US M&A settles back down

Deal value in the first half of 2022 could not match the record-breaking level of activity in 2021

US M&A deal levels remain robust, despite dropping from historic highs set in 2021

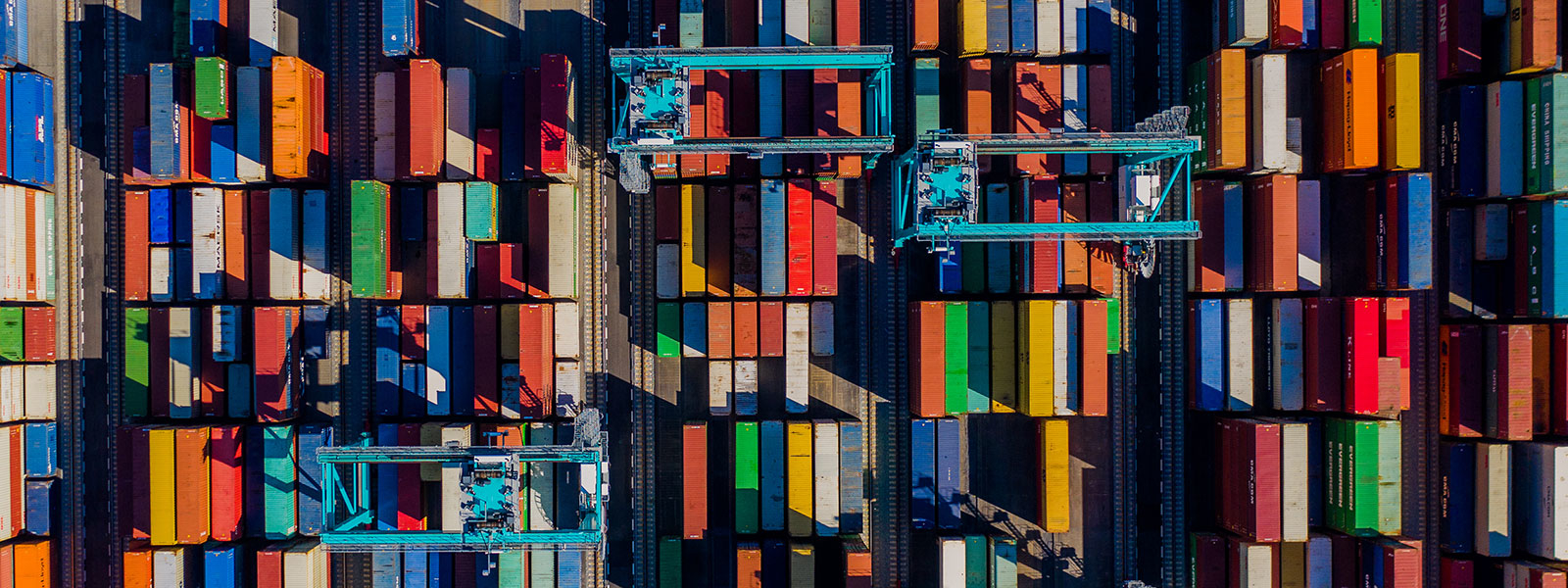

US M&A activity eased off in the first half of 2022 following an annus mirabilis for US M&A in 2021. Total value slipped to US$995.3 billion, a 29 percent year-on-year fall, though this is consistent with dollar volumes seen before the pandemic and so remains healthy by historic standards. Deal volume also fell, by 21 percent to 3,818 transactions. While this also remains above average, there was a material softening in the frequency of deals moving through Q2, which saw a quarter-on-quarter drop of 22 percent to levels last seen in Q1 2020, when the market was just beginning to recover from the initial shock of the pandemic.

A lot has happened this year to test acquirers’ nerves. Inflation concerns had already begun to set in before the war in Ukraine started. The conflict catalyzed further unease in capital markets as well as exacerbated supply chain troubles which have, in part, contributed to inflationary pressures. The S&P 500 officially entered a bear market in mid-June, and the Federal Reserve has embarked on a monetary tightening program to bring prices under control, leading to an increase in financing costs.

Regulations are another consideration. The SEC has taken the SPAC market to task, proposing accountability for deal parties and intermediaries for inflated projections. This type of transaction ground to a standstill in Q2 this year, as participants digested their risk exposure and the implications of the regulator’s proposals weighing on overall M&A volume. More recently we have seen some truly innovative SPAC structures that have the potential to re-stimulate interest in these deals.

For the most part, the US M&A market has stood up impressively to everything that has been thrown at it, which alone is solid grounds for optimism. Despite technology stocks being sold off heavily in equity markets, the sector has once again outperformed on the M&A front as companies and PE sponsors, who remain heavily armed with dry powder in spite of the more challenging deal financing conditions, continue to be attracted to innovation.

The fall in price-to-earnings ratios in the public markets and EBITDA multiples in private markets mean that, all else being equal, acquisitions are more attractive today than they were a year ago. Naturally, investors remain cautious as they closely watch how inflation plays out, the Fed response and the impact of those actions on underlying economic growth. However, the second half of 2022 has the potential to reclaim some of the confidence lost in recent months.

Deal value in the first half of 2022 could not match the record-breaking level of activity in 2021

Despite facing economic and regulatory hurdles in H1, PE dealmaking remains resilient, and looks set to reach its second-highest value on record

After a series of rollercoaster years for the SPAC market, investors and sponsors are finding ways to improve deal integrity

Under the Biden administration, CFIUS continues its rigorous assessment of security concerns across a wider range of sectors

Explore the data

In its Annual Report to Congress for calendar year 2021, CFIUS reported a nearly 40 percent increase in overall CFIUS filings in 2021 from 2020. Notwithstanding this substantial increase in volume, the metrics indicate that CFIUS has mostly maintained, and in some cases slightly improved, its efficiency in dealing with filings. Moreover, there were not significant increases in the percentage of transactions requiring mitigation or abandoned based on CFIUS concerns, though some cases requiring mitigation took longer to resolve. CFIUS also identified more non-notified transactions compared to the prior year, but ultimately requested fewer total filings. Overall, while parties are notifying substantially more transactions, CFIUS continues to approve the vast majority of cases without mitigation.

A continuing trend under the Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA) is the increase in formal internal processes and procedures used to review investments.

The Committee on Foreign Investment in the United States (CFIUS), the interagency committee authorized to review certain transactions involving foreign investment into the US, continued to ramp up its outreach in 2021. Under the Biden administration, the committee remains steadfast in its comprehensive approach to deal reviews, with particular focus on a wide range of areas of interest, such as global supply chains, and an increased engagement with international allies.

Under the Foreign Investment Risk Review Modernization Act of 2018 (FIRRMA), CFIUS continues to broaden its involvement in certain sectors on the grounds of national security. One such example is real estate. FIRRMA's implementing regulations include separate regulations for investment and real estate transactions, and a single transaction cannot fall under both sets of regulations. While fewer than 2 percent of the CFIUS filings made in 2021 were pursuant to the real estate regulations, those regulations are useful for investment transactions because they provide parameters for assessing whether a target's US locations could raise national security concerns based on their proximity to sensitive US government facilities. This assessment is particularly important when a transaction involves investors from higher-threat countries.

There remains some discussion surrounding the extent to which CFIUS should control outbound investments from the US, with interest in this area growing over the past six months. This has been driven by interest in having more control over outbound technology transfers and investments, beyond what is already in place through export control regulations.

In March of this year, US Secretary of Commerce Gina Raimondo expressed support for a screening regime to review outbound investments. This follows on from similar moves by the White House earlier this year, signaling that an outbound investment screening mechanism could be a possibility in the future.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2022 White & Case LLP