For further information, please visit the White & Case Coronavirus Resource Center.

As part of our periodic updates, here is an overview of recent developments of relevance to participants in the real estate finance market across certain key jurisdictions in Europe.

Europe

COVID-19

We hope all our readers and their families and friends are safe and well. With many of us seeing loosening of lockdown restrictions and awaiting our vaccines, we all continue to support our respective client and business needs. For our borrower and lender clients, we are aware of hardship caused by COVID-19 on businesses and their ability to service new and existing loans. With some companies faring well during this time (see here for our thought leadership piece on how the European leveraged finance market remains resilient after a year of hardship) and the leisure and hospitality sectors continuing to be negatively affected (see here), governments across Europe continue to provide assistance through fiscal stimulus and liquidity measures to help companies that need assistance.

In most European countries, these measures extend into the real estate finance markets, especially with measures such as mortgage payment holidays, a hiatus on the serving of eviction notices for rental properties and an inability for landlords to forfeit business leases due to non-payment of rent for a period of time, continuing to apply to date. Government policies aside, lenders are also working with their clients to offer alternative solutions, such as covenant waivers, release of cash to meet operating needs and seeking to accommodate amendments to leases, including for the use of turnover rents. However, lenders are inevitably also readying themselves for a rise in non- performing loans and making provisions for these, where appropriate, for when government support ends or sponsor support is exhausted.

Further information on the response to COVID-19 can be found here, and we also have a German-language article, available here, looking at the impact on commercial leases.

LIBOR Discontinuation

Much has happened in the world of LIBOR Discontinuation since our last update.

In terms of documentation, most notably, the sterling working group published its conventions for the loan market in September 2020. Since then, the LMA has published exposure drafts of rate switch agreements (which allow for lenders to provide LIBOR loans, which switch to risk-free rates on the occurrence of a pre-agreed date or trigger event); as well as exposure drafts for use when providing new risk-free rate loans. As we see market participants familiarising themselves with these drafts and the sterling working group's conventions, we are seeing an increased number of bilateral and syndicated deals, including in the real estate finance market.

In markets that predominately provide euro loans, we continue to see the use of EURIBOR (although €STR is now used in place of EONIA, where relevant). At present, there is no suggestion that EURIBOR will be discontinued, so that approach continues to be workable. In fact, in February, the European Money Markets Institute, the administrator of EURIBOR, posted the outcome of its review of the EURIBOR calculation methodology, following the passing of a year since the introduction of its hybrid calculation methodology. It concluded that, aside from some minor adjustments (which it will implement by 19 April) that would help improve representativeness, the benchmark remained robust, resilient and representative of underlying markets.

The most notable announcement in the market, however, was from the FCA on 5 March 2021, when it made a public announcement on the future cessation and loss of representativeness of LIBOR. The announcement follows a consultation launched by the administrator of LIBOR, ICE Benchmark Administration (IBA), back in December. The announcement stated that: a cessation date of 31 December 2021 has been set for all Euro LIBOR settings; all Swiss Franc LIBOR settings; the Spot Next, 1-week, 2-month and 12-month Japanese Yen LIBOR settings; the overnight, 1-week, 2-month and 12-month Sterling LIBOR settings; and the 1-week and 2-month US dollar LIBOR settings; with a cessation date of 30 June 2023 set for overnight and 12-month US dollar LIBOR settings. The FCA has confirmed that it intends to consult on synthetic LIBOR rates for 1-month, 3-month and 6-month LIBOR settings for US dollar, Japanese Yen and Sterling, but these will be considered "unrepresentative" from 31 December 2021 (in the case of Japanese Yen and Sterling) and 30 June 2023 (in the case of US dollar). This announcement means that a "Rate Switch Trigger Event" will have occurred under the LMA exposure drafts, although "Rate Switch Trigger Event Dates" will be as per the dates above. For legacy loans containing the more recent versions of the LMA's Replacement of Screen Rate clause, this announcement should see the consent thresholds lowered to that set out in their documentation (Parent and Majority Lenders, in most cases).

For the SONIA market, the next key target date is for all new issuances of sterling LIBOR-referencing loan products that expire after the end of 2021 should cease by the end of Q1 2021, with the legacy book to be reduced thereafter. With its recognition that loan market participants need to put relevant operating systems in place before this transition can occur, the LMA documentation (expected to become recommended forms before this deadline) provides welcome certainty for the market at this time.

Brexit

After last minute trade negotiations kept the UK and EU member states on tenterhooks in December, the transition period ended on 31 December 2020, with the EU-UK Trade and Cooperation Agreement concluded on 24 December 2020. This avoided a no-deal Brexit scenario and secured zero tariffs and quotas for trade in goods between the EU and UK. However, it still left some points unresolved. Further details on the agreement can be seen here.

For the real estate finance market, one of the main issues readers will have wanted a quick and efficient resolution on was 'passporting'. The EU passporting system in place for banks and financial services companies enabled firms that are authorised in any EU or EEA state to trade freely in any other with minimal additional authorisation. Certain EU legislation provides for third country regimes, which allow non-EU based firms (such as the UK) to offer a limited number of services into the EU if their home country's regulatory regime is accepted by the EU as being 'equivalent' to EU standards. Unfortunately, the area of financial services was left unresolved by the EU-UK Trade and Cooperation Agreement, with no so-called 'equivalence' decisions adopted. This means that access to the EU financial services market for UK service providers is therefore no longer possible under EU passporting rights, and UK service providers can only provide such services in the EU if they have relocated relevant businesses to the EU. A Joint Declaration on Financial Services Regulatory Cooperation is expected in due course, however, which will cover cooperation on financial services. Further information on this is available here. Further materials on other Brexit related topics can be found here.

Belgium

Corporate income tax reform

Since major corporate income tax reform was enacted at the end of 2017, numerous modifications have been made, alongside further developments by way of Royal Decree. These include, among others, changes to the corporate income tax rate and base, the Belgian holding regime, withholding tax and anti-'tax avoidance' directives.

Most notably, the corporate income tax rate was reduced gradually to a nominal rate of 25% in 2020 for non-small and medium sized enterprises ("SME"). Some small and medium enterprises benefit from a further reduction to 20% on the first €100,000 of their income, but pay 25% thereafter.

Changes were also made to the tax treatment of capital gains on shares. The exemption for capital gains on shares was aligned with the 'dividends received' deduction, meaning the minimum threshold requirement of either 10% or EUR 2,500,000 acquisition value was therefore extended to capital gains on shares. Similarly, limitations to the 'dividends received' or 'participation' deduction were also applied to the capital gains exemption. The minimum capital gains tax on shares of 0.412% that was applicable to non-SMEs qualifying for the participation exemption was abolished. Similarly, the separate tax rate of 25% on capital gains that are realised on shares within the one- year holding period was abolished as of 2020.

Lease management

The Belgian government has not yet legislated regarding the obligation to pay rents related to commercial leases during COVID-19, even though courts are required to provide rulings on this point.

On 30 October 2020, the Judge of Peace of Etterbeek ruled in favour of a commercial tenant who had not paid rent due during the first lockdown period, on the basis that the landlord failed to fulfil his obligation to provide the tenant with peaceful enjoyment of the leased premises.

Other judges have, however, rendered contradictory judgments in that regard. The situation therefore remains uncertain.

Belgian Companies Code

The Belgian Code on Companies and Associations (the "BCCA"), enacted by the Belgian parliament on 28 February 2019, repeals the existing Belgian Companies Code (the "Current BCC"). The BCCA aims at modernising and simplifying company law in order to make Belgium more attractive for both domestic and foreign businesses.

Key changes are that some company forms, such as the Comm.VA/SCA, (i.e., partnership limited by shares), have been abolished (as a consequence of which Real Estate Investment Trusts, which choose that legal form, will now need to be converted into a public limited liability company (NV/SA); the BVBA/SPRL (i.e., private limited liability company) have been abolished; the BVBA/SPRL has been rebranded as BV/SRL and becomes the standard form for non-listed companies with limited liability; both the BV/SRL and the NV/SA can have a single founder or shareholder; the registered office will be the only relevant factor to determine the applicable company law and non- profit organizations are now permitted to pursue profit-making activities, provided that the profits are not distributed to members or directors.

The BCCA will offer more flexibility to Belgian companies, but require them to amend their articles of association and bring them in line with the provisions of the BCCA by 1 January 2024.

The enactment of the BCCA has various (positive) implications on Belgian financing transactions, both for borrowers and lenders: (i) allowing private limited liability companies (BV/ SRL) to provide for the free transfer of shares in their articles of association (and thus avoiding the need to amend the articles of association to allow for a free transfer of shares in case of enforcement of a pledge over shares); (ii) simplifying the corporate approval process by allowing board decisions to be made by unanimous written resolutions (unless the articles of association provide otherwise); and (iii) clarifying and simplifying the conditions which allow for financial assistance to be given.

Germany

'StaRUG' – New German restructuring tool

1 January 2021 saw the launch of German legislation aimed at transposing the EU's Preventive Restructuring Directive into local law. Introducing a number of changes to the restructuring and insolvency regime in Germany, its most notable restructuring mechanism is the 'Framework for the Stabilisation and Restructuring of Companies', otherwise known as 'StaRUG'.

Comparable to the English law Scheme of Arrangement (and other recent tools made available under the English Corporate Insolvency and Governance Act 2020), under this new German tool, a company can be restructured, provided the consent of 75% of the respective creditor groups is obtained. Prior to the introduction of StaRUG, out-of-court restructurings in Germany (other than the restructuring of German law-governed bonds) generally required unanimous approval by all affected creditors. StaRUG also provides for a cross-class cram-down mechanism, such that a dissenting class can be "crammed down", if (i) the majority of classes vote in favour of the restructuring plan; (ii) members of the dissenting class can be expected to be in a position that is not worse than without the restructuring plan; and (iii) members of the dissenting class receive an adequate share in value created by the restructuring plan. The process can be used where a company is facing liquidity issues, but is not yet required to initiate formal insolvency proceedings.

Further information on this is available here.

Electronic securities

On 16 December 2020, draft legislation on the introduction of electronic securities was adopted by the German Federal Cabinet, with the aim of modernising securities law in Germany and strengthening Germany's position as a financial centre. German law previously required financial instruments that qualify as securities to be in physical form. This new legislation enables the issuance of German-law debt securities in purely electronic form as well as the issuance of crypto-securities enabling the implementation of distributed ledger technology-based instruments – as a first step the draft legislation is limited to electronic securities in the form of bearer bonds (Inhaberschuldverschreibungen) and share certificates (Anteilsscheine).

Under this new system, electronic securities are to be registered in a central register maintained by a central securities depository or custodian subject to technical security and data compliance standards if authorised expressly in text form. Electronic securities can be registered in collective or single entry form. The registered holder of an electronic security in single entry form is presumed to be the owner of that security. Registered holder of an electronic security registered in collective entry form will be the operator of the respective register, making it a digital version of a global certificate. Crypto-securities, on the other hand, are created by entering into a decentralised crypto-securities register. The entity responsible for maintaining the register will be subject to mandatory licensing. In absence of a designation, the obligation reverts to the issuer.

The register will replace the securities certificate; however, the legal structure of the acquisition remains the same. Property ownership regulations will therefore apply in full, and will provide the owners of electronic securities with the same protection as the owners of certified securities. It should also be noted that these changes in law introduce an additional option for the issuance of securities and does not replace the current legislation. Accordingly, the issuance of securities in traditional physical form will continue to be a viable option.

Luxembourg

DLT and issuance of dematerialised securities

On 26 January 2021, the law of 22 January 2021 modifying the Law of 5 April 1993 on the financial sector and the Law of 6 April 2013 on dematerialised securities (the "Law of 2021"), entered into force with the aim of modernising the existing legal framework for dematerialized securities, notably by: (i) explicitly recognising the possibility of using secure electronic registration mechanisms, including distributed ledger technology ("DLT"), to record the issuance of dematerialised securities. The Law of 2021 constitutes a continuation of the Luxembourg Act, dated 1 March 2019, which already recognised the use of DLT in the context of the circulation of securities. The entire issuance and circulation process can thus now occur in a DLT-based environment; and (ii) opening the role of the central account keeper with respect to unlisted debt securities to EU credit institutions and investment firms (provided that they meet specific organisational and technological criteria).

The Law of 2021 made no amendment to the security regime for dematerialised securities, such that pledges over shares in dematerialised form require recording in a securities account.

Commercial and residential lease arrangements

Certain temporary measures are currently in place as a result of COVID-19: (i) Suspension of eviction orders: the law of 19 December 2020 suspended eviction orders in respect of leases for residential uses until 31 March 2021; and (ii) Freeze on rent increases: the Luxembourg government decided on a temporary freeze on all rent increases for all residential leases until 30 June 2021.

At the beginning of the health crisis, a draft law was considered to temporarily suspend the obligation to pay rent related to commercial leases. However, this bill was not successful.

In two first instance court rulings rendered on 13 and 14 January 2021, the District Court of Luxembourg (Tribunal de Paix) ruled in favour of commercial tenants who had not paid their rents during COVID-19, on the basis that the period of closure during the lockdown constituted a temporary case of force majeure depriving the tenant of his right to peaceful enjoyment of the leased property in accordance with the purpose intended by the parties.

Spain

New Spanish Insolvency Act has entered into force

On 1 September 2020, the new Spanish Insolvency Act (Real Decreto Legislativo 1/2020, de 5 de mayo, por el que se aprueba el texto refundido de la Ley Concursal) entered into force. This new Spanish Insolvency Act is a recast version of the previous law, as the Spanish Parliament decided that the content of the former law should be reorganised and clarified after successive amendments thereto were scattered throughout its text. Even though the new Spanish Insolvency Act does not diverge from the previous Spanish insolvency regime, it now includes certain insolvency case law already in place.

The introduction of new article 152 is an example of the benefits of embedding case law in the Spanish Insolvency Act. This new article includes, for the first time, the regulation of secured claims interest accrual after an insolvency. This article sets forth what was already determined by the Spanish Supreme Court: that only default interest accrued (and falling within the scope of the "secured obligations" agreed in the mortgage) before the insolvency declaration is secured, as we explained in one of our previous alerts, available here.

Catalonian regional law accepts second-ranking pledges

Historically, Catalonian regional law has banned the creation of successive pledges over collateral already subject to a first-ranking lien. This circumstance impacted the structure of security packages and the choice of law when Catalonian regional law applies.

In its previous wording, the Catalan Civil Code prohibited successive pledging of collateral, unless it was done in favour of the same creditors who were the beneficiaries of the first-ranking pledge, and provided that distribution of the liability for the secured obligations was made. In practice, this meant that it was not possible to create second-ranking and successive pledges over collateral subject to the Catalan Civil Code, which obliged the parties to seek alternatives to comply with this restriction.

Regional Catalonian Law 5/2020, of 29 April 2020, approved new wording for this rule and put an end to this limitation by expressly permitting the successive pledges, unless otherwise agreed.

This amendment follows a previous attempt of the Catalonian government, who had approved the Regional Catalonian Decree Law 9/2019 in 2019. However, that was not validated by the Catalonian Parliament and, consequently, it was repealed only one month later.

Tax amendments

A range of tax changes, including rises in, among others, Personal Income Tax, Corporate Income Tax and Net Worth Tax, were introduced under the National Budget Law for 2021, in force since 1 January 2021.

In relation to Corporate Income Tax, the most notable amendment relates to the exemption on dividends and income (gains) from the transfer of securities representing the equity of legal entities, which has now been reduced from the previous full exemption to a limited 95% exemption, thus resulting in an effective tax rate of 1.25%. The wording of the new rule is generally interpreted as cumulatively applying in respect of chains of participated entities. For this exemption to apply, among other requirements, a minimum direct or indirect 5% stake in the capital or equity of the subsidiary must have been held. Note that, previously, this 5% minimum participation requirement was deemed to be complied with if the investment´s acquisition value exceeded €20 million whereas, according to the new rules, such €20 million threshold has been eliminated (though with a transitory period) with the 95% dividend exemption not being in the future available to investments under 5% of the subsidiary´s equity regardless of the acquisition value of the investment.

The above reduction of the exemption will not apply, subject to compliance with certain requirements, to dividends received by entities whose annual turnover corresponding to the previous year is below €40 million, where such dividends are distributed by an entity incorporated after 1 January 2021 and the dividends are collected in the three years immediately following such incorporation.

Where, alternatively, the foreign tax credit mechanism, rather than the exemption mechanism, is applied on dividends received by Spanish companies, the amount of dividends to be considered for the purposes of calculating the limit of Spanish taxes applicable must, similarly, now be reduced by 5% (except in the case of dividend recipient entities whose annual turnover is below €40 million under similar conditions, as explained above in respect of the dividend exemption).

Finally, in the same context, 5% of dividends received from controlled foreign corporations (in respect of income previously allocated for taxation under Spain´s CFC rules) will now be taxable (except in the case of dividend recipient entities whose annual turnover is below €40 million under similar conditions, as explained above).

In the field of Non Residents´ Income Tax, the law has been amended to extend the existing exemption of interest and capital gains on movable goods applicable to EU residents not operating in Spain through a permanent establishment to European Economic Space residents, subject to the existence of an effective exchange of information mechanism between Spain and their countries of residence. As anticipated, further changes have been introduced in relation to Transfer Tax and Stamp Duty with the tax rate for transfers and rehabilitation of titles of nobility and grandeeships being increased by 2%. The tax on insurance premiums has also been increased from 6% to 8%. Finally, the VAT rate applicable to certain sugared drinks has been raised from 10% to 21%.

Sweden

Reintroduction of temporary discount for fixed rental costs in vulnerable sectors

We informed you in our previous alert (available here), that, last year, as a way of mitigating the financial consequences of COVID-19, the Swedish Government adopted an ordinance providing for a discount on fixed rental costs in vulnerable sectors. This covers, for example, retailers, logistical activities, restaurants as well as the organisation of congresses/ fairs; and consumer services such as dentists, physiotherapist practices and hair and beauty salons. There is a proposal to reintroduce such an initiative, allowing landlords who reduce fixed rents for tenants in these vulnerable sectors during the period of 1 January 2021 to 31 March 2021 to receive compensation for 50% of the rent reduction. In other respects, the rent rebate scheme will be the same as the previous initiative described in our previous alert.

No legislative changes have been adopted to date to reintroduce a temporary discount for fixed rental costs in vulnerable sectors. As this is a matter of state aid, the initiative must first be approved by the European Commission.

United Kingdom

Ban on forfeiture and commercial rent arrears recovery

The Coronavirus Act 2020 contained a moratorium on commercial landlords exercising forfeiture rights for non- payment of rent or other sums due, in place since March 2020, which has subsequently been extended until 31 March 2021. Landlords are also prevented from presenting winding-up petitions. Forfeiture will remain available as an enforcement method in respect of breaches other than non-payment of rent. This remains subject to landlords complying with the statutory restrictions of service of a notice under section 146 of the Law of Property Act 1925 and giving the tenant a reasonable period of time to remedy the breach(es). It is worth noting that commercial tenants in Northern Ireland and Scotland have different protections.

During this period of hardship, the government's recommendations for dealing with issues related to rental payments are set out in the Code of Practice for commercial property relationships during the COVID-19 pandemic. The Code acknowledges the hardship COVID-19 caused for businesses and therefore encourages landlords and tenants to enter into discussions to ensure that otherwise viable businesses can continue occupation through the period of recovery. Overall, transparency and openness is encouraged, and examples of concessions are set out.

Leasehold reform

In July 2020, the Law Commission produced three reports in relation to the future of home ownership, providing recommendations on how to overhaul laws relating to leasehold ownership of houses and flats, including lease extensions and ground rents. The overall aim of the reports was to improve the leasehold system to promote transparency and fairness in the residential leasehold sector and provide a 'better deal' for leaseholders. It also suggested ways of improving the take-up of the commonhold ownership model (which, to date, has not been popular). Commonhold ownership, introduced in 2002, allows residents of a building to own the freehold of their individual flat, or "unit", and manage the shared areas through a company. Under this model, no ground rent is payable and the homeowner has greater control. The Law Commission has recommended removing the requirement that conversion to commonhold requires unanimous agreement of leaseholders, with protections for those who have not consented. They say developers should be allowed to use commonholds in complex development, so they can respond to the changing needs of the site as the building progresses.

In January, Robert Jenrick, the Housing Secretary, announced long-awaited proposals in this area. Firstly, that leaseholders of residential properties will be given the right to extend their leases for up to 990 years, at zero ground rent. Further, new retirement leasehold properties must have zero ground rent. The proposed changes would apply in England and Wales only. Some critics have suggested leaseholders might find that, rather than paying a ground rent to a landlord over the lifetime of their lease term, they will simply have to pay this money to the landlord upfront (as landlords themselves will still require some form of compensation). To counteract that to some extent, the government have also suggested that a cap will be introduced on the amount payable when a leaseholder chooses to either extend their lease or become a freeholder. Separately, to improve uptake of the commonhold model, a Commonhold Council (which would include industry experts) will be established to prepare homeowners and the market for a transition to the commonhold model and away from leasehold. Legislation to this effect will be tabled at Parliament and is expected to be passed by late summer.

Corporation tax rise and Capital Gains Tax review

The Chancellor presented his 2021 budget on 3 March, with the main point to note for our clients being the increase in corporation tax rates from 19% to 25% for profits exceeding £250,000, applying from the 2023 financial year. Further information on this is available here.

Capital gains tax was also expected to feature in the budget. Capital Gains Tax ("CGT") rates are currently lower than income tax rates (up to 45%). For individuals (as well as private equity funds which hold assets through UK holding structures, for example) capital gains are taxed at between 10 and 28%, subject to an annual exemption. Although CGT represents only about 1% of annual tax revenue, in July 2020, the Office of Tax Simplifications ("OTS") were instructed to conduct a review of CGT. The OTS published its first of two reports ("Simplifying by Design") in November 2020.

The OTS recommended CGT rates should be more closely aligned with income tax rates, and if this was implemented, it should (i) consider relief for inflationary gains, (ii) consider the interactions with the tax position of companies and (iii) consider allowing a more flexible use of capital losses. If CGT and income tax rates were not to be aligned, recommendations included reducing the number of CGT rates (currently 4) and basing those CGT rates on the level of a taxpayer's income.

The OTS recommends reducing the annual exemption (£12,300 for the 2020-21 tax year) and instead considering the introduction of broader exemptions for certain classes (e.g., personal chattel sales). Separately, currently, investors' relief and business asset disposal relief together reduce CGT payable on a disposal to effectively 10% for the first £1 million on the sale of a business. The OTS has suggested abolishing investors' relief in its entirety and urged the government to consider replacing business asset disposal relief.

However, given that this year's budget has concentrated on overcoming COVID-19, the above issues were not dealt with as part of this year's budget.

Stamp duty holiday and surcharge for overseas purchasers

Whilst a stamp duty land tax ("SDLT") holiday exists between 8 July 2020 and 30 June 2021, providing complete or partial relief from stamp duty on the purchase of residential property for residents, overseas investors in residential real estate in England and Northern Ireland should note, that from 1 April 2021, an additional 2% surcharge in SDLT for non-resident buyers will arise which would apply across all SDLT rates. The intention of introducing the surcharge is to help make house prices more affordable to UK nationals, helping people get onto and move up the housing ladder in line with wider objectives on homeownership. It therefore does not apply to commercial dwellings.

The surcharge will be incurred where all of the following are satisfied: (i) one of the purchasers is non-resident in the UK; (ii) a major interest in a dwelling is the main subject matter of the transaction (although there are exceptions for short leaseholds (21 years or less) and property subject to a long lease (with a remaining term of more than 21 years)); and (iii) the price (chargeable consideration) is £40,000 or more. It is worth noting that buildings such as hotels, hospitals and student accommodation, for example, do not count as 'dwellings', as these are for commercial use.

Where contracts are exchanged prior to 11 March 2020 but complete or are substantially performed on or after 1 April 2021, transitional rules may apply. Transitional rules may also apply where a contract is substantially performed on or before 31 March 2021 but does not complete until 1 April 2021 or later. Additional rules have been set for trusts.

DAC 6

The European Union (EU) adopted certain Directives (known as "DAC6") which introduce additional reporting requirements in respect of potentially aggressive tax arrangements. DAC6 requires disclosure to the relevant tax authority of all arrangements (i) with an EU cross-border element (i.e., arrangements involving an EU member state and the UK, for example); (ii) where the arrangements fall within certain "hallmarks"; and (iii) in certain instances where the main or expected benefit of the arrangement is a tax advantage. Primarily, the reporting obligation lies with the EU intermediary that designs, promotes, or implements the arrangement (e.g., professional advisers such as law firms and accountants, and others such as lenders and fund managers etc.).

The UK transposed DAC6 into domestic law; however, this was significantly amended on 31 December 2020 to narrow the scope of mandatory reporting within the UK by removing a significant number of the "hallmarks" that applied. The only two hallmarks which will continue to apply in the UK relate to cross-border arrangements which (i) may have the effect of undermining reporting obligations; or (ii) involve non-transparent beneficial ownership structures. The effect is that DAC6 reports will be required more rarely from intermediaries or taxpayers in the UK. The change will apply to both historic and future cross- border arrangements. However, it should also be noted that in December 2020, the Chartered Institute of Taxation published an update announcing that, according to a letter from HMRC, the UK will consult on and implement the Organisation for Economic Co-operation and Development's (the OECD's) Mandatory Disclosure Rules (the MDR) to replace DAC6, and thereby transition from EU to international rules on tax transparency. Further guidance on this is pending.

Appointment of process agents

In the case of Banco San Juan v Petroleos [2020] EWHC 2145 (Comm), where a borrower had failed to comply with its contractual obligations to appoint a process agent and the lender appointed an agent on its behalf, the High Court interpreted the language in two separate facilities agreements such that this was permitted. It was therefore held that proceedings were properly served on the borrower by service on the lender- appointed process agent.

Looking a little further into the details of the case, as is standard in loan documentation seen in Europe, the defendant was obliged to appoint a process agent to be an "authorised" agent for service of proceedings in England. Under the terms of the facilities agreements, if for any reason the process agent ceased to be such an agent, then the defendant was obliged to appoint a new agent. If the defendant failed to comply with its obligation, the lender was permitted to appoint an agent for service of process. The claimant therefore appointed a process agent under the identical provisions in both facilities agreements and served two sets of proceedings on the defendant. The defendant argued it had not been properly served with the claims under either facility agreement, as the bank's appointment could not be of the defendant's "authorised" agent, and that it was otherwise "unfair" for it to be encumbered with an agent not of its choosing.

The court ruled in favour of the claimant bank. In relation to the first facilities agreement, the court construed "authorised" in to mean authorised by that agreement, as the defendant's argument would otherwise negate the bank's rights. In relation to the second facilities agreement, the court ultimately adopted an "appropriately purposive construction" to not "deprive the clause of its intended benefit", as otherwise the defendant could frustrate the operation of the clause by failing to appoint an original process agent. The court found no unfairness, as the defendant simply needed to comply with its contractual obligation to appoint its own process agent to avoid a situation where it is encumbered with an agent of the bank's choosing.

Exclusion of liability on an enforcement sale

In the case of CNM Estates (Tolworth Tower) Ltd v VeCREF I Sarl and Others [2020] EWHC 1605 (Comm), the court was required to consider the exclusion of the equitable duty imposed on mortgagees to exercise reasonable skill and care in carrying out their functions (including to act in good faith and achieve the best price reasonably obtainable when selling charged assets). Generally speaking, the mortgagee does not discharge his duty by appointing an agent to conduct the sale. However, receivers can incur liability in the same way when selling charged assets on behalf of mortgagees, and subject to the contractual structure in which their powers are contained. Parties can also exclude or limit the equitable duty by express agreement.

In this case, 'CNM' entered into two loan agreements, a debenture and intercreditor agreement ("ICA"), to finance the acquisition of Tolworth Tower, secured by fixed charges over the development site. When CNM defaulted on its payments under the loans, the security agent appointed receivers to sell the development site. CNM claimed the receivers negligently failed to achieve the best price obtainable, in breach of their equitable duty. At the preliminary trial, the court considered the exclusion clauses in the ICA and debenture and placed reliance on previous case-law. This first of these stated that exemption clauses excluding liability for negligent discharge of the equitable duty must be expressly conferred and will be strictly construed (Bishop v Bonham [1988] 1 WLR 743). The second was the case of Canada Steamship v The King [1952] AC 192, which said that if the clause clearly and unambiguously exempts a party from liability for negligence, the court should give effect to that provision. However, if the clause is ambiguous, the court should consider whether the words used are wide enough, given their ordinary meaning, to exclude negligence.

Looking at the debenture and the ICA against that case-law, the court ultimately concluded that, whilst an equitable duty was owed under the documentation (i.e., had not been excluded), the documentation made clear that breaches of that duty are only actionable where the facts which give rise to those breaches involve gross negligence or wilful misconduct. This case highlights the importance of carefully drafting exclusions of liability.

Click here to download European Real Estate Finance: Market Update – Q1 2021 (PDF)

Please visit our LIBOR hub for further information

Brendon Vyas (White & Case, London) contributed to the development of this publication.

This publication is provided for your convenience and does not constitute legal advice. This publication is protected by copyright.

© 2020 White & Case LLP

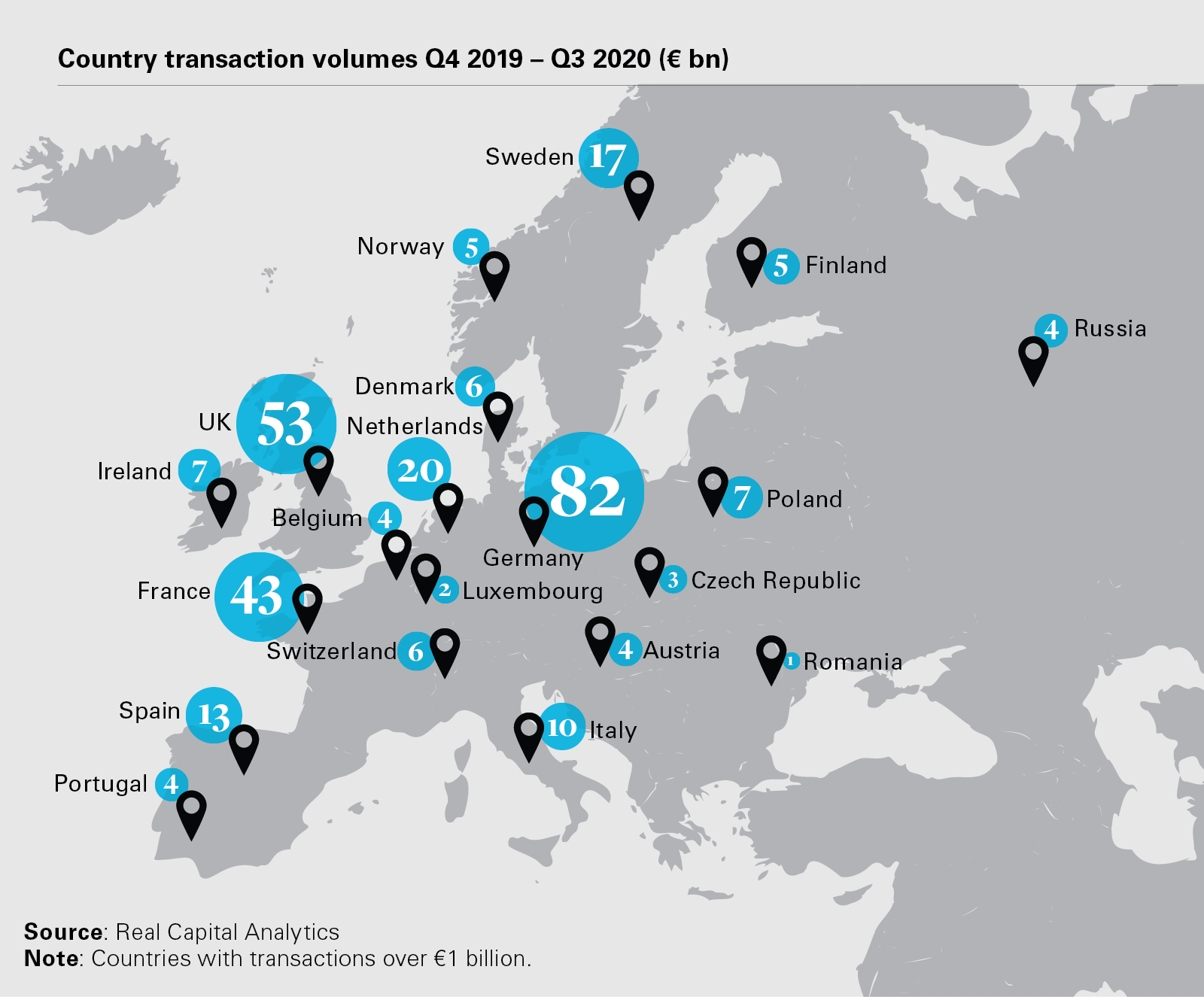

View full image 'Country transaction volumes Q4 2019 – Q3 2020 (€ bn)' PDF

View full image 'Country transaction volumes Q4 2019 – Q3 2020 (€ bn)' PDF

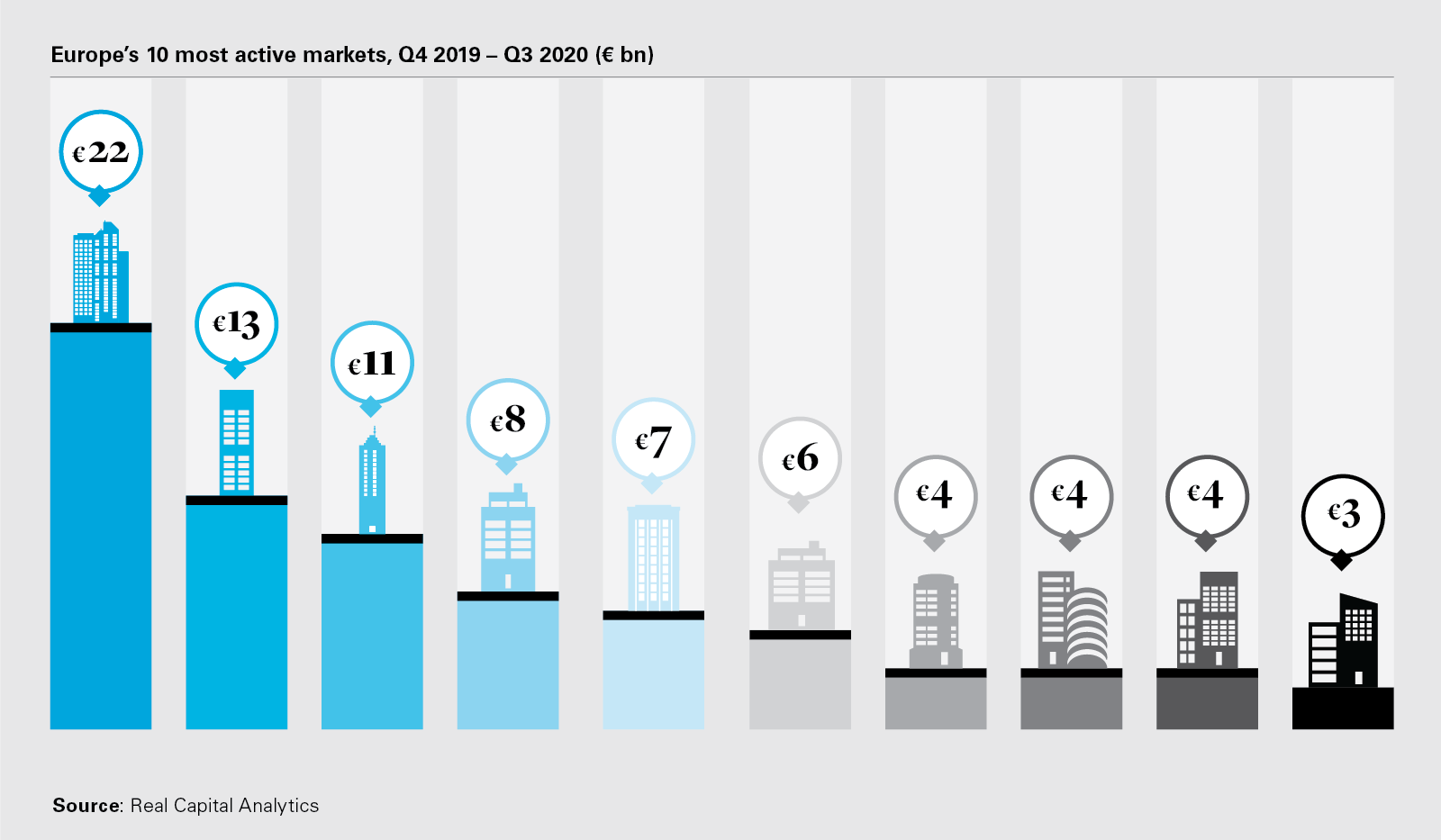

View full image 'Europe’s 10 most active markets, Q4 2019 – Q3 2020 (€ bn)' (PDF)

View full image 'Europe’s 10 most active markets, Q4 2019 – Q3 2020 (€ bn)' (PDF)