UK National Security and Investment Act screening regime to go live from 4 January 2022

8 min read

Having received Royal Assent on 29 April 2021, the Secretary of State for Business Energy and Industrial Strategy ("SoS") has announced that the investment-screening regime envisaged by the National Security and Investment Act 2021 ("NSIA") will become operational from 4 January 2022.

The SoS's announcement was accompanied by three further key pieces of the puzzle when it comes to the final form that the NSIA system will take:

- A consultation paper on the statement to accompany exercise of the SoS "call-in power". This is designed to help investors gauge the risk that transactions will be "called in" for national security review;

- A draft copy of the statutory instrument defining the seventeen sectors that from 4 January 2022 will require mandatory notification before closing; and

- Various guidance documents. The guidance documents issued include an overview of the NSIA, a guide to its extraterritorial application, guidance on how the NSIA will work alongside other regulatory bodies and market practices, and guidance for Higher Education institutions and other research organisations.

Mandatory Notification: Sensitive Sectors

The Department for Business Energy and Industrial Strategy ("BEIS") first set out its proposals for a mandatory pre-screening mechanism in seventeen designated "sensitive" sectors in November 2020 (see our alert here). Following a consultation, these were further refined in March 2021 (see our subsequent alert here).

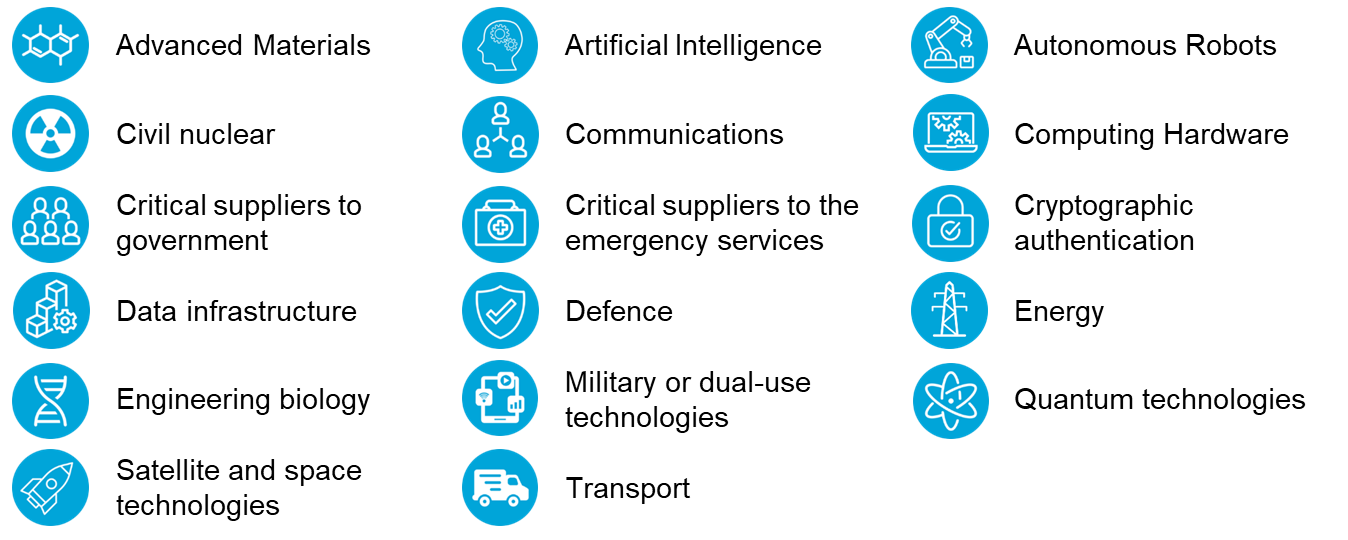

The draft statutory instrument published on 20 July 2021 contains further elaboration of the sectors that will be subject to mandatory notification under the NSIA. The headline sectors have not changed; these remain:

What's new?

Previous iterations of the regime have been quite detailed, but the suite of guidance documents provides some welcome clarifications in certain areas:

Extraterritorial application of the NSIA

BEIS has published dedicated guidance on how the NSIA will affect people or acquisitions outside the UK. The previous versions of the NSIA made clear that non-UK targets that carry on activities in the UK would be captured by the regime. The guidance makes clear that this would encompass the supply of goods and services to the UK, R&D in the UK, a UK office or branch, the performance of supervisory functions from the UK or the supply of goods to a UK hub (unless that UK hub only places orders for goods to be sent elsewhere).

Helpfully, the guidance also confirms what will not qualify as "carrying on activities in the UK". These circumstances include entities with staff working remotely from the UK for a non-UK office; owners/investors based in the UK; purchase of goods or services from UK suppliers; has a parent company with other UK-based subsidiaries; or lists securities on a regulated or exchange-regulated market in the UK.

We can also expect further guidance on additional requirements for entities engaged in "particularly sensitive activities in the UK". Publication of that further guidance is still pending.

Operation of the NSIA alongside other regulatory requirements

BEIS has also published guidance on the interplay between the NSIA and other regulatory regimes, including the Enterprise Act 2002, the exercise of merger control jurisdiction by the Competition and Markets Authority ("CMA"), Export Control, the Takeover Code, the Financial Conduct Authority and the Prudential Regulation Authority.

Amongst the key takeaways are that while NSIA will become the sole route for review on national security grounds, the public interest intervention powers will remain under the Enterprise Act 2002, from 4 January 2002.

Further, the government is empowered to use Enterprise Act powers usually applicable to merger control once a final order is in force following the "call-in" of a transaction.

Higher Education Institutions and other research organisations

BEIS has also set out a series of examples of the kind of transactions in this sector that may fall within the scope of the NSIA. The guidance covers, for example:

- Development or formation of research centres that take control of research organisations conducting research in a sensitive sector;

- Acquisition of university or research organisation spin-out companies active in a sensitive sector;

- Any agreement that provides for control to be acquired over any future intellectual property generated in the UK including, for example, through the funding of students or university programmes.

The guidance makes clear that ordinary donations, even to sensitive sector research projects, will not fall within the NSIA scope given they involve no acquisition of control.

Overview of the NSIA Regime

BEIS has also set out overview guidance on the operation of the regime. Transactions which will be subject to the mandatory notification regime can be briefly summarized as follows:

|

Mandatory notification under the NSIA |

|---|

|

Trigger Events |

|

Only "Qualifying Acquisitions" fall within the scope of the NSIA. This may mean they are subject to mandatory notification or fall within the scope of the SoS?s call-in review powers. |

|

Qualifying Acquisitions |

|

|

Qualifying Acquisitions are those related to a "qualifying entity" or "qualifying asset". Only the acquisition of a qualifying entity will be subject to mandatory notification. The acquisition of a qualifying asset does not require notification, but may be subject to call-in review. |

|

|

Qualifying entities are any entities including:

|

Qualifying assets include:

|

|

UK Nexus |

||

|

Only transactions with some UK nexus will be subject to mandatory notification. This condition will be satisfied if:

|

||

|

Level of Control |

|||

|

Only transactions that meet certain thresholds will be in scope of the NSIA. These include: Shareholding/voting thresholds: i.e., for the acquisition of shares or voting rights, any stake which takes an investor from:

For limited liability partnerships, the thresholds refer to rights in the percentage share of any surplus assets on a winding up. Power to pass or block resolutions governing the affairs of the entity: such an acquisition will fall within NSIA scope, regardless of the percentage of shares/voting rights already held. Any shares/voting rights already held before the acquisition will be taken into account when assessing whether an acquisition meets this threshold. In the case of minority veto rights, the voting rights only count where they provide the holder with a right to vote on all or substantially all matters governing the affairs of the entity. |

|||

|

Sensitive Sector |

|||

|

If all the above requirements are met, then a transaction that involves the acquisition of a Qualifying Entity needs to be reviewed to gauge whether it falls within one of the seventeen "sensitive sectors". If it does, a mandatory pre-notification will have to be submitted before the transaction can close. |

|||

Call-in power

What is being consulted upon?

The NSIA regime establishes a system whereby certain transactions in the seventeen sensitive sectors will become subject to mandatory screening. If the SoS deems those deals may pose a national security risk, he can "call-in" the transaction for review. In addition, the NSIA also reserves for the SoS the power to "call-in" other transactions, i.e., those not subject to mandatory notification, post-closing if merited.

The content of the consultation, therefore, is designed to help parties gauge the likelihood that a transaction will be called in by the SoS and to plan accordingly. The consultation focuses on whether the statement provides a sufficiently clear indication of how this power will be used.

One of the key takeaways from the draft statements is that for deals not subject to mandatory notification, the more proximate a transaction is to a sensitive sector the more likely it is to be called in. There are three "risk factors" that will be considered relevant to the exercise of the call-in power for transactions that are not otherwise notifiable. These are:

- Target risk, i.e., whether the target of the qualifying acquisition is being used, or could be used, in a way that poses a risk to national security.

- Acquirer risk, i.e., whether the acquirer has characteristics that suggest there is, or may be, a risk to national security from the acquirer having control of the target. Relevant characteristics are explained as encompassing factors such as the sector(s) of activity, technological capabilities and links to entities which may seek to undermine or threaten the interests of the UK. Some characteristics, such as a history of passive or longer-term investments, may indicate low or no acquirer risk.

- Control risk, i.e., in short, the higher the level of control the investor will exercise, the greater the control risk will be. The draft statement notes in particular that an acquirer's ties or allegiance to a state or organisation which is hostile to the UK will be considered when assessing whether their qualifying acquisition has given, or may give, rise to a risk to the UK's national security.

Review of notified transactions

How long will national security review take?

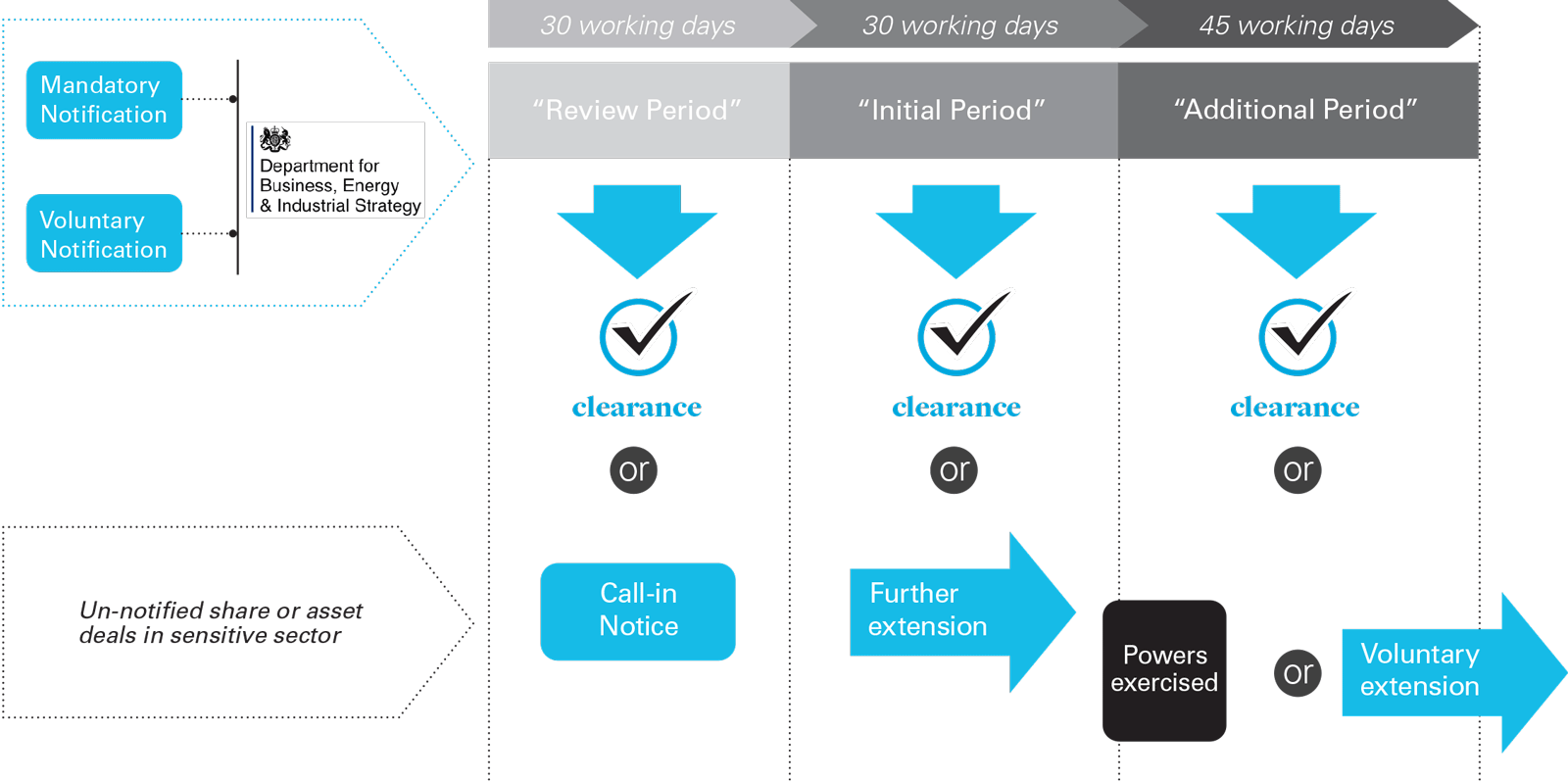

The basic architecture of the review process for mandatory notifications remains unchanged, with an initial review period of 30 working days. If a transaction is called in, either after a notification or on the basis of an SoS assessment that it may pose a national security risk, there is a further 20-working-day period, extendable by another 45 working days if appropriate.

Next steps

The consultation will close on 30 August 2021. It is expected that the statutory instrument will be laid before Parliament before the end of the year.

Once the NSIA becomes fully effective on 4 January 2022, the regulatory landscape for deals with a UK nexus will be radically different.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2021 White & Case LLP

View full image (PDF)

View full image (PDF)

View full image (PDF)

View full image (PDF)