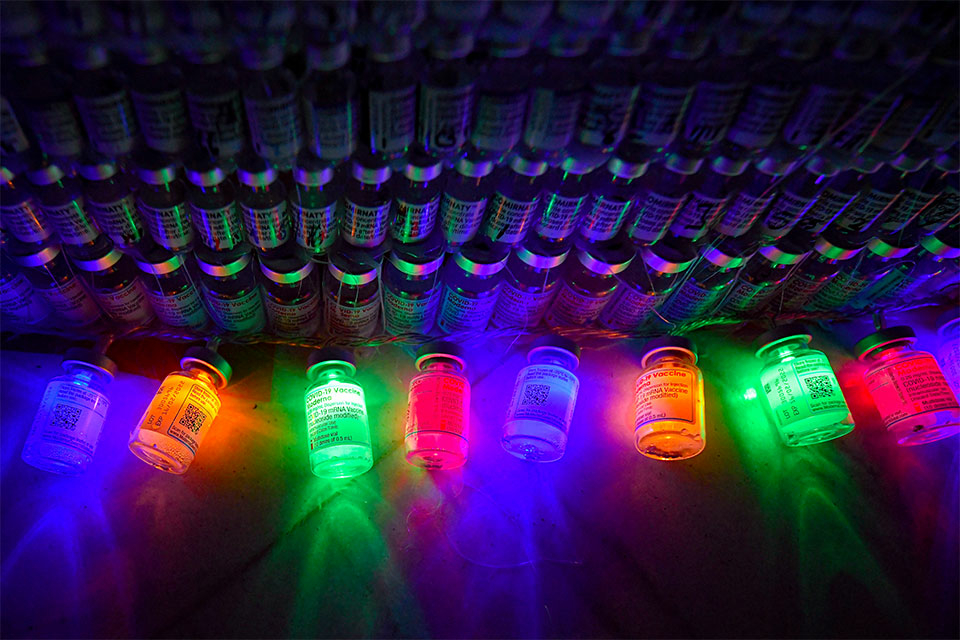

What have we learned from COVID-19?

Epidemiologist Syra Madad says it’s critical to engage with local communities

Hugh Verrier

Chair

In 2021, the COVID-19 pandemic continued to affect nearly every aspect of our lives. Against this backdrop, our global teams worked on groundbreaking transactions, resolved high-stakes disputes and, through our global citizenship initiatives, responded to societal challenges around the world.

The role of business in society evolved as environmental, social and governance (ESG) issues entered the mainstream, concentrating on challenges including the energy transition and achieving greater diversity and inclusion. Like our clients, we looked for ways to create long term value and growth—a shared goal that created opportunities for collaboration.

It was in this context that we launched a new five-year strategy, focused on creating a distinctive experience for our clients.

Our emphasis on complex, cross-border matters helped us grow in all of the regions where we work and achieve outstanding results for our clients. As we look to the next five years, we are committed to building the capabilities our clients need, supported by a strong, resilient culture.

Guest speakers at Firm events talk about issues that made news in 2021

Epidemiologist Syra Madad says it’s critical to engage with local communities

Think tank CEO Chris Pinney is encouraged by moves to focus on impact, not just policies and procedures

Bill Emmott, who co-leads a nonprofit that studies the far-reaching effects of COVID-19, discusses the importance of business scenario planning

Developments that reshaped the world

Countries and companies are increasingly committing to net-zero goals that would require them to significantly reduce carbon emissions on relatively short timelines

The pandemic accelerated global concerns over climate change and inequality, pushing societal expectations around responsible business practices into the spotlight

Most of 2021 was characterized by free-flowing capital, as government aid in response to COVID-19 propped up economies

Globalization may be evolving, as nations and regions reassert their regulatory powers on a wide range of issues

Matters in eight practice areas that highlight our global impact for clients

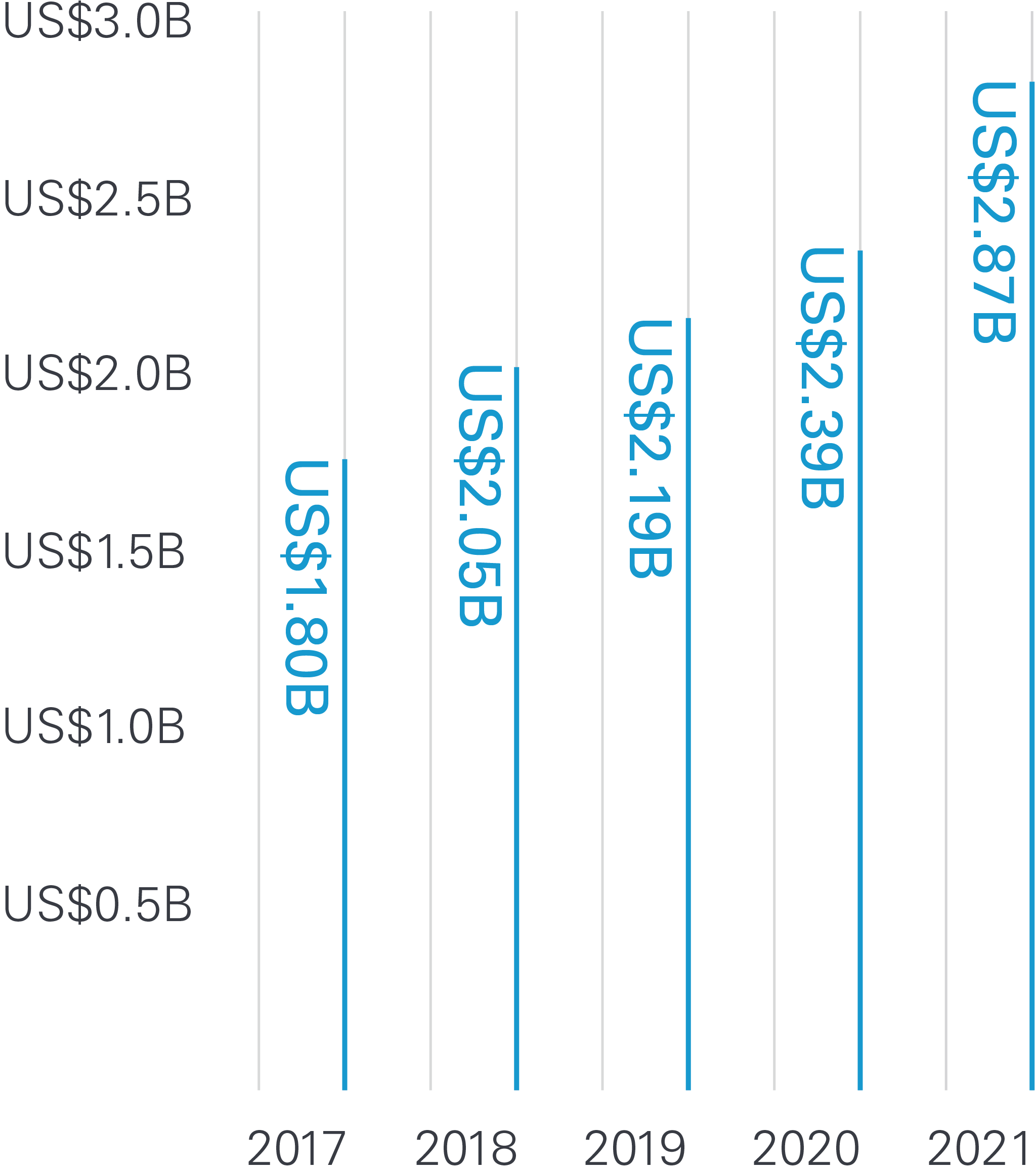

Our 2021 achievements cap an outstanding five-year success story

2,464 Total lawyers

An outstanding roster of talented lawyers strengthened our Firm in 2021

White & Case earned many of the legal industry’s top accolades for outstanding performance in 2021

White & Case is committed to fair and ethical operations that respect human rights and recognize the importance of our natural environment.

As a signatory to the UN Global Compact we affirm our commitment to doing business responsibly by supporting the Compact’s ten principles on human rights, labor, the environment and anti-corruption. The steps we are taking to continue to embed these principles into our Firm are outlined in our most recent Communication on Progress.

Our latest Environmental Sustainability Report includes information on our environmental policies, footprint, key actions and goals.

Where White & Case is a longtime leader — and we're just getting started.

10 global affinity networks

Our ten global affinity networks foster a sense of community among the Firm’s Black, Asian, Latinx/Hispanic, Middle Eastern, minority ethnic and LGBT+ lawyers, business services professionals and their allies. Each network sets its own agenda, initiatives and goals, which are specific to the issues it feels are most important. Affinity networks also create and enhance awareness of these groups within the Firm and its larger culture, drive community and connection across our global offices, and support their members with career and professional development opportunities.

26 local women’s networks

Our 26 local women’s networks are active in 40 offices across the Americas, EMEA and Asia-Pacific. These networks foster professional development and mentoring activities, and support business-related client partnerships. They also provide a forum for our lawyers and business services professionals to share perspectives and create programs to support and retain our talent while fostering and promoting gender equity.

For more than a decade, leading publications and alliance organizations have recognized White & Case’s commitment to diversity and inclusion.

We continued to advance toward our diversity and inclusion goals, narrowing the gap between thought and action with new trainings

Like our clients, we are seeking ways to sustainably create long-term value and growth, a shared goal that presents opportunities to collaborate

We set out to ensure we provide our clients with an experience that emphasizes the attributes they seek in a trusted advisor

Most of 2021 was characterized by free-flowing capital, as government aid propped up economies in response to COVID-19. Low interest rates and other central bank stimulus measures contributed to an environment that helped see many companies through challenging times. But as 2022 neared, governments were set to withdraw aid and inflation had risen, creating uncertainty.

Against this evolving backdrop, we advised our clients, including banks, alternative capital providers, listed corporations, startups and sovereigns, on a range of financing transactions, restructurings, workouts and regulatory matters, and represented them in litigation. Below are some of the developments that drove business.

After soaring in the immediate aftermath of COVID-19, US corporate bankruptcies fell to historic lows in 2021. One of the pandemic’s first and most high-profile chapter 11 cases wrapped up in 2021 with Hertz emerging from bankruptcy with a lower cost of capital and a structure that afforded stability and greater profitability than before. In Europe, restructurings were down significantly compared to 2020.

As governments and central banks around the world pumped money into their economies in the wake of COVID-19 and interest rates sat at near zero, companies that faced financial challenges were able to refinance or take on more debt. Others avoided bankruptcies and full-blown restructurings through a liability management exercise. But rising inflation and the possibility of higher interest rates will add to the challenges for financially distressed companies.

Global leveraged financing activity spiked in 2021, driven largely by refinancing and repricing during the first half of the year, and M&A and buyout activity in the second. Across regions, interest in a range of sustainability-linked debt products also hit new highs.

In the US, leveraged financing issuance was up overall. Loan activity drove the uptick, climbing from US$861.7 billion in 2020 to US$1.4 trillion in 2021. High yield bond issuance held steady, rising just slightly from US$428.3 billion to US$429.7 billion. Putting these numbers into context, high yield bond issuance hit a five-year high in 2020, and 2021 issuance remained well above pre-pandemic levels.

Europe saw year-on-year leveraged loan issuance climb by more than a quarter in 2021, to €289.7 billion in 2021. The region’s high yield bond markets were even more enthusiastic, with issuance for the year hitting €148 billion, up 47 percent over 2020.

And in the Asia-Pacific region (data excludes Japan), debt markets saw strong growth. Combined high yield bond and leveraged and non-leveraged loan issuance rose from US$422.3 billion in 2020, to US$498 billion in 2021. These gains occurred despite ongoing pandemic-induced disruptions in China’s real estate market, which were offset by a resilient loan market and revived PE activity.

SPAC IPOs, which contributed to the global IPO boom that began in early 2021, had another strong year. The market for these deals, in which a company with no business operations is formed solely to raise capital through an IPO to acquire an existing company, cooled following a record first quarter. But this was foreseeable given the unsustainable pace at which these companies were being formed. In addition, SPAC sponsors and investors may have grown more cautious as the prospect of possible SEC regulation loomed. Still, by the end of 2021, 610 US SPACs had raised US$153.22 billion, up from the 245 deals that raised US$80.37 billion in 2020.

As more and more SPACs came of age, de-SPAC transactions, in which the SPAC merges with the target company, also soared in the US. In 2021, 221 de-SPAC transactions were valued at US$403.63 billion, compared to 92 such transactions worth US$139.18 billion in 2020. While SPACs remained largely a US phenomenon, global interest grew. The trend took off in Israel, which saw a boom in SPACs, as US-registered cash shells began scooping up assets and the Israeli Securities Authority set ground rules to open up the Tel Aviv Stock Exchange to local SPACs.

In Europe, SPAC activity was relatively modest but on the rise. The overall number and value of deals climbed steadily, with listings on key markets including Amsterdam and Frankfurt. In addition, deal sizes hit new highs and EU and UK regulators weighed in. The SPAC wave also reached the Asia-Pacific region where jurisdictions including Singapore and Hong Kong introduced their own regimes to capitalize on the momentum.

Photo by Simon Carter © Getty Images

An arrow points the way in the UK