— have revolutionized deep-water drilling, enabling oil companies to produce oil in areas that were not previously economically viable with fixed pillared structures, giving rise to a giant new industry in building and operating fleets of rigs, platforms and service vessels needed to exploit the deposits.

Due to the technical advantages and flexibilities of these vessels, FPSOs have been much in demand in the lead-up to 2020. But the COVID-19 pandemic, the subsequent drop in oil prices and the broader tendencies towards decarbonization have stalled the previously buoyant FPSO market. A large number of units—25—have been stacked, either directly or indirectly, in response to the pandemic and only four new FPSO units had been awarded by the end of 2020.

But with COVID-19 seemingly coming under control around the world, the FPSO market is beginning to show signs of activity returning, with some estimates suggesting the market would reach a projected US$67 billion by 2027, backed by a robust order book—with forecasts of 20 FPSO awards for 2021 and 2022.

Demand for offshore LNG is likely to fuel the recovery, with LNG FPSOs being used on major LNG projects to process, store and export condensate and LPG directly to market. A recent example is the Ichthys Venturer—one of the largest and most advanced facilities of its kind, able to operate in cyclonic conditions and designed to process 100,000 bpd of condensate. New FPSO units on order reflect this trend towards LNG FPSOs, driven in part by the transition to a low-carbon future in response to climate change.

In the next few years, a number of vessels are expected to come off contract due to age or anticipated field closures, but the reduction in FPSOs will not affect the overall processing capacity, as bigger units come online in place of ageing smaller ones.

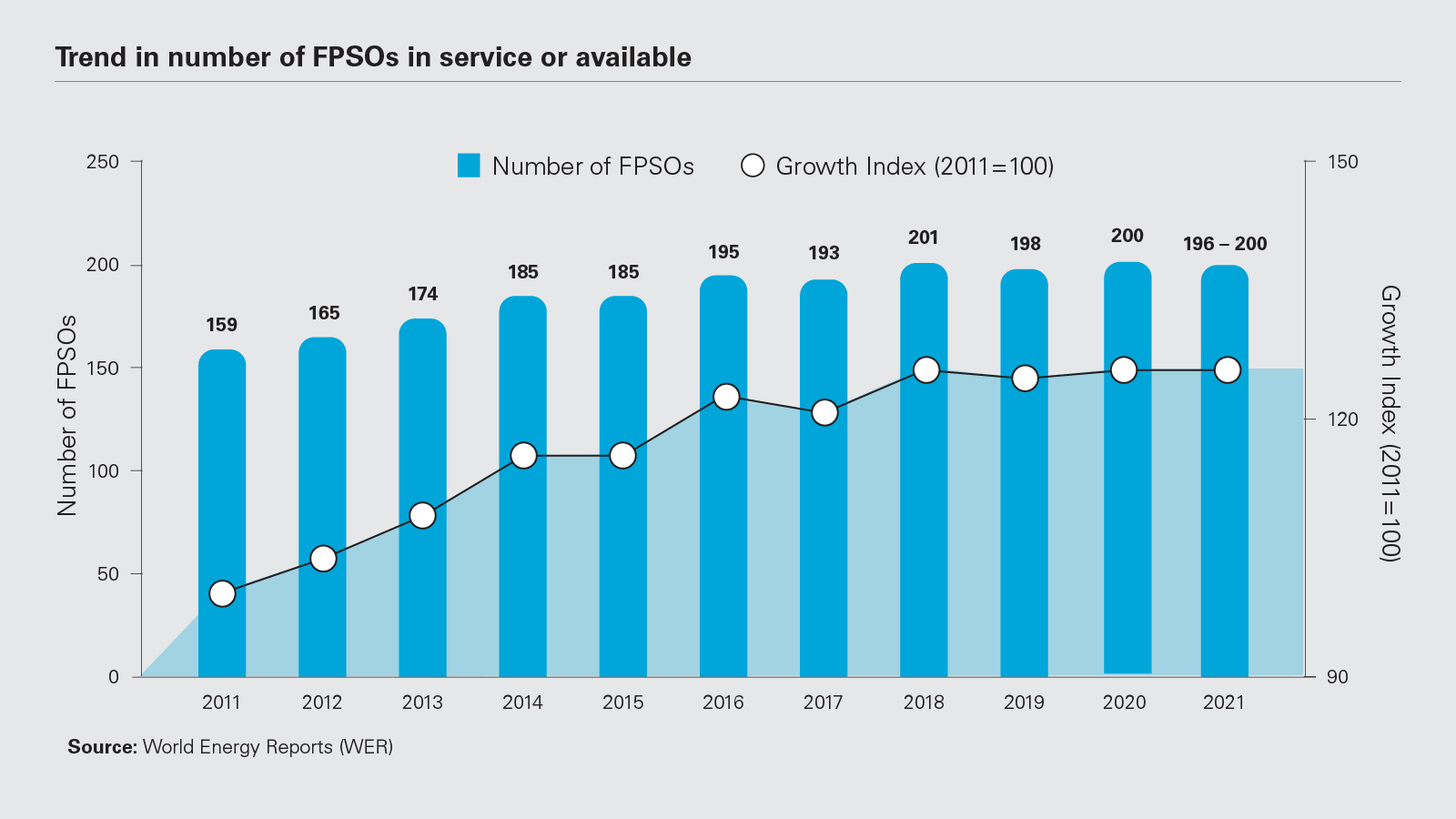

According to a report from International Maritime Associates (IMA) and World Energy Reports (WER), in January 2021 there were 110 projects in the planning stage that require an FPSO as part of a production system. As of November 2020, there were 220 FPSOs in operation, on order, or available—likely the peak of the global floater inventory.

Despite the pandemic, there are a significant number of factors supporting a positive outlook for the FPSO market, including government incentives, lower operating costs than traditional offshore platforms, and the opportunity of redeploying existing vessels with increasing ease.

Yet while FPSOs have transformed deep-water oil extraction, and more recently the LNG value chain, the market has also seen an increase in disputes over both the order process and then specification after delivery, while the relatively nascent opportunity to redeploy vessels is one that the industry has yet to fully exploit.

There are several structural industry elements that have made the business environment for FPSOs prone to these disputes.

220

FPSO units in operation, on order or available as of November 2020Source: WER

Most FPSOs are highly optimized for the exploitation of a specific deposit with its own characteristics, from the oil specification to water depth, making redeployment challenging

Industry environment

Key to understanding the FPSO market is a grasp of how the industry they serve has changed. Like all commodities, oil & gas prices are highly volatile, but there have been several recent developments in the global energy markets that have accentuated this volatility. The emergence of US shale dramatically reduced the power of OPEC to control prices and ensure the stability its members favor. At the same time, Russia, a non-OPEC member, has significantly increased output, and its fractious diplomatic relationship with Saudi Arabia has added volatility to global oil policy. Along with significant uncertainty around global growth, the key factor, particularly during the early phases of the pandemic, has been oil demand, which has seen oil prices fluctuate dramatically from as high as US$107 a barrel to as low as US$26 a barrel in the past five years.

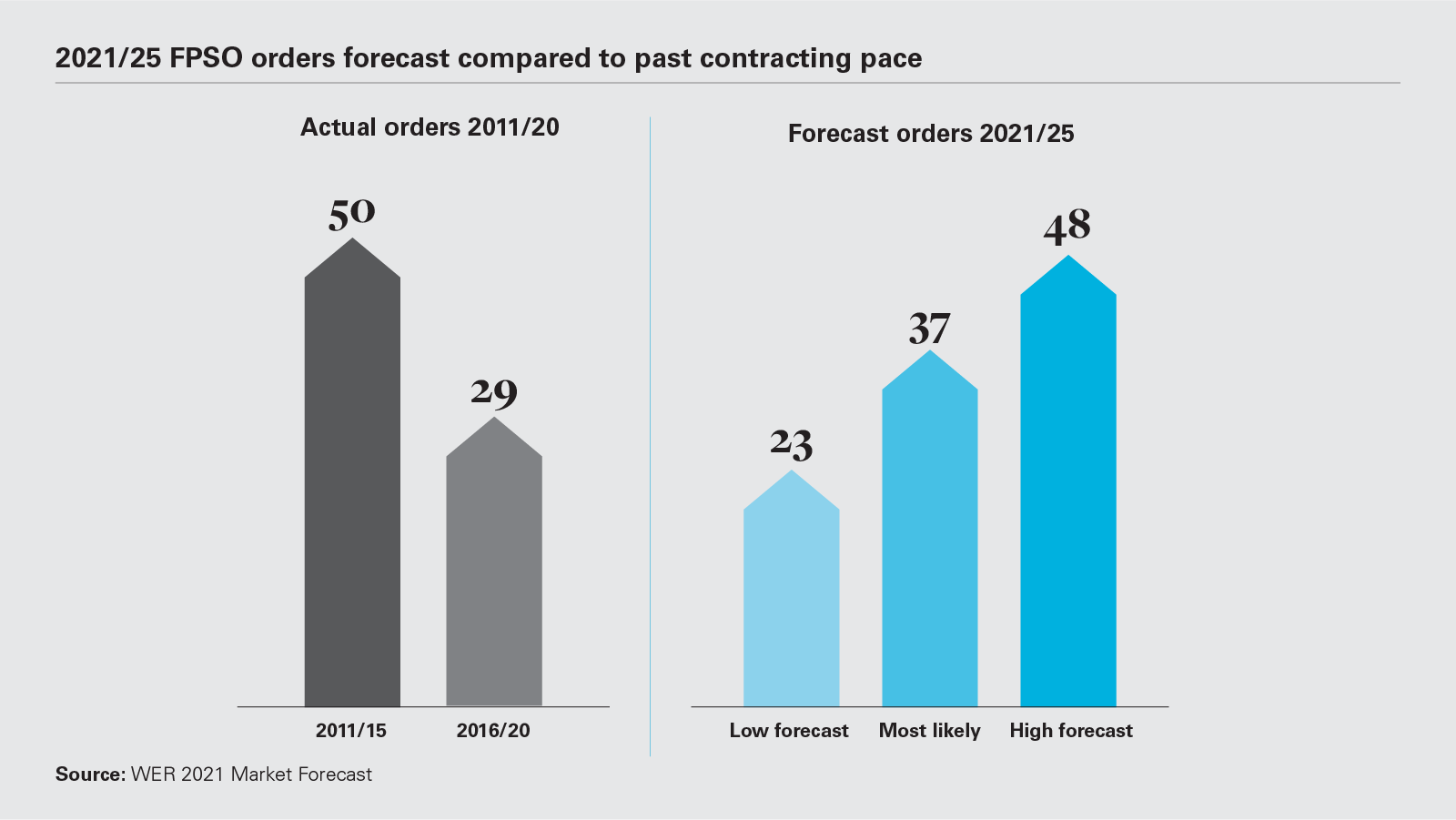

The 2016 oil slump changed the economics of oil extraction and led to a raft of order cancellations for FPSOs. Buyers attempted to extract themselves from contracts, while builders, with vessels already under construction, sought to enforce the contracts, putting the payment, delivery and dispute mechanics of standard industry contracts under the microscope. Indeed, the aftereffects were long-lasting, with orders completely drying up by 2016.

Redeployment, new-build or conversion?

Operators have three options when procuring new FPSOs: redeploy an FPSO that has been operating on another field; order a custom-built vessel; or convert an existing tanker.

Redeployment

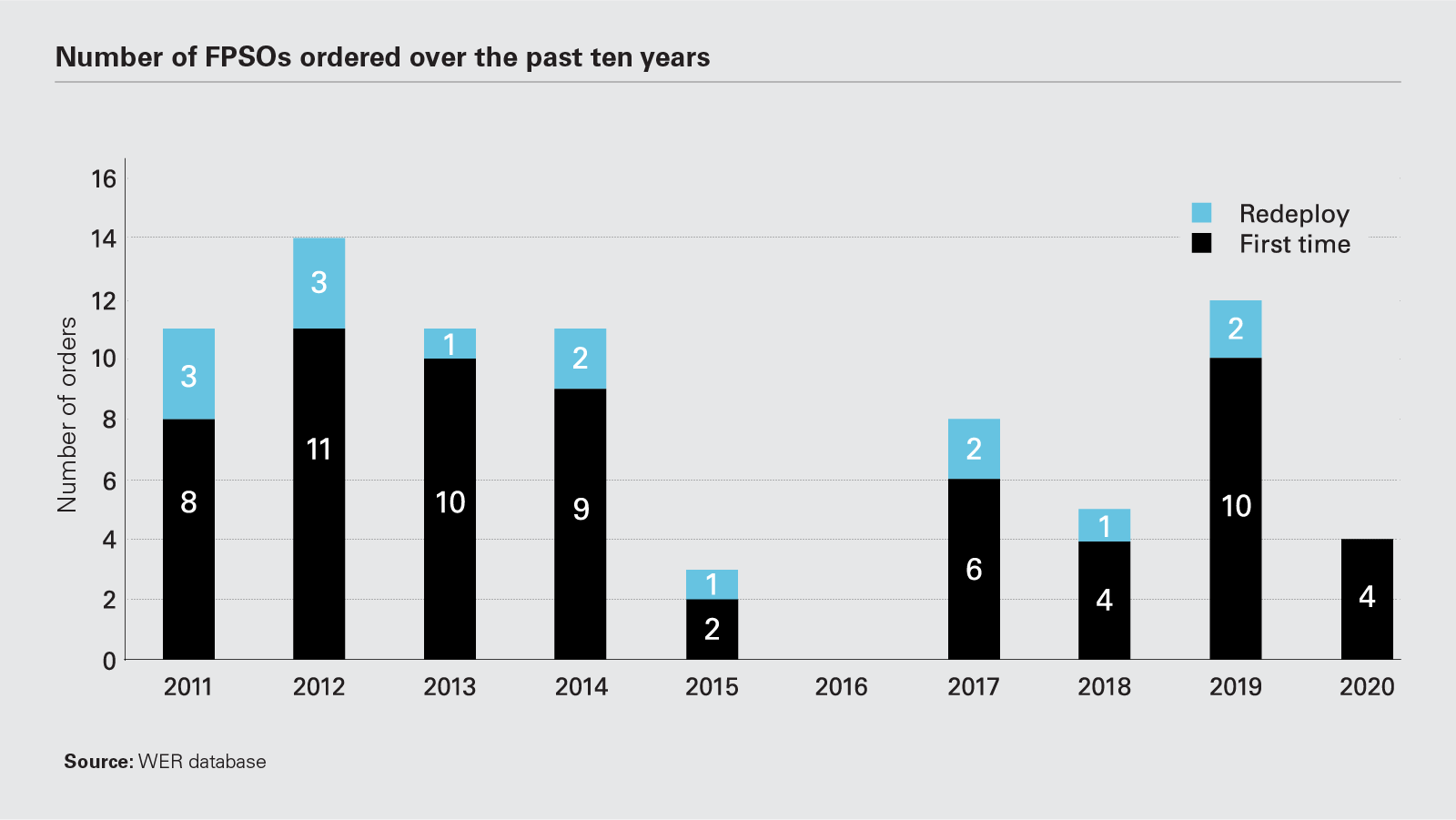

Traditionally, redeployment has been challenging for the industry, but it increasingly offers significant opportunities for those that can make it work because of the potential, significant, cost benefits of being able to re-use an asset. Out of 79 FPSOs commissioned between 2011 and 2020, 64 units involved construction or conversion of first-time FPSOs that had not operated as production units previously, and only 15 contracts were for redeployment of an existing FPSO to a new field. In 2019, two existing units were awarded new contracts, with a forecast for eight FPSO redeployments throughout 2021 – 2025.

The difficulty in redeployment is highlighted by the fact that most FPSOs are highly optimized for the exploitation of a specific deposit with its own characteristics, from oil specification to water depth. Moreover, different deposits fall under regulatory regimes with their own requirements.

Adding to these pressures is the need for most vessels tagged for redeployment to require another phase of conversion, especially if the vessel has deteriorated in service, and this can be compounded by the need to ensure compliance with both class and flag regulations.

One trend that has emerged in recent years has been the push for greater standardization that will give operators more confidence. Petrobras, for example, commissioned eight replicated vessels in 2014. SBM Offshore has developed its Fast4Ward program, standardizing the hull and shaving up to 12 months off the delivery to market.

This is not a unanimous view, however. One international contractor says that although cost reduction is a key mandate in the present climate, the conservative nature of the oil & gas industry will ensure no material deviation from the fundamental and traditional approach of using designs highly customized to specific projects. While it is possible that certain aspects become more standardized, an industry-wide standardization across oil companies is seen as unlikely.

US$67bn

Some estimates suggest the FPSO market would reach a projected US$67 billion by 2027Source: Market data

Ingredients for success

Because of the custom-built nature of the unit, redeployments are relatively rare—with multiple complex variables at play—an understanding of CAPEX figures is crucial. In smaller fields, for instance, the CAPEX recovery of a newly commissioned FPSO is likely to be challenging, and redeployment of an existing unit may be a more economically sound option. According to IMA/World Energy Reports, between 25 and 35 units are expected to become available for redeployment in 2021 – 2025. But CAPEX savings must be assessed against high operating costs and production risks. The key to a successful redeployment is in removing as much of the risk for owners of a new project as possible. This can be done by ensuring that all maintenance, design and specification documentation is correct and up-to-date, helping remove potential pitfalls. Vessels that have a proven track record, and come with an experienced crew who have previously operated the vessel, also allay concerns for potential customers. The initial vessel design, with flexible topsides, also make redeployment more attractive.

Finally, operators who are coming off contract face a dilemma if a replacement contract is not lined up: whether to keep the vessel crewed and in serviceable condition or essentially shut it down. Keeping a vessel in a warm stack condition is costly, but it removes a large degree of risk for a potential new customer because it allows for maintaining existing equipment and topsides, and decreasing time and costs for a conversion project.

New-build FPSOs

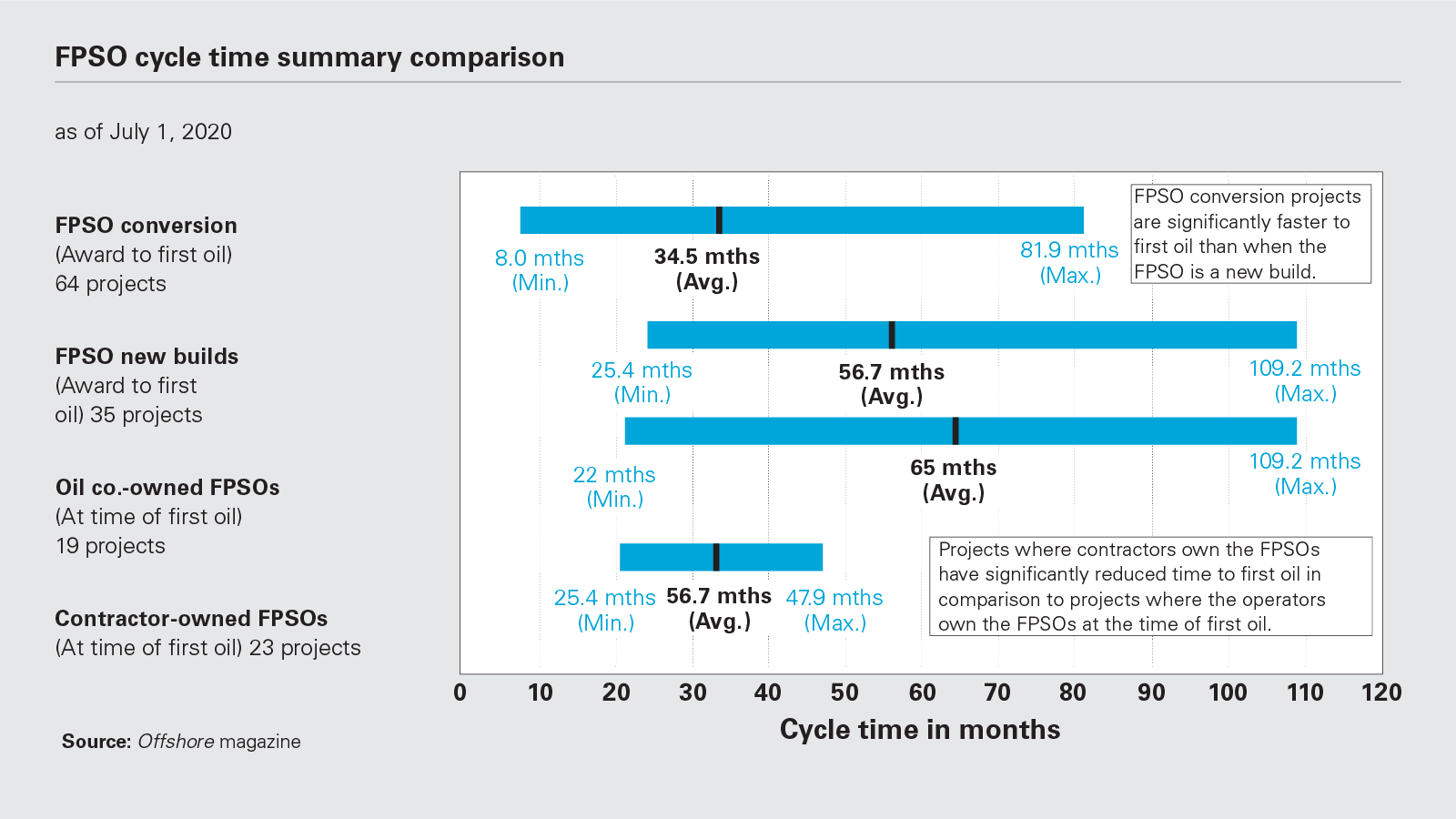

Of the remaining two options, there has recently been a gradual shift towards new-build FPSOs as compared to conversions, on account of growing investment toward exploitation in more challenging environments with more extreme seas or weather conditions, and the expansion of deep-water drilling off the coast of Brazil and West Africa with new undersea well development technologies. The opportunity to have FPSOs that have optimal design parameters, lower operational costs, the latest offshore technologies and advanced safety features in addition to being flexible to field life extensions are all huge draws for new-build investments. However, significantly higher CAPEX and longer project schedules compared with their converted alternatives remain the major obstacles to the market.

US$200m-

US$3bnThe cost of building an FPSO ranges from US$200 million to US$3 billion, depending on capacity, design and other considerationsSource: Market data

Conversion

Apparent attractions of conversion as compared to new-build are speed of deployment and much lower CAPEX. In an industry that is highly susceptible to oil price volatility, being able to exploit deposits as quickly as possible is a key driving factor. It also allows operators to drive faster returns on capital, or pursue fast-track projects. Conversion vessels are also typically based on large mature vessels, often more than 20 years old, allowing a degree of recycling to take place. For context, the converted FPSO market witnessed seven units being deployed in 2018.

In terms of geographies, the Latin American FPSO market is likely to witness the most robust growth in the coming years, owing in part to the positive outlook of state-owned enterprises favored by supportive government measures. Furthermore, there have been a number of recent discoveries of significant pre-salt oil reserves. Petrobras estimates that the Campos and Santos basins offshore Brazil have an estimated six billion barrels in reserve of pre-salt oil that were previously inaccessible but can now be exploited due to improved technology for deep-water subsea fields.

The key to a successful redeployment is removing as much of the risk for the new owners as possible

Causes of disputes

While the nature of the oil & gas industry can create the environment for commercial disputes, the specific complexities of FPSOs creates an additional tension between owners/ buyers and builders.

FPSOs are not bought off the shelf; whether converted or newly built, they require significant customization and are always individually tailored for a specific resource. Given engineering and construction timeframes, lead times can exceed three years. That leaves significant time for changes in market conditions and the viability of projects between order and delivery.

There is frequently insufficient adaptation of FPSO EPC or EPIC contracts to take account of the specific performance and other requirements of a particular project. Resulting contractual lacunae or ambiguities and contracting parties' differing assumptions can lead to higher costs and delays. Another common procurement-phase flaw which can generate risk and potential disputes during execution is insufficient coordination amongst the array of contractors, designers and suppliers involved in delivering an FPSO project.

There is also the underlying challenge that FPSO construction and deployment spans two industries and must accommodate the distinct cultures of the oil & gas sector and the maritime sector. Unexpected disputes can arise from this merger between historically different approaches to risk allocation, differing codes and quality standard and different standard-form contracting traditions in the two sectors. This interaction between differing sectoral approaches is played out against the backdrop of the very significant lost earnings of operators and project sponsors if installation is delayed for whatever reason.

60%

Brazil and Guyana/Suriname are expected to account for more than 60% of the FPSO contracts awarded between 2021 and 2025Source: Offshore magazine, IMA/WER

Regardless of where the FPSO is being fabricated and the regulatory requirements of the region to which it is being deployed, delays are commonplace when building and commissioning such complex units. Owners and builders frequently find themselves in the position of deciding whether to leave the unit at the shipyard for longer than planned (with potential delay liquidated damages consequences), or whether to carry over aspects of the work for completion while the FPSO is being towed to the field. Carry-over work brings with it increased cost and risk to be borne by the party responsible for the delay. However, as the delay increases, so does the pressure to achieve delivery of the FPSO in an incomplete state. That pressure becomes particularly pronounced where the buyer has been unwilling to grant the builder an extension of time.

Even on otherwise successful projects, FPSOs rarely leave the yard in fully finished condition. It is not uncommon for the buyer or charterer to perform some completion and commissioning works itself. This can lead to disputes as to whether the vessel was delivered in a satisfactory state within the contract terms, particularly if the buyer directly enters into new contracts with the preexisting subcontractors and suppliers.

Defect rectification work too is frequently carried out after the vessel has left the shipyard and either whilst being towed into position, or following installation. The reason for this is because many FPSO system defects remain undiscovered until the pre-commissioning and commissioning stage. This can leave builders, owners or operators (depending on the nature of the defect and the agreed risk allocation) facing the additional complexities and expense of needing to deliver equipment and materials to remote offshore locations to perform the required defect rectification works, as well as needing to understand and comply with the different regulatory requirements in the jurisdiction in which the work is performed.

When disputes under FPSO contracts are unable to be resolved, parties will typically agree to resolution by arbitration, including because doing so enables them to protect the confidentiality of commercially sensitive subject matter of the dispute. However, various national courts have recognized the high-stakes nature of FPSO projects and the sophisticated complex contracting arrangements required.

- In the case of Altera Voyageur Production v. Premier Oil E&P UK Ltd [2020] EWHC 1891, the High Court of England and Wales declined to depart from the terms agreed between the parties (in this instance, regarding the formula for calculating the hire of an FPSO), considering the provisions to be a sophisticated commercial bargain that had been agreed between the parties.

- Meanwhile, the Supreme Court of Western Australia recognized in Armada Balnaves PTE LTD v. Woodside Energy Julimar PTY LTD [No 2] [2020] WASC 14, in the context of an FPSO services agreement that "[t]ime is money in this environment…Undue delay is commercially intolerable." The court recognized that the FPSO services agreement was a technically complex, elaborately regulated subsea oil extraction endeavor and held that Woodside was entitled to terminate the contract in response to Armada unduly delaying the acceptance tests for the FPSO.

Ultimately, the FPSO market will continue to grow and mature, driven by increasing demand for offshore LNG and the broader transition to a low-carbon future in response to climate change

Conversion disputes

While there are many reasons to favour a conversion over a new-build, there are a number of inherent contractual risks in the FPSO industry that are exacerbated by taking this path.

One of the biggest challenges is the addition of extra layers of contractual complexity. Indeed, according to Crondall Energy Consultants, conversions tend to have worse outcomes compared to new-builds, both in terms of schedule slippage (20 percent vs. 15 percent) and cost growth (25 percent vs. 15 percent).

FPSO conversion frequently requires the use of additional construction phases and contractors, including engineering and design services, a ship-building or conversion yard to overhaul and modify the hull, and then procurement and fabrication contractors to supply, fabricate and install new equipment on the vessel. These services are usually carried out by different providers and often across different jurisdictions. This process significantly increases the risk of contractual disputes, and the proliferation of interfaces inevitably fosters a blame-shifting approach should problems arise. It can be difficult, time-consuming and costly to determine who is at fault and where responsibility lies for the cost of remedying problems.

Retrofitting ageing vessels also has its own risks. Most conversions are from existing tankers that were designed, operated and had undergone maintenance for a very different purpose. There is almost always a degree of uncertainty over the vessel condition and the degree of hull repairs that will be required.

The scope of the conversion can rarely be fully established before the vessel is in a dry dock, given exposure to marine environments for prolonged periods of time, where corrosion and fatigue can have material impacts on hull integrity. This is especially relevant when a vessel is being converted for a function it was not originally designed for, such as being at sea for significantly longer periods of time than an FPSO.

These issues can create an environment in which cost overruns and extended conversion times can become an occupational hazard of a conversion project, leading to contractual disputes.

8

On average, just under eight FPSOs have been ordered annually from 2011 to 2020Source: Market data

Redeployment disputes

Redeployment projects present many of the same issues as conversion projects discussed above.

However, an additional challenge in seeking to redeploy a vessel is that of finding an alternative customer whilst the vessel is still in its development phase where the original client's needs have changed, or those of the overall industry swing without warning, undermining the economics of the original project. There rarely is an easy fall-back option in this scenario, meaning legal recourse is more likely than in a more traditional, off-the-shelf-style, shipbuilding or onshore plant construction project.

The speed with which redeployments are conducted can cause delays given the level of complexity often involved. The engineering and construction phases are often compressed together, thereby making the project more vulnerable to incorrect information or changes during the project. Meticulous planning is integral to success, with up-to-date data vital. A properly defined scope of work should be established, thereby leading to realistic timetables being agreed upon. Eliminating changes during a project is crucial, as the knock-on effects created from such decisions are the most common reason for delays, and deciding what parts of the vessel can be reused or not at the very start of the process can alleviate these concerns.

The market for redeployment of floaters will grow, and it will be crucial to develop a project approach that contains and controls the risks associated with a redeployment. The benefits from redeploying vessels will continue to pique plenty of interest from operators.

The bottom line

Ultimately, the FPSO market will continue to grow and mature, driven by the shift towards more remote offshore locations at the same time as budgets are being reduced and the oil price remains volatile. The industry has become experienced in dealing with changing environments, and these cost-reduction pressures, newer technologies and broad range of FPSO options, including demand for LNG FPSOs, should provide a buffer to the effects of an economic slowdown should one occur.

With this platform for growth comes greater challenges, often in the form of disputes, which can be very costly. A greater understanding of the types of conflicts that can arise, particularly in the redeployment space, should enable improved contractual arrangements and a more realistic approach to developing projects in the most efficient manner.

Click here to download 'FPSOs: Overcoming challenges to unlock potential' (PDF)

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2021 White & Case LLP

View full image: Trend in number of FPSOs in service or available (PDF)

View full image: Trend in number of FPSOs in service or available (PDF)

View the full image: 2021/25 FPSO orders forecast compared to past contracting pace (PDF)

View the full image: 2021/25 FPSO orders forecast compared to past contracting pace (PDF)

View the full image: Number of FPSOs ordered over the past ten years (PDF)

View the full image: Number of FPSOs ordered over the past ten years (PDF)

View the full image: FPSO Cycle time summary comparison (PDF)

View the full image: FPSO Cycle time summary comparison (PDF)

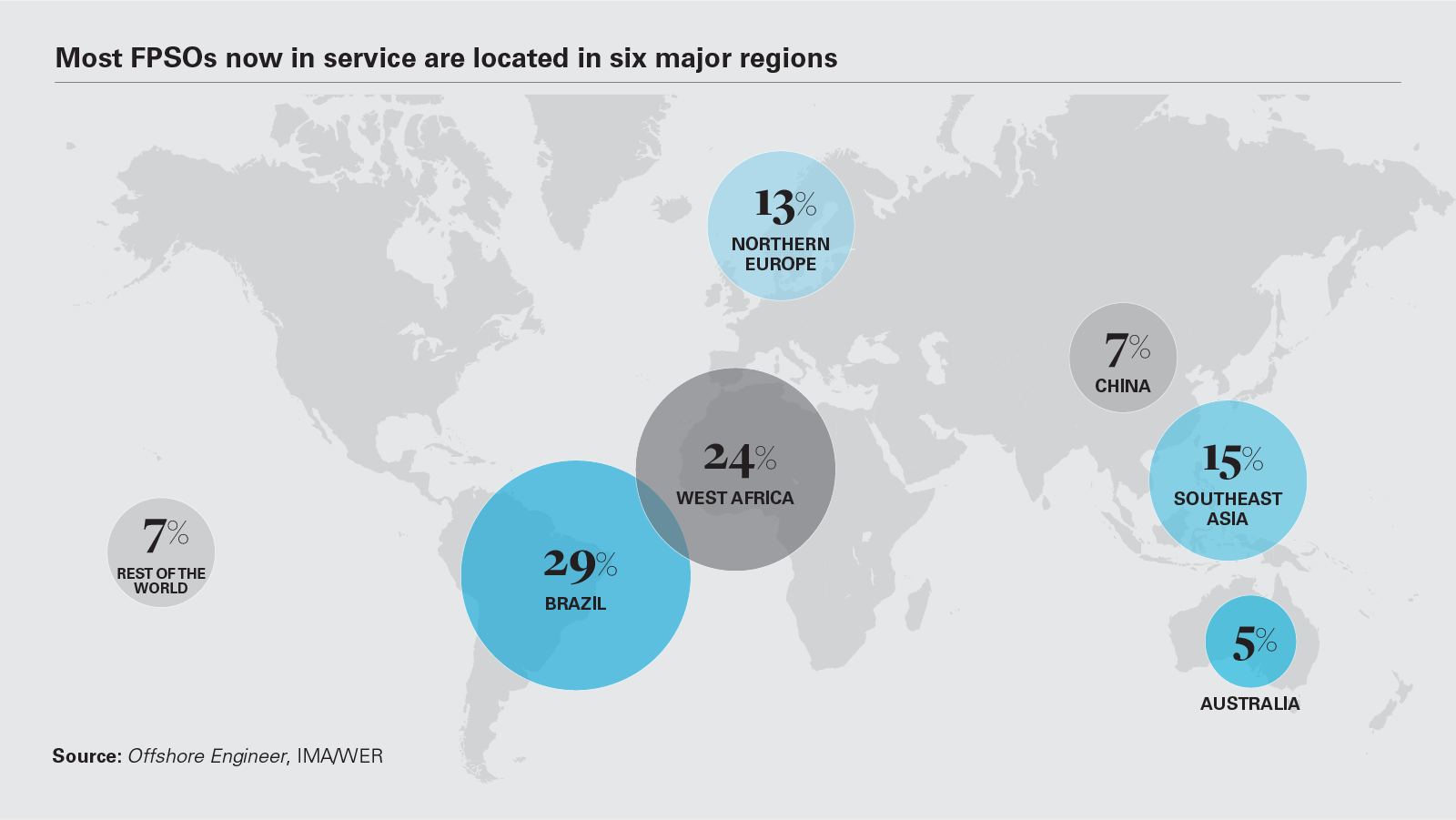

View the full image: Most FPSOs now in service are located in six major regions (PDF)

View the full image: Most FPSOs now in service are located in six major regions (PDF)