Making the trading system work for Africa

The African Continental Free Trade Area could trigger a new era in intra-African trade.

By Mukund Dhar, Africa Interest Group Leader

As our last edition of Africa Focus was published in September 2020 in the midst of the COVID-19 pandemic, some progress had been made on the development, trial and authorization of COVID-19 vaccines. However, there was no assurance of efficacy or effectiveness, and there was profound uncertainty in our personal and professional lives, with unprecedented upheaval in the global economy.

This spring 2021 issue comes to you in a changed environment: Multiple vaccines have been approved; millions of vaccine doses are being manufactured and administered every day; and a return to normality feels no longer like a matter of hope, but of time. Therefore, while uncertainty in our lives and disruption in the global economy continues, we can perhaps permit ourselves to review the business and legal environment in Africa with a renewed sense of cautious optimism and against the backdrop of groundbreaking changes that raise important issues for companies and financial institutions doing business in Africa.

Nearly the entire African continent is involved with the African Continental Free Trade Area (AfCFTA), a single trade and investment market with a combined GDP of close to US$3.4 trillion. Trading under these new arrangements started on January 1, 2021. At the same time, development finance institutions have mounted a robust response to the COVID-19 pandemic by harnessing support from international investors and aggressively funding infrastructure and development. Several sectors of Africa’s economy continue to offer private equity and venture capital investment opportunities, while multilateral development banks are successfully supporting post-COVID recovery and growth in key African sectors. Meanwhile, innovative technologies and new approaches to decommissioning mining assets are transforming Africa’s mining industry and enabling sustainable exits.

This sixth edition of Africa Focus begins with "Making the trading system work for Africa," which explains how AfCTA's plan for virtually all African nations to open their markets to each other may have arrived at exactly the right time to spark change. "African development finance institutions" discusses how African DFIs are achieving positive impacts by funding recovery responses, leading the way with sustainable lending and attracting commercial lenders to African markets.

The article "Private equity in Africa: Trends and opportunities in 2021" highlights several industries in Africa that remain attractive private equity and venture capital destinations, particularly for those focused on long-term investments, and "Ensuring sustainable exits from African mining" discusses how mining companies can improve the ways they decommission and close their operations as well as factors that mining companies, regulators and other stakeholders can consider when formulating rules to reflect environmental, social and governance principles.

In "European multilateral development banks in sub-Saharan Africa," we examine how multilateral development banks, including the European Investment Bank, the European Bank for Reconstruction and Development and others, are collaborating with other key stakeholders and acting as catalysts for growth.

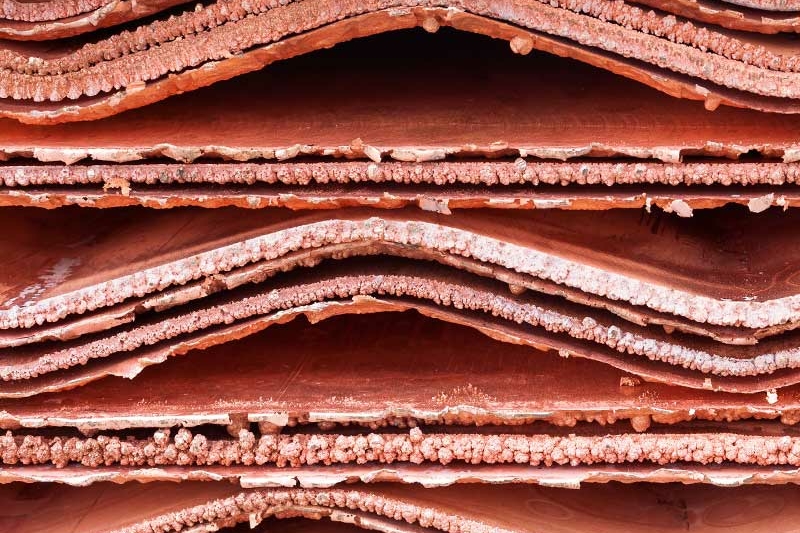

Finally, in "African mining 4.0: An innovative sunrise for African miners," we discuss how new transformative technologies, rapidly becoming available to the mining industry, are ushering in a new era of increased productivity, efficiency, safety and growth for miners.

We welcome your suggestions for any topics to review in our upcoming issues. For now, we hope this issue of Africa Focus helps you navigate the rapidly changing business landscape and explore current opportunities for doing business and investing in Africa.

The African Continental Free Trade Area could trigger a new era in intra-African trade.

Rising to challenges, funding a recovery response and leading the way to sustainable lending.

Despite challenges, Africa remains an attractive PE and VC investment destination.

The development of mine decommissioning and closure laws.

Supporting post-COVID recovery and growth in key sectors.

Transformative technologies are ushering in a new era of efficiency, safety and growth.

The African Continental Free Trade Area could trigger a new era in intra-African trade

Subscribe to receive Africa Focus

World in Transition

Our views on changing dynamics in energy, ESG, finance, globalization and US policy.

The plan is for virtually all African nations to open their markets to each other to establish a single market covering both trade and investment with a combined GDP of US$3.4 trillion.

Competing for media attention at the beginning of 2021 was the fact that nearly the entire African continent created a free-trade zone: the African Continental Free Trade Area (AfCFTA). While much work remains to be done before the AfCFTA becomes fully operational and relevant, it does not lack for ambition. The plan is for virtually all African nations to open their markets to each other to establish a single market covering both trade and investment with a combined GDP of US$3.4 trillion.

Economic integration is not a new idea in Africa. There are many sub-regional and other economic and trade agreements in Africa, several of which have been around for a long time. In fact, their longevity and relative lack of success in creating economic prosperity can explain some of the indifference and cynicism shown towards the AfCFTA.

But is past necessarily prologue? This newest integration effort occurs at a time when the world's trading system is undergoing significant change on many levels. The multilateral system established after World War II through the GATT and then the WTO is under strain. Economic nationalism is springing up in many countries that openly question the value of multilateralism, seemingly intent on fashioning a trading system based on strict reciprocity instead of non-discrimination. Overall, there is a growing impatience with the existing economic and trade architecture, which some argue has not delivered on its goals of raising living standards, particularly in developing countries.

Against this backdrop, the AfCFTA may have arrived at the right time, as long as this is the beginning of a process, not the end.

Trade agreements can do more than lower tariffs and make trade more efficient. They can improve transparency and create a legal framework more hospitable to trade and investment from both within and outside the region. Examples abound, including in Asia-Pacific, Europe and the Americas. Why not Africa?

We cannot answer that question in this article. Instead, this article places the recent developments in the context of previous integration efforts in Africa and discusses how other regions are interacting with Africa and have used trade agreements in their economic relations. It concludes with some key points for businesses participating in the development of Africa's trading relationships.

52.3%

potential increase in intra-African trade

(UN Economic Commission for Africa)

54

of the 55 African Union member states have signed the AfCFTA

Regional economic integration arrangements have existed on the African continent since the beginning of the last century, starting with the Southern African Customs Union (SACU)1 in 1910 and the East African Community (EAC)2 in 1919.

As of January 2021, ten regional economic communities in Africa aim to increase intra-regional trade, boost regional economies and reduce poverty, and many African countries have overlapping memberships in these communities. In addition to the SACU and EAC, other key regional trade arrangements on the continent include the Economic Community of West African States (ECOWAS, established in 1975)3, the Economic Community of Central African States (ECCAS, established in 1983)4 , the Southern African Development Community (SADC, established in 1992)5 and the Common Market for Eastern and Southern Africa (COMESA, established in 1994)6.

African countries also participate in trade agreements and trade programs with trade partners outside the continent, including, among others: economic partnership agreements (EPAs) with the European Union (EU); generalized system of preferences (GSP) schemes with Japan and the United States; the African Growth and Opportunity Act (AGOA) with the US; and multiple arrangements granting duty-free treatment for the least-developed countries. Meanwhile, investment protection takes place across the African continent under complex and disparate legal provisions, including investment protocols in bilateral investment treaties (BITs),7 national investment laws and regulations, and regional investment frameworks, including the non-binding Pan-African Investment Code (PAIC)8 backed by the African Union.9

Intra-regional trade and investment arrangements have led to a limited amount of intra-regional trade. African countries conduct much of their trade with countries outside the continent; raw material dominates trade exports, while incoming foreign direct investment tends to flow into resource extraction. According to Organization for Economic Co-operation and Development (OECD) data, the share of intra-African exports as a percentage of total African exports increased from approximately 10 percent in 1995 to just under 19 percent in 2019. While slowly rising, this amount is relatively low in comparison to the levels in Europe and Asia-Pacific, where intra-regional trade accounts for well over 50 percent of total export trade for each region.10

The AfCFTA officially commenced at the beginning of 2021, as participating member states established a single market covering both trade and investment with a combined GDP of US$3.4 trillion.11

The AfCFTA aims to eliminate tariffs on 90 percent of intra-African trade in goods, reduce non-tariff barriers, liberalize trade in services, develop mutual recognition of standards, promote inclusive and sustainable development, and facilitate the movement of capital and people between countries. The agreement is structured in stages, meaning it will evolve over time (more negotiations are planned in areas such as competition policy, investment, intellectual property rights and e-commerce). The AfCFTA incorporates and builds upon WTO agreements and disciplines, which is important, because 11 African Union members are not yet WTO members.12 Once fully implemented, the AfCFTA has the potential over time to increase intra-African trade by 52.3 percent, according to the UN Economic Commission for Africa (UNECA).

Fifty-four of the 55 African Union member states have signed the AfCFTA (Eritrea is not a signatory), and 36 member states, including Africa's largest economies—Nigeria, Egypt and South Africa—have ratified it (as of February 5, 2021).13

The AfCFTA incorporates and builds upon WTO agreements and disciplines, which is important since 11 African Union members are not yet WTO members.

As is often the case, administrative obstacles have emerged for the AfCFTA. The individual tariff schedules of some member states remain incomplete, and rules-of-origin provisions have yet to be finalized in line with the AfCFTA Establishment Agreement, although the parties reportedly aim to complete these outstanding tasks by the end of June 2021. Perhaps the greatest substantive shortcoming is the fact that the AfCFTA may not address the so-called "grey economy" (informal trade, which is difficult to regulate and believed to be a key driver for many African economies, supporting the livelihood of millions of people).14

The real test of AfCFTA will be its success in creating trade and investment flows that raise living standards. For that to happen, the Agreement will require meaningful implementation and enforcement, and member states will have to overcome classic enemies of increased trade: insufficient infrastructure; excessive or ineffective bureaucracy; foreign-currency restrictions; lack of reliable power supplies; creditworthiness; and old-fashioned fear and protectionism. Time can also be an enemy. The credit rating agency Fitch Ratings downgraded the creditworthiness of many African economies in 2020, citing the economic impact of the COVID-19 pandemic. In a report issued at the start of 2021, the agency noted "the impact of trade liberalisation [from the AfCFTA] should be positive for the region's economic potential, but the scale of the impact is likely to be small… and materialise only in the long term."15

Africa is not alone in facing these challenges, nor does the integration process happen in a vacuum, isolated from other economic, political and social forces. Africa's attempt to create economic progress through increased trade among its nations and with the world coincides with similar efforts in other regions and an overall weakening of the multilateral system. Other regions offer both opportunities and lessons for Africa, as briefly outlined below.

US$190 billion

trade with China in 2019 (China-Africa Research Initiative, Johns Hopkins University School of Advanced International Studies)

Since 2000, Africa's trade flows have shifted from the US and Europe to China and Asia-Pacific more generally.

In the case of emerging Asia-Pacific markets, this shift has been largely driven by the rise of the middle classes and their growing appetite for commodities, resource-based products and raw materials, while rising economic growth in many African countries has increased demand for value-added manufactured goods from Asia-Pacific.

Economic links between Africa and China have increased significantly over the past 25 years in the form of trade, investment, loan financing and public infrastructure projects. For more than a decade, China has ranked as Africa's largest or second-largest trading partner, with Sino-African trade reaching US$190 billion in 2019.16 As a country with a population of more than 1.3 billion people, China interacts with every one of the 55 African Union member states, which cumulatively have a population of roughly the same size.

Under China's Belt and Road Initiative (BRI), China frequently works with individual African governments to establish Special Economic Zones, usually termed Foreign Economic and Trade Cooperation Zones or Overseas Cooperation Zones, to promote trade and investment.

China's BRI projects and investment in Africa support port development, infrastructure and connectivity, and industrial and energy projects. In 2018, the African Union signed a memorandum of understanding on BRI cooperation with China, marking the first cooperation document signed by China and a regional international organization.

The BRI is just one facet of China's engagement with Africa. On January 1, 2021, the China-Mauritius Free Trade Agreement (CMFTA) entered into force. The CMFTA is China's first free-trade agreement (FTA) with an African country and a likely model for future trade agreements between China and individual African countries. China's decision to commence bilateral FTA negotiations first with Mauritius likely demonstrates its use of FTAs for geopolitical purposes. Located in the Indian Ocean, off the east coast of the African continent and to the west of India, Mauritius lies at the crossroads of maritime trade. It is also one of Africa's rising economies, with a robust manufacturing sector, an outward-oriented services sector, and a predictable regulatory regime and reputation for good governance. Mauritius has concluded nearly 50 BITs and 50 double-tax avoidance agreements, which have played an important role in developing its domestic financial sector and establishing the island country as a financial hub for the region.17

Indonesia and the African nations have a history of trying to foster strong economic and trading relationships.

In April 1955, Indonesia hosted the Bandung Conference,18 which marked the first large-scale conference between countries in the two regions (some of which were newly independent) to promote economic and cultural cooperation and to oppose colonialism or neo-colonialism. Asian and African countries renewed their commitment for a New Asian-African Strategic Partnership during the 2015 Asian-African Summit in Jakarta.

During the 2018 Indonesia-Africa Forum held in Bali, senior Indonesian government officials and their African counterparts explored investment and trade opportunities and announced business transactions totaling more than US$1 billion. They also agreed to expand bilateral trade relationships by establishing preferential trade agreements (PTAs), which tend to focus on tariff elimination for a targeted set of products. To date, Indonesia has signed a PTA with Mozambique, commenced PTA negotiations with Morocco and Tunisia, is in preliminary PTA discussions with the Southern African Customs Union, Djibouti, Kenya and Nigeria, and is exploring an agreement with ECOWAS.

Indonesia is also the largest economy of the Association of Southeast Asian Nations (ASEAN), which, prior to the start of the COVID-19 pandemic, had a combined GDP of approximately US$3 trillion, according to the ASEAN Secretariat. Trade and economic development are at the core of ASEAN, and the ten member states are currently implementing the ASEAN Economy Community: a single market and production base covering the free movement of goods, capital, services and investment. African countries can draw lessons from the experience and practices in ASEAN, particularly as they commence implementation of the AfCFTA.

49 countries

in sub-Saharan Africa can export goods to the US

(2015 US African Growth and Opportunity Act)

The US and Mexico offer opportunities and perhaps an example of how trade agreements can bolster both intra-regional trade and trade with others.

Historically, the US has viewed its trade with the nations of Africa in terms of either economic aid or as a source of resources. Trade, as part of aid, has been a predominant US theme in recent decades.

The US extended its unilateral preference system, the Generalized System of Preferences (GSP), to most African nations, providing reduced or duty-free access for African products to the US market. This type of unilateral preference system can be helpful episodically but has limits. GSP must be authorized by the US Congress and, over the years, its reauthorization has been postponed or left uncertain. As in any unilateral preference system, sensitive products are excluded; often, these sensitive products are precisely ones that would impact GSP beneficiary countries, such as textiles, apparel and certain basic steel products. More fundamentally, unilateral preferences are tariff concessions—limited in nature and ambition—that do not seek an economic partnership and only grant a tariff break on certain products.

The US took a step toward a more meaningful program with Africa through its 2015 African Growth and Opportunity Act (AGOA). While still a unilateral preference program, the AGOA provides a specific benefit program allowing the 49 countries in sub-Saharan Africa to export goods to the US. Goods that qualify under AGOA can be imported duty-free into the US until the end of 2025. In 2020, 38 African nations exported goods that qualified for this treatment.

Although AGOA enjoys bipartisan support in the US, efforts to establish more reciprocal trading arrangements with African nations have gained momentum in recent years. In 2015, the Obama Administration took the position that the US should transition away from unilateral preferences and pursue reciprocal agreements with African nations following AGOA's scheduled expiration in 2025.20 This was motivated in part by concerns that emerging reciprocal trade agreements between Africa and other partners, such as the EU and China, would place US businesses at a disadvantage in the region. Other factors that played a role included the proliferation of non-tariff barriers, such as localization requirements in several African countries, improving economic conditions in Africa and decisions by other developed economies, such as Canada and the EU, to scale back their unilateral tariff preference programs. In light of these trends, Congress mandated in the AGOA legislation that the US Trade Representative develop plans to negotiate reciprocal FTAs with African countries.

In 2018, the US took an important first step towards more reciprocal trade relations with Africa by announcing its intention to negotiate an FTA with Kenya. The Trump Administration had hoped that a US-Kenya FTA could serve as a "model agreement" for FTAs with additional African nations. In March 2020, then-US Trade Representative Robert Lighthizer sent the required notification to Congress of the US' intent to negotiate an FTA with Kenya, potentially enabling an FTA, if reached, to be considered by Congress under a "fast track" legislative procedure that would result in an up or down vote on the negotiated agreement. However, the window for this to occur is closing quickly, since the Trade Promotion Authority (TPA) under which the fast-track process occurs is set to expire at the end of June 2021. If the US Congress decides to extend or renew the TPA, then the likelihood increases of successfully concluding a US-Kenya FTA.

The Biden Administration has made some positive opening gestures to the African countries, 21 but understandably has not yet defined its position on specific issues, including whether to continue FTA negotiations with Kenya. Given President Biden's campaign pledge to temporarily refrain from entering into new trade agreements, the negotiations may be put on hold or even abandoned in favor of other initiatives. Nevertheless, the rationale that led the US to pursue a "model FTA" in Africa remains compelling, and the push for more reciprocal trade relations is likely to continue over the long term.

Although FTAs remain a long-term prospect, the US Department of Commerce International Trade Administration and its Foreign Commercial Service officers in embassies and consulates in Africa provide an excellent resource for US exporters seeking to sell goods or services in Africa. Under the Trump Administration, the US Department of Commerce launched a Prosper Africa initiative focused on bilateral engagement with African nations to boost US trade with Africa, and that initiative or a similar one is likely to continue in some form under the Biden Administration. President Biden has indicated that his administration will focus on trade agreements that increase jobs in the US and has expressed interest in supporting multilateral approaches.

Finally, in 2020 the US Congress enacted legislation providing more tools for the US government to support American companies competing in international markets, in particular by creating the International Development Finance Corporation (IDFC). The IDFC has increased authority to provide loans and loan guarantees that support US participation in international development projects, with even greater flexibility accorded to the IDFC to provide support in cases where competing offers are being made with government or state-owned enterprise support from China.

Trade between Mexico and Africa is currently minimal. Mexico's bilateral trade with sub-Saharan countries roughly doubled from US$1.185 billion in 2010 to US$2.21 billion in 2018, but this amount pales in comparison to Mexico's bilateral trade with the rest of North America, which increased from approximately US$400 billion to US$585 billion during the same period. 22

While Mexico may not be a significant market or source of trade or investment capital for African countries, it provides an interesting example of a country that followed a unique approach to regional integration while simultaneously remaining an active member of the multilateral system. Mexico used its regional and multilateral trade negotiations to reinforce its domestic economic policy goals of opening its economy, attracting investment and raising wages and living standards.

Mexico's experience with trade agreements is best understood as a change in policy from one dominated by import substitution for most of the mid-20th century. Following a significant economic crisis in the early 1980s, the Mexican government decided to open its economy and integrate economically. It acceded to the GATT in 1986, signed a limited FTA with Chile (largely an agreement to lower tariffs on goods) and began negotiating the comprehensive North American Free Trade Agreement (NAFTA), which the US, Canada and Mexico signed in 1992. NAFTA covered trade in goods, services, investment protection mechanisms, government procurement, dispute settlement, intellectual property and other issues. The message was clear: Mexico would use trade agreements—multilateral, bilateral and regional—to modernize its economy and integrate with the world, especially the US.

Economic progress is the result of many factors, and it is difficult to attribute progress to any one policy decision. Nonetheless, Mexico's approach to trade agreements seems to have contributed significantly to the country's economic development. Mexico's total trade with the US and Canada increased from approximately US$94 billion in 1993 to approximately US$647.7 billion in 2019,23 when it renegotiated NAFTA with the US and Canada (creating the agreement known as the T-MEC in Mexico and the USMCA in the US). In recent decades, the world rewarded Mexico with investments: Direct foreign investment increased from approximately US$14 billion in 1999 to approximately US$608 billion in 2020, more than half of which came from the US and Canada.24

Mexico went on to sign 13 other FTAs, including with Europe, Japan, the Pacific Alliance and Central America. In 2019, Mexico was the world's 12th-largest export economy, with US$472.3 billion in exports.25

Mexico has taken advantage of its geographical position and become a powerhouse exporter of manufactured and agricultural goods by developing the following trade preferences:

African countries mostly export primary goods to the EU (66 percent of the value of total exports in 2019) and mostly import manufactured goods (70 percent of the value of total imports in 2019).

Europe is perhaps the world's best example of the power of trade agreements. A sub-regional sectoral trade agreement formed after World War II, the European Coal and Steel Community, led to deeper economic integration through the 1957 formation of the European Economic Community and later the European Community and the European Union. Liberalized trade was a first step to economic and political cooperation, as strong ties bound European nations together and eventually created a broad economic and political union where goods, services and people travel freely across national borders.

Africa and Europe have a long trading history, beginning before Europe's own economic integration. The EU often ranks among Africa's largest trading partners: In 2019, the EU accounted for 31 percent of Africa's imports and 29 percent of its exports. African countries mostly export primary goods to the EU (66 percent of the value of total exports in 2019) and mostly import manufactured goods (70 percent of the value of total imports in 2019).

Since 1975 and the conclusion of the first Lomé Convention with African, Caribbean and Pacific (ACP) countries, the EU has granted imports from sub-Saharan Africa preferential access to its market. The different Lomé conventions also provided for aid.

After the Lomé IV Convention was found to be inconsistent with the WTO Agreements in the framework of the EC – Bananas dispute, the EU and ACP States signed the Cotonou Agreement in June 2020, which aims to reduce poverty and contribute to the gradual integration of ACP states into the world economy. The Cotonou Agreement is based on three pillars regarding development, economic and trade cooperation and political engagement, and provides for the negotiation of EPAs (development-oriented free-trade arrangements) between the EU and ACP countries. With the EPAs, the EU intended to move from providing unilateral preferences to concluding bilateral or multilateral trade agreements.

The EU has signed the following EPAs with Africa to date:

African countries that have not signed EPAs continue to benefit from trade preferences under the EU's Generalized Scheme of Preferences and the Everything But Arms scheme that is available to the least-developed countries and other developing countries under certain conditions.

The Cotonou Agreement was due to expire in February 2020, but was extended to allow the EU and ACP countries to conclude their negotiations on a successor agreement. On December 3, 2020, the EU and the Organization of ACP States reached a political agreement on the new Partnership Agreement, which must be signed and ratified in 2021. The new agreement (the text of which is not yet published) is reported to cover a large number of areas, ranging from sustainable development and growth, to human rights and peace and security. Meanwhile, EPA negotiations will continue with African countries.

As is evident in the preceding discussion, sub-regional trade agreements in Africa are not new, and they have not led to either significant intra-regional trade or mutually beneficial trade and investment with countries outside of Africa. But trade agreements can have a significant impact, as the experiences of ASEAN, the EU and Mexico show. Is AfCFTA worthwhile, and what will determine its success?

In our view, AfCFTA is worthwhile. Intra-regional trade is low, and increasing trade among African countries seems achievable. The factors necessary to increase intra-regional trade—lowering barriers to goods and services, institutional reform, transparency in administration, strengthening the rule of law—are the same factors that will help attract investment capital and trade from other regions. The AfCFTA can serve a "standard-setting" function among the African nations and for Africa's economic relations with the rest of the world. It can also facilitate the entry into the WTO of those African countries that remain outside the world's foremost trade agreement, just at the time that the WTO membership has elected its first Director General from an African nation.26

As for the factors that will determine AfCFTA's success, we can name a few:

1. Forward momentum with patience – Economic integration takes time: Investment flows require legal security, which in turn require confidence in institutions, transparency and a sense of predictability. It is unreasonable to expect this to happen upon the signing of an FTA, no matter how comprehensive. Instead, small successes creating momentum toward bigger success is the necessary approach.

2. Support from the business community – Trade agreements are not much use without a willing business community. It will be important to see examples of businesses using the AfCFTA to their advantage, and having a positive impact on the social goals implicit and explicit in the AfCFTA. Again, success can breed success.

3. Political leadership – Launching the AfCFTA took leadership; making it successful will require more. African leaders will have to remain committed to its success, despite inevitable bumps in the road and domestic criticism. There will be criticism and obstacles in every country because successful trade agreements cause change. Leaders should plan for resistance and manage it.

4. Wise choices – If the AfCFTA is successful, it will increase intra-regional trade and make Africa a more attractive place for business, which, one would hope, will ultimately benefit the people of the African nations. Along the way, there will be many choices to make, including:

The AfCFTA is a start. Much work remains to make it a success for African nations and the African people. These efforts are worth it, because trade agreements can have a positive impact on raising living standards and building the types of societies that African nations want.

1 SACU has five member states: Botswana, Eswatini (formerly Swaziland), Lesotho, Namibia and South Africa.

2 EAC has six member states: Burundi, Kenya, Rwanda, South Sudan, Tanzania and Uganda.

3 ECOWAS has 15 member states: Benin, Burkina Faso, Cape Verde, Cote d'Ivoire, the Gambia, Ghana, Guinea, Guinea Bissau, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leone and Togo.

4 ECCAS has 11 member states: Angola, Burundi, Cameroon, Central African Republic, Chad, Democratic Republic of the Congo, Equatorial Guinea, Gabon, Republic of Congo, and São Tomé and Príncipe.

5 SADC has 16 member states: Angola, Botswana, Comoros, Democratic Republic of Congo, Eswatini, Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, Seychelles, South Africa, Tanzania, Zambia and Zimbabwe.

6 COMESA has 21 member states: Burundi, Comoros, Democratic Republic of Congo, Djibouti, Egypt, Eritrea, Eswatini, Ethiopia, Kenya, Libya, Madagascar, Malawi, Mauritius, Rwanda, Seychelles, Somalia, Sudan, Tunisia, Uganda, Zambia and Zimbabwe.

7 According to UNCTAD's Investment Policy Hub, African countries have signed 879 BITs, both intra-African and with third- party states. To date, there are 521 BITs in force.

8 The PAIC is the first continent-wide model investment treaty that aims to provide an effective and substantive protection for investors and investments, while respecting sustainable development goals and preserving the rights of the host country. Adopted in 2015, the PAIC provides a pathway for African countries to replace intra-African BITs or regional investment instruments with the PAIC.

9 The African Union is an interovernmental organization founded in 2002 as the successor to the Organization of African Unity (OAU) in place since 1963. The African Union comprises 55 member states that represent all economies of the African continent (including the Sahrawi Arab Democratic Republic, also known as Western Sahara, which is a disputed territory claimed by Morocco).

10 2019 Policy Note on Africa: Infrastructure and Regional Connectivity, OECD Development Centre. See here: https://www.oecd.org/dev/development-philanthropy/AfricaPolicyNote%20_2019.pdf

11 For an excellent discussion of the AfCFTA's development, content, and potential significance, see Katrin Kuhlmann and Akinyi Lisa Agutu, "The African Continental Free Trade Area: Toward a New Legal Model For Trade And Development," Georgetown Journal of International Law, Vol. 51, Issue 4 at 753 (2020).

12 As of January 2021, the following countries are WTO observers: Algeria, Comoros, Equatorial Guinea, Ethiopia, Libya, São Tomé and Príncipe, Somalia, South Sudan and Sudan—meaning that they must commence accession negotiations within five years after becoming an observer. Eritrea is not an observer, and the Sahrawi Arab Democratic Republic remains a disputed territory claimed by Morocco.

13 United Nations. Economic Commission for Africa (2019), African Continental Free Trade Area: Questions & Answers, Addis Ababa. © UN. ECA. See here: https://repository.uneca.org/ds2/stream/?#/documents/7743085e-72f9-5c76-b94b-400625d76350/page/1

14 Economic Development in Africa Report 2019: Made in Africa – Rules of Origin for Enhanced Intra-African Trade, United Nations, 2019, pgs. 42-43. See here: https://unctad.org/system/files/official-document/edar2019_en_ch1.pdf

15 https://www.fitchratings.com/research/sovereigns/african-fta-growth-impact-too-small-to-affect-ratings-07-01-2021

16 Data from the China-Africa Research Initiative, Johns Hopkins University’s School of Advanced International Studies (SAIS), 2020. See here: http://www.sais-cari.org/data-china-africa-trade

17 In 2020, Mauritius was ranked first among African countries and 13th out of 190 economies in the World Bank’s Ease of Doing Business Report, and according to the United Nations Conference on Trade and Development (UNCTAD), Mauritius is expected to become a high-income economy by 2030.

18 The Bandung Conference was an important step in the formation of the Non-Aligned Movement (NAM), which was established in 1961 during the Cold War as an international platform for developing countries (125 as of 2018) to raise their concerns on issues of mutual interest.

19 ASEAN’s ten members include Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

20 "Beyond AGOA: Looking to the Future of U.S.-Africa Trade and Investment," Office of the US Trade Representative, September 2016. Available at https://ustr.gov/sites/default/files/2016-AGOA-Report.pdf

21 President Biden addressed the African leaders as they began the 34th African Union Summit in February. "Biden Signals New Tone on US-Africa Relations," available at https://www.voanews.com/africa/biden-signals-new-tone-us-africa-relations

22 Data from World Bank’s World Integrated Trade Solution, https://wits.worldbank.org/CountryProfile/en/Country/MEX/Year/2010/TradeFlow/EXPIMP/Partner/SSF/Product/all-groups (last visited February 7, 2021).

23 See https://www.canadainternational.gc.ca/mexico-mexique/canmex.aspx?lang=eng and https://ustr.gov/countries-regions/americas/mexico

24 See https://www.gob.mx/se/acciones-y-programas/competitividad-y-normatividad-inversion-extranjera-directa?state=published (data showing that the United States and Canada account for approximately 54% of the US$608 billion in accumulated foreign investment in 2020 (last consulted March 9, 2021)).

25 http://www.worldstopexports.com/mexicos-top-exports/

26 In February 2021, WTO members agreed by consensus to select Ngozi Okonjo-Iweala of Nigeria as the WTO's seventh Director-General. Dr Okonjo-Iweala is the first woman and the first African to be chosen as Director-General. Her term extends through August 2025 and is renewable. For more information, see https://www.wto.org/english/news_e/news21_e/dgno_15feb21_e.htm

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2021 White & Case LLP