Making the trading system work for Africa

The African Continental Free Trade Area could trigger a new era in intra-African trade.

By Mukund Dhar, Africa Interest Group Leader

As our last edition of Africa Focus was published in September 2020 in the midst of the COVID-19 pandemic, some progress had been made on the development, trial and authorization of COVID-19 vaccines. However, there was no assurance of efficacy or effectiveness, and there was profound uncertainty in our personal and professional lives, with unprecedented upheaval in the global economy.

This spring 2021 issue comes to you in a changed environment: Multiple vaccines have been approved; millions of vaccine doses are being manufactured and administered every day; and a return to normality feels no longer like a matter of hope, but of time. Therefore, while uncertainty in our lives and disruption in the global economy continues, we can perhaps permit ourselves to review the business and legal environment in Africa with a renewed sense of cautious optimism and against the backdrop of groundbreaking changes that raise important issues for companies and financial institutions doing business in Africa.

Nearly the entire African continent is involved with the African Continental Free Trade Area (AfCFTA), a single trade and investment market with a combined GDP of close to US$3.4 trillion. Trading under these new arrangements started on January 1, 2021. At the same time, development finance institutions have mounted a robust response to the COVID-19 pandemic by harnessing support from international investors and aggressively funding infrastructure and development. Several sectors of Africa’s economy continue to offer private equity and venture capital investment opportunities, while multilateral development banks are successfully supporting post-COVID recovery and growth in key African sectors. Meanwhile, innovative technologies and new approaches to decommissioning mining assets are transforming Africa’s mining industry and enabling sustainable exits.

This sixth edition of Africa Focus begins with "Making the trading system work for Africa," which explains how AfCTA's plan for virtually all African nations to open their markets to each other may have arrived at exactly the right time to spark change. "African development finance institutions" discusses how African DFIs are achieving positive impacts by funding recovery responses, leading the way with sustainable lending and attracting commercial lenders to African markets.

The article "Private equity in Africa: Trends and opportunities in 2021" highlights several industries in Africa that remain attractive private equity and venture capital destinations, particularly for those focused on long-term investments, and "Ensuring sustainable exits from African mining" discusses how mining companies can improve the ways they decommission and close their operations as well as factors that mining companies, regulators and other stakeholders can consider when formulating rules to reflect environmental, social and governance principles.

In "European multilateral development banks in sub-Saharan Africa," we examine how multilateral development banks, including the European Investment Bank, the European Bank for Reconstruction and Development and others, are collaborating with other key stakeholders and acting as catalysts for growth.

Finally, in "African mining 4.0: An innovative sunrise for African miners," we discuss how new transformative technologies, rapidly becoming available to the mining industry, are ushering in a new era of increased productivity, efficiency, safety and growth for miners.

We welcome your suggestions for any topics to review in our upcoming issues. For now, we hope this issue of Africa Focus helps you navigate the rapidly changing business landscape and explore current opportunities for doing business and investing in Africa.

The African Continental Free Trade Area could trigger a new era in intra-African trade.

Rising to challenges, funding a recovery response and leading the way to sustainable lending.

Despite challenges, Africa remains an attractive PE and VC investment destination.

The development of mine decommissioning and closure laws.

Supporting post-COVID recovery and growth in key sectors.

Transformative technologies are ushering in a new era of efficiency, safety and growth.

The development of mine decommissioning and closure laws

Subscribe to receive Africa Focus

World in Transition

Our views on changing dynamics in energy, ESG, finance, globalization and US policy.

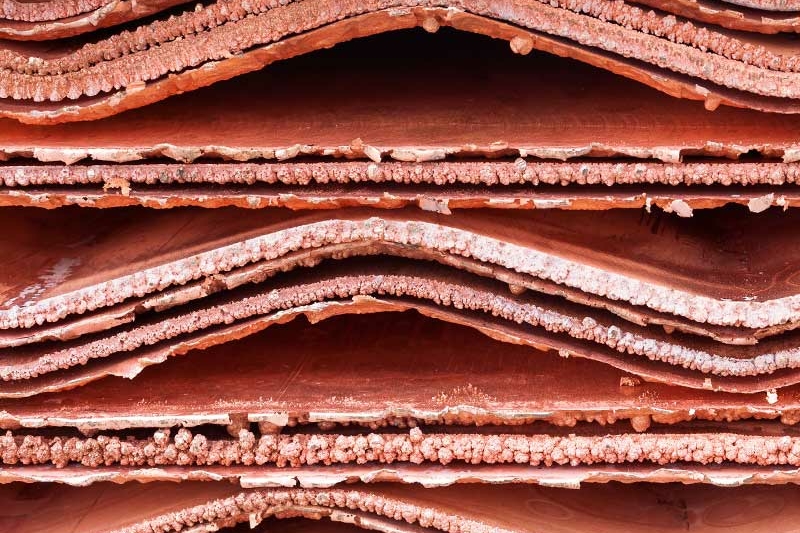

Increased focus on environmental, social and governance (ESG) issues in the mining sector has led to a reassessment of sustainable mining practices.

Mining is the cornerstone of many economies in Africa. It generates foreign direct investment, creates employment and drives development of supporting infrastructure. At the same time, mining can have negative impacts on health and the environment that might devastate communities if they are not correctly managed during the lifetime of a mine. This applies particularly during the decommissioning and closure phases of a mine's life cycle.

Increased focus on environmental, social and governance (ESG) issues in the mining sector1 has led to a reassessment of sustainable mining practices. New technologies currently being researched and piloted seek to improve safety, reduce greenhouse gas emissions and use non-renewable resources more efficiently.2 However, improved sustainability is not limited to the operational phases of mines. There is also room to improve how mining companies exit the jurisdictions in which they operate—by decommissioning and closure of their operations or by selling their assets.

In many African jurisdictions, the laws governing rehabilitation and closure are not well developed. While waiting for the laws to catch up, mining companies still need to implement measures based on industry best practices, their sustainable development goal commitments and investor and stakeholder expectations.

This article sets out some of the current legal issues relating to mine closures, decommissioning and sale of mining assets, and factors that mining companies, regulators and other stakeholders should consider when formulating rules to better reflect ESG principles.

Transparency is increasingly important for a mining company's social license to operate. The appropriateness of proposed rehabilitation measures, post-closure uses of mining land, and the risk of any latent and residual environmental and health impacts are critical considerations that communities and other stakeholders take into account when considering whether to grant—or continue to grant—a social license to operate.3

As a social license to operate is not a physical license, it might be unclear whether it is in place. It is established if a mining company has developed a trust relationship with communities, which only occurs through engagement and interaction.4 As a result, many mining companies are re-evaluating their participatory process to ensure that they obtain and maintain their social licenses, while ensuring that their decommissioning and closure objectives and plans meet the expectations of communities, investors and regulators.

Much of the public participation literature suggests that a successful participatory process must permit major stakeholders (communities, government institutions, environmental organizations, the mining company itself) to share their interests and objectives and, through debate and discussion, develop outcomes that are acceptable to all parties.5

By actively working together to reach these outcomes, participants can exercise a degree of control over the engagement process and, in doing so, feel that they are influencing the process outcome. In this way, they are more likely to accept the outcome, even if it does not align with their own interests or objectives.6

Mining companies and regulators can use several tools to improve the transparency and stakeholder acceptance of their mining operations:

Investors are another category of stakeholder who need to be consulted and engaged in a very different manner from communities. Mining companies communicate with investors primarily through their annual reports and sustainability reports. According to the United Nations Environmental Program, the "current state of reporting of the mining sector has however been largely inadequate to meet the various stakeholders' information needs.10 An important challenge to achieving a higher level of mining sector environmental and social performance is the lack of a global common vision for the sector in terms of what constitutes sustainable operations for mining, including key performance indicators at the mine-site level. A clearer framework for the sustainability of the sector could help standardize and improve sustainability reporting for mining companies and inform relevant government policies or reporting and related initiatives."11

This form of voluntary disclosure followed the collapse of the Brumadinho tailings dam, which led to numerous deaths and had a significant environmental impact, when The Church of England Pension Board asked mining companies to disclose information relating to the tailings dams under their control, and the safety and risk of failure of these dams.12 Although participation in the Church of England Pension Board's program was voluntary, it highlighted some of the mining operational risks to investors and raised questions about mining companies that elected not to participate. As ESG principles filter further into the mining sector, there may be an increasing focus on disclosure of environmental liabilities and the financial capacity of the mining companies to remedy harms they cause, in accordance with the "polluter pays" principle.

The purpose of providing financial provision or a rehabilitation bond is to ensure that a polluter is held to account for the impacts of mining and that a government is not left with the rehabilitation obligations.13 Mine closure is a material component of sustainable mining.14 One of its key components concerns the manner in which environmental rehabilitation will be implemented and funded during the life of the mine and after the mine ceases operation.

Mining companies have been criticized for not being transparent about mine closure planning and financial provisioning.15 Furthermore, no standard approach exists to calculate a financial provision, which makes it difficult to understand whether the financial provision quantum is adequate to cover the actual costs of the environmental liability. In addition, jurisdictions vary considerably regarding calculations and use of financial provisions. Here are some factors that should be considered:

In some jurisdictions, it is unclear if a mining company can be reimbursed from the financial provision it holds in circumstances where it has implemented progressive rehabilitation, reducing the overall environmental liability. In circumstances where the financial provision can be reduced over time as progressive rehabilitation is implemened, there is often a dispute regarding the quantum by which the financial provision can be reduced. In other words, an amount spent on implementing rehabilitation measures does not necessarily translate into an equal reduction in the overall environmental liability at a mine. It is possible that US$1 spent could result only in a US$0.5 reduction in overall environmental liability. Allowing a mining company to draw down the financial provision by US$1 seems inapproprtiate, as it exposes the government to liability if the mining company is unable to fulfill its obligation.

The converse is also controversial. Is a company entitled to draw down more of the financial provision if its overall environmental liability is reduced by a greater amount than what the mining company spent to effect the remediation? In some jurisdictions, these concerns are avoided by restricting mining companies from drawing down the financial provision in reimbursement for progressive rehabilitation, indicating that any excess funds will be offset against future environmental liabilities.16

This approach may be reasonable in circumstances where the financial provision and the estimated environmental liability are similar in value. However, in circumstances where the financial provision significantly exceeds the environmental liability, mining companies could be discouraged from contributing funds to the financial provision if they cannot draw down on these funds for progressive rehabilitation. From a cash flow perspective, there may be benefits to incurring closure costs when cash flow is positive,17 as opposed to implementing final closure after production is completed and cash flows are negative.18 Of course, there is no restriction on mining companies setting aside funds for rehabilitation purposes in a manner that falls outside of the regulatory process, though these funds would not be ring-fenced for environmental rehabilitation in the event that the company is placed into liquidation. See Figure 1.

Regulators may be reluctant to allow drawing down a financial provision amount, particularly if future residual and/or latent environmental impacts might require funding. In some jurisdictions, the regulator may retain a portion of the financial provision of the funds after a mine closes to cover the costs of latent or residual environmental liabilities. Residual environmental liabilities are known environmental liabilities that exist at the end of the mining operations (such as pumping groundwater to prevent other mines from flooding). Mining companies will be required to continue to fund these costs until they are either transferred to a third party or until the residual liabilities no longer exist. At that point, the financial provision held by the regulator should be returned to the mining company. To the extent a mining company fails to continue with pumping costs, the regulator can use the financial provision.

Latent environmental liabilities are different. These are unknown environmental liabilities that might occur in the future (such as pollution that could have a future environmental impact). In some jurisdictions, such as South Africa, the relevant authority is permitted to retain funds for latent environmental liabilities.19 However, there is no time period attached to how long the authorities may continue to hold these funds and when they would be returned to the mining company. A risk assessment of potential future liabilities should be conducted at the end of a mine's life to assess potential future environmental liabilities, with time periods attached to this residual liability. That is, if the residual liability does not arise within a particular period of time (say, ten years based on the risk assessment), the funds should be released to the mining company. In some jurisdictions, these funds seem to be held by the regulators indefinitely without mechanisms for their release.

Regulators may use a financial provision if a mining rights holder fails to fulfill its legal obligation under the relevant environmental management plan and environmental laws, or if the mining company has failed to act. However, these funds cannot be used in circumstances where the environmental harm arose from an emergency incident, such as a tailings dam failure. In these circumstances, the mining company must fund rehabilitation from an alternative resource. Companies should hold appropriate insurance, over and above any financial provision requirements, to cover environmental and social liabilities arising from emergency incidents. This is particularly relevant as extreme weather events arising from climate change test the limits of infrastructure.

Environmental rehabilitation is only one component of the sustainable decommissioning and closure of mines. Aside from the long-term environmental impacts that may need to be monitored and, if necessary, remedied after mining operations have ceased, there are various social considerations to consider.

Communities develop around mining operations. These typically comprise mine employees and their families, persons looking for employment at the mine and entrepreneurs supporting the community. In addition, mining operations situated in rural areas or municipalities with limited economies often fulfill the roles and responsibilities of municipalities by providing services such as potable water, sewage services and electricity. As a result, when a mine closes, these communities may suffer extreme hardship unless steps are taken during the life of the mine to decrease the community's dependency on the mine and to create other economic opportunities.20

The ICMM Good Practice Guide highlights the potential long-term liabilities of mining companies in circumstances where social transition planning is not incorporated into the closure planning strategy.21

Closure planning is an iterative process that involves: understanding social closure requirements; engaging with relevant stakeholders in accordance with relevant regulatory requirements; developing and implementing plans to reduce the dependency of stakeholders on the mine; assessing the effectiveness of the implementation plans; and, to the extent necessary, revising plans to accommodate new events or unsuccessful plans.

There are a number of ways to adapt existing large-scale mining operations to provide alternative or supplementary social economies. Mine infrastructure has been converted into tourist attractions in locations such as the Big Hole in Kimberley, South Africa; the Bonne Terre Mine in the United States; Slate Caverns in Wales; and Kolmanskop in Namibia.22

In some instances, opportunities might exist to assist local governments with regulating artisanal mining operations.23 Mining waste deposits can leave significant impacts on the soil, ground and surface water, particularly where the deposits were not suitably lined and/or maintained and rehabilitated. This is particularly true of historical mining waste deposits. Technology now makes it feasible, in certain circumstances, to extract minerals from these waste deposits (and in doing so, remove a point source of pollution) and deposit any resulting waste materials in a more environmentally appropriate waste disposal facility. Opportunities might exist to utilize new technologies and historic mine waste deposits to formalize artisanal or small-scale mining operations and, in doing so, develop a secondary mining and rehabilitation economy.

Social transition in these cases needs to begin well before mining operations cease. While some of the examples above cannot formally commence until mining operations are completed, a number of steps should be considered and implemented well before the anticipated closure of a mine. For example, developing a formalized artisanal mining program might require legislation governing how such programs will run, transferring environmental liabilities from the mining companies to the state or the artisanal mining program, and obtaining and maintaining a financial provision for rehabilitation.

Unlike environmental rehabilitation, no obligation exists to hold a financial provision for purposes of social transitioning at the end of the life of a mine. In part, this is because social transition costs may not be quantifiable in the same way as environmental costs.24 Yet as a mine approaches closure, these costs become more evident and can be better determined through engagement with communities and other stakeholders.

Mining companies may decide to dispose of mining assets for political, legal, economic or strategic reasons. Whatever the reason, companies (and possibly even shareholders in some instances) run the risk of future liability under the "polluter pays" principle. It is common for purchasers in sub-Saharan Africa to assume all environmental liabilities and indemnify sellers against any future claims. Generally, environmental liabilities are incorporated into the determination of a purchase price agreed between the parties.

While commercial arrangements can reduce a seller's liability risk, they do not eliminate it. Legislation based on the polluter pays principle exists in many sub-Saharan countries and authorizes the relevant authority to seek the rehabilitation costs from previous mine owners and operators.25 In these circumstances, depending on the wording of the sale agreement, a seller may have a claim against the purchaser for any costs it incurs arising from a claim by the authorities, though the value of such a claim depends on whether the purchaser has the funds and ability to make good on the claim.

In practice, regulators are most likely to target the current mine owner and operator for remediation efforts and (where possible) look to previous owners and operators if there is any shortfall. In these circumstances, an indemnity under a sale agreement would have no value. Avoiding liability might be possible if the seller is able to demonstrate that, at the time that it owned/operated the mine, it took all reasonable and lawful measures to mitigate environmental liabilities and to prevent pollution or environmental degradation from occurring, continuing or recurring.

As part of a sale process, both sellers and buyers should follow measures so assets are sustainably maintained and, at the relevant time, decommissioned and closed:

An increasing focus on ESG principles is revising all aspects of the mining industry. In particular, steps must be taken to ensure that the long-term environmental and social impacts of mining are sustainably rehabilitated. Significant legal considerations, some new and relatively untested, will need to be incorporated into legal frameworks going forward to ensure that communities are properly consulted in developing the post-mining land uses, that land is effectively rehabilitated and that communities are not left stranded when mining operations end.

1 White & Case, 'Mining & Metals 2021: ESG momentum reaching a crescendo in a resilient market'

2 Donna Schmidt 'Technology of mining in the future' Mining Magazine; Felipe Sanchez and Philipp Hartlieb 'Innovation in the Mining Industry: Technological Trends and a Case Study of the Challenges of Disruptive Innovation' Mining, Metallurgy and Exploration 37 1385 – 1399 (2020).

3 International Council on Mining and Metals, Integrated Mine Closure Good Practice Guide, 2nd Edition, at 40.

4 Robert Boultier and Ian Thomson 'Modelling and Measuring the Social Licence to Operate: Fruits of a Dialogue between Theory and Practice' (2011) Social Licence at 2.

5 Amy Gutmann and Dennis Thompson, Democracy & Disagreement (1998), at 1.

6 Matthew Burnell, "Developing and applying a constitutional framework for public participation in South Africa," at 16.

7 Jie Lu and Daniel Churchill 'Using social networking environments to support collaborative learning in Chinese university class: Interaction patter and influencing factors' (2014) 30(4), Australian Journal of Educational Technology at 473.

8 Cynthia Farina, Mary J Newhart, Josiah Heidt and Jackeline Solivan "Balancing Inclusion and "Enlightened Understanding" in Designing Online Civic Participation Systems: Experiences from Regulation Room' (2013), Cornell e-Rulemaking Initiative Publications, Paper 14 at 184.

9 Matthew Burnell, "Developing and applying a constitutional framework for public participation in South Africa," at 177.

10 UNEP, Sustainability Reporting in the Mining Sector Current Status and Future Trends at 11.

11 Id.

12 Investor Mining and Tailings Safety Initiative

13 Cornelissen, H, "An analysis of actual cost data for surface mine rehabilitation projects in south Africa and comparison with guideline values published by the Department of Mineral Resources" at 16.

14 A Carneiro and A Fourie, "Assessing the impacts of uncertain future closure costs when evaluating strategies for tailings management," Journal of Cleaner Production (2019).

15 Centre for Environmental Rights 'Full Disclosure: the truth about mining rehabilitation in South Africa'

16 Proposed Regulations Pertaining to Financial Provisioning for the Rehabilitation and Remediation of Environmental Damage caused by Reconnaissance, Prospecting, Exploration, Mining or Production Operations GNT 667 in Government Gazette 42464 dated 17 May 2019.

17 International Council on Mining and Metals, Integrated Mine Closure Good Practice Guide, 2nd Edition, at 40.

18 Ibid.

19 S24R of the South African National Environmental Management Act 107 of 1998.

20 ICMM, Integrated Mine Closure Good Practice Guide, 2nd Edition, at 43.

21 Id.

22 Skye Sherman '7 abandoned mines that are new awesome tourist attractions'

23 Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development, "Global Trends in Artisanal and Small-Scale Mining (ASM): A Review of Key Number and Issues."

24 ICMM at 45.

25 S28 of the South African National Environmental Management Act 107 of 1998; the Zimbabwe Environmental Management Act of 2002; Botswana Strategy for Waste Management; Mozambique: Mpaputo City Waste Management Strategy, 2006

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2021 White & Case LLP