Mega private equity buy-outs shape Europe’s FMI landscape—KKR seeks to emulate Blackstone’s Refinitiv success through acquisition of OSTTRA.

Current market:

- Not high in volume, but makes up in value

We are seeing:

Eye-catching stock exchange acquisitions:

- Horizonal consolidation (e.g., Euronext's voluntary share exchange offer for ATHEX)

- Regional influence (e.g., Euronext's acquisition of Nasdaq Clearing Sweden's and Nasdaq Oslo's commodities exchange and clearing businesses)

- International expansion (e.g., MIH's acquisition of TISE)

Financial sponsors drive M&A activity:

- Mega private equity buy & build strategies (e.g., KKR's acquisition of OSTTRA)

- SWFs dip a toe into European FMI (e.g., GIC's acquisition of 4.99% of Euroclear)

- International public sector investors (e.g., TCorp's acquisition of 4.92% of Euroclear)

Euronext leads the charge on vertical integration:

- Research and market data (e.g., acquisitions of Global Rate Set Systems and Substantive Research)

- Financial reporting and cross-border tax relief (e.g., acquisition of Acupay)

- Transaction management (e.g., acquisition of Admincontrol)

Euroclear leads the charge on digital transformation:

- Investment technology solutions (e.g., acquisition of strategic stake in Inversis)

- DLT-powered financial market infrastructure (e.g., acquisition of strategic stake in Marketnode)

Key drivers / challenges:

Cashing out of liquid FMI stakes by:

- Banks: Société Générale's and Citi's disposals of 3.9% and 0.99% of Euroclear, respectively

- Stock exchanges: LSEG's disposal of 4.92% of Euroclear and MOEX's disposal of 13.1% of KASE

Availability of high-quality non-core businesses:

- Commodities exchanges and clearing (e.g., Nasdaq's disposal of Nordic power futures business)

- OTC post-trade infrastructure (e.g., S&P's and CME's disposal of OSTTRA)

Digital asset players scale inorganically across:

- OTC trading (e.g., Zodia's acquisition of Elwood)

- On-exchange trading (e.g., CoinDCX's acquisition of BitOasis)

- Custody (e.g., Zodia's acquisition of Tungsten Custody Solutions)

Trends to watch:

Euroclear's July 2025 plans (to establish EU-wide post-trade infrastructure single market) to drive intra-EU acquisitions and JVs.

Differentiated regulatory approach to FMI:

- Increased scrutiny of established FMI (e.g., introduction of Bank of England's "fundamental rules" for FMI operators)

- Support for new-age FMI (e.g., launch of UK's Digital Securities Sandbox)

Middle East emerges as the region to watch for FMI expansion:

- Outbound (e.g., UAE-based Fundament Capital's acquisition of 6.86% of MOEX)

- Inbound (e.g., UAE-based Tungsten Custody Solutions acquired by Zodia)

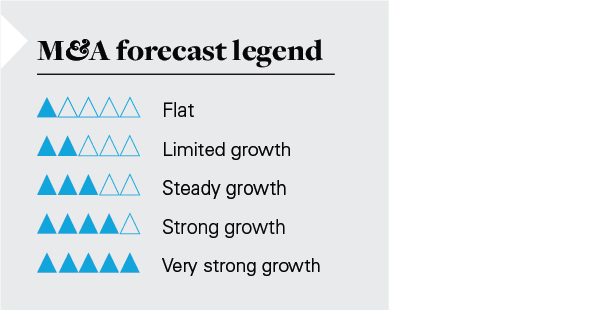

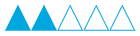

Our M&A forecast

Euronext and Euroclear have set feverish paces for inorganic vertical integration and digital transformation, respectively. In a vertical where international scale and product scope means everything, we expect intense competition between LSEG, Deutsche Börse, Nasdaq, Euronext and Euroclear for choice market data and post-trade solution targets to continue.

Financial Market Infrastructure – Publicly reported deals & situations

FMI horizontal expansion

Acquisitions:

- Miami International Holdings / MIH East Holdings: Stock exchange, Acquisition of The International Stock Exchange Group (March 2025)

- Euronext: Power derivatives trading, Acquisition of Nasdaq's Nordic power futures business (January 2025)

- SIX Group: Stock exchange, Acquisition of Aquis Exchange(November 2024)

Partnerships:

- LCH: FX clearing, Expansion of ForexClear service JV with CMU OmniClear (June 2025)

- SimCorp: Risk analytics, Integration of SimCorp's offering into Axioma Risk analytics (February 2025)

- Euronext: Collateral Management Services JV with Euroclear (February 2025)

- Boerse Stuttgart Digital: lCrypto infrastructure, Crypto infrastructure JV with Fenergo (November 2024)

- Euroclear: DLT, Tokenise gilts, gold and Eurobonds JV with Digital Asset and World Gold Council (October 2024)

FMI vertical integration

- Euronext: SaaS, Acquisition of Admincontrol (March 2025)

- SIX Group: Information services, Acquisition of Swiss Fund Data (January 2025)

- Euronext: Tax compliance, Acquisition of Acupay (October 2024)

- Euronext: AI research platform, Acquisition of Substantive Research (September 2024)

- London Stock Exchange Group: Post-trade processing platform, Acquisition of Veris (September 2024)

- Euronext: Benchmark administration, Acquisition of 75% of Global Rate Set Systems (June 2024)

FMI digital expansion

- Euroclear: SaaS, Acquisition of 49% of Inversis (October 2024)

- Euroclear: Digital market infrastructure, Acquisition of strategic stake in Marketnode (October 2024)

Mega private equity buy & build

- KKR: OTC post-trade infrastructure, Acquisition of Osttra (April 2025)

Cashing-out of "liquid" FMI stakes

Banks:

- Societe Generale: Belgium, Disposal of 3.9% of Euroclear (February 2025)

- Citi: Belgium, Disposal of 0.99% stake in Euroclear to GIC (February 2025)

- State Street: Russia, Disposal of 6.86% of Moscow Exchange (October 2024)

FMI Businesses:

- London Stock Exchange: Belgium, Disposal of 4.92% of Euroclear (December 2024)

- Moscow Exchange: Kazakhstan, Disposal of 13.1% of Kazakhstan Stock Exchange (October 2024)

Foreigners dip a toe in

- GIC: Singapore, Acquisition of 4.99% of Euroclear (February 2025)

- TCorp: Australia, Acquisition of 4.92% of Euroclear (December 2024)

- Fundament Capital: UAE, Acquisition of 6.86% of Moscow Exchange (October 2024)

Inorganic growth of digital asset players

- Zodia Markets (Standard Chartered): Digital asset custody,Acquisition of Tungsten Custody Solutions (June 2025)

- CoinDCX: Crypto trading, Acquisition of BitOasis (July 2024)

- Zodia Markets (Standard Chartered): Digital asset OTC trading, Acquisition of Elwood Capital Management (July 2024)

Non-core exits

- S&P Global and CME Group: OTC post-trade infrastructure, Disposal of Osttra (April 2025)

- Nasdaq: Power derivatives trading, Disposal of Nordic power futures business (January 2025)

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2025 White & Case LLP