Europe's consumer finance decacorns stumble as their valuations crumble.

Overview

Current market

We are seeing

-

Established banks:

-

Provide equity support for developing consumer finance providers (e.g., Crédit Mutuel Arkéa's participation in Younited Credit's €60 million venture funding round)

-

Provide lifeline debt support for established consumer finance providers (e.g., BNP Paribas' participation in Fluro's €200 million debt funding round and Barclays' participation in Liberis' £140 million debt funding round)

-

Hover up buy-now, pay-later providers (e.g., Mediobanca's acquisitions of HeidiPay Switzerland and Soisy)

-

Buy-now, pay-later providers at all stages of development still attract capital notwithstanding tightening VC purse strings:

-

Early-stage fundraisings (e.g., Tranch's US$100 million seed funding round)

-

Series B/C fundraisings (e.g., Tabby's US$58 million Series C funding round and Zilch's US$50 million Series C extension funding round)

-

Late-stage fundraisings (e.g., Klarna's US$800 million equity funding round)

-

Smaller consumer lenders seek scale through consolidations with competitors and partnerships

-

Consumer finance providers tap industrial-scale debt servicers to manage ballooning portfolios (e.g., PayPal's disposal of €40 billion French, German, Italian, Spanish and UK BNPL loans to KKR)

Key drivers/challenges

- Financial sponsor appetite continues—verticals which received most interest in the last 12 months were BNPL, embedded finance and mortgage lending

- Market conditions have differing impacts on consumer lenders:

- Cost of living crisis materially increased borrower appetite for BNPL products (e.g., UK shopper BNPL utilisation increased by more than 10%)

- Soaring mortgage interest rates materially decreased borrower appetite for housing loans (e.g., eurozone demand for housing loans fell by 74%)

- Buy-now, pay-later platforms turn to interest-bearing lending through BigTech (e.g., vaIU's partnership with Amazon Egypt)

- Consumer finance providers consolidate with competitors in search of:

- Expanding licencing footprint (e.g., Scalapay's acquisition of Cabel IP)

- Conquering niches (e.g., Acorns' acquisitions of GoHenry and Pixpay)

- Enhancing geographic reach (e.g., Remity's acquisition of Rewire and ColCap's acquisition of 80% of Molo)

- Broaden product suite (e.g., Zopa's acquisition of DivideBuy and SoFi Technologies' acquisition of Wyndham Capital Mortgage)

- Deeper customer penetration (e.g., Schufa's acquisition of Forteil)

Trends to watch

- Growing pressure on consumer lenders to deliver profitability in order to attract PE/VC financial support

- Increasing focus of regulators on:

- BigTech's entry into consumer finance (e.g., UK FCA's study into BigTech's entry into financial services)

- Consumer duty obligations and potentially harmful lending practices (e.g., UK FCA proposed new measures for marketing financial products (including BNPL) and launched its new Consumer Duty rules)

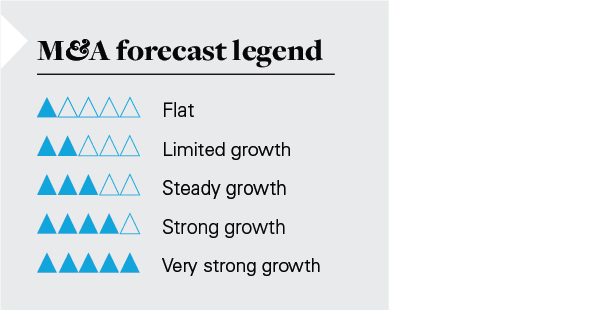

Our M&A forecast

Market conditions to continue to have a polarising impact on viability of lending models—rising interest rates are likely to dampen appetite for mortgages while consumer appetite for BNPL/POS offerings are likely to rise. However, borrower reliance is often accompanied by tighter and more invasive regulation.

Other financial services—Publicly reported deals & situations

Healthy buyer/investor appetite

Deal highlight:

White & Case advised Zip on the AUD 8 million sale of Payflex Poprietary to FeverTree Finance.

Strategics:

- Cassa Centrale Banca (Online consumer lending): Acquisition of Prestipay (June 2023)

- Mediobanca/Compass (BNPL): Acquisition of HeidiPay Switzerland (June 2023)

- Crédit Mutuel Arkéa/Confidis (Online consumer lending): Acquisition of Magyar Cetelem Bank (May 2023)

- FeverTree Finance (Consumer finance): Acquisition of Payflex Proprietary (March 2023)

- Eurobank Bulgaria (Consumer finance): Acquisition of BNP Paribas Personal Finance Bulgaria (December 2022)

- Mitsubishi UFJ Financial Group (Consumer finance): Acquisition of Home Credit Group's Filipino and Indonesian businesses (November 2022)

- Mediobanca/Compass (BNPL): Acquisition of Soisy (October 2022)

- BNP Paribas (Consumer credit): Participation in €200 million debt funding round for Fluro (October 2022)

- Cembra Money Bank (BNPL): Acquisition of Byjuno and Intrum Finance Services (September 2022)

- Nationwide (PropFinance): Minority equity investment in Kettel Homes (July 2022)

PE/VC:

- Soma Capital and FoundersX (BNPL): Participation in US$100 million Seed funding round for Tranch (January 2023)

- Sequoia Capital India (BNPL): Participation in US$58 million Series C funding round for Tabby (January 2023)

- Atalaya Capital Management and Partners for Growth (BNPL): Participation in US$150 million debt funding round for Tabby (August 2022)

- IAG Silverstripe (Mortgage lending): Participation in £35 million Series A funding round for Perenna (August 2022)

Smaller lenders consolidate market share

Demand for housing loans in the eurozone fell at a net percentage of minus 74%, the fastest pace on record. Finextra (February 2023)

BNPL payments increase more than 10% as cost of living hits UK shoppers. Finextra (February 2023)

Demand for BNPL deals has surged among all age groups in the UK, including older people, who find themselves squeezed by the cost of living crisis. Financial Times (January 2023)

- SaveLend Group (Marketplace lending): Acquisition of Lendify (April 2023)

- SoFi Technologies (Mortgage lending): Acquisition of Wyndham Capital Mortgage (April 2023)

- Acorns (Children's financial education): Acquisition of GoHenry (April 2023)

- Acorns (Children's financial education): Acquisition of Pixpay (April 2023)

- ColCap (Buy-to-let mortgages): Acquisition of 80% of Molo (March 2023)

- Groupe Meilleurtaux (Consumer credit): Acquisition of MiD Finance (March 2023)

- Scalapay (BNPL): Acquisition of Cabel IP (March 2023)

- Zopa (BNPL): Acquisition of DivideBuy (February 2023)

- Schufa (Consumer credit): Acquisition of Forteil (December 2022)

- Remity (Migrant worker finance): Acquisition of Rewire (August 2022)

- valU (Consumer credit): Acquisition of Paynas (August 2022)

Smaller lenders stockpile lending firepower

Deal highlight:

White & Case advised Klarna on its US$800 million Equity round, at a post-money valuation of US$6.7 billion.

- M-Kopa (Consumer credit): Successful US$55 million funding round led by Sumitomo Corporation (May 2023)

- Tranch (BNPL): Successful US$100 million seed funding round led by Soma Capital and FoundersX (January 2023)

- Tabby (BNPL): Successful US$58 million Series C funding round led by Sequoia Capital India (January 2023)

- Younited Credit (Consumer credit): Successful €60 million Venture funding round led by Eurazeo, Crédit Mutuel Arkéa, Bpifrance and Goldman Sachs (December 2022)

- Fluro (Consumer credit): Successful €200 million debt funding round led by BNP Paribas (October 2022)

- Liberis (Embedded finance): Successful £140 million debt funding round led by Barclays and BCI Finance (September 2022)

- Tabby (BNPL): Successful US$150 million debt funding round led by Atalaya Capital Management and Partners for Growth (August 2022)

- Perenna (Mortgage lending): Successful £35 million Series A funding round led by IAG Silverstripe (August 2022)

- Zilch (BNPL): Successful US$50 million Series C extension funding round led by Ventura Capital (June 2022)

- Klarna (BNPL): Successful US$800 million Equity funding round led by the existing main shareholders (July 2022)

- Kettel Homes (Mortgage lending): Successful equity investment from Nationwide (July 2022)

Partnership model

Buy-now, pay-later platforms turn to interest-bearing lending via bank partners. As rising funding costs bite into the margins of interest-free BNPL products, leading players are increasingly leaning on interest-bearing loans. S&P Global (March 2023)

FCA commences study into Big Tech entry into financial services. FCA warns that Big Tech companies’ expansion into payments, lending and other financial products could harm competition. S&P Global (October 2022)

- Zilch (BNPL): Partnership with StepChange (February 2023)

- MoCo (Mortgage lending): Mortgage lending JV with An Post (August 2022)

- vaIU (BNPL): BNPL partnership with Amazon Egypt (July 2022)

Consumer finance providers tap industrial-scale debt servicing

Sellers:

- PayPal (France, Germany, Italy, Spain and UK): Disposal of €40 billion European BNPL loans to KKR (June 2023)

Acquirers:

- KKR (France, Germany, Italy, Spain and UK): Acquisition of €40 billion European BNPL loans from PayPal (June 2023)

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2023 White & Case LLP