Investor appetite is at an all-time high—while VC investors back growing service providers, PE investors supercharge IPO glide paths and established banks refuse to abdicate market share

Overview

Current Market

- Extreme activity levels—the sun hurts our eyes!

We Are Seeing

- Investor appetite at an all-time high:

- Private equity investors supercharge late-stage payments service providers (e.g., Advent International's acquisition of MangoPay and equity investment in Global Processing Services)

- Venture capital investors back growing payments service providers (e.g., Dragoneer's equity investments in Checkout.com, Lydia, VNLife and Yoco)

- Established banks refuse to abdicate market share (e.g., Northmill's acquisition of Moreflo and Deutsche Bank's acquisition of Better Payment)

- Sovereign wealth funds ride the exponential upward trajectory (e.g., GIC's and QIA's participation in Checkout.com's US$1 billion Series D funding round)

- Payment services businesses favour inorganic growth through:

- Mergers (e.g., merger between P27 and Bankgirocentralen)

- Acquisitions (e.g., Worldline's acquisitions of 80% of Axepta Italy, 80% of Eurobank Merchant Acquiring and Handelsbanken's card acquiring business)

- Partnerships with complementary operators (e.g., Mastercard's Egyptian onboarding, disbursement and collection partnership with Kashat, payment cards partnership with 11Onze, embedded working capital partnership with Demica and spare change investment partnership with EveryoneInvested)

- Partnerships with established banks (e.g., EVO Payments' merchant acquiring partnership with NBG, Nexi's SoftPOS partnership with UniCredit and Trusple's cross-border payments partnership with BBVA)

Key Drivers/Challenges

- Investors seeking to reap the rewards of:

- Exponential growth in customer demand (e.g., Payhawk's status as the first-ever Bulgarian unicorn, with the support of Lightspeed in its US$100 million Series B follow-on round and Greenoaks in its US$112 million Series B round)

- New entrants conquering underserviced market segments (e.g., Ribbit's participation in Series A rounds for B2B payments platform Balance and sub-Saharan African mobile payments pioneer Wave)

- Service providers consolidating market share (e.g., Target Global's lead investment in Rapyd's US$300 million Series E round, to finance strategic acquisitions)

- Payment services businesses drive revenue generation through:

- Access to new markets (e.g., PayRetailers' acquisition of Chile's Paygol and Colombia's Pago Digital)

- Consolidating market share (e.g., Paysafe's acquisitions of SafetyPay and PagoEfectivo)

- Questing for a slice of the American pie (e.g., SumUp's acquisition of Fivestars)

- Open banking access (e.g., Visa's acquisition of Tink and Mastercard's acquisition of Aiia)

- Staying at the cutting edge of tech developments (e.g., Lunar's acquisition of Paylike)

- Improving efficiencies through partnerships (e.g., Visa credit availability AI partnership with Pagaya)

Trends to Watch

- Increasing regulatory scrutiny of payment services involving crypto-assets (e.g., ECB's extension of oversight framework for electronic payments to include stablecoins and other crypto-assets)

- Resurgence of class actions against payment rail providers in relation to alleged interchange fee price-fixing (following the UK Competition Appeal Tribunal's "green light" for a 46 million-strong class action against Mastercard)

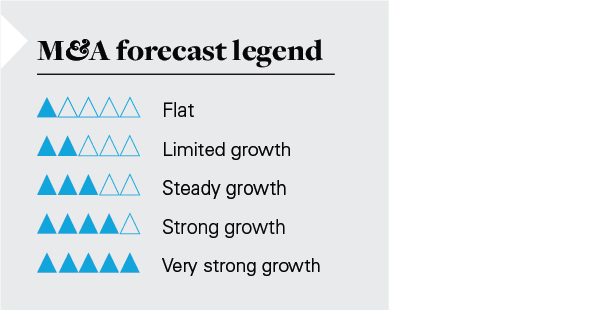

Our M&A Forecast

Extreme M&A activity to continue, as cashless payments become the new norm in the post COVID 19 world. We have all said it at one time or another: "Sorry, I don't usually carry cash."

High appetite and deep pockets

Deal highlight:

White & Case advised Pollinate, the UK-based merchant acquiring pioneer, on: its US$20 million Series C follow-on funding round, led by Canadian Imperial Bank of Commerce; and its US$30 million Series C+ funding round, supported by existing investors including Insight Partners, NatWest, NAB, EFM Asset Management and Fiserv.

Private equity:

- KKR: Participation in US$200 million Series D funding round for Paddle (May 2022)

- Advent International: Acquisition of MangoPay (April 2022)

- Blackstone TacOpps: £140 million equity investment in Currencies Direct (March 2022)

- Summa Equity: Acquisition of majority stake of Intix (March 2022)

- FSI: Acquisition of 60% of BCC Pay (February 2022)

- Thoma Bravo: Acquisition of Bottomline (December 2021)

- Keensight Capital: Acquisition of Buckaroo (December 2021)

Venture capital:

- Hoxton Ventures, Frst and Y Combinator: Participation in US$3.1 million pre-Seed funding round for Formance (June 2022)

- Bain Capital: Participation in €590 million Series E funding round for SumUp (June 2022)

- Accel: Participation in US$65 million Series A funding round for kevin. (May 2022)

- Kora Capital, PayPal Ventures and Clay Point: Participation in US$50 million Series B funding round for Paymob (May 2022)

- General Atlantic: Participation in £83 million Series C funding round for Modulr (May 2022)

- Flutterwave and Techstars: Participation in US$3.4 million pre-Series A funding round for Dapio (March 2022)

- SVB Capital and Salesforce Ventures: Participation in US$50 million Series C funding round for Modern Treasury (March 2022)

- Brightfolk: Participation in €5 million Seed funding round for Softpay (March 2022)

- ZedCrest Capital: Participation in US$10 million pre-Seed funding round for Leatherback (April 2022)

- Gradient Ventures: Participation in €8 million Seed funding round for Payaut (April 2022)

- firstminute Capital: Participation in US$2.4 million pre-Seed funding round for Volume (April 2022)

- Accel Partners, Local Globe and Union Square Ventures: Participation in US$30 million Venture funding round for Super Payments (April 2022)

- Insight Venture Partners: Participation in US$32.8 million Seed funding round for Dash (March 2022)

- Digital Horizon: Participation in US$5 million Series A funding round for SteadyPay (March 2022)

- B Capital Group: Participation in US$250 million Series D funding round for Flutterwave (February 2022)

- Lightspeed Venture Partners: Participation in US$100 million Series B follow-on funding round for Payhawk (February 2022)

- The Spruce House Partnership: Participation in US$21 million Series A funding round for Stitch (February 2022)

- Edenred Capital: Participation in US$20 million Series A funding round for Banked (February 2022)

- Signal Peak Ventures: Participation in US$20 million Series A funding round for Hubpay (February 2022)

- Permira: Participation in US$312 million Series G funding round for GoCardless (February 2022)

- Advent International and Viking Global Investors: Participation in US$400 million funding round for Global Processing Services (January 2022)

- Toscafund and Penta Capital: Participation in US$25 million equity funding round for CellPoint Digital (January 2022)

- Coatue Management: Participation in US$17 million Series A funding round for Silverflow (December 2021)

- G Squared: Participation in US$270 million Series F funding round for Tipalti (December 2021)

- Dragoneer and Echo Street: Participation in US$103 million Series C funding round for Lydia (December 2021)

- Vitruvian Partners: Participation in €45 million Series C funding round for Enfus (December 2021)

- Greenoaks: Participation in US$112 million Series B funding round for Payhawk (November 2021)

- Coatue Management and Tiger Global: Participation in US$555 million Series A funding round for MoonPay (November 2021)

- AfricInvest FIVE: Participation in US$100 million Series C funding round for MFS Africa (November 2021)

- OTB Ventures and Speedinvest: Participation in US$10 million Seed funding round for kevin. (October 2021)

- Iconiq Growth: Participation in US$50 million Series B funding round for Primer (October 2021)

- Advent International and Viking Global Investors: Participation in US$300 million investment in Global Processing Services (October 2021)

- Elbrus Capital and Black River Ventures: Participation in US$50 million Series C funding round for TransferGo (October 2021)

- Sequoia Heritage, Founders Fund and Ribbit: Participation in US$200 million Series A funding round for Wave (September 2021)

- Connected Capital and Iris Capital: Participation in €12.2 million Venture funding round for SurePay (September 2021)

- Ribbit: Participation in US$25 million Series A funding round for Balance (August 2021)

- Farallon Capital, Leapfrog, TCV and Accel: Participation in US$292 million Series E funding round for WorldRemit (August 2021)

- SoftBank Vision Fund II: Participation in US$400 million Series C funding round for Opay (August 2021)

- Target Global: Participation in US$300 million Series E funding round for Rapyd (August 2021)

- General Atlantic and Dragoneer: Participation in US$250 million Series B funding round for VNLife (August 2021)

- Dragoneer: Participation in US$83 million Series C funding round for Yoco (July 2021)

- NewView Capital Management: Participation in US$50 million Series C funding round for Paystand (July 2021)

Banks:

- CIBC: Minority equity investment into Pollinate (February 2022)

- Northmill: Acquisition of Moreflo (February 2022)

- JPMorgan Chase: Acquisition of 49% of Viva Wallet (January 2022)

- Deutsche Bank: Acquisition of Better Payment (September 2021)

- Goldman Sachs: Participation in US$160 million Series C funding round for Form3 (September 2021)

- JPMorgan Chase: Acquisition of 75% of Volkswagen Payments (September 2021)

- Otkritie Bank: Acquisition of 40% of Tochka (July 2021)

SWFs:

- GIC and QIA: Participation in US$1 billion Series D funding round for Checkout.com (January 2022)

- QIA: US$200 million investment in Airtel Africa (August 2021)

Other payment service providers:

- Poste Italiane: Participation in US$27 million Series B funding round extension for Scalapay (May 2022)

IPOs:

- Nayax: US$142 million TASE IPO (February 2022)

Scaling-up of market players

Deal highlight:

White & Case advised Nets, one of Europe's largest payments providers, on its acquisition of paytec GmbH.

Deal highlight:

White & Case advised the New York Stock Exchange–listed payments platform Paysafe on its acquisition of German payments infrastructure provider viafintech.

Deal highlight:

White & Case advised Tink, a leading Nordic open banking platform provider, on its €1.7 billion sale to Visa.

Mergers:

- Tutuka & Paymentology: Merger (December 2021)

- P27 Nordic Payments Platform & Bankgirocentralen: Merger (July 2021)

Acquisitions:

- MFS Africa: Acquisition of Global Technology Partners (June 2022)

- Fleetcor Technologies: Acquisition of Global Reach Group (June 2022)

- Ximedes: Acquisition of Ginger Payments (June 2022)

- Rewire: Acquisition of Imagen (June 2022)

- ibanFirst: Acquisition of Cornhill (June 2022)

- Trustly: Acquisition of Ecospend (May 2022)

- Ebury: Acquisition of Bexs (May 2022)

- Checkout.com: Acquisition of ubble (May 2022)

- PayU: Acquisition of Tecnipagos (April 2022)

- PayRetailers: Acquisition of Paygol (April 2022)

- PayRetailers: Acquisition of Pago Digital (April 2022)

- Banking Circle: Acquisition of SEPAexpress (April 2022)

- PPRO: Acquisition of Alpha Fintech (March 2022)

- LHV: Acquisition of EveryPay (March 2022)

- PostePay: Acquisition of LIS Holding (February 2022)

- Revolut: Acquisition of Arvog Forex (February 2022)

- DNA Payments: Acquisition of Card Cutters (February 2022)

- Transtura: Acquisition of WazoMoney (February 2022)

- Worldline: Acquisition of 80% of Axepta Italy (January 2022)

- Midpoint Holdings: Acquisition of Blockchain World (December 2021)

- Nets: Acquisition of paytec (December 2022)

- Worldline: Acquisition of 80% of Eurobank Merchant Acquiring (December 2021)

- Tinkoff: Acquisition of 51% of Just Look (November 2021)

- Transguard: Acquisition of 50% of Transguard Cash (November 2021)

- Nydig: Acquisition of Bottlepay (November 2021)

- Net1: Acquisition of Connect Group (November 2021)

- Paysafe: Acquisition of viafintech (November 2021)

- MFS Africa: Acquisition of Baxi (October 2021)

- Worldline: Acquisition of Handelsbanken's card acquiring business (October 2021)

- SumUp Payments: Acquisition of Fivestars (October 2021)

- Lunar: Acquisition of Paylike (October 2021)

- Market Pay: Acquisition of Dejamobile (September 2021)

- Entrust: Acquisition of Antelop Solutions (September 2021)

- PagoNxt: Acquisition of 70% of Mercadotecnia, Ideas y Tecnologia (September 2021)

- Prosus/PayU: Acquisition of BillDesk (August 2021)

- Brex: Acquisition of Weav (August 2021)

- Alta Pay: Acquisition of remaining 36.1% of Alta Banka (August 2021)

- Paysafe: Acquisition of SafetyPay (August 2021)

- Nexi: Acquisition of 51% of Alpha Bank's merchant acquiring business (August 2021)

- Paysafe: Acquisition of PagoEfectivo (August 2021)

- NCR: Acquisition of LibertyX (August 2021)

- Visa: Acquisition of Currencycloud (July 2021)

- Nomu Pay: Acquisition of Wirecard Payment Solutions Malaysia (July 2021)

- Nomu Pay: Acquisition of Wirecard Payment Solutions Hong Kong (July 2021)

- NIUM: Acquisition of Wirecard Forex India (July 2021)

- Rapyd: Acquisition of Valitor (July 2021)

Vertical integration:

- Visa: Acquisition of Tink (March 2022)

- SurePay: Cross-border confirmation-of-payee JV with SepaMail.eu and StreamMind (December 2021)

- Mastercard: Acquisition of Aiia (September 2021)

- Amex Ventures: (Undisclosed) equity investment in Plaid (August 2021)

- PayPal: Participation in US$250 million Series B funding round for VNLIFE (August 2021)

JVs:

- Mobily Pay: International money transfer JV MoneyGram (June 2022)

- Mastercard: E-commerce payments JV with HyperPay (May 2022)

- Network International: Middle East payments JV with Amazon Payment Services (February 2022)

- Nexi: Collection solutions JV with Fipe (February 2022)

- Mastercard: Egyptian onboarding, disbursement and collection partnership with Kashat (February 2022)

- Ripple: Cross-border payments partnership with Modulr (February 2022)

- Visa: Credit availability AI JV with Pagaya (January 2022)

- Huawei: NFC payments functionality JV with Curve (January 2022)

- Mastercard: Non-fungible token JV with Coinbase (January 2022)

- Pay360: Open banking JV with Ordo (January 2022)

- Mastercard: Payment cards JV with 11Onze (January 2022)

- Paysend: Weixin JV with Tencent (January 2022)

- Google Pay: Junior customers JV with Revolut (December 2021)

- Mastercard: Embedded working capital JV with Demica (October 2021)

- Flutterwave: Mobile money JV with MTN MoMo (September 2021)

- Mastercard: Spare change investment JV with EveryoneInvested (September 2021)

- Worldline: Sustainability-as-a-Service JV with ecolytiq (August 2021)

Service providers stockpile growth capital

Deal highlight:

White & Case advised Banc of America Strategic Investments Corporation, the venture capital arm of Bank of America, as lead investor in the US$20 million Series A funding round of Banked.

Deal highlight:

White & Case advised QIA on its US$200 million acquisition of a minority interest in Airtel Mobile Commerce, a subsidiary of London Stock Exchange–listed Airtel Africa.

91.1% of all eligible UK card transactions in 2021 were made contactlessly, with the total value of contactless payments made increasing by 40.2% year-on-year. (Finextra, January 2022)

Money laundering red flags have been indicated at more than 1/3 of UK-licensed electronic money institutions. (Financial Times, December 2021)

- Formance: Successful US$3.1 million pre-Seed funding round led by Hoxton Ventures, Frst and Y Combinator (June 2022)

- Param: Successful US$200 million Venture funding round led by EBRD, CEECAT Capital, Revo Capital and Alpha Associates (June 2022)

- SumUp: Successful €590 million Series E funding round led by Bain Capital (June 2022)

- kevin.: Successful US$65 million Series A funding round led by Accel (May 2022)

- Scalapay: Successful US$27 million Series B funding round extension led by Poste Italiane (May 2022)

- Paddle: Successful US$200 million Series D funding round led by KKR (May 2022)

- Paymob: Successful US$50 million Series B funding round led by Kora Capital, PayPal Ventures and Clay Point (May 2022)

- Modulr: Successful £83 million Series C funding round led General Atlantic (May 2022)

- Leatherback: Successful US$10 million pre-Seed funding round led by ZedCrest Capital (April 2022)

- Payaut: Successful €8 million Seed funding round led by Gradient Ventures (April 2022)

- Volume: Successful US$2.4 million pre-Seed funding round led by firstminute Capital (April 2022)

- Qonto: Successful €5 million crowdfunding round (April 2022)

- Super Payments: Successful US$30 million Venture funding round led by Accel Partners, Local Globe and Union Square Ventures (April 2022)

- Dapio: Successful US$3.4 million pre-Series A funding round led by Flutterwave and Techstars (March 2022)

- Modern Treasury: Successful US$50 million Series C funding round led by SVB Capital and Salesforce Ventures (March 2022)

- Softpay: Successful €5 million Seed funding round led by Brightfolk (March 2022)

- Dash: Successful US$32.8 million Seed funding round led by Insight Venture Partners (March 2022)

- SteadyPay: Successful US$5 million Series A funding round led by Digital Horizon (March 2022)

- Flutterwave: Successful US$250 million Series D funding round led by B Capital Group (February 2022)

- Payhawk: Successful US$100 million Series B follow-on funding round led by Lightspeed Venture Partners (February 2022)

- Stitch: Successful US$21 million Series A funding round led by The Spruce House Partnership (February 2022)

- Banked: Successful US$20 million Series A funding round led by Bank of America and Edenred Capital (February 2022)

- Rewire: Successful US$25 million Venture funding round led by Migdal Insurance (February 2022)

- Hubpay: Successful US$20 million Series A funding round led by Signal Peak Ventures (February 2022)

- GoCardless: Successful US$312 million Series G funding round led by Permira (February 2022)

- Global Processing Services: Successful US$400 million funding round led by Advent International and Viking Global Investors (January 2022)

- Checkout.com: Successful US$1 billion Series D funding round, with participation from Altimeter, Dragoneer, Franklin Templeton, GIC, Insight Partners, QIA, Tiger Global and the Oxford Endowment Fund (January 2022)

- CellPoint Digital: Successful US$25 million equity funding round led by Toscafund and Penta Capital (January 2022)

- Silverflow: Successful US$17 million Series A funding round led by Coatue Management (December 2021)

- Tipalti: Successful US$270 million Series F funding round led by G Squared (December 2021)

- Lydia: Successful US$103 million Series C funding round led by Dragoneers and Echo Street (December 2021)

- Enfus: Successful €45 million Series C funding round led by Vitruvian Partners (December 2021)

- Telr: Successful US$15 million Series D funding round led by Cashfree Payments (November 2021)

- Payhawk: Successful US$112 million Series B funding round led by Greenoaks (November 2021)

- MoonPay: Successful US$555 million Series A funding round led by Coatue Management and Tiger Global (November 2021)

- Ziglu: Successful £7.19 million crowdfunding round (November 2021)

- MFS Africa: Successful US$100 million Series C funding round led by AfricInvest FIVE (November 2021)

- Chipper Cash: Successful US$150 million Series C extension funding round led by FTX (November 2021)

- Qonto: Successful €486 million Series D funding round led by Tiger Global and TCV (November 2021)

- kevin.: Successful US$10 million Seed funding round led by OTB Ventures and Speedinvest (October 2021)

- Primer: Successful US$50 million Series B funding round led by Iconiq Growth (October 2021)

- Global Processing Services: Successful US$300 million investment from Advent International and Viking Global Investors (October 2021)

- TransferGo: Successful US$50 million Series C funding round led by Elbrus Capital and Black River Ventures (October 2021)

- Form3: Successful US$160 million Series C funding round led by Goldman Sachs (September 2021)

- Wave: Successful US$200 million Series A funding round led by Sequoia Heritage, Founders Fund, Stripe and Ribbit (September 2021)

- SurePay: Successful €12.2 million Venture funding round led by Connected Capital and Iris Capital (September 2021)

- Balance: Successful US$25 million Series A funding round led by Ribbit Capital (August 2021)

- WorldRemit: Successful US$292 million Series E funding round led by Farallon Capital, Leapfrog, TCV and Accel (August 2021)

- Opay: Successful US$400 million Series C funding round led by SoftBank Vision Fund II (August 2021)

- Rapyd: Successful US$300 million Series E funding round led by Target Global (August 2021)

- VNLife: Successful US$250 million Series B funding round led by General Atlantic and Dragoneer Investment Group (August 2021)

- Airtel Africa: Successful US$200 million investment from QIA (August 2021)

- Yoco: Successful US$83 million Series C funding round led by Dragoneer Investment Group (July 2021)

- Paystand: Successful US$50 million Series C funding round led by NewView Capital Management (July 2021)

Banks opt for partnership model

- Lloyds: Construction sector payments JV with ProjectPay (March 2022)

- First Abu Dhabi Bank: Disposal of 60% of Magnati to Brookfield Business Partners (February 2022)

- UniCredit: SoftPOS JV with Nexi (January 2022)

- Intesa Sanpaolo: JV with Elen to acquire Mooney (December 2021)

- National Bank of Greece: Merchant acquiring JV with EVO Payments (December 2021)

- BBVA: Cross-border payments partnership with Trusple (August 2021)

- Alpha Bank: Disposal of 51% of merchant acquiring business (August 2021)

Regulator intervention

- UK Payment Systems Regulator: Notice to card schemes of investigation into fee charged to merchants (April 2022)

- ECB: Extension of oversight framework for electronic payments to include stablecoins and other crypto-assets (November 2021)

Click here to download 'Financial institutions M&A: Sector trends — Other FS' PDF

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2022 White & Case LLP