At Mid-year, US Merger Filings Down From 2021's Torrid Pace, But Still Far Above the Historic Average

White & Case Global Antitrust Merger StatPak (WAMS)

4 min read

More from WAMS

White & Case Global Antitrust Merger StatPak

White & Case Antitrust/Competition is a “one-stop shop for global deals.”

The Legal 500 US

About the WAMS dataset

White & Case collects and analyzes data from a variety of sources for WAMS. This includes communicating directly with competition authorities to capture the latest data available, as well as analyzing public reports issued by competition authorities and others sources such as the Organisation for Economic Co-operation and Development (OECD). WAMS is updated and expanded on a regular basis.While data is available for certain jurisdictions over a number of years, there are gaps in reporting for certain jurisdictions. Where applicable, we offer clarifications regarding the data.

White & Case Global Antitrust Merger StatPak (WAMS)—the first real-time clearinghouse for global merger notification data—has analyzed merger notifications in reporting jurisdictions for the first half of 2022 (H1 2022: January 1, 2022 – June 30, 2022).

Key Highlights

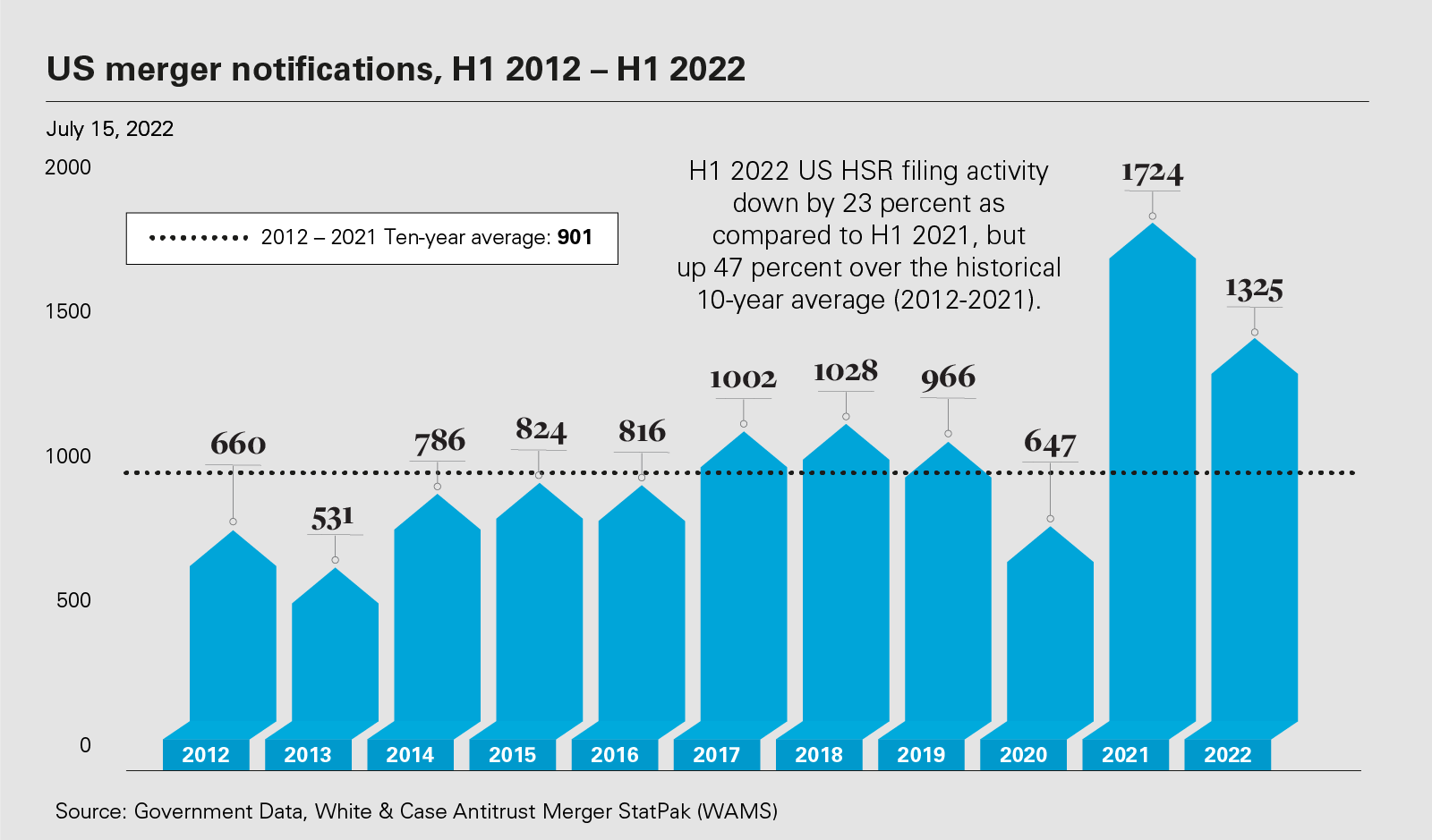

- According to WAMS data, US merger control filing activity has cooled off: H1 2022 merger filing activity is down 23 percent versus H1 2021. However, US HSR filings in H1 2022 are 47 percent above the 10-year trailing average of US HSR filings.

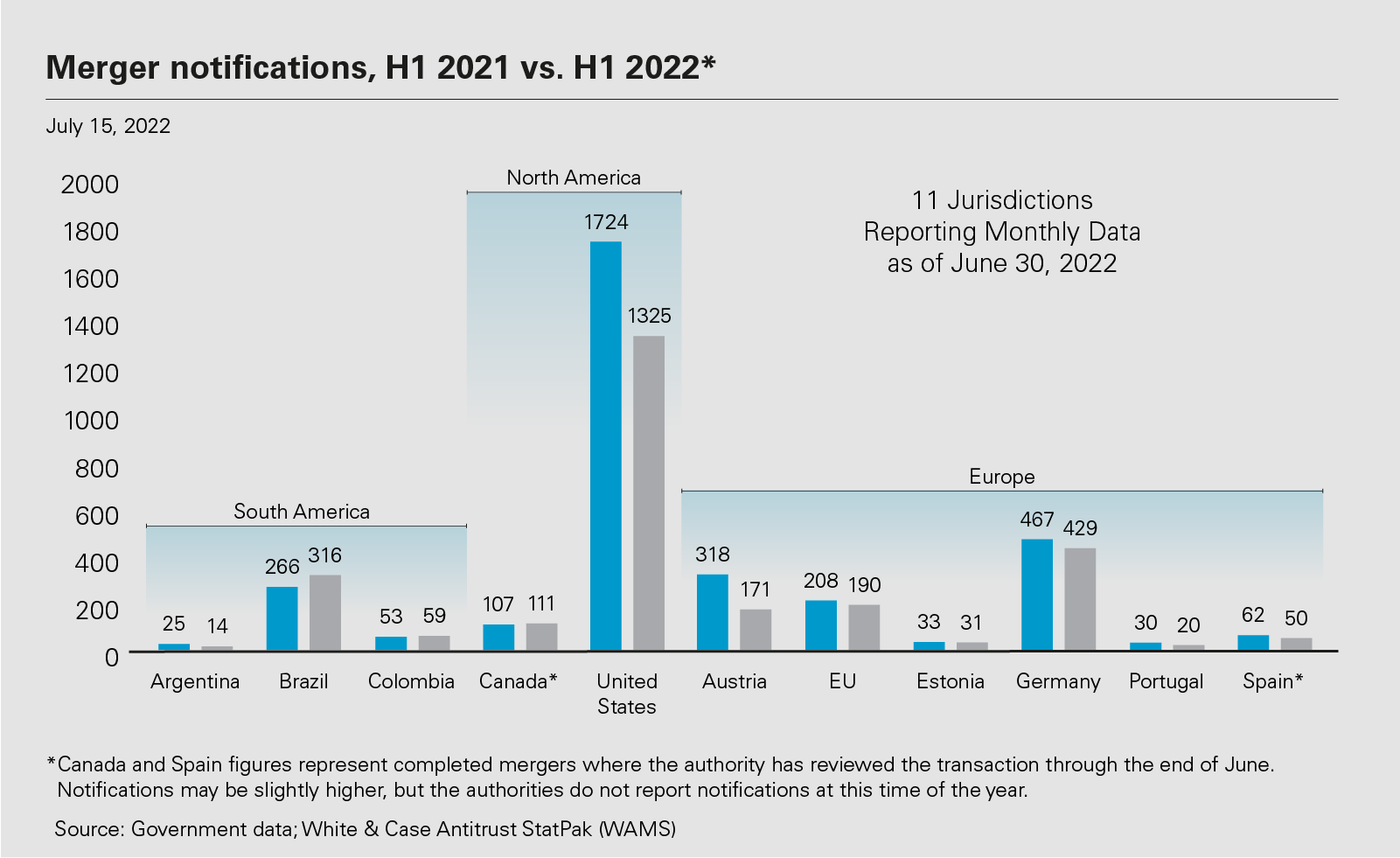

- Merger filing activity in H1 2022 across Europe has decreased slightly less than the US—showing a decline of 20 percent in five European jurisdictions compared to H1 2021.

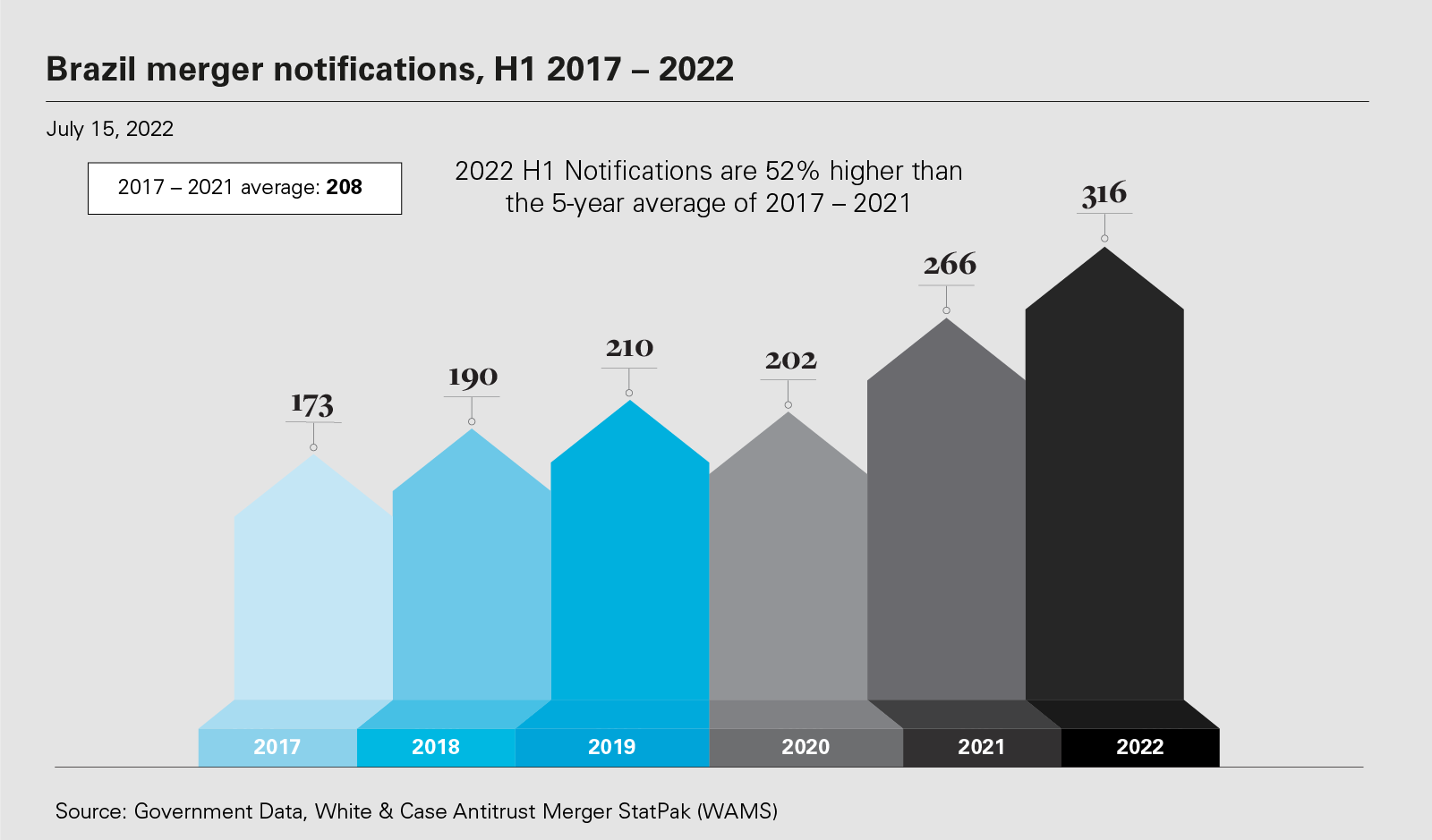

- Brazil filing activity in H1 2022 is up roughly 20 percent compared to H1 2021, and up roughly 52 percent as compared to 2017-2021 average.

US Merger Control Filings in H1 2022 Are 47 Percent Above Historical 10-Year Average

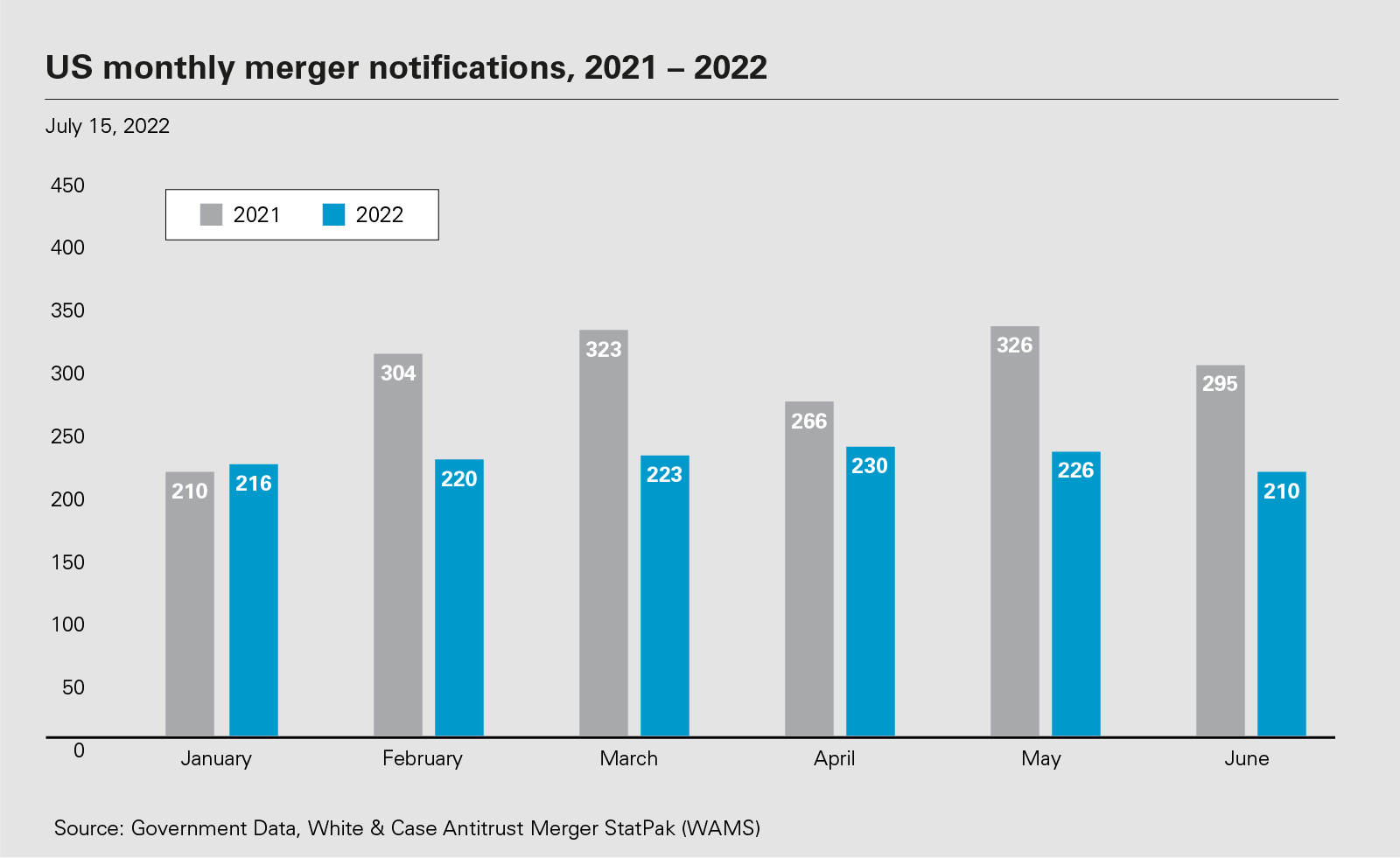

In the US, after a record year in 2021, merger filing activity in H1 2022 (January 1, 2022 to June 30, 2022) was down by 23 percent as compared to H1 2021. However, 2022 merger filing activity in the US remains quite brisk. The first half (H1) of 2022 level of US merger filings continue to be at a historically high level: 47 percent higher than the historical H110-year average (2012-2021).

The Federal Trade Commission (FTC) released its end of June 2022 Hart-Scott Rodino (HSR) filing statistics on the day the Chair of the White House Competition Council and Director of the National Economic Council Brian Deese urged the US Congress to "act swiftly" to boost funding for the Department of Justice's Antitrust Division and the Federal Trade Commission because "the annual number of completed mergers and acquisitions doubled," in the past decade while appropriations for the agencies has remained "essentially flat—and decreased in real terms."1

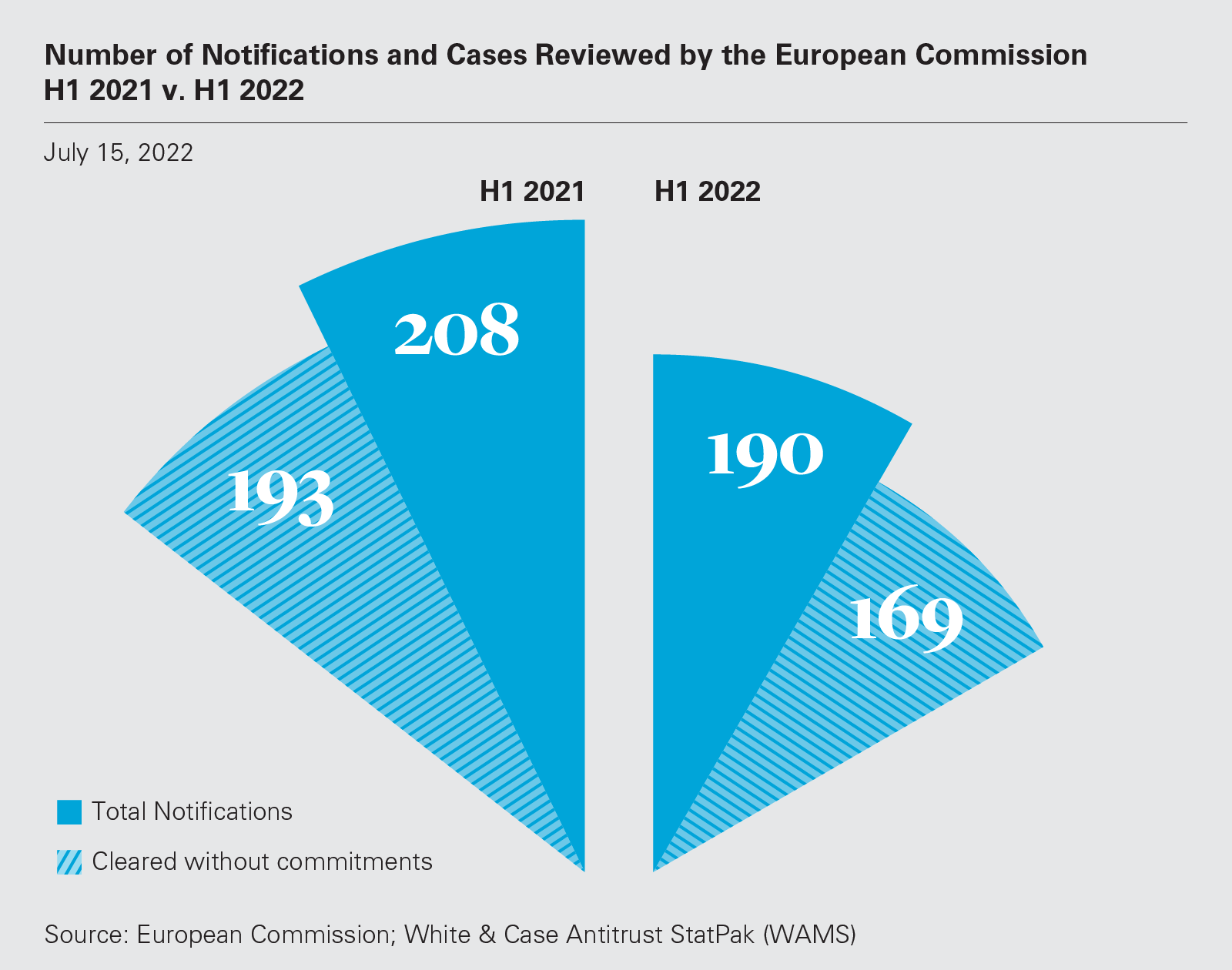

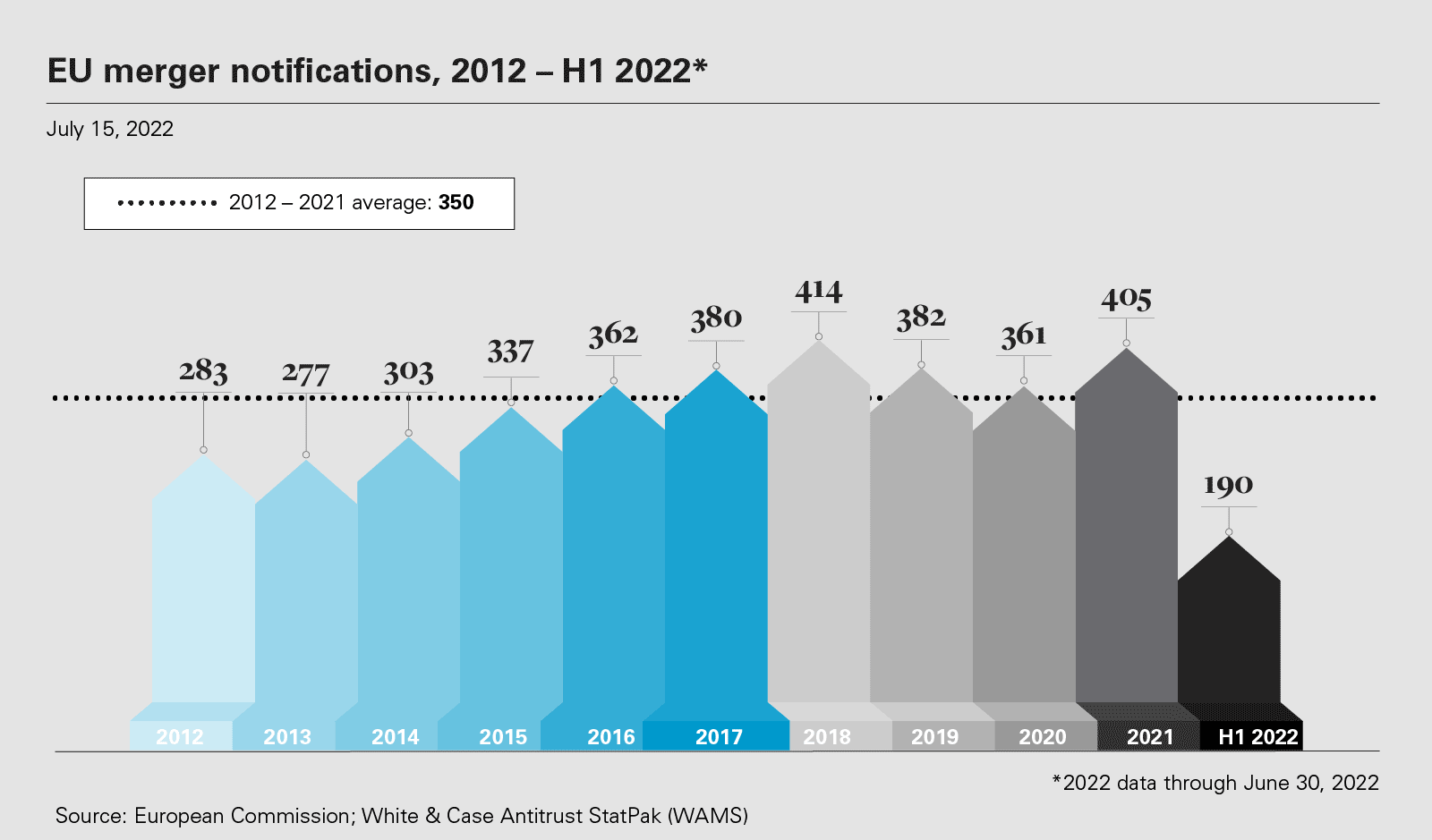

European Union: H1 2022 Merger Filings Fall Short of H1 2021 Levels

In Europe, merger notifications to the European Commission during H1 2022 are down roughly 9 percent compared to H1 2021, suggesting that year-end EU merger notifications in 2022 could be lower than in 2021. As of June 30, 2022, the European Commission has reviewed 190 transactions and cleared without commitments 169 transactions.

Brazil: H1 2022 Merger Notifications Are Above Historical Five-Year Averages

WAMS data also show increasing merger control filings in Brazil in H1 2022 as compared to previous years. So far in 2022, Brazil filing activity is up roughly 20 percent compared to H1 2021. The WAMS data also show a roughly 52 percent increase in H1 2022 merger filings in Brazil as compared to the average in the preceding five years (2017-2021). The data show that merger activity continues to boom in the first half of 2022 similar to or at a greater pace than 2021, which was a record year for merger activity in Brazil.

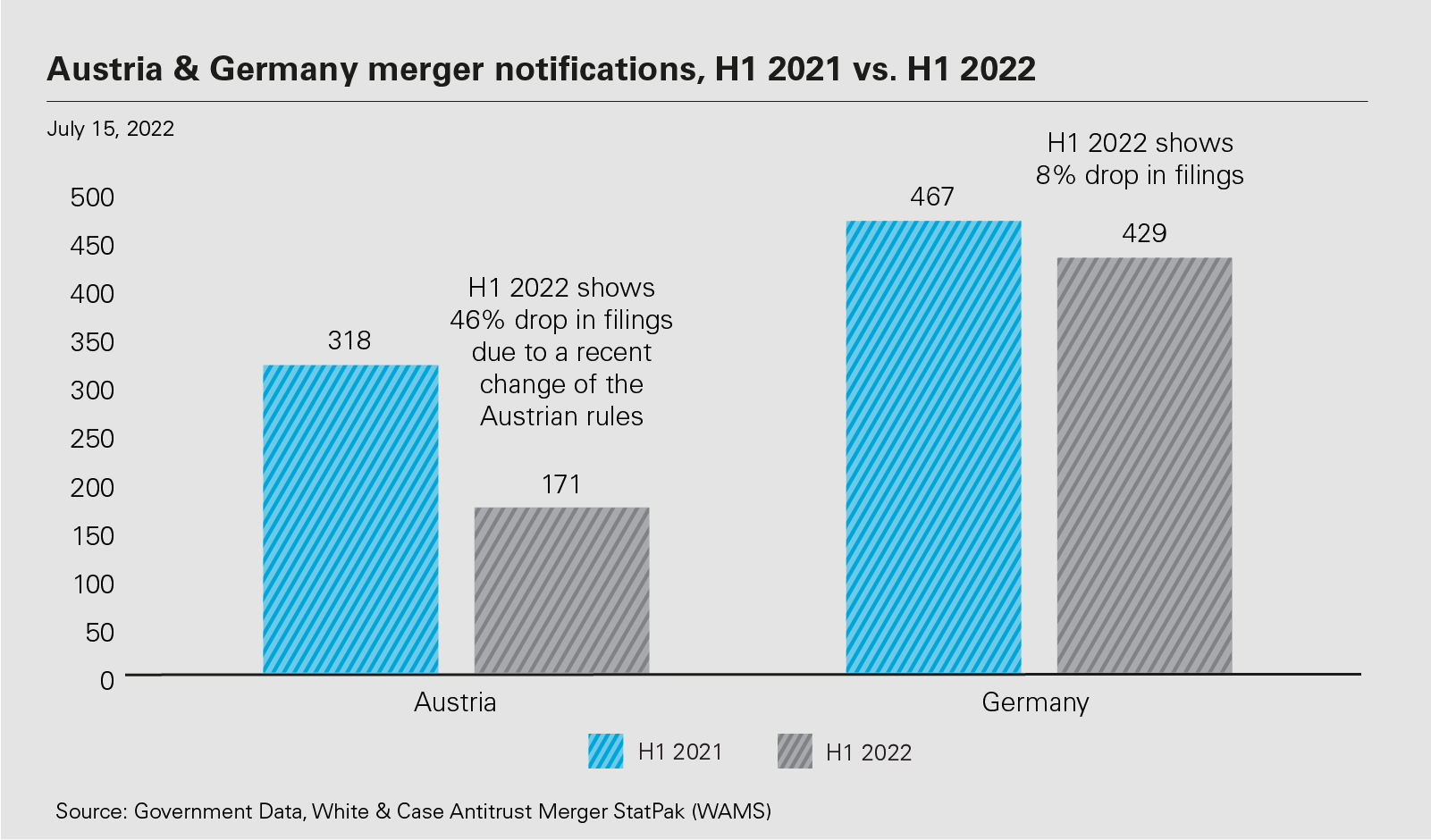

Germany and Austria: New Thresholds Result in Lower Number of Filings than in Previous Years

Germany changed its merger filing thresholds in early 2021. While effects in 2021 had been somewhat limited, WAMS data demonstrate that the number of filings in Germany continues to drop in H1 2022 as compared to H1 2021. Based on WAMS data for H1 2022, notifications in Germany are down roughly 8 percent versus H1 2021, from approximately 467 to 429.2

A more recent change of the Austrian rules (introducing a second domestic threshold of € 1 million) at the end of 2021 is now showing its effect in the number of filings in Austria. Compared to H1 2021, filings in Austria dropped by almost 50 percent, from 318 to only 171 in H1 2022.

Mid-Year 2022 Merger Filings Show Varied Impact of Economic Cool-Down

Across Europe more broadly, the trend is similar to the United States. The EU, Austria, Estonia, Germany, Portugal, and Spain are all showing decreased activity in H1 2022 as compared to H1 2021. Collectively, the EU, Austria, Estonia, Germany, and Portugal show a decline of 20 percent compared to H1 2021. This trend has not been universal as some jurisdictions in Latin America (such as Brazil and Colombia) show increased activity in H1 2022 as compared to H1 2021.

WAMS: A continuing effort

It is hoped that the WAMS will prompt greater transparency and additional real-time reporting by antitrust merger control authorities around the world. Transparency assists merging parties in complying with the law.

1 See Brian Deese Remarks on President Biden's Competition Agenda, The White House, July 14, 2022

2 WAMS estimates at least 467 notifications were made in Germany in H1 2021, but this number was likely higher.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2022 White & Case LLP

View full image: US merger notifications, H1 2012 – H1 2022 (PDF)

View full image: US merger notifications, H1 2012 – H1 2022 (PDF)

View full image: US monthly merger notifications, 2021 – 2022 (PDF)

View full image: US monthly merger notifications, 2021 – 2022 (PDF)

View full image: Number of Notifications and Cases Reviewed by the European Commission H1 2021 v. H1 2022 (PDF)

View full image: Number of Notifications and Cases Reviewed by the European Commission H1 2021 v. H1 2022 (PDF)

View full image: EU merger notifications, 2012 – H1 2022 (PDF)

View full image: EU merger notifications, 2012 – H1 2022 (PDF)

View full image: Brazil merger notifications, H1 2017 – 2022 (PDF)

View full image: Brazil merger notifications, H1 2017 – 2022 (PDF)

View full image: Austria & Germany merger notifications, H1 2021 vs. H1 2022 (PDF)

View full image: Austria & Germany merger notifications, H1 2021 vs. H1 2022 (PDF)

View full image: Merger notifications, H1 2021 vs. H1 2022 (PDF)

View full image: Merger notifications, H1 2021 vs. H1 2022 (PDF)