Foreign direct investment reviews 2021: European Union

Member States are introducing or expanding investment screening regimes, and the European Commission is now playing an active role

16 min read

“Some national FDI regimes determine filing requirements or intervention rights based solely on the size of the stake acquired”

While there is no standalone foreign direct investment (FDI) screening at the EU level, the EU continues to push for a coordinated approach among Member States toward foreign direct investments into the EU. The key instrument is the EU Screening Regulation, which entered into force on October 11, 2020 and is now fully operational. Other legislative instruments have already been proposed, including the adoption of a regulation introducing new tools to control acquisitions by and activities of foreign-subsidized investors in the EU.

The EU has stepped up efforts to ensure a coordinated approach toward investments into health-critical EU assets during the COVID-19 pandemic. The EU is also displaying an increasing focus on an independent and resilient supply chain, especially in the area of hi-tech and products needed to drive digitalization.

“The EU continues to push for a coordinated approach among Member States toward foreign direct investments”

PART 1: EU DEVELOPMENTS/EU SCREENING REGULATION

The EU Screening Regulation falls short of delegating any veto or enforcement rights to the EU, which means that Member States remain in the driver's seat for FDI controls.

It is primarily a means of harmonizing and coordinating the widely differing review mechanisms in place at the Member State level throughout the EU. It ensures each affected country as well as the EU as a whole are aware of ongoing FDI reviews and can weigh in.

In particular, the Regulation introduced a coordination mechanism whereby the European Commission (EC) may issue non-binding opinions on FDI reviews performed in Member States. "Non-reviewing" Member States may provide comments to the "reviewing" Member States. Member States and the EC may also provide comments on a transaction that is not being reviewed because it takes place in a Member State with no FDI regime, in a Member State in which the transaction does not meet the criteria for an FDI review by the government, or the reviewing Member State decided to waive screening of a particular investment. In the latter case, the Member State concerned by the FDI must provide a minimum level of information without undue delay to the other relevant Member States and/or the EC on a confidential basis.

The cooperation mechanism may also apply to a completed investment that is subject to scrutiny under a Member State ex post regime (most Member States, however, have adopted ex ante FDI regimes), or an investment that has not been scrutinized within 15 months after the investment has been completed.

The final say in relation to any FDI undergoing screening or any related measure remains the sole responsibility of the Member State conducting the review pursuant to its national FDI screening procedures. However, it cannot be excluded that (in particular) smaller EU Member States may find themselves under considerable pressure to conform to opinions or comments issued by the EC or other Member States.

The first months of implementation of the Regulation show that national FDI authorities take different approaches. Certain FDI authorities have systematically notified, under the EU cooperation mechanism, every transaction involving non-EU investors, while others do so under specific circumstances only. Investors also face multiple EU notifications in transactions where the target has multijurisdictional presence in the EU.

The most immediate effects of the Regulation, however, are largely procedural. In particular, the new role of the EC and the other Member States has increased the number of stakeholders weighing in on the national investment screening review processes, albeit it remains clear that the reviewing Member State has the final say.

In addition, despite the fact that the status quo of Member States being responsible for any enforcement action post-FDI screening still stands, the implementation of the Regulation has created an impetus for Member States to align themselves better with the EU Screening Regulation. This alignment may also prompt Member States to consider establishing a new national security review regime (where one does not already exist). While the EU Screening Regulation does not oblige EU Member States to introduce a national FDI review process, a number of additional Member States have done so over the last year, such as the Netherlands, Sweden, Denmark, Czech Republic, Poland, Slovakia and Ireland, and more are currently contemplating the adoption of FDI regimes. Other Member States have amended their current regimes to comply with the Regulation such as Germany, which has recently clarified the thresholds for mandatory review.

In terms of substantive requirements, the Regulation sets out the following cornerstones that an FDI regime should reflect:

- Investment reviews should revolve only around the baseline substantive criteria of "security and public order"

- Investments in the following (non-exhaustive) sector-specific assets and technologies may be problematic: critical infrastructure (whether physical or virtual, including energy, transport, water, health, communications, media, data processing or storage, aerospace, defense, electoral or financial infrastructure, as well as sensitive facilities and investments in land and real estate, crucial for the use of such infrastructure); critical technologies and dual-use items (as defined in the EU Dual Use Regulation, including artificial intelligence, robotics, semiconductors, cybersecurity, quantum technology, aerospace, defense, energy storage, nuclear technologies, nanotechnologies and biotechnologies); supply of critical inputs, including energy or raw materials, as well as food security; access to sensitive information, including personal data, or the ability to control such information; and media activities as far as freedom and pluralism are concerned

- Investments may be particularly problematic where a foreign government (including state bodies or armed forces) directly or indirectly—as through ownership structures or "significant funding"— controls the acquirer

“The EC has concerns that subsidies granted by non-EU governments are escaping its control because it believes that there is an enforcement gap in its current toolbox”

PROPOSED REGULATION ON FOREIGNSUBSIDIZED COMPANIES

While the EU Screening Regulation has just entered into force, the EU is already preparing the introduction of new tools to control acquisitions by and activities of foreign-subsidized investors in the EU. In May 2021, the EC issued a proposal for a regulation to tackle foreign subsidies. The new instrument targets foreign-subsidized transactions as well as any kind of subsidized commercial activity affecting EU markets, including bidding for public contracts.

The EC has concerns that subsidies granted by non-EU governments ("foreign subsidies") are escaping its control because it believes that there is an enforcement gap in its current toolbox.

The proposed regulation would apply to all sectors and to a wide variety of situations. It establishes a three-tiered investigative tool for investigating foreign subsidies with the following components:

- A notification-based investigative tool for certain transactions involving a financial contribution by one or more non-EU government(s) where the turnover of the EU target (or at least one of the merging parties) exceeds €500 million and the foreign financial contribution exceeds €50 million over the previous three years

- A notification-based investigative tool for bids in public procurements involving a financial contribution by a non-EU government, where the estimated value of the procurement is €250 million or more

- A general investigative tool for the EC to investigate all other market situations, smaller transactions, and public procurement procedures, which the Commission can start on its own initiative (ex officio)

The enforcement of the proposed regulation would lie exclusively with the EC to ensure the uniform application of the rules across the EU.

A foreign subsidy shall be deemed to exist where the public authorities of a non-EU country provides a financial contribution that confers a benefit to an undertaking engaging in an economic activity in the EU.

Once the existence of a foreign subsidy is established, the EC has to establish whether the foreign subsidy distorts the internal market.

The EC has the power to impose structural and behavioral redressive measures on an undertaking to remedy any distortion, or indeed any potential distortion, caused by the subsidy. The undertaking concerned also has the possibility to offer commitments to remedy the distortion, such as offering to repay the subsidy to the third country that granted it, together with appropriate interest.

The EC can impose fines and periodic penalty payments for procedural infringements, for failure to notify, and/or for supplying incorrect or misleading information.

The proposals are extremely far-reaching and, if adopted into legislation, will increase the regulatory risk and burden for companies operating or investing in the EU with support from foreign states. They may also open up new opportunities for strategic complaints by competitors.

The new measures will add complexity to the regulatory clearance path for M&A by state-backed investors involving EU targets, as companies may potentially have to file notifications under the new mandatory procedures, "regular" merger control at the EU or national level, and pursuant to national FDI regimes prior to closing their transactions.

The proposals will be the subject of significant debate during the legislative process under the ordinary legislative procedure between the European Parliament and the Council, which may take approximately two years.

PART 2: FDI AT THE MEMBER STATE LEVEL

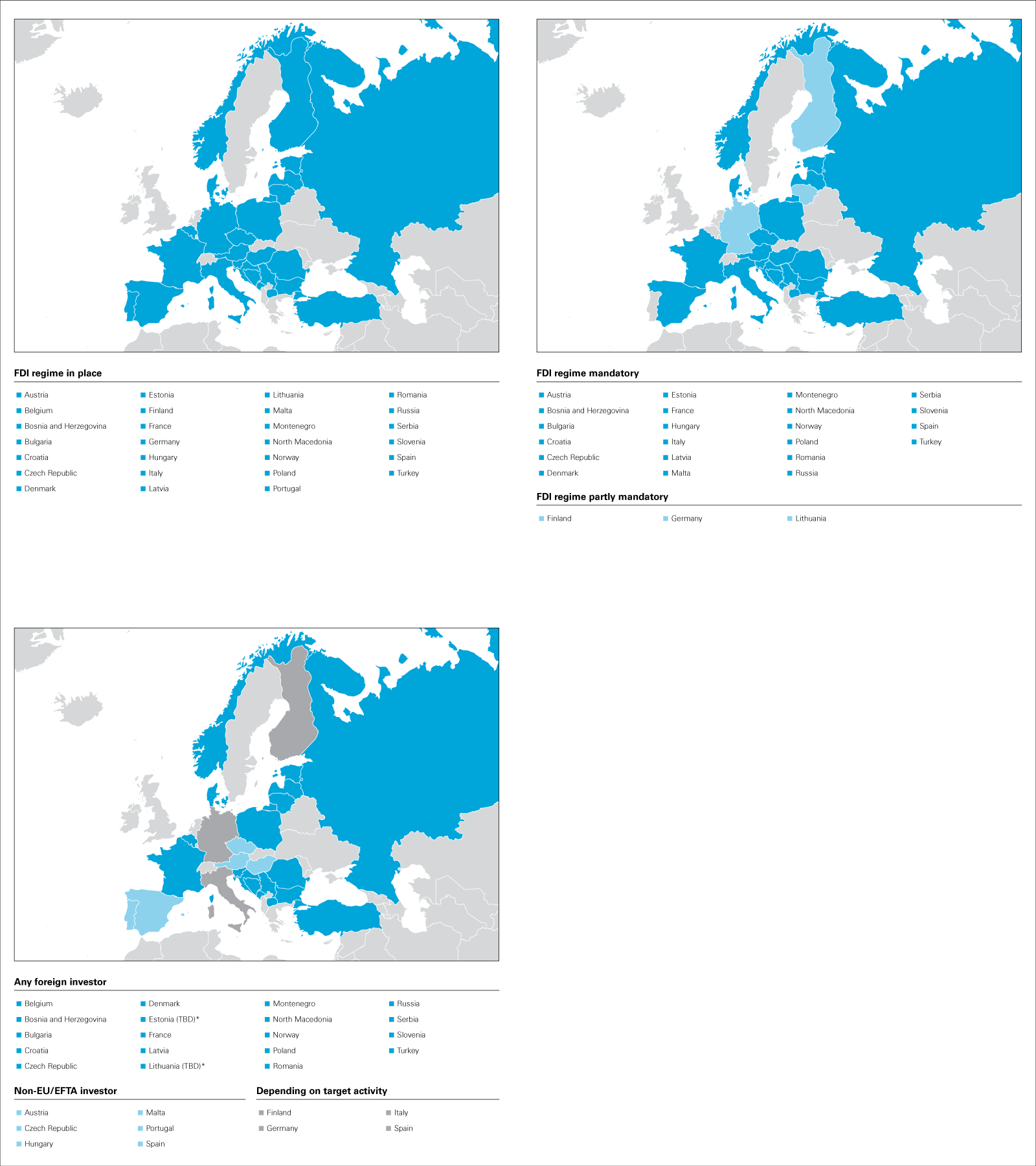

Eighteen of the 27 EU Member States have a screening regime. The regimes differ widely in terms of:

- Whether they provide for mandatory or voluntary filings, or ex officio intervention rights of the government

- Where filing requirements exist, whether there is a threshold related to the percent of voting rights or shares acquired, a turnover-based threshold, or another type of trigger

- Which industries are viewed as "critical" and may hence trigger a filing obligation and/or government intervention

- Whether the government has a right to intervene below the thresholds

- Whether they are suspensory (i.e., provide for a standstill obligation during the review)

- Whether they cover only investments by non-EU/EFTA-based investors or by any non-domestic investor

- The duration and structure of the proceedings, including whether clearance subject to remedies (e.g., compliance or hold separate commitments) is possible

Some regimes are truly hybrid, and the answer to these questions depends on the target's activities and other factors.

OVERVIEW OF REGIMES WITH/WITHOUT STANDSTILL OBLIGATION

There is broad divergence among legislative regimes regarding whether they provide for mandatory filings, voluntary filings, ex officio investigations or a mixture thereof. The German regime is illustrative—as set out in the chapter "Germany," it provides for a mandatory filing requirement based on the target's activities, the size of the stake (voting rights) acquired and the "nationality" of the investor.

If these thresholds are not met, the government may still intervene, and investors may consider making voluntary filings, under certain circumstances. For an ex officio investigation or a voluntary filing, there still needs to be a direct or indirect acquisition of at least 25 percent of the voting rights of a German company by a non-EU/EFTA-based investor—otherwise the government does not have jurisdiction to review the transaction. The regime provides for a standstill obligation where filings are mandatory, but not where they are voluntary.

COVERAGE OF INVESTMENTS BY NON-EU INVESTORS ONLY?

The various national regimes also differ in terms of whether they only cover investments by non-EU-based investors or any non-domestic acquirer. Some regimes are, again, hybrid: For example, the German regime scrutinizes investments by any non-domestic acquirer in the defense sector (as of a 10 percent stake), while in all other sectors, investments by EU or EFTA-based acquirers are permitted by law (although the government takes a very broad view as to whether an investor is non-EU/EFTA-based).

The French regime captures acquisitions of control by any non-French investor, but minority acquisitions only if the investor is non-EU/EEA-based (as of 25 percent of voting rights for all kinds of entities and, until the end of 2021, as of 10 percent of voting rights with respect to listed companies).

In contrast, the Spanish regime only captures acquisitions by non-EU/EFTA investors if they exceed a 10 percent share or control threshold. However, this does not include government investors, investors undergoing administrative or criminal proceedings in another Member State, or investors that already invested in sensitive sectors in another Member State, which are always captured as long as they are not Spanish.

Similarly, the regime in the Czech Republic defines "foreign investor" for filing purposes as one from a non-EU country.

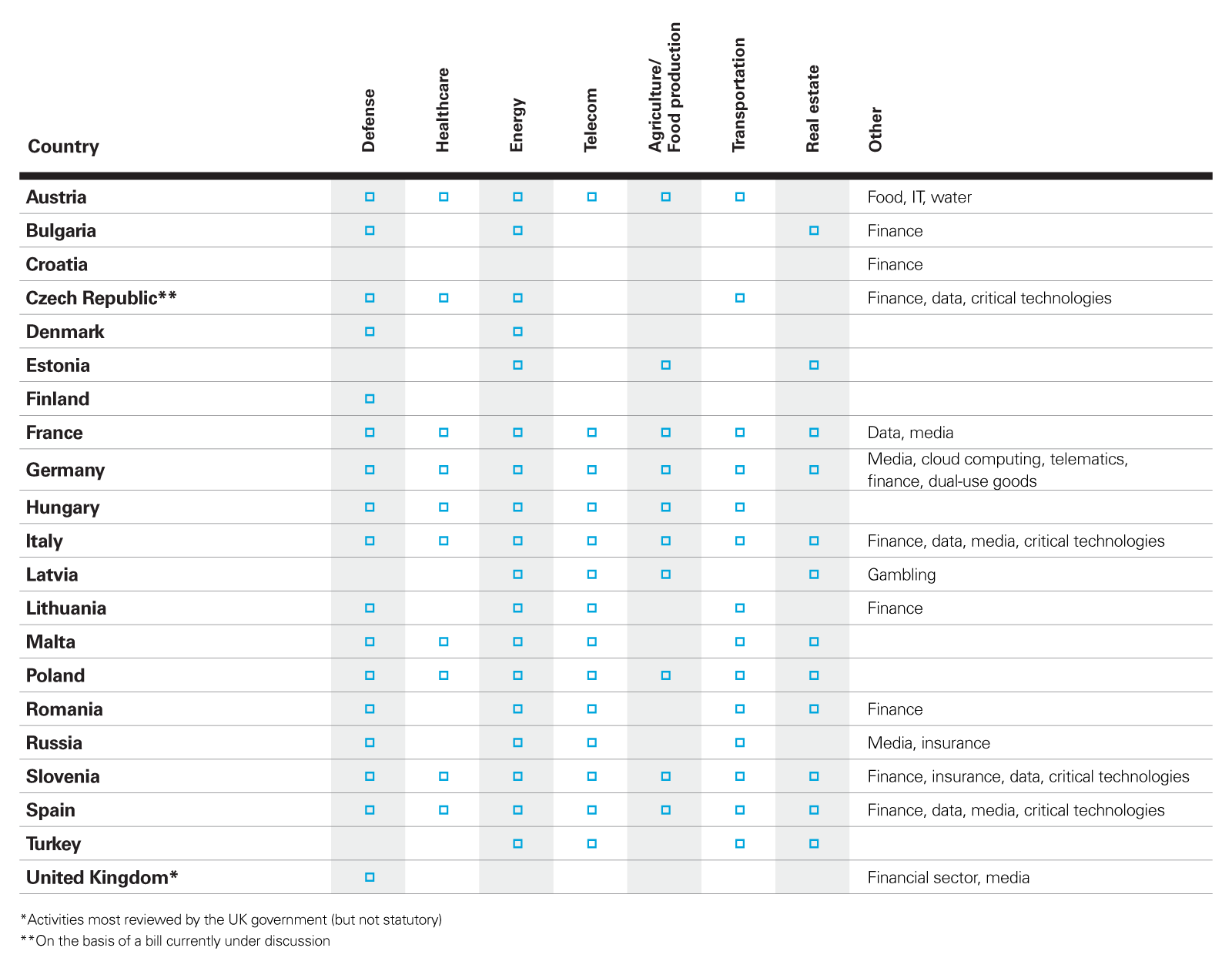

INDUSTRIES SUBJECT TO SCRUTINY

We are seeing an increased convergence in views across the US, Europe and elsewhere that so-called "sensitive" sectors need to be protected in a more or less coherent way from what is being described in the US as "adversarial capital." This trend is displayed through both the lowering of thresholds that trigger FDI reviews and an expansion of what qualifies as a sensitive sector for purposes of FDI reviews, export controls and international trade compliance.

Sensitive sectors are no longer limited to the traditional sectors associated with national security at a macro level (defense, energy or telecom), but are now expanding to biotechnologies, hi-tech, new critical technologies such as artificial intelligence or 3D printing, and data-driven activities.

Moreover, the COVID-19 pandemic brought FDI into sharper focus and accelerated movement on a national level across Europe. Governments were concerned about foreign investors taking advantage of European companies being in distress, and of course, the crisis led the governments to add the healthcare sector to the sensitive industries. In line with the EU Screening Regulation, FDI screening is also expanding to the area of food security, which has become a priority concern in the EU. Investments in the agri-food sector are subject to review in several Member States like Estonia, France, Germany, Italy, Latvia, Malta, Poland and Spain.

Finally, 5G technology has become a source of concern for certain Member States that had issued specific rules to ensure FDI screening in relation to 5G networks/equipment. In Italy, the government's "Golden Power" preclearance process is mandatory for contracts or agreements with non-EU persons relating to the supply of 5G technology infrastructure, components and services. France introduced a specific ad hoc authorization process for operating 5G technology in French territory.

In Germany, the Federal Network Agency has published a security catalog for telecoms and data processing, highlighting the critical nature of 5G networks, and the Federal Government is contemplating supplementing the technical security check for 5G networks with a political review process.

FILING THRESHOLDS

Some national FDI regimes determine filing requirements or intervention rights based solely on the size of the stake acquired, and cover share deals and asset deals alike; others rely on different or additional factors, such as the target's revenues.

For example, in the healthcare sector, the German regime provides for a filing obligation for an investment of at least 10 percent by a non-EU/EFTA-based acquirer, inter alia, into Germany:

- Hospitals handling 30,000 or more cases/year

- Production facilities for direct lifesaving medical products with an annual turnover of €9.068 million

- Production facilities and warehouses for other pharmaceuticals as well as pharmacies with 4.65 million packages put on the market per year

- Diagnostic and therapeutic laboratories with 1.5 million orders/year

Prior approval is required in Austria only if the target company has an annual revenue of €700,000 or more.

INTERVENTIONS OUTSIDE THE FORMAL SCOPE

Triggered by the COVID-19 pandemic, the German Federal Ministry for Economic Affairs and Energy announced in June 2020 that the state-owned Kreditanstalt für Wiederaufbau (KfW) will acquire a 23 percent interest in CureVac, a biopharmaceutical company whose focus is on developing vaccines for infectious diseases like COVID-19 and drugs to treat cancer and rare diseases, in order to avoid its potential acquisition by any foreign investor.

Similarly, in July 2018, the German Federal Government decided to prevent the acquisition of a 20 percent stake in the power grid operator 50Hertz by a Chinese investor by arranging for an investment by KfW (because it did not have jurisdiction to block the deal under the then-pertinent FDI regime). The German Federal Government officially confirmed that the acquisition by KfW was aimed at protecting critical infrastructure for energy supply in Germany.

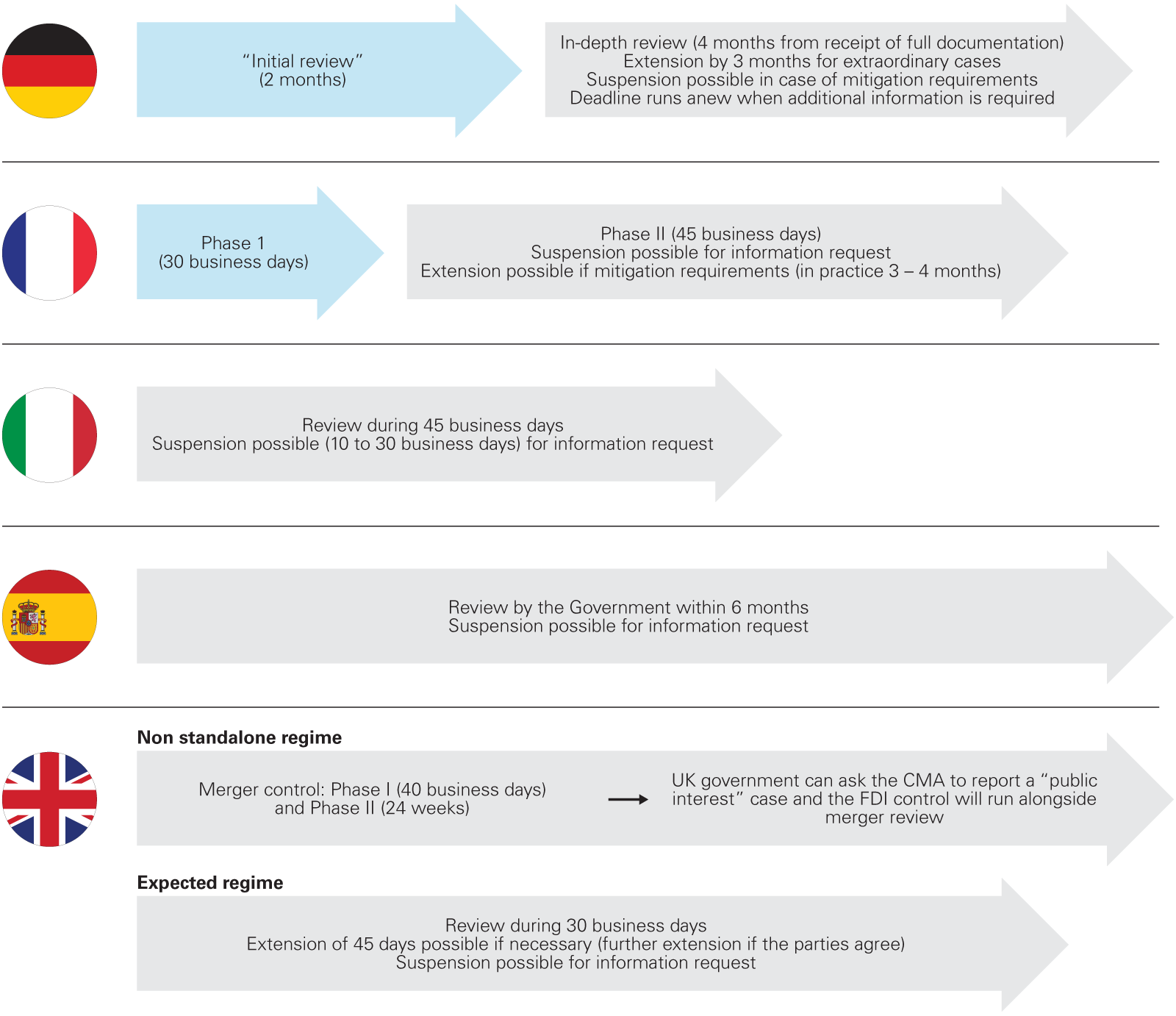

DURATION OF PROCEEDINGS (INCLUDING SCOPE FOR EXTENSIONS)

The duration of proceedings differs widely between jurisdictions. Generally, the process takes several months, and many feature a two-phase process (initial review period followed by in-depth review) and provide for stop-the-clock mechanisms, such as suspension based on information requests, or negotiation of mitigation requirements.

POSSIBLE OUTCOMES OF PROCEEDINGS

Blocking decisions on national security grounds remains an exception in most Member States. Issuing a formal veto to a potential foreign investor may leave the target business without a new investor as illustrated by the recent Photonis and Carrefour examples in France. In March 2020, the French Minister of the Economy issued an informal objection to US company Teledyne Technologies Inc.'s contemplated investment in Photonis, a French producer and supplier of light intensifier tubes using digital technology with military applications.

Teledyne has finally decided to withdraw its offer. In January 2021, French finance minister Bruno Le Maire expressed public opposition to Canadian store operator Alimentation Couche-Tard Inc.'s proposed €16.2 billion takeover of French retail group Carrefour. Le Maire reportedly said Carrefour is a "key link in the chain that ensures the food security of the French people" and that its acquisition by a foreign competitor would put France's food sovereignty at risk. Couche-Tard finally decided to withdraw its offer.

Clearance with "remedies" (mitigation agreements) is becoming customary in an increasing number of Member States. Remedies generally include maintaining sufficient local resources related to the sensitive activities, restrictions on the use of intellectual property rights or on the governance of the target company, mandatory continuation of sensitive contracts to ensure continued services, appointing an authorized security officer within the target company and reporting obligations, etc. In extreme cases, national authorities may also impose mandatory disposal of sensitive activities to an approved acquirer.

Please read the recent White & Case Alert about the first European Commission annual report on FDI screening regulation.

LESSONS LEARNED

- While the EU Screening Regulation is by and large an instrument of "soft law," it does add substantial complexity and uncertainty to security reviews performed at the Member State level. It puts additional pressure on Member States to consider a broader range of security interests, which is likely to facilitate lobbying efforts from other stakeholders taking an interest in a transaction.

- From a practical point of view, the new EU Regulation established an automatic information exchange system between all Member States on every notified transaction. Investors should make sure that a comprehensive multijurisdictional FDI assessment is carried out in transactions involving potentially strategic sectors and a variety of jurisdictions where the target business operates. Investors should also anticipate a proper strategy to deal with multiple parallel EU notification processes in several Member States and to ensure a consistent approach.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2021 White & Case LLP

View full image: FDI map (PDF)

View full image: FDI map (PDF)

View full image: FDI - Country table (PDF)

View full image: FDI - Country table (PDF)

View full image: FDI Timeline (PDF)

View full image: FDI Timeline (PDF)