Banks

Systemically important banks are streamlining within geographic borders, continuing to generate deals through non-core disposals and strategic acquisitions

Inorganic growth strategies are key to remaining competitive and winning market share in the European financial services sector

Almost a decade after the financial crisis, most European financial institutions are still grappling with the combined effects of higher regulation, lower interest rates, the explosion of new technology, and the arrival of many new 'disruptors' that are threatening the business models of even the best-capitalised and most sophisticated banks, asset managers, insurers and other key players in the financial services sector.

Navigating the complex and rapidly evolving European financial services ecosystem can be extremely challenging. In such a highly interconnected environment, individual financial services subsectors cannot—and should not—be considered in isolation.

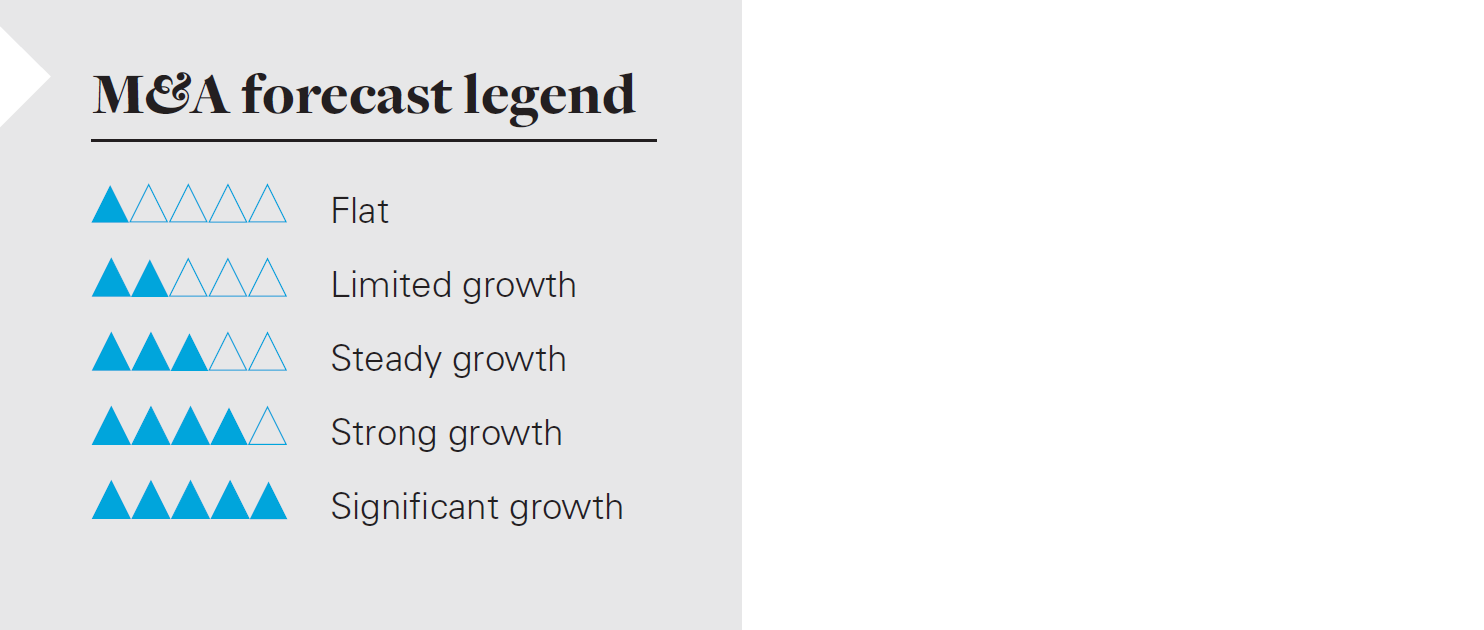

With this in mind, our report highlights the key European M&A trends that span the main financial services subsectors, and offers insight into the outlook for M&A in each:

European financial services

M&A trends

Systemically important banks are streamlining within geographic borders, continuing to generate deals through non-core disposals and strategic acquisitions

Increasing pressure from the ECB and local regulators—alongside challenges faced by government stability funds—is continuing to drive M&A

By Guy Potel

Regulator and financial sponsor support is at an unprecedented high. Fintech is now regarded as an enabler rather than a disruptor

By Gavin Weir

Increasing competition, pressure on costs and changes in investor behaviour have already led to some consolidation in the industry. Much more is on the horizon

By James Greig

Regulatory change continues to be a key driver of M&A activity

With many larger banks focusing on corporate lending, consumers are turning to alternative finance sources, potentially heralding a new era of inorganic growth for specialty finance businesses

By Roger Kiem

Favourable environment for insurance M&A including ongoing consolidation in the life insurance sector