FTSE 350 AGMs: Snapshot of how companies are responding to the new Pre-Emption Group guidelines

5 min read

The Pre-Emption Group issued new guidelines in November 2022. The guidelines have increased the threshold for which companies may disapply pre-emption rights to 20% and have added a new flexibility whereby companies may disapply pre-emption rights for up to an additional 4% to be used for the purposes of follow-on offers.

Now companies are nearing the end of the 2023 AGM season, this client alert provides a snapshot of the approach FTSE 350 companies have taken to the new guidelines since they were introduced.

Introduction

In July 2022, the UK Government published the UK Secondary Capital Raising Review ("UK SCRR"), which recommended changes to guidance on the disapplication of pre-emption rights. The UK SCRR consulted with market participants on capital raisings by UK listed companies, the predominant take-away being that in relation to pre-emption rights, companies wanted to retain the increased flexibility that had been granted to them during the pandemic, and UK companies were perceived to have used this additional flexibility appropriately.

In November 2022, the Pre-Emption Group ("PEG") issued revised guidance on the disapplication of pre-emption rights based on the UK SCRR's recommendations.

The PEG guidance previously stated that premium listed companies could only disapply up to 5% of existing share capital for the purposes of general disapplication, and up to an additional 5% to finance a specified capital investment, with a rolling 3-year 7.5% limit on use of disapplication for general purposes.

What does the new guidance say?

The new guidance states that a premium listed company may disapply pre-emption rights for:

- no more than 10% of issued share capital for any purpose, with a further authority for no more than 2% to be used for the purposes of making a follow-on offer; and

- no more than 10% of issued share capital for an acquisition or specified capital investment, with a further authority for no more than 2% to be used for the purposes of making a follow-on offer.

Higher levels of disapplication might be considered appropriate for companies which had expressly disclosed to investors that they should be considered "capital hungry" (e.g. fast growth tech companies). However, as a rule, premium listed companies must currently publish a prospectus if they issue (over a 12 month period) shares representing 20% or more of those already admitted to listing, which should be taken into account when seeking the maximum possible disapplied authority.

What are the features of a follow-on offer?

In order for a follow-on offer to be made, the following features are expected:

- Qualifying shareholders: the offer should be made to shareholders as at a record date prior to announcing the placing. This excludes any shareholder allocated shares in the related placing.

- Individual monetary cap: qualifying shareholders should be entitled to subscribe for shares up to a monetary cap of not more than £30,000 per ultimate beneficial owner.

- Size: the number of shares issued in the follow-on offer must not exceed 20% of those being issued in the placing.

- Price: the issue price of shares issued in a follow-on offer should be equal to, or less than, the offer price in the placing.

- Timing: the company should announce any follow-on offer when (or as soon as reasonably practicable after) the placing is announced.

- Offer period: the company should ensure that any follow-on offer is open for a period sufficient to allow qualifying shareholders to become aware of the offer and to give them time to reach an investment decision.

What approach are FTSE 350 companies taking?;

We have tracked FTSE 350 companies' adoption of the revised form resolutions in line with the new PEG guidance since the start of 2023. As of 15 May 2023, there have been 160 FTSE 350 companies that have published their AGM notices this year, representing 46% of the FTSE 350 index.

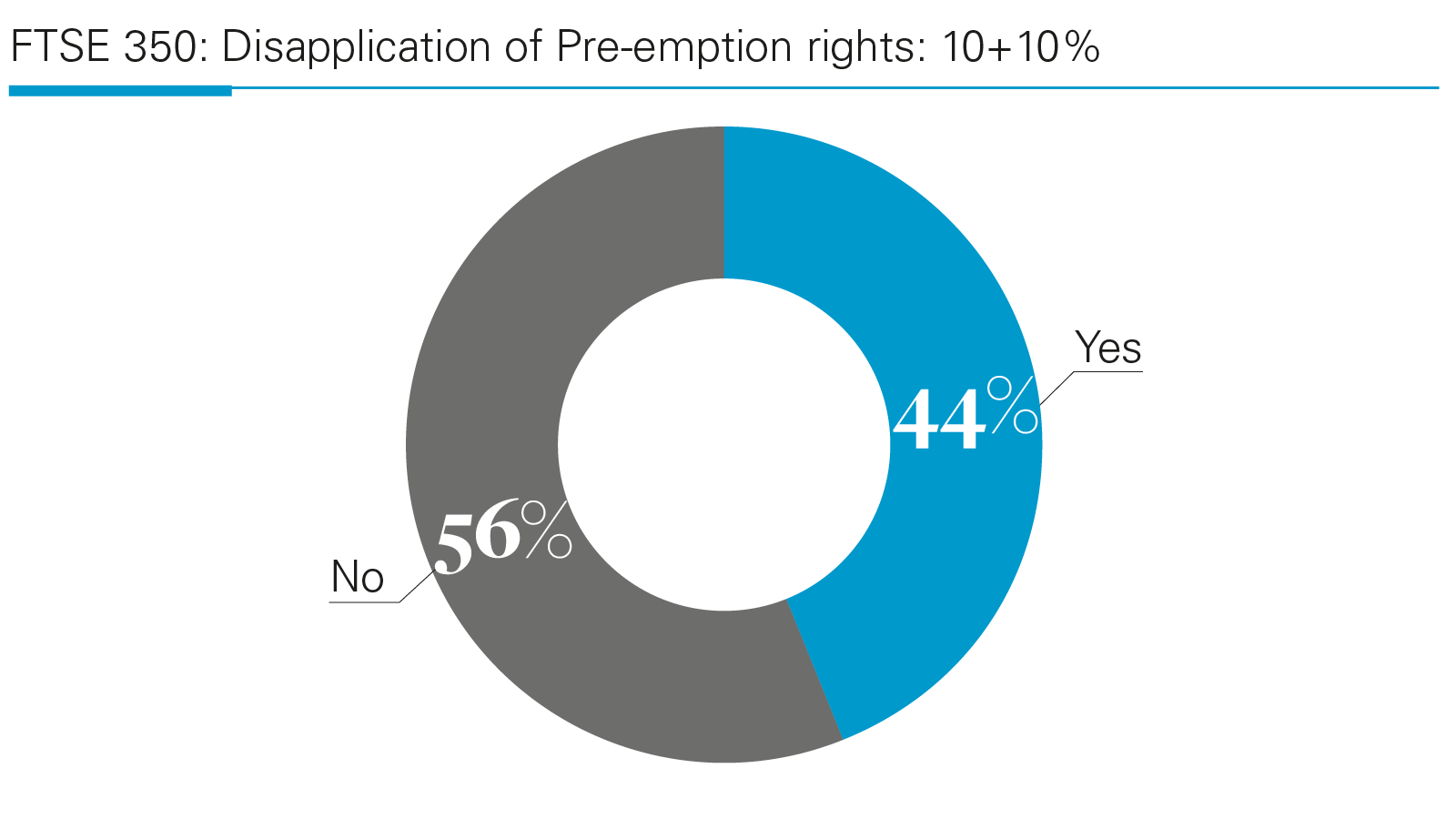

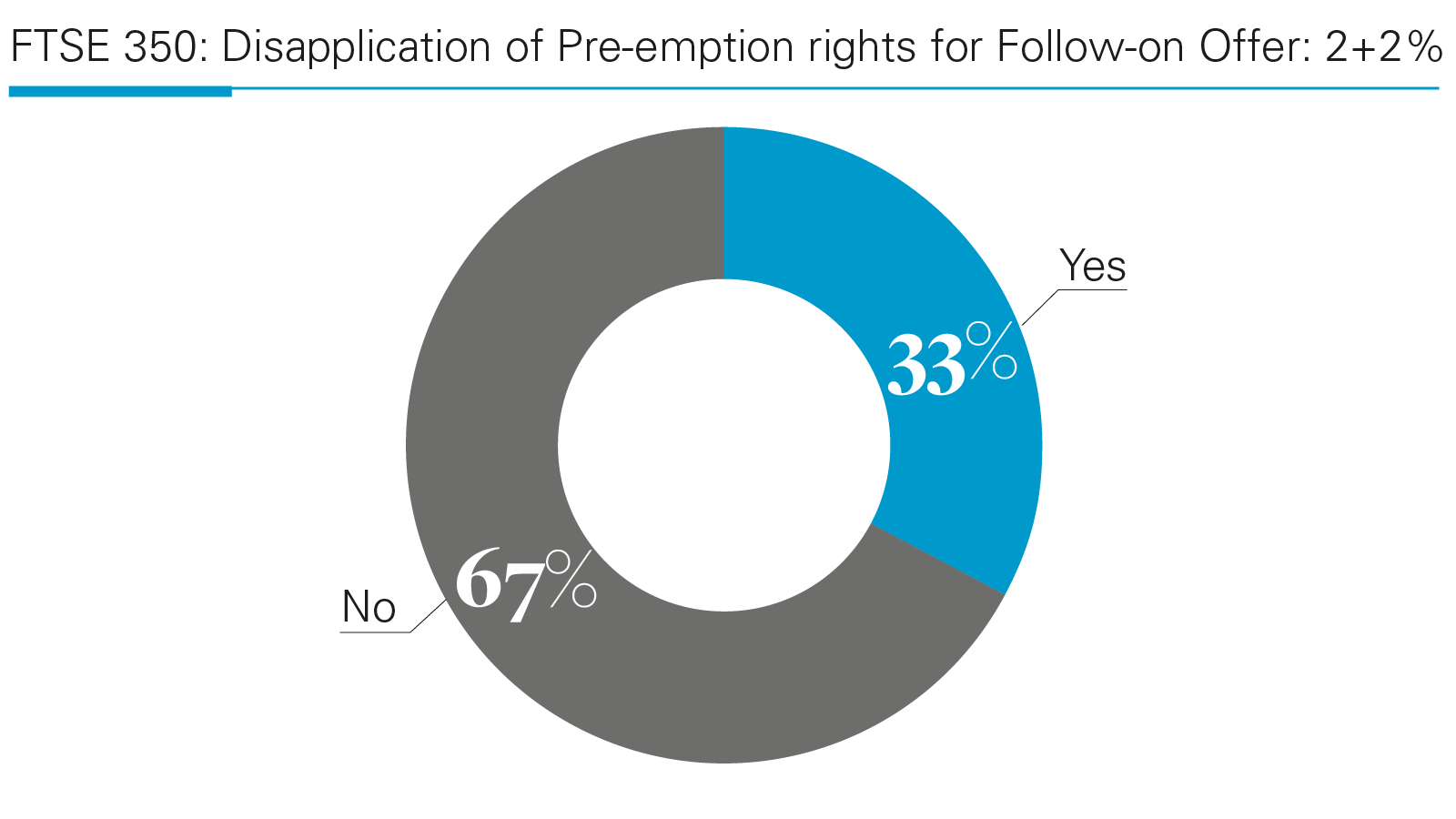

Of the FTSE 350 companies that have issued their AGM notices:

- 33% have adopted the new 10% + 10% thresholds for disapplication of pre-emption rights and authority for related follow-on offers; and

- an additional 11% have adopted the new 10% + 10% thresholds only, but have decided to not take authority for related follow-on offers.

Therefore, a total of 44% of FTSE 350 companies who have issued their AGM notices have adopted the new PEG guidelines to some extent.

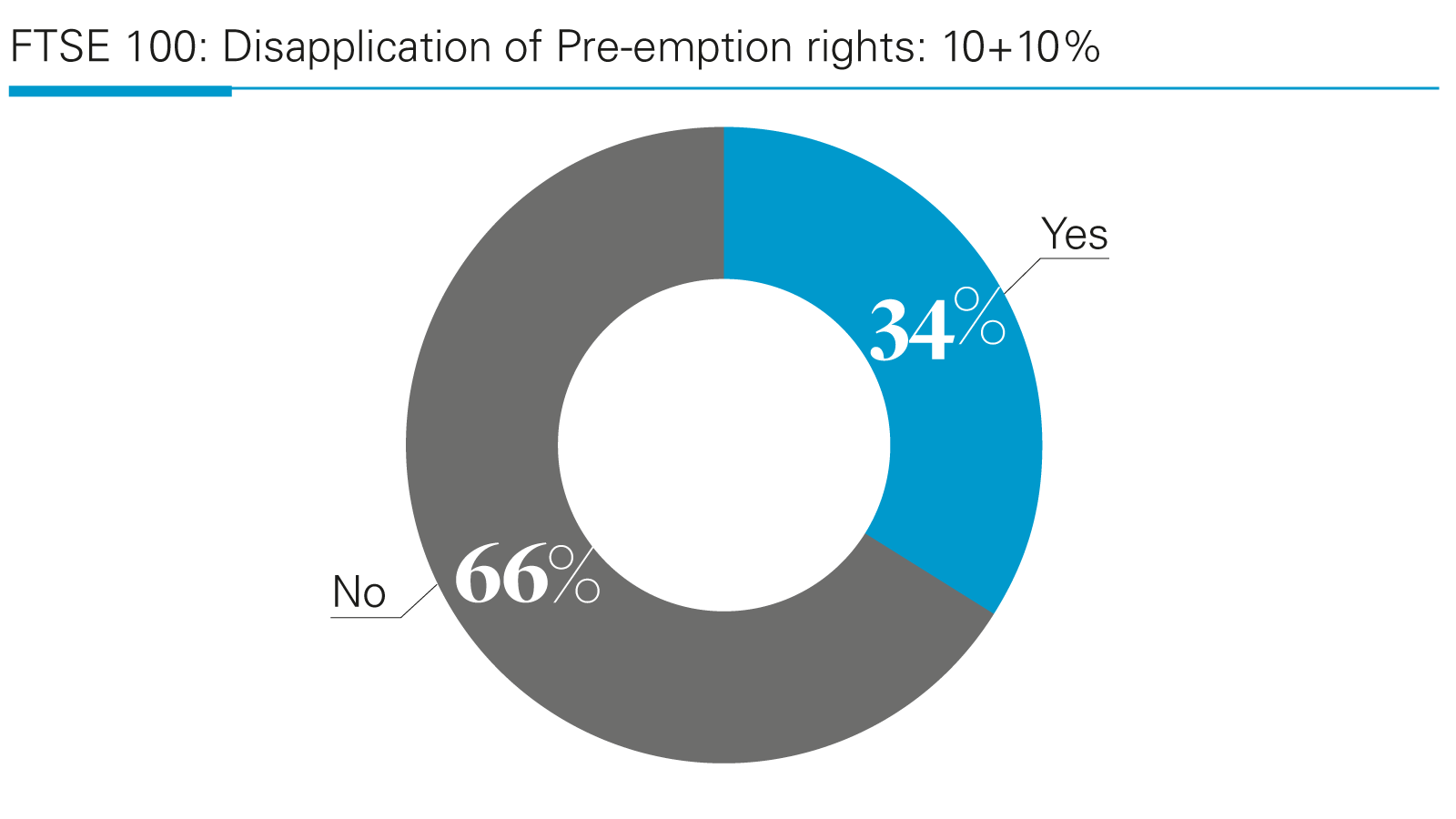

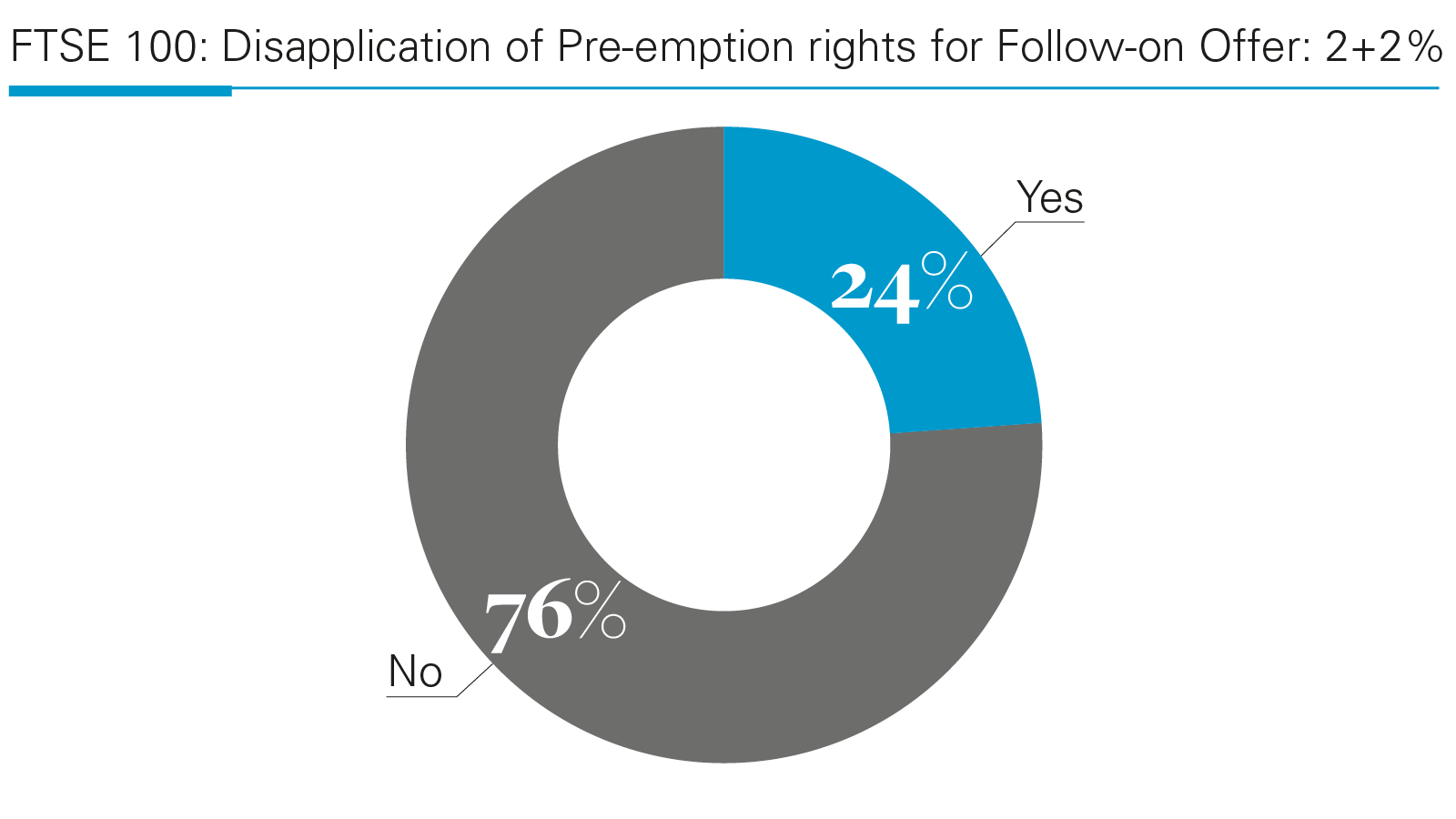

Furthermore, there have been 58 FTSE 100 companies that have issued their 2023 AGM notices. Of these companies:

- 24% have adopted the new 10% + 10% thresholds for disapplication of pre-emption rights and authority for related follow-on offers; and

- an additional 10% have adopted the new 10% + 10% thresholds only.

As such, a total of 34% of FTSE 100 companies who have issued their AGM notices are wholly or partly following the new PEG guidelines.

Concluding remarks

In comparison to when the PEG principles were last updated in 2015, it appears that companies are adopting the new 2022 principles faster than before. This is likely because the new principles were published in November (2022 update), rather than March (2015 update), thus giving companies more time to amend their AGM resolutions. However, it generally takes time for market practice to change, particularly as there may be some reluctance for companies to be a "first mover". Finally, it may simply be that some companies have decided that they do not need the 20% allowance, or following engagement with their major shareholders, they are not certain that the 10% + 10% resolutions would pass.

It is unclear why some companies that are adopting the increased 10% + 10% thresholds are not also seeking authority for follow-on offers, although this may be related to the potential prospectus requirement (noted above) as well as taking into account the previous limit of 20% which applied after PEG relaxed its guidance during the COVID-19 pandemic (and therefore is at a level that institutional investors have generally accepted).

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2023 White & Case LLP