Why small modular reactors will shape the future of nuclear debate

SMRs are gaining the attention of governments and power providers across the world because of the optionality they offer. But the champions of the SMR will have to work hard to ensure its potential can be fully unlocked.

12 min read

Subscribe

Stay current on your favorite topics

The authors would like to thank Shannon Quinn, Vice-President of Science, Technology and Commercial Oversight at Atomic Energy of Canada Limited and Seth Grae, president and CEO of Lightbridge for their contributions to this article.

SMRs are now gaining the attention of governments and power providers across the world, and even though they are a relatively nascent concept, judging by the backers lining up behind it, that won’t be the case for much longer

The vessel Akademik Lomonosov—named after an 18th-century Russian scientist, and anchored off Russia's Arctic coast—is a surprising place to find the future of nuclear energy. Yet for now, the barge is home to the world's only operating small modular reactor (SMR), a nuclear plant that produces enough electricity to power a city of about 100,000 people.

SMRs are a relatively nascent concept, but judging by the backers lining up behind it, that won't be the case for much longer. Newly elected US President Joe Biden has already signaled that they have a key role to play in the world's biggest economy's US$2 trillion investment in clean energy, while UK Prime Minister Boris Johnson has also said he'll pour money into the concept. And it's not just governments; companies including EDF—the world's biggest operator of atomic plants— and Rolls -Royce are championing the future role of the SMR.

SMRs are now gaining the attention of governments and power providers across the world because of the optionality they offer. They can provide reliable energy in the form of both electricity and heat. The heat can help lower the emissions from carbon-intensive industries such as steel and cement making, while the power offers baseload energy that can help underpin more intermittent supply from renewables such as wind and solar. The SMR offers a step change from the existing world of nuclear power.

In 1954, the Soviet Union started the world's first nuclear power plant, sending nuclear-generated electricity to a power grid, creating a whole new industry that promised to deliver a never-ending supply of reliable power. Yet that dream has faced challenges to deliver on its potential. Despite nuclear being a safe, carbon-free source of energy, the cost and scale of projects, along with major incidents at Three Mile Island, Chernobyl and Fukushima, have threatened to undermine the industry. However, the arrival of the SMR offers a solution to many of these issues.

400

nuclear power reactors are in operation around the globe

The case for nuclear

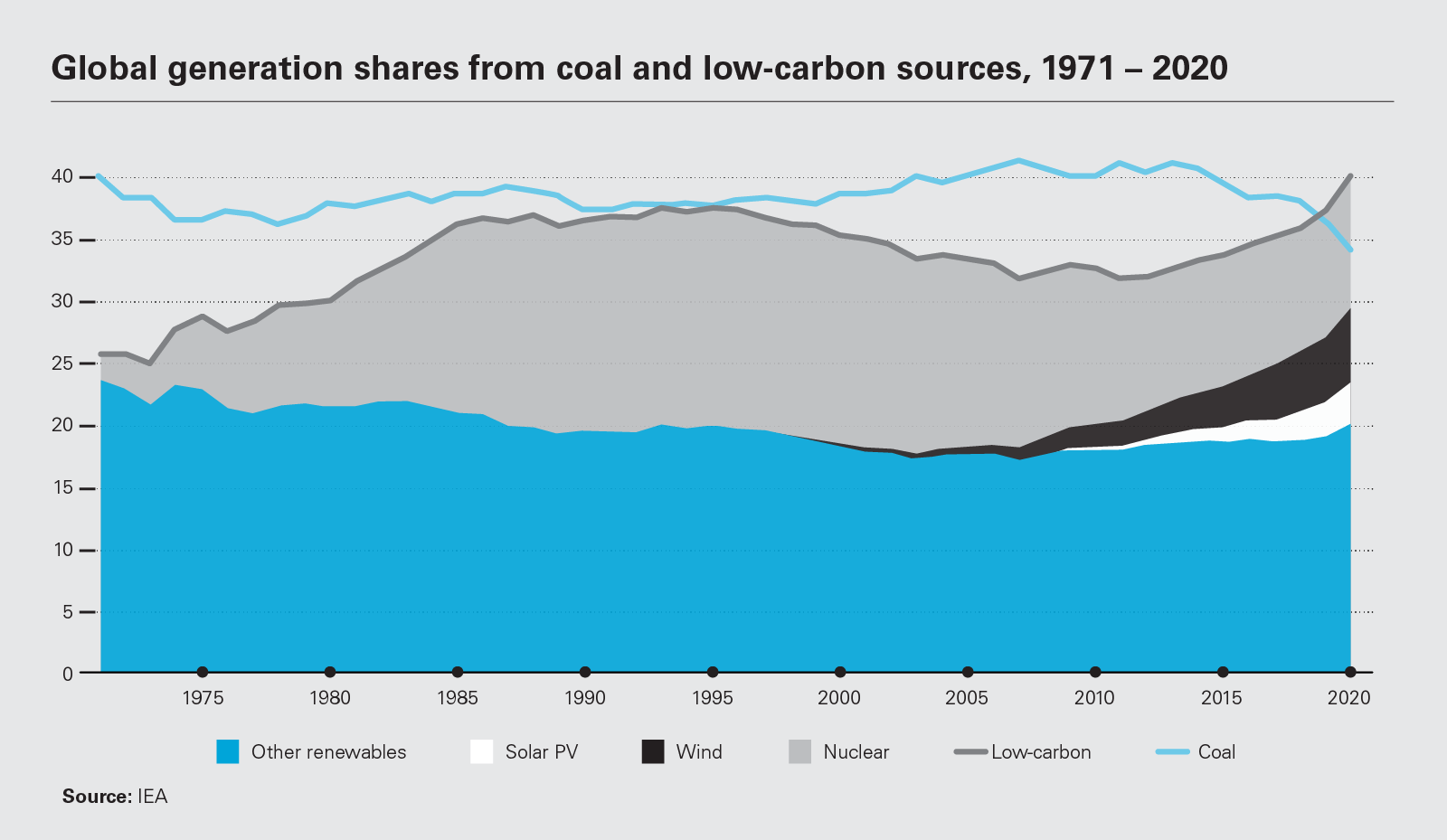

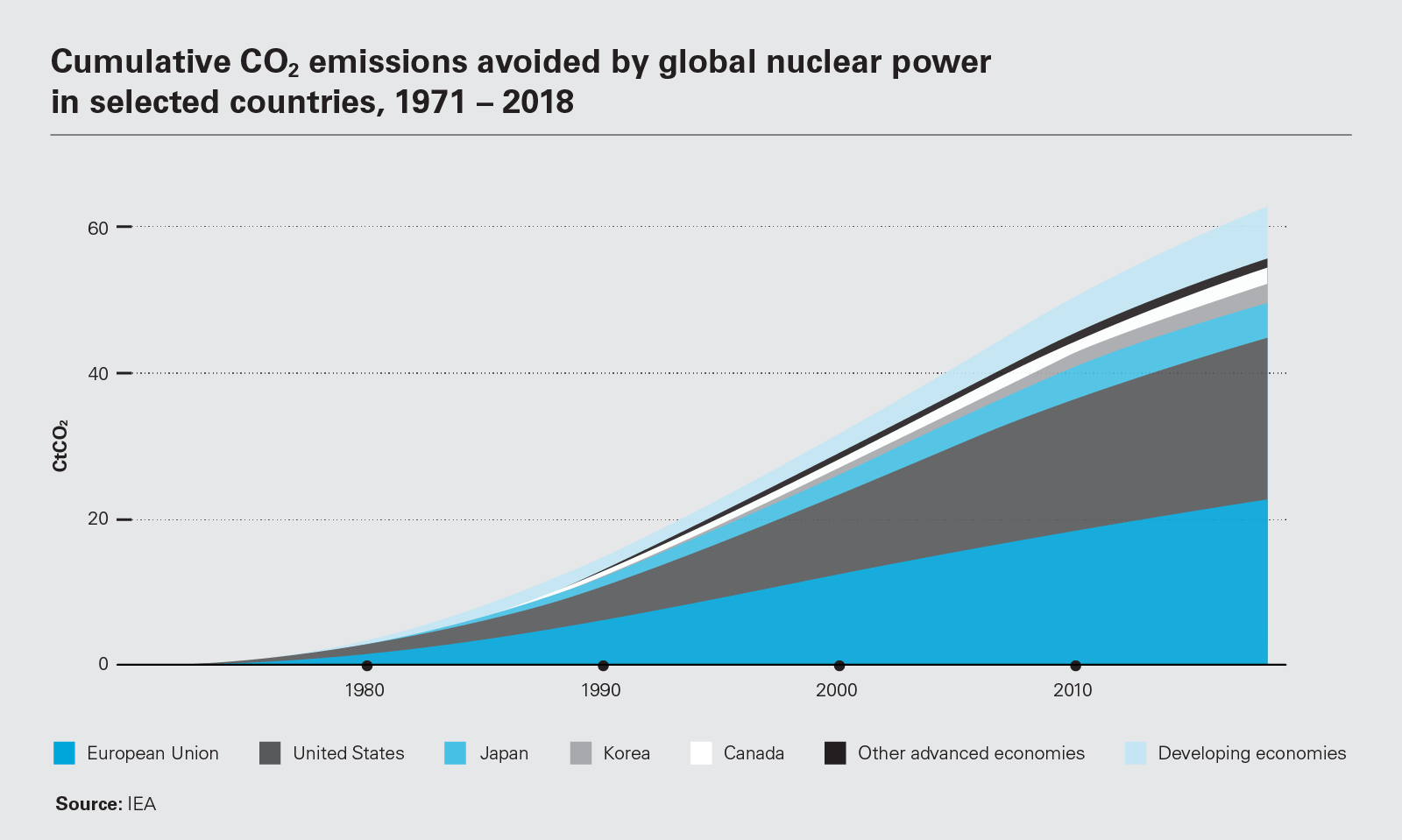

Nuclear reactors generate virtually emission-free power, which means they can play a crucial role in global efforts to lower emissions and reach the Paris climate goals. The global power sector accounts for approximately one-third of global emissions, with the burning of fossil fuels still the dominant source. The role of renewable energy generation—amid dramatic falling costs—has risen exponentially in recent years, but the inability of solar and wind to deliver reliable baseload generation has meant that many countries still rely on fossil fuels to fulfill that role.

Yet the pressure is on governments around the world to replace fossil-fuel power generation. The provision of affordable and clean energy is one of 17 United Nations Sustainable Development Goals, and at least 80 percent of the world's electricity must be low carbon by 2050—by which point the world's energy consumption is expected to have more than doubled—to have a realistic chance of keeping warming within 2°C of pre-industrial levels. Nuclear plants have a small environmental footprint and keep the air clean. They require only a small amount of fuel compared to gas or coal, and take up a fraction of the space required for wind and solar farms.

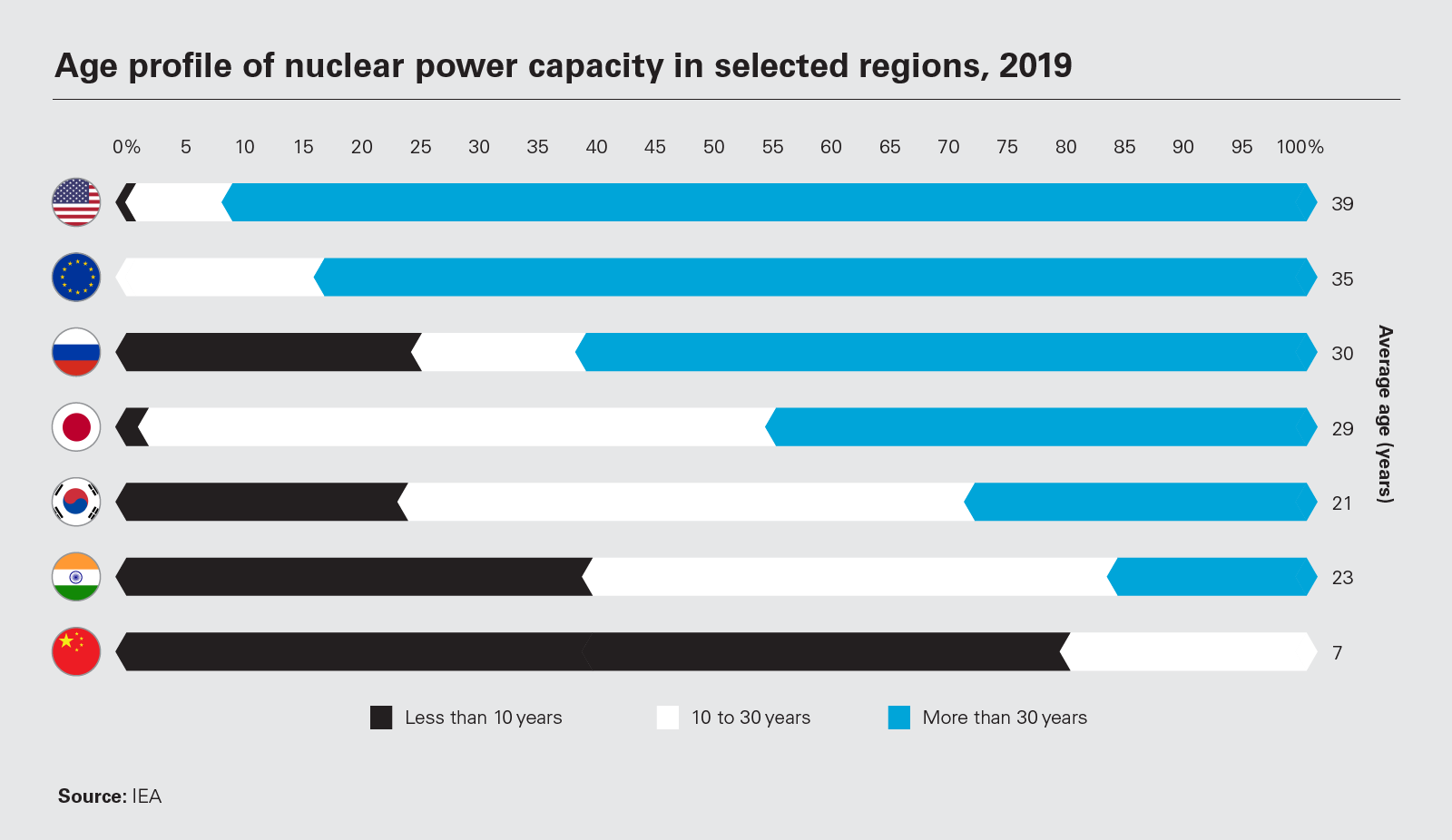

Currently, the roughly 400 nuclear power reactors that operate in some 30 countries around the globe provide about 10 percent of the world's power supply. The majority of the installed capacity is in Western countries, but a significant shift to developing nations—predominantly in Asia—is forecast over the next two decades. There is currently uncertainty about plans for replacement or life extensions in dominant producers France, Japan and the US.

80%

of the world's electricity must be low carbon by 2050

What exactly is an SMR?

SMRs are broadly defined as nuclear reactors that produce less than 300 MWe—compared to the more than 1,600 MWe that modern nuclear power plants can produce.

The attraction of building smaller plants, based on a set design framework, is clear. Plants can be built quickly and to a proven standard. Additional plants can be added as more power is required, and economies of scale can be achieved as more numbers are produced. The capital outlay also becomes manageable for smaller utilities, whereas at the moment only the biggest players can shoulder the initial capital outlay burden and risks associated with some developments.

The smaller size and diversity of reactors can also mean they can be built in locations not traditionally suitable for nuclear power plants, and—importantly—close to power-intensive industries or remote communities. This allows them to cover areas of the world that rival power solutions can't reach, with the potential to replace highly inefficient and polluting power sources such as diesel generators.

SMRs can also be deployed on the sites of retiring coal plants, making the new small nuclear plants more locally acceptable by providing employment. Taking advantage of existing infrastructure, including electrical switchyards and coal plant turbines, could reduce SMR construction costs and avoid the need of adding new transmission lines from the sites.

Political support is widespread

Governments have been quick to see the potential. After years of setbacks in the UK in developing the next generation of large nuclear power plants, Prime Minister Johnson has promised funding and political support to develop the next generation of small and advanced reactors as part of his government's 10 Point Plan for a green industrial revolution.

In the US, President Biden has set goals of achieving 100 percent carbon-free electricity production by 2035 and reducing net CO2 emissions to zero by no later than 2050. Biden's energy platform specifically cites advanced nuclear as part of "critical clean energy technologies," and his administration also plans to create an Advanced Research Projects Agency for climate that will have a specific focus on modular reactors. During April's US-led climate summit, Biden pledged to cut the country's emissions to half of 2005 levels by 2030, stressing that the world is in a "decisive decade" for tackling climate change.

The nuclear industry has not been shy to showcase its potential role in the fight. Coinciding with Biden's two-day summit, six nuclear industry trade associations released a statement importuning that nuclear power be included in the fight against emissions, arguing that the size and urgency of the challenge demands that a "realistic, science-based approach that addresses all sectors" is required. In order to deliver the quantity of clean energy required to meet carbon neutrality, "this will require that we use every low-carbon technology at our disposal. Nuclear power must be one of those technologies," the associations said.

70

There are currently almost 70 different SMR technologies under development

Source: International Atomic Energy Agency

The private sector is also keen

Some of the biggest industrial companies and utilities have also gotten behind the technology, with reactor designs being developed by companies from Rolls-Royce to NuScale Power and TerraPower, which has drawn investment from Bill Gates. According to the International Atomic Energy Agency, there are currently almost 70 different SMR technologies under development, a significant jump from just a couple of years ago.

EDF said earlier this year that it sees a huge global market developing for small reactors over the next decade to replace fossil-fuel generators. The company plans to complete the basic design of a 170 MW reactor by the end of 2022, and will try to convince the French government to build a pilot project by about 2030. The signs are positive. In April, French ministers signed an updated strategic plan for the French nuclear industry to account for the challenges the pandemic has brought. Almost €500 million is to be made available for the industry, with €70 million of this directed towards special projects that include the construction of a prototype SMR.

Canada released its own SMR Action Plan in December, laying out a roadmap for the development and deployment of the technology, described by the Minster of Natural Resources as "the next great opportunity," as the country seeks to phase out coal and electrify carbon-intensive industries. Shannon Quinn, Vice-President of Science, Technology and Commercial Oversight at Atomic Energy of Canada Limited, a government agency which owns the country's largest nuclear science and technology laboratory, spells it out more clearly: "SMRs are a real option in the fight against climate change. In order to meet greenhouse gas reduction targets, there is a need to bring to bear all technology options—renewables, nuclear, hydrogen and many more. We need all of them to be successful." The Baltic state of Estonia is also developing plans to place SMRs at the center of its low-carbon future. In March, Rolls-Royce and Fermi Energia—a company founded by Estonian energy and nuclear energy professionals to bring SMRs to their homeland—signed a Memorandum of Understanding to study the potential deployment of SMRs across the country.

It's not all about state-level decision-making though; there are also opportunities for smaller, more innovative companies that have been locked out of the more costly and technologically advanced traditional plants. The emergence of both private investors and smaller companies in the space offers a step change from the traditional route of government-led and funded research, development and implementation, and offers an opportunity for new methods and approaches.

One such smaller, more innovative company is Lightbridge, which has developed new metallic fuel rods that it believes are significantly more economical and safer than traditional fuel. "We have less time than the length of a typical mortgage to change the world‘s energy mix," says Seth Grae, president and CEO of Lightbridge. "Renewables most likely will generate only a small portion of the clean energy the world will need by 2050."

For Grae, there are arguably too many SMR technologies in development, which risks spreading expertise too thin: "After all, Apollo didn't happen because of a hundred private sector players pursuing different options," he adds. The world needs to get behind the most reliable and cost-effective methods. This would better enable what to scale up more quickly and provide the consistent baseload that helps offset the intermittent nature of renewables.

It’s not all about state-level decision-making when it comes to SMR technologies; there are opportunities for smaller, more innovative companies

5%

of the world's total energy consumption comes from nuclear energy

Challenges remain, namely regulation

Regulation has always been a challenge in nuclear plant development, and that's likely to remain the case for SMRs. Issues include factors such as certification of design, construction license and operation license costs, which are hurdles that are likely here to stay.

Licensing risk has long been a difficult and controversial issue in nuclear power, and has attracted significant attention from policy makers, the public and environmentalists. The proliferation of nuclear plants envisaged by the widespread rollout of SMRs will be unlikely to avoid this scrutiny. Given the required oversight at all levels of development, the prospect of delays, cost overruns and disputes remains, particularly in the initial rollout of new technologies.

The industry must also overcome many of the perceptions from previous generations of nuclear power; that the projects are too costly and complex, especially when compared to both traditional fossil-fuel power generation and the breakneck rollout of renewables. The issue of waste is also pertinent to the conversation. NuScale says that because SMRs contain less radioactive material and can be located below ground, their risks are lower; however, this has received criticism from some experts.

As of yet, there is no guarantee that SMR producers will not face the same obstacles that have plagued developers of traditional nuclear power. There also exists the challenge of convincing industrial users—a customer that seems well suited for the SMR offering—that it can compete with low-cost natural gas or proven renewables such as wind and solar. And the nature of SMRs mean they will have to be built close to the communities they serve, raising new challenges for public engagement.

The rollout of a new generation of nuclear power will inevitably lead to legal and commercial disputes. The intense scrutiny, from policy-makers and the public—given the safety and security angle combined with a nascent technology—will likely cause delays and conflicts. So will jockeying for position in a potentially more competitive nuclear industry marketplace. With first-of-a-kind designs, and potentially new and less experienced players in the market, comes increased risk of regulatory issues, delays, cost overruns and disputes. Understanding the nuclear regulatory framework and the nature of risks that commonly arise concerning nuclear projects will be key to navigating these issues and minimizing their impact.

Unlocking the SMR's full potential

The SMR has widespread political support. The technology's offering is compelling: carbon-free power that's reliable, safe, more affordable and can be built and deployed without the significant costs and complexity of traditional nuclear power.

In a world where almost every investment decision will now be measured against its climate impact and whether it is compatible with the Paris climate goals, the SMR offers a solution without many of the drawbacks that have hobbled its larger predecessors.

Yet, as with all new technologies, there are challenges to overcome and, as is always the case with nuclear power, these can be costly and protracted. The champions of the SMR will have to work with all stakeholders, from governments and investors to the wider public, to ensure its potential can be fully unlocked.

Click here to download 'Why small modular reactors will shape the future of nuclear debate' (PDF)

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2021 White & Case LLP

View full image: Global generation shares from coal and low-carbon sources, 1971 – 2020 (PDF)

View full image: Global generation shares from coal and low-carbon sources, 1971 – 2020 (PDF)

View full image: Age profile of nuclear power capacity in selected regions, 2019 (PDF)

View full image: Age profile of nuclear power capacity in selected regions, 2019 (PDF)

View full image: Cumulative CO2 emissions avoided by global nuclear power in selected countries, 1971 – 2018 (PDF)

View full image: Cumulative CO2 emissions avoided by global nuclear power in selected countries, 1971 – 2018 (PDF)