Surging M&A surpasses expectations

All the stars aligned in 2021, creating a confident and exceptionally busy M&A market

Challenges loom—including the possibilities of tighter regulations, rising inflation and a stock market correction—but markets show little sign of slowing down

The value of US M&A blew past the US$2 trillion mark in 2021, ending the year more than 30 percent above the previous record set in 2015. US deal value reached US$2.6 trillion, twice the value of 2020, and volume set a new record at 7,896 transactions.

Confidence reigned among dealmakers as stock markets continued to rise; increasing numbers of SPACs sought merger targets; and private equity houses set new records, deploying some of the sector's historic levels of dry powder. All of which was underwritten by flexible and cheap debt financing.

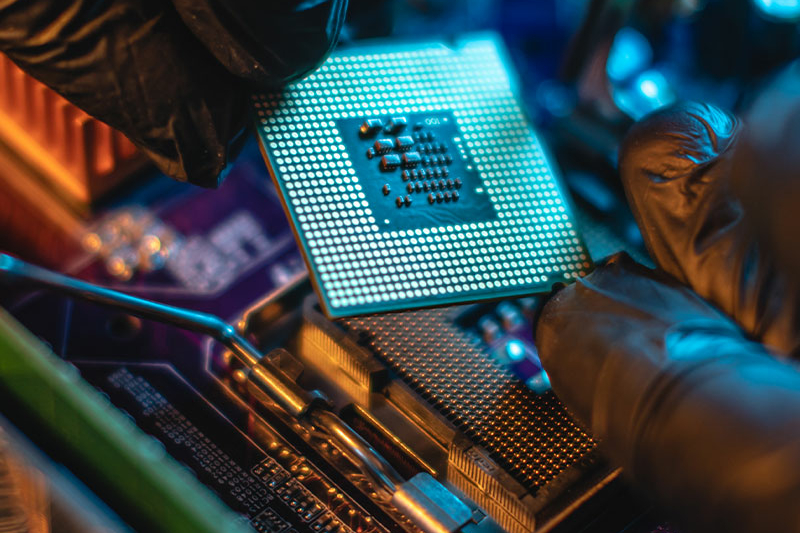

Technology was a major driver of M&A, fueled by pandemic-related trends that continued to accelerate deployment of digital technologies across all sectors. The tech sector itself led the sector charts. Companies with product mixes boosted by the pandemic, including those in the pharma and healthcare sector, turned to M&A to complement and add to their existing business portfolios.

Despite a continuing positive outlook, dealmakers will need to keep potential risks in mind in 2022. Under the Biden administration, CFIUS went on a recruitment drive, and it will clearly continue to take a more aggressive stance across sectors, particularly when deals involve technology.

Indeed, regulatory scrutiny is tightening from a number of angles. The Securities and Exchange Commission under chair Gary Gensler is taking a tougher stance on enforcement and has its sights set on SPACs, cryptocurrencies and ESG. And the Federal Trade Commission has announced far-reaching antitrust policy changes that may require companies that reach settlements to observe a ten-year mandatory clearance period on new acquisitions and disposals—the new rules would even apply to buyers of affected assets.

This increasingly tough approach to regulating M&A has so far had little impact on dealmakers' appetites for transactions—although new rules may eventually render some deals less attractive.

In response to recent inflation, the Fed will increase interest rates, which could pose another challenge for dealmakers. But given that rates are so low by historical standards, increases are unlikely to have any direct significant effect on M&A for most of 2022.

One of the biggest questions is whether stock markets will continue to hold up. A correction seems inevitable at some point, but it's unclear what might trigger one in the foreseeable future. For example, markets seem to have shrugged off concerns related to the emergence of the Omicron variant of COVID-19—at least at the time of writing. And private equity still has a mountain of capital to deploy. Recent events, however, suggest that markets will be volatile.

As a result, although regulatory hurdles continue to multiply, we expect 2022 will be another strong year for US M&A, with robust activity through the first half and possibly well beyond.

All the stars aligned in 2021, creating a confident and exceptionally busy M&A market

Transaction values more than doubled year-on-year, as firms deployed ever-larger amounts of dry powder

Dynamics may be changing as the focus shifts to de-SPACs and regulatory scrutiny intensifies

In what was a stand-out year, M&A picked up the pace in almost every sector

Dealmaking may continue to rise, as price volatility abates and companies embrace energy transition

The pervasiveness of technology, particularly since the pandemic, continues to drive deals to all-time highs

Despite the absence of megadeals, M&A in the sector climbed from 2020 levels thanks in part to strong PE and SPAC activity

After dropping in 2020, real estate M&A ramped up significantly in 2021

The Federal Trade Commission is taking an increasingly stringent approach to antitrust investigations

Increased sector scope and concerns around a more aggressive approach to identifying non-notified transactions is leading to rising numbers of filings

Dealmakers should be braced for a more aggressive stance under Chair Gary Gensler

Borrower-friendly terms over the past few years have helped boost M&A totals—and a number of factors suggest the financing will not change dramatically in 2022

With data privacy laws tightening and cyberattacks on the rise, due diligence of technology networks and data processes should be a top priority for dealmakers

In the second half of 2021, Delaware courts issued several decisions affecting M&A dealmaking

Five factors that will shape dealmaking over the coming 12 months

In the second half of 2021, Delaware courts issued several decisions affecting M&A dealmaking

Explore the data

The Delaware Court of Chancery was once again required to determine whether a potential buyer should be relieved of its obligation to acquire a target business due to the alleged occurrence of a "Material Adverse Effect." In Bardy Diagnostics, Inc. v. Hill-Rom, Inc., the Court found that, despite the approximately 86 percent decline in the reimbursement rate for the sole product manufactured and marketed by Bardy Diagnostics, an MAE had not occurred and ordered Hill-Rom to close on its acquisition of Bardy.

While acknowledging the magnitude of the rate change (comparing it to a Mike Tyson uppercut), the Court found that Hill-Rom failed to prove the "durational significance" of the rate change—a critical element in establishing an MAE. The Court found that Hill-Rom failed to prove that the lower rate would endure for a commercially reasonable period and failed to prove that the lower rate would not be meaningfully revised upwards. In particular, the Court noted that it was insufficient to show that the lower rate might be durationally significant, as "a mere risk of an MAE cannot be enough (citing Akorn)."

While the Court's analysis could have ended there, it went on to determine whether carve-outs to the MAE definition applied. The Court found that the MAE carve-out for changes in law, which expressly included any healthcare law as well as any regulation or rule, "squarely encompasses" changes in Medicare reimbursement rates. Therefore, even if the rate change had been found to be an MAE, the carve-out would have excluded it. Finally, the Court determined that the exception to the MAE carve-out for matters with "materially disproportionate impact" did not apply. The Court focused on the precise wording of the disproportionate impact exception, which required comparison to "similarly situated companies operating in the same industries or locations." Describing this as a "narrower, more target-friendly exclusion to the MAE carve-outs," the Court found only one other similarly situated company, and determined that Bardy was not disproportionately impacted.

Bardy Diagnostics confirms the difficult task buyers face when attempting to avoid closing due to an alleged MAE. It also highlights the importance of carefully attempting to negotiate carve-outs to the MAE definition to ensure that they allocate risks as the parties intend.

The Delaware Court of Chancery failed to dismiss fraud claims made by Bertelsmann, Inc. in connection with its 2018 acquisition of continuing education company OnCourse Learning. Bertelsmann alleged fraud with respect to representations and warranties in the SPA regarding OnCourse Learning's sales and use tax liability. The defendants argued that the SPA's survival clause (which expressly provided that the representations and warranties terminated upon closing) extinguished all claims (including fraud claims) when the deal closed. In addition, defendants argued that the seller's parent entity was protected by the SPA's non-recourse provision, which provided that claims under the SPA may be asserted only against parties to the SPA.

The Court of Chancery disagreed, citing Abry Partners for the notion that "fraud vitiates everything it touches." The Court held that when "an agreement purports to limit liability for a lie made within the contract itself, and parties know of the lie, such parties cannot skirt liability through contractual limits within the very contract they procured by fraud." The Court found that the plaintiffs affirmatively pled that tax information was actively withheld from Bertelsmann's data room, and then false representations were purposefully inserted into the SPA regarding these same tax liabilities. The Court questioned a prior Chancery Court decision (Sterling) which defendants argued stood for the proposition that parties may agree contractually to shorten the limitations period for fraud claims without violating Delaware public policy, provided there is a reasonable opportunity to discover the potential misrepresentations. In any event, the Court found that such reasonableness determination was not appropriate for resolution on the pleadings. On this basis, the Court held that, at this motion to dismiss phase, the SPA's survival clause does not defeat the plaintiffs' fraud claims. As for the non-recourse provision, the Court found that the plaintiffs pled that the seller's parent entity did, in fact, know of and facilitate the fraudulent misrepresentations in the SPA, and therefore could not invoke the non-recourse provision to avoid liability.

Online Healthnow is an example of the balancing act Delaware courts must undertake when express contractual limitations of liability are confronted with viable allegations of fraud within the same contract and stands for the Delaware courts' view that a contractual disclaimer (in the form of a non-recourse provision) does not vitiate a fraud claim against a non-party if a fraudulent statement is made within the four corners of the purchase agreement.

The Delaware Supreme Court affirmed a prior Chancery Court decision upholding a contractual waiver of appraisal rights. The case involved the 2017 acquisition of Authentix Acquisition Company, Inc. Cash from the transaction, which was structured as a merger, was distributed to stockholders pursuant to a waterfall provision. A group of common stockholders filed a petition for appraisal in the Court of Chancery under Section 262 of the Delaware General Corporation Law. Authentix moved to dismiss the petition, arguing that the petitioners had waived their appraisal rights under a stockholders' agreement that bound the corporation and all of its stockholders. The Court of Chancery granted the motion to dismiss, holding that the petitioners had agreed to a clear provision requiring that they "refrain" from exercising their appraisal rights with respect to the merger.

The Supreme Court affirmed the Chancery Court's decision. The Supreme Court first affirmed that petitioners had agreed to a clear waiver of their appraisal rights. In particular, while the stockholders' agreement's termination provision did not contain a savings clause expressly providing for the refrain obligations to survive a company sale, the Supreme Court agreed with the Chancery Court's finding that the refrain obligation imposed a clear post-termination duty on the petitioners to refrain from exercising their appraisal rights. However, the fact that this was even in dispute serves as a reminder to ensure that any obligations expected to be enforced following a sale should be specifically addressed in the termination provision.

The Supreme Court went on to address what it called the "real crux" of the petitioners' argument—that appraisal rights are core characteristics of the corporate entity that provide basic protections to investors and as such they cannot be waived—at least ex ante ("before the event")—under a bilateral agreement. While the Supreme Court acknowledged that the availability of appraisal rights might theoretically discourage attempts to pay minority stockholders less than fair value, it was "unconvinced that appraisal claims play a sufficiently important role in regulating the balance of power between corporate constituencies to forbid sophisticated and informed stockholders from freely agreeing to an ex ante waiver of their appraisal rights under a stockholders' agreement in exchange for consideration". The Supreme Court also noted that Section 262(g) provides a de minimis exception from appraisal rights for stockholders of publicly traded corporations. According to the Supreme Court, "[i]f appraisal rights are sacrosanct to the corporate form, it would make little sense for the General Assembly to adopt this exception. The Supreme Court also noted that the petitioners' position would also cast doubt on whether drag-along rights are enforceable, as they often require stockholders to vote in favor of a merger, which would result in a forfeiture of an appraisal claim. Importantly, the Supreme Court emphasized the particular facts of this case, noting that "this case is about whether 'sophisticated and informed parties, represented by counsel and with the benefit of bargaining power', can freely agree to alienate their appraisal rights ex ante in exchange for valuable consideration. The answer to that question is yes."

Of note, Justice Karen L. Valihura dissented from the Supreme Court's ruling, finding that the waiver was not sufficiently unambiguous and unequivocal. And even if it was, she would hold that such a term goes to the heart of corporate governance and can only be contained in a corporate charter, not a bylaw or stockholders' agreement. And even if it had been contained in a charter amendment, she would hold that such an amendment contravenes the DGCL and cannot be valid without authorization from the General Assembly.

While Manti Holdings provides comfort that contractual waivers of appraisal right will generally be respected, practitioners are wise to evaluate the circumstances under which such waivers are obtained, particularly with respect to less sophisticated and informed parties.

The Delaware Supreme Court upheld the 2020 Delaware Court of Chancery decision to allow MAPS Hotels and Resorts One LLC ("MAPS"), a subsidiary of Mirae Asset Financial Group, to terminate its September 2019 agreement to purchase Strategic Hotels & Resorts LLC ("Strategic") from AB Stable, a subsidiary of Anbang Insurance Group ("AB Stable"). While the Court of Chancery found that the business of Strategic and its subsidiaries did not suffer a "Material Adverse Effect" as defined in the sale agreement, it concluded that MAPS could terminate the sale agreement because AB Stable breached a covenant and a condition in the sale agreement.

First, according to the Court of Chancery, AB Stable violated the ordinary course covenant by failing to operate in the ordinary course of its business (closing hotels, laying off or furloughing thousands of employees, and implementing other drastic changes to its business) without MAPS' consent. Second, a condition requiring title insurance for the hotel properties failed because the title insurers' commitment letters had a broad exception covering fraudulent deeds, and MAPS did not cause the failure.

On appeal, AB Stable argued that it satisfied the ordinary course covenant because the covenant did not preclude it from taking reasonable, industry-standard steps in response to the pandemic. In addition, AB Stable argued that the Court of Chancery's ruling negated the parties' allocation of pandemic risk to the buyer through the Material Adverse Effect provision and its breach of the notice requirement in the covenant was immaterial. AB Stable also claimed that the Court of Chancery gave too expansive a reading to the exception in the title insurance condition, or, alternatively, that the court incorrectly found that MAPS did not contribute materially to its breach.

The Supreme Court affirmed the Court of Chancery's 2020 decision, finding that the Court of Chancery concluded correctly that AB Stable's drastic changes to its hotel operations in response to the COVID-19 pandemic without first obtaining MAPS consent breached the ordinary course covenant and excused MAPS from closing. The Supreme Court noted that the parties "did not choose the actions of industry participants as the yardstick" and the Court of Chancery therefore correctly ruled that compliance is measured by AB Stable's operational history. The Supreme Court also noted that the ordinary course covenant did not contain a reasonableness qualifier, while the parties included such qualifiers elsewhere in the agreement. Because the failure to comply with the ordinary course covenant was dispositive of the appeal, the Supreme Court did not reach whether the title insurance condition was breached.

AB Stable serves as a reminder that parties must carefully consider what can happen between signing and closing of an acquisition agreement and, to the extent appropriate, build flexibility into the agreement to both maintain the target business and maintain the bargain between the parties.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2022 White & Case LLP