2022 Year in Review: White & Case Global Antitrust Merger StatPak (WAMS)

Australia, Brazil, Saudi Arabia, and Turkey See Significant Surge in Merger Filing Activity; US and EU Merger Filing Activity is Down Compared to 2021's Record Levels, But Still Above Historical Levels

15 min read

White & Case Global Antitrust Merger StatPak (WAMS)—the first real-time clearinghouse for global merger notification data—has analyzed year-to-date 2022 merger notifications in reporting jurisdictions and has included spotlights on select jurisdictions below.

More from WAMS

White & Case Global Antitrust Merger StatPak

White & Case Antitrust/ Competition is a “one-stop shop for global deals.”

The Legal 500 US

Key Highlights

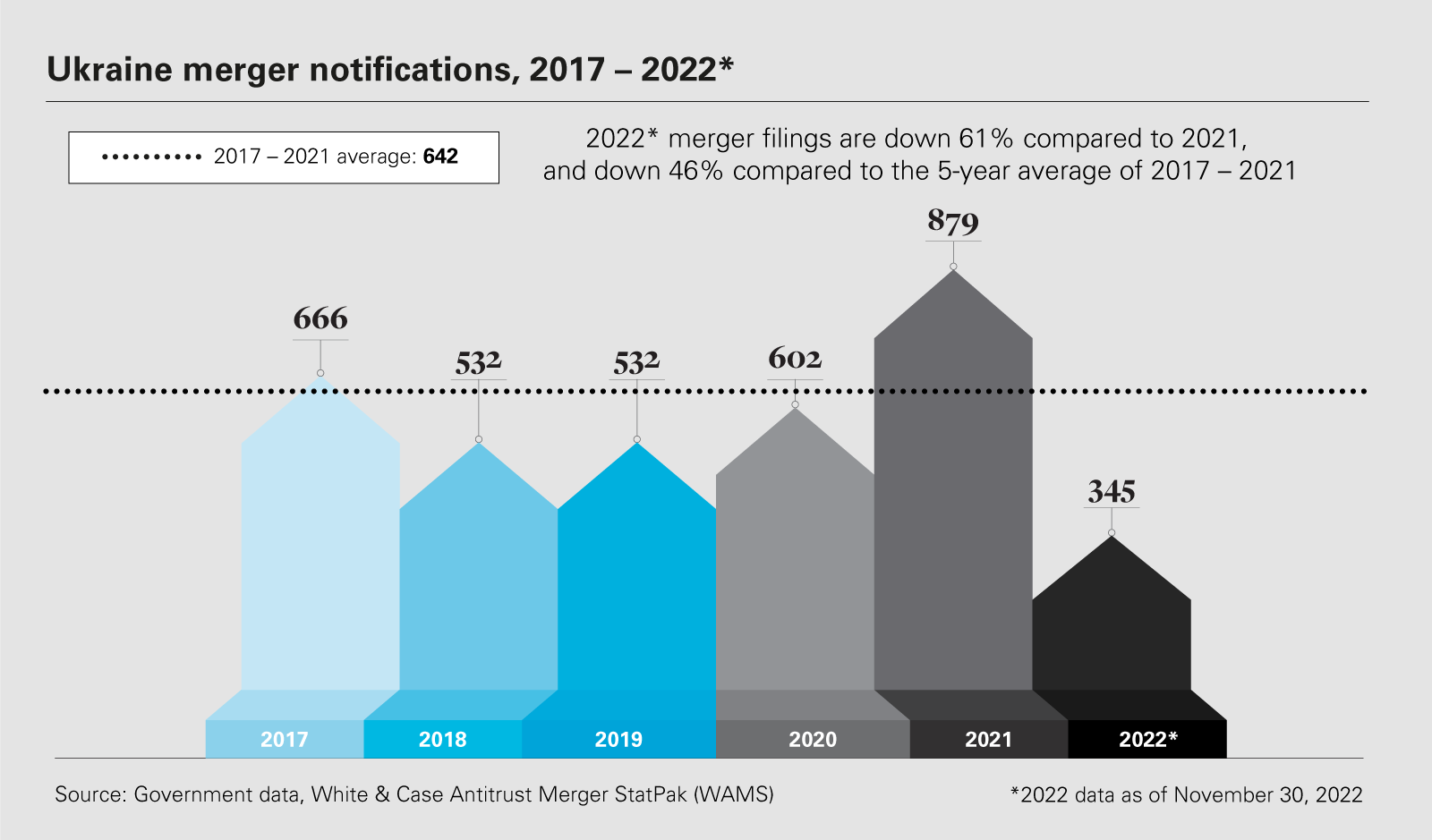

- The Ukraine War. Merger filing activity in Ukraine is down 61% compared to 2021, but the Ukrainian competition authority throughout 2022 reviewed over 300 mergers and continued to initiate merger investigations.

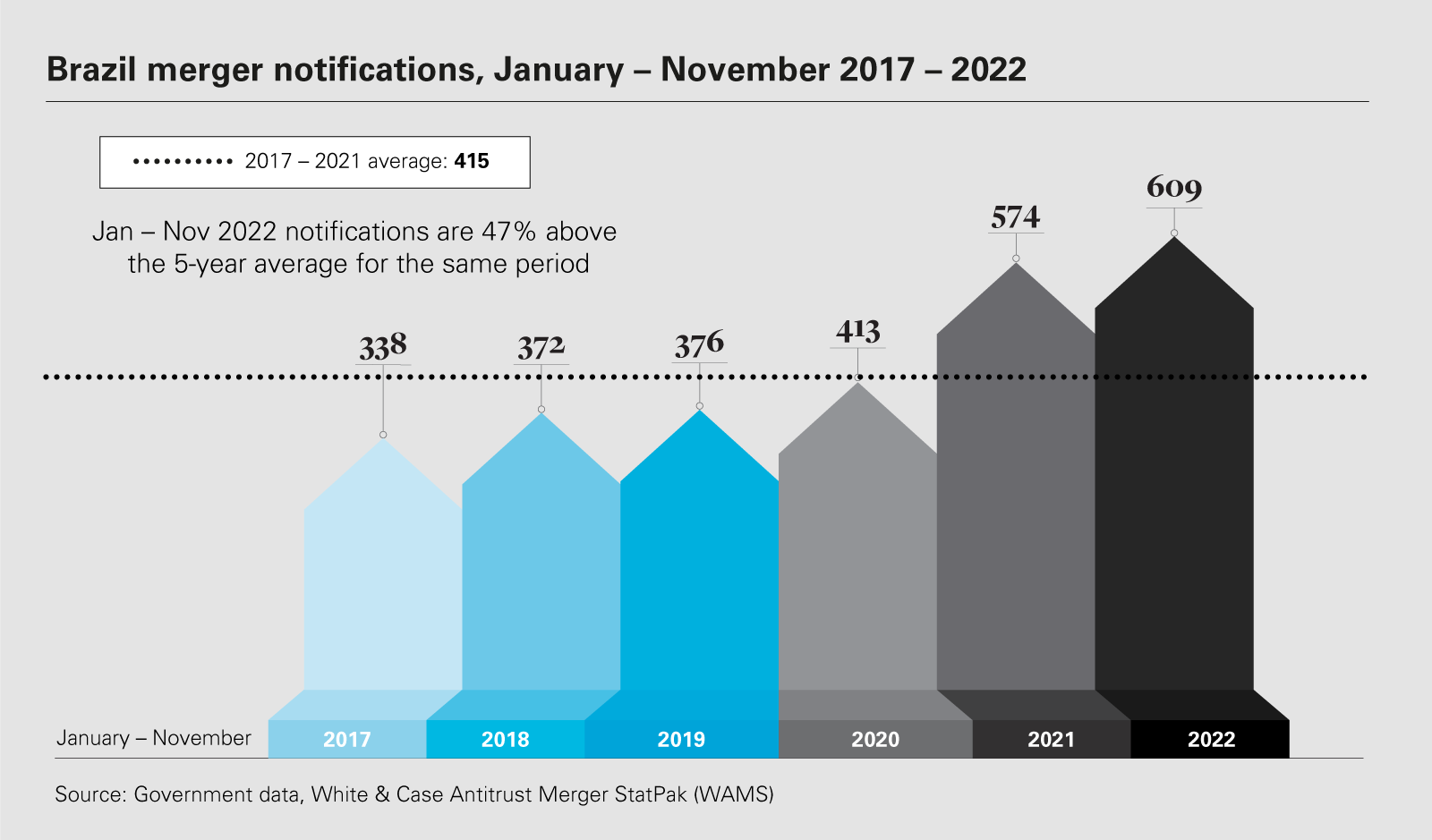

- Brazil filing activity is rising steeply, up 47% compared to the five-year average for the same period (January – November) and up 6% compared to 2021.

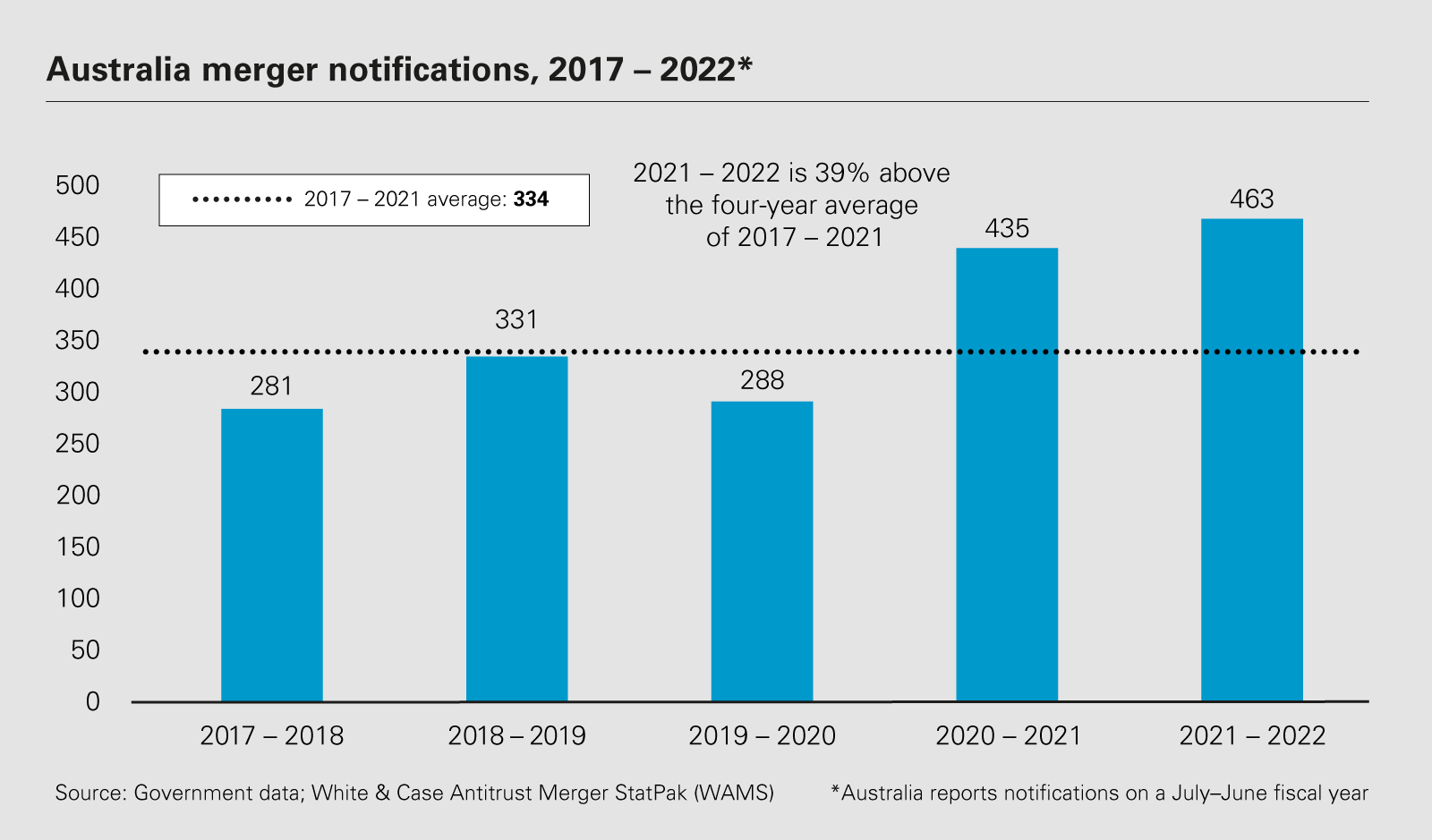

- Australia merger assessments are up 39% above the four-year average of 2017 – 2020.

- Middle East merger control continues to rise:

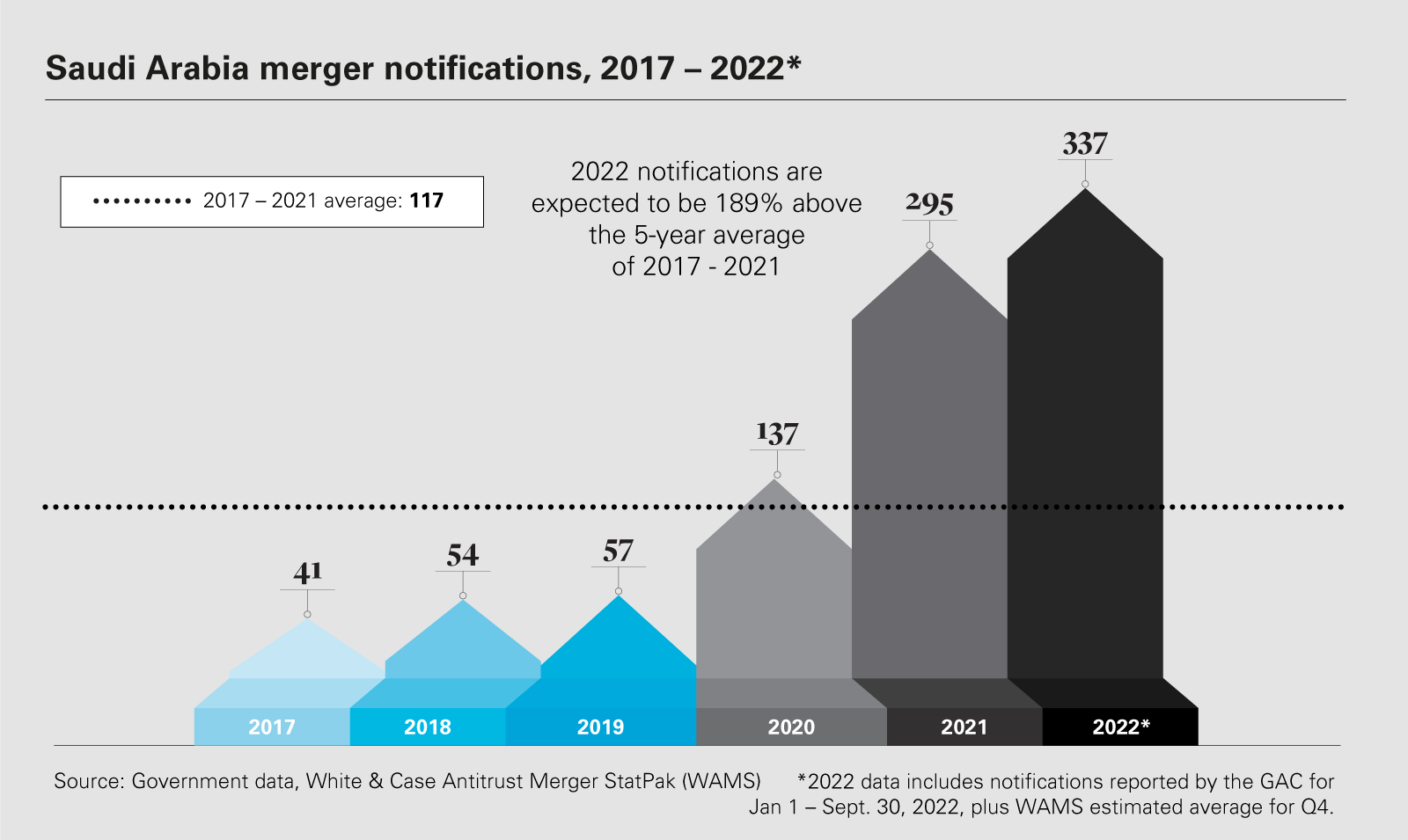

- Saudi Arabia filing activity in 2022 is up by 14% compared to 2021, and in 2022, the Saudi Arabian competition authority blocked its first deal on substantive grounds.

- Egypt adopted a new merger control regime, which will require pre-merger clearance under new turnover thresholds and will institute gun-jumping fines that could exceed US$ 20 million.

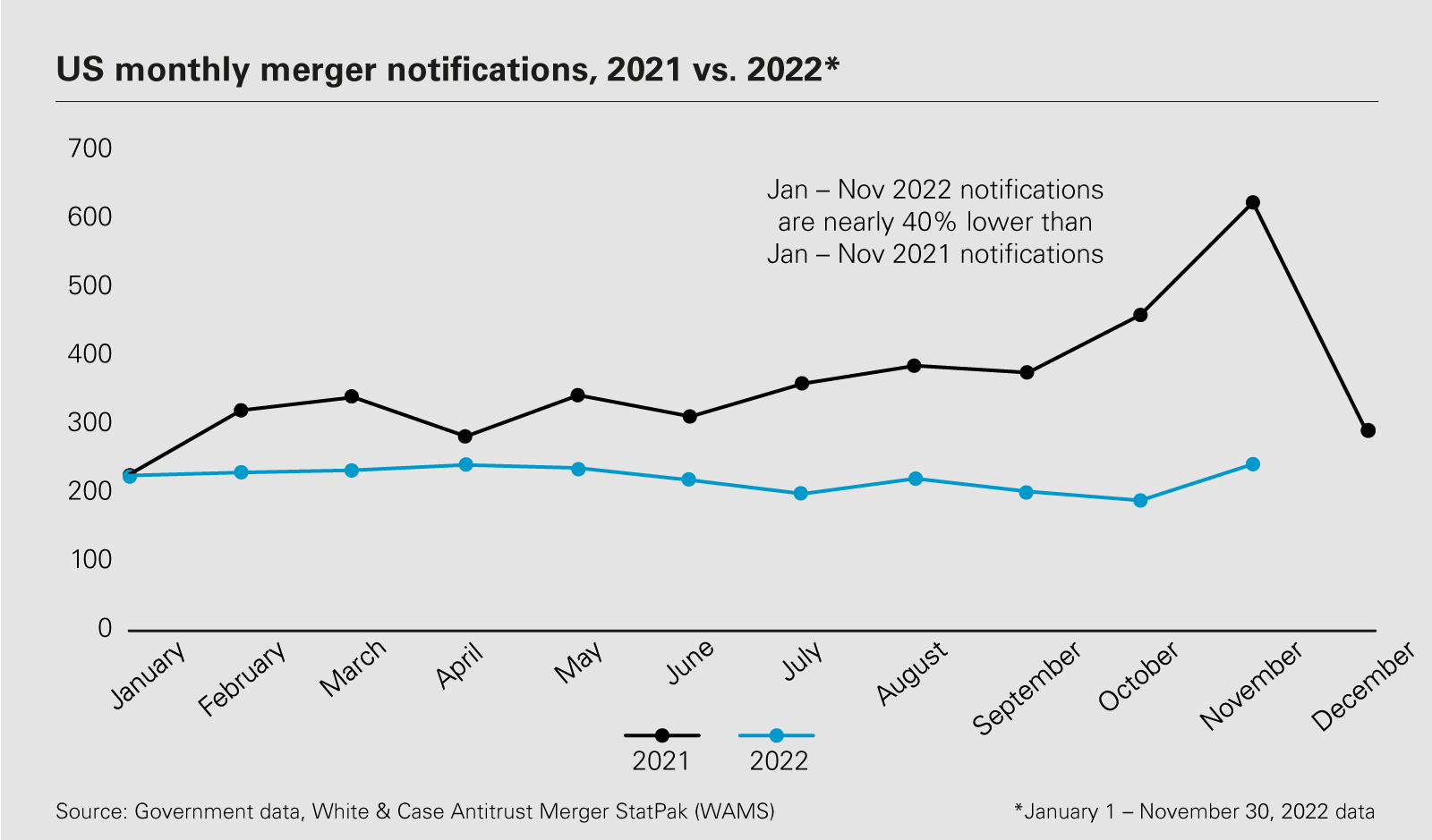

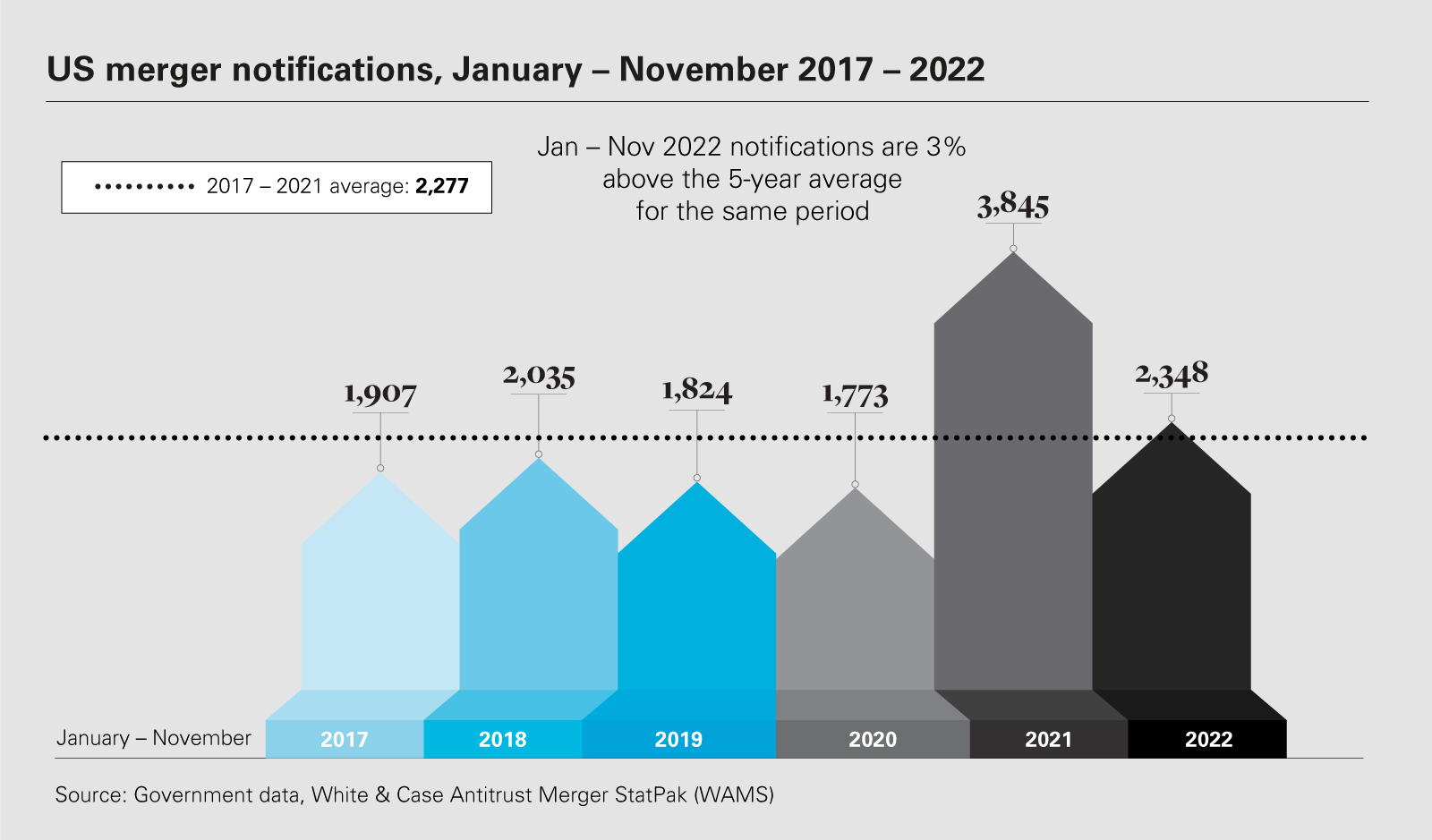

- U.S. HSR filings are down nearly 40% compared to 2021's record-shattering year, but are 3% above the five-year trailing average of U.S. HSR filings for the same period (January – November).

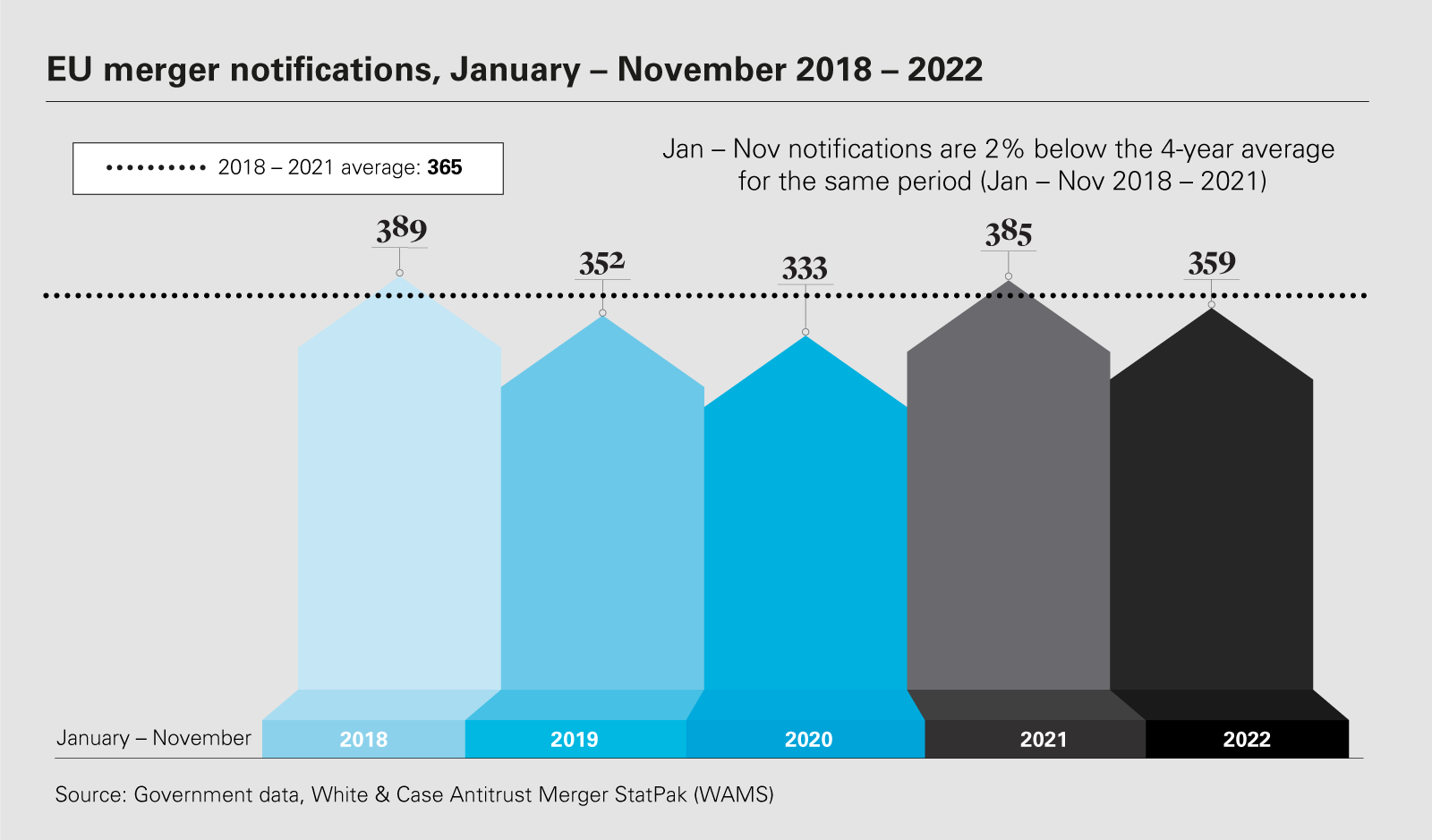

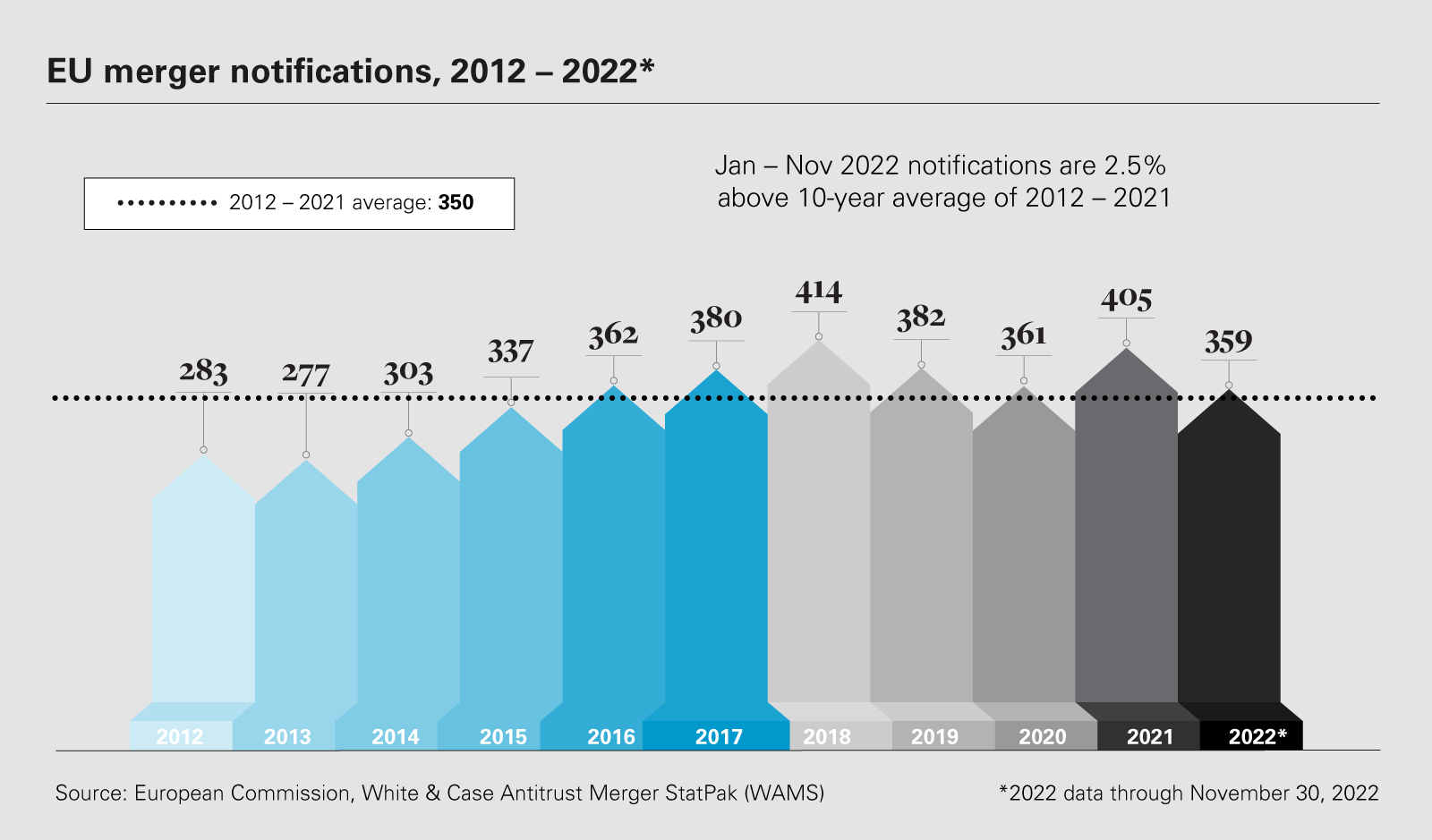

- EU merger filing activity in 2022 has decreased by 7% compared to 2021, but is down only 2% compared to the four-year trailing average for the same period (January – November).

Although Down From 2021's Record Level, U.S. Merger Control Filings Are Above Historical Averages with November 2022 Merger Filings Showing a Cooling of Year-End HSR Activity

As the year ends, U.S. merger filing activity has slowed down compared to earlier in 2022, but it remains above historical levels. In November 2022—historically the busiest month for U.S. Hart-Scott-Rodino (HSR) filings—there were only 243 filings, which is 60% lower than the November 2021 total of 607 HSR filings and 43% lower than November 2020 total of 424. November 2022 HSR filings are nearly 30% lower than the five-year historical average of November filings between 2017-2021. From January 1 – November 30, 2022, there have been 40% fewer U.S. HSR filings than January 1 – November 30, 2021. However, 2022 U.S. merger control filings are 3% above the five-year average for the same period (January 1 – November 30, 2022) and 5% above the five-year average for full year 2017-2021.

November 2022 marks the first full year that President Biden's antitrust team has been in place. In June 2021 and November 2021, the U.S. Senate confirmed FTC Chair Lina Khan and Department of Justice Assistant Attorney General for the Antitrust Division Jonathan Kanter, respectively. Despite announcements of more enforcement, measured by court actions, the data show that the agencies have filed a similar number of complaints in 2022 as compared to 2021. In 2021, the DOJ and the FTC filed a combined 15 complaints (including complaints filed with settlements or consents) against merging parties, whereas in 2022, the DOJ and the FTC filed a combined 17 complaints against merging parties, including complaints filed with settlements or consents. In 2021, DOJ filed 12 complaints, but only filed 4 in 2022. Conversely, in 2022, the FTC filed 13 complaints, whereas in 2021 it filed 3.

Looking ahead: The DOJ and the FTC are expected to release new merger guidelines in late December or early 2023. In January 2022, the DOJ and the FTC announced plans to revise the 2010 Horizontal Merger Guidelines and the 2020 Vertical Merger Guidelines. The new merger guidelines are expected to significantly alter the existing frameworks for assessing mergers.

EU Merger Filing Activity is Down 7% in 2022 Compared To 2021, But 2.5% Above the 10-Year Historical Average

WAMS data show that there are fewer EU merger filings in 2022 compared to 2021. According to WAMS data for January 1, 2022 – November 30, 2022, merger filings before the European Commission (EC) are down approximately 7% compared to the same period in 2021 (January 1, 2021 – November 30, 2021). However, merger filings to the EC are only down 2% compared to the four-year average for the same period (January 1 – November 30, 2018-2021) and up 2.5% compared to the ten-year average for full years 2012-2021.

WAMS data also show a higher intervention rate in the EC for merger filings. Between January 1, 2022 and November 30, 2022, the European Commission has issued two prohibition decisions, compared to none in full-years 2021 and 2020. In the past 10 years (2013-November 30, 2022), there have been 11 prohibition decisions, 7 of which occurred in the last 5 years (2018-November 30, 2022). The number of EC cases involving remedies is increasing. The number of deals cleared by the European Commission in Phase I (in non-simplified cases) subject to remedies has increased from 7 in full-year 2021 to 10 in 2022 (January 1 – November 30, 2022).

Looking ahead: The EU General Court's endorsement in the Illumina/Grail case of the European Commission's new Article 22 referral policy has been one of the most remarkable developments in 2022. The Court confirmed the European Commission's jurisdiction to review the Illumina/Grail transaction following a referral pursuant to Article 22, despite the fact that the transaction did not meet the turnover thresholds in any EU Member State. Since the Illumina/Grail case, the European Commission has already accepted Article 22 referral requests in three cases (Meta/Kustomer, Viasat/Inmarsat, and Cochlear/Oticon Medical), although in each of these three cases the transaction triggered the national merger control thresholds in at least one EU Member State. The European Commission and certain EU Member States are expected to continue actively monitoring below-threshold transactions to consider whether they are suitable for referral to the European Commission. Additionally, it is expected that there could be a number of Article 22 referrals in the digital sector as a result of the Digital Markets Act's requirement for gatekeepers to inform the European Commission of all intended acquisitions of tech companies or any transactions that enable the collection of data. The information provided will be relayed to national competition authorities, which may use the information to request the European Commission to examine a transaction under the Article 22 referral mechanism.

Ukraine Competition Authority Continues to Analyze Transactions During Russia's War in Ukraine

The Ukrainian competition authority, the Antimonopoly Committee of Ukraine (AMCU), continues to operate normally since Russia's February 24, 2022 invasion of Ukraine. However, likely as a result in part of Russia's war in Ukraine, the number of merger filings in 2022 from January 1, 2022 – November 30, 2022 dropped significantly as compared to the previous years. During January 1, 2022 – November 30, 2022, the AMCU reviewed over 300 merger notifications, which is down 61% compared to 2021 year-end notifications. 2021 merger notifications in Ukraine were record-breaking. WAMS data show a 51% increase in merger notifications in 2021, as compared to the four-year average of (2017 – 2020).

The AMCU also continues to initiate investigations and take enforcement actions, issuing fines for failure to notify transactions amid the invasion. As of November 30, 2022, the AMCU completed six Phase II proceedings initiated in 2021 related to one deal in the energy sector and has initiated at least six new Phase II cases in 2022. Three of the investigations are in the energy sector, while the others are in chemicals, pharmaceuticals and grain storage. The AMCU has issued 21 fines for failure to notify a merger with fines ranging between USD 2,000 and USD 60,000.

The AMCU is operating from Kyiv. Except for a three-month period of inactivity during the beginning of the war, the AMCU has tried to maintain normal statutory review timelines.

Looking ahead: Air raids and power shortages continue to cause interruptions to normal operations, therefore, longer than usual review periods may be expected in the coming months. The AMCU is unlikely to apply fast-track review and rejections of notifications on technical grounds are expected to be more common. Nevertheless, deals without significant impact on local markets should benefit from a standard Phase I review.

Brazil Merger Filing Activity is Record-Breaking in 2022, 47% Above Historical 5-Year Averages

WAMS data show record-breaking merger filing activity in Brazil in 2022, which is estimated to surpass 2021 merger filing activity. From January 1 – November 30, 2022, there have been 609 merger notifications in Brazil. In 2021, a record year for Brazil, there were 628 merger notifications by year-end. WAMS data also show that merger notifications are 47% above the five-year average for the same period (January 1 – November 30, 2017 – 2021) and 32.5% above the preceding five-year average (full years 2017-2021).

Looking ahead: The election of Luiz Inácio Lula da Silva, who will take office in January 2023, is not expected to have major impacts on antitrust enforcement in the short term. CADE's most senior positions (CADE's President, General-Superintendent and Commissioners) have fixed terms, and they cannot be removed by President Lula da Silva. The term of CADE's President ends in July 2025, and the term for the General-Superintendent ends in April 2024.

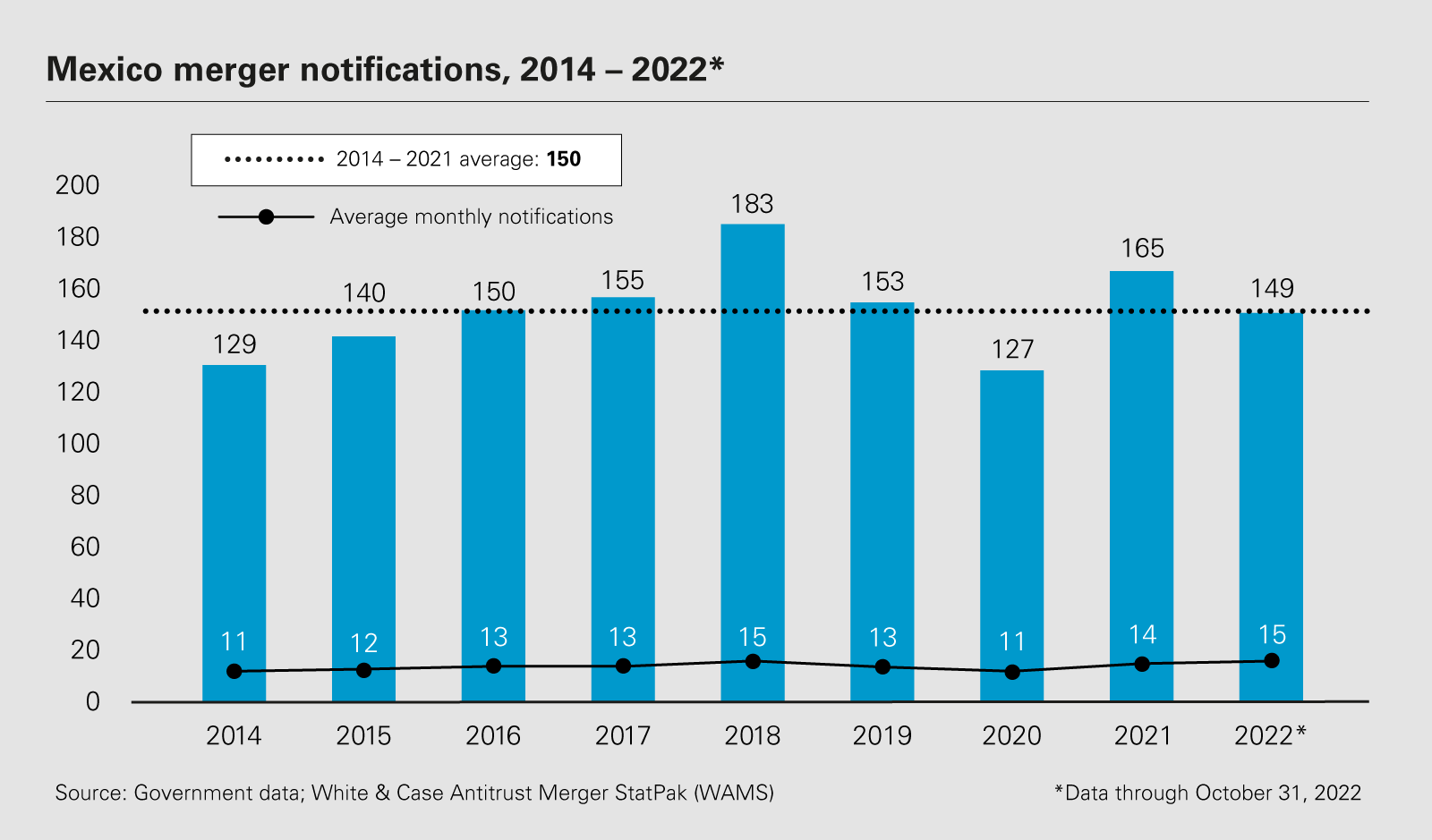

Mexico Merger Filing Activity Remains High in 2022 Despite New Levels of Scrutiny

Despite increased enforcement by the Mexican competition authority, Comisión Federal de Competencia Económica (COFECE), merger notifications in 2022 in Mexico are keeping pace with 2021. From January 1, 2022 – October 31, 2022, transacting parties have made 149 merger notifications to COFECE, which is similar to the eight-year average for 2014 – 2021. Notifications are expected to increase in December 2022, and are likely to surpass notifications in 2021.

In 2022, COFECE has taken an aggressive approach to merger enforcement. COFECE is actively reviewing and assessing common ownership among the notifying parties, and examining transactions post-closing to ensure parties adequately notified prior deals. As a result of this scrutiny, parties can expect a longer review period and heightened burden of proof; however the new scrutiny has not deterred merger filing activity.

Looking ahead: Currently, there are three vacant seats on the COFECE board of commissioners. As a result of a recent ruling from the Mexico Supreme Court of Justice, Mexico's President, Andrés Manuel López Obrador, will have to fill these vacant seats. President Obrador has only appointed one individual to fill one of the vacancies, but the appointment is still subject to ratification by the Senate. The new board composition may change COFECE's enforcement policy. Beyond these changes, practitioners should anticipate an increase in the number of gun-jumping investigations in 2023. This is expected to continue a trend from 2022 of COFECE investigating gun-jumping actions as part of its investigations into already consummated transactions.

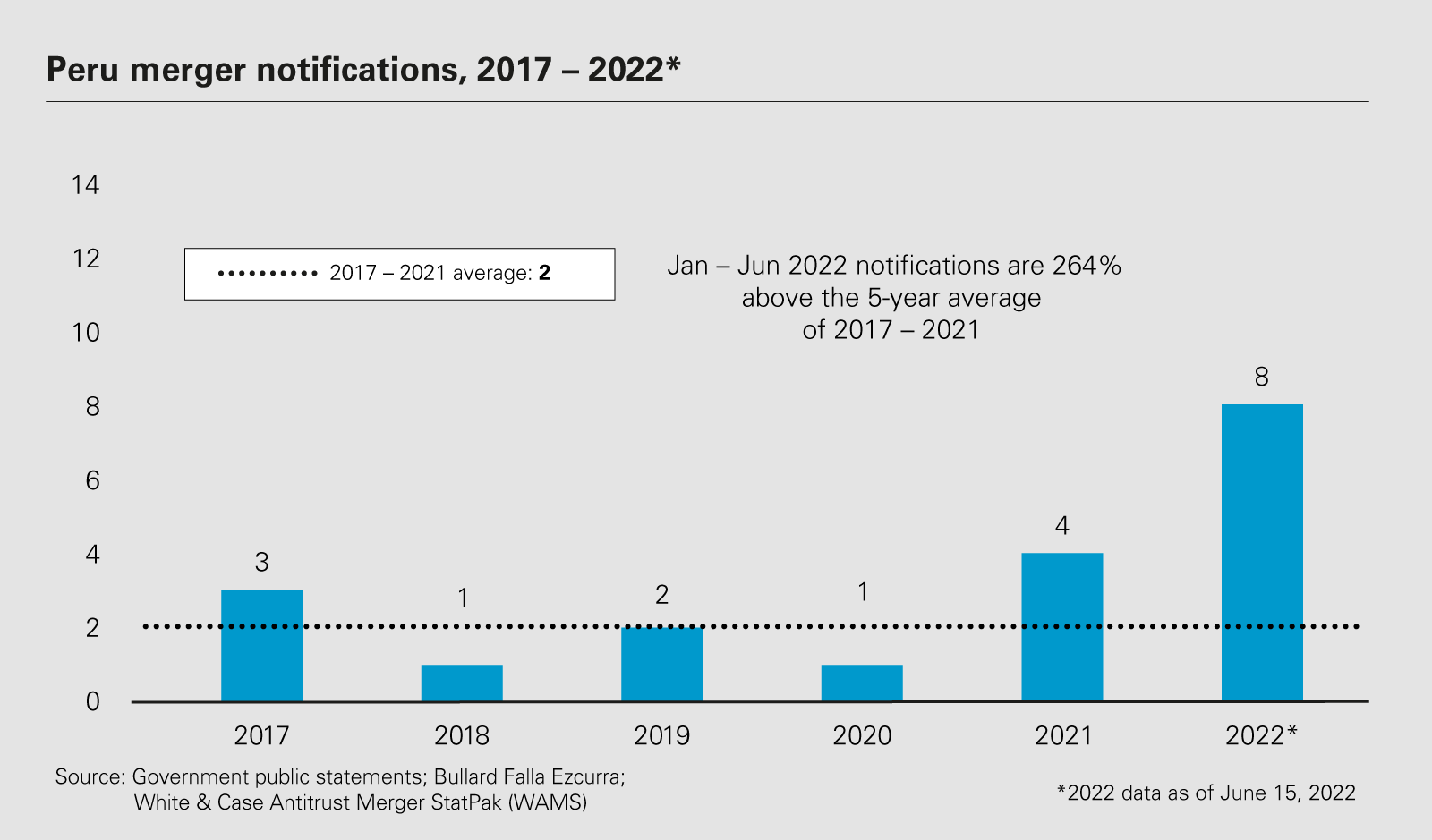

New Pre-Merger Notification Law in Peru Leads to Tripling of Merger Notifications1

2022 has been a significant year for Peru's merger control regime. In 2021, Peru approved a new pre-merger notification regime that expanded Peru's merger control regime to all sectors and industries, when merging parties meet certain revenue thresholds. Prior to 2021, Peru's merger control regime only addressed mergers in the electricity sector. From January 1, 2022 – June 15, 2022, the Peruvian competition authority, Instituto Nacional de Defensa de la Competencia y de la Protección de la Propiedad Intelectual (Indecopi) received eight notifications, which is double the notifications that it received the prior year. The notifications span a number of sectors, including telecommunications, pharmaceuticals, mining, retail, and others. Six of the eight transactions have been approved without conditions.

Looking ahead: During the past few months, Indecopi has been active in issuing guidance and rules for the new regime. In May 2022, Indecopi published draft merger guidelines, which outlines criteria Indecopi will use to analyze the competitive effects of a proposed transaction, among other guidance for merging parties. In 2023, merging parties can expect more notifications, Phase II investigations, and final merger guidelines from Indecopi.

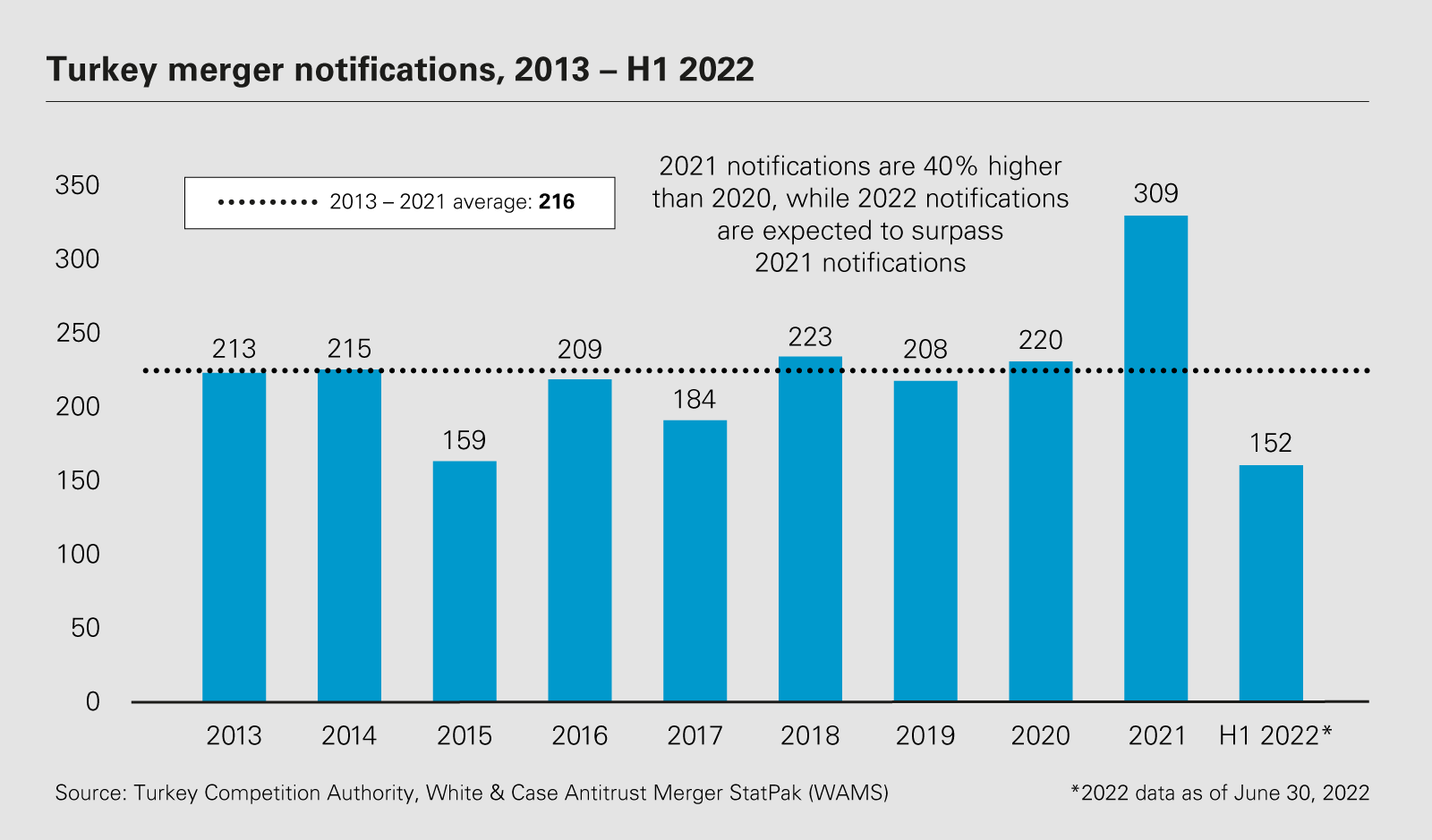

Turkey Merger Filing Activity in 2022 Expected to Surpass 2021 Merger Filing Activity

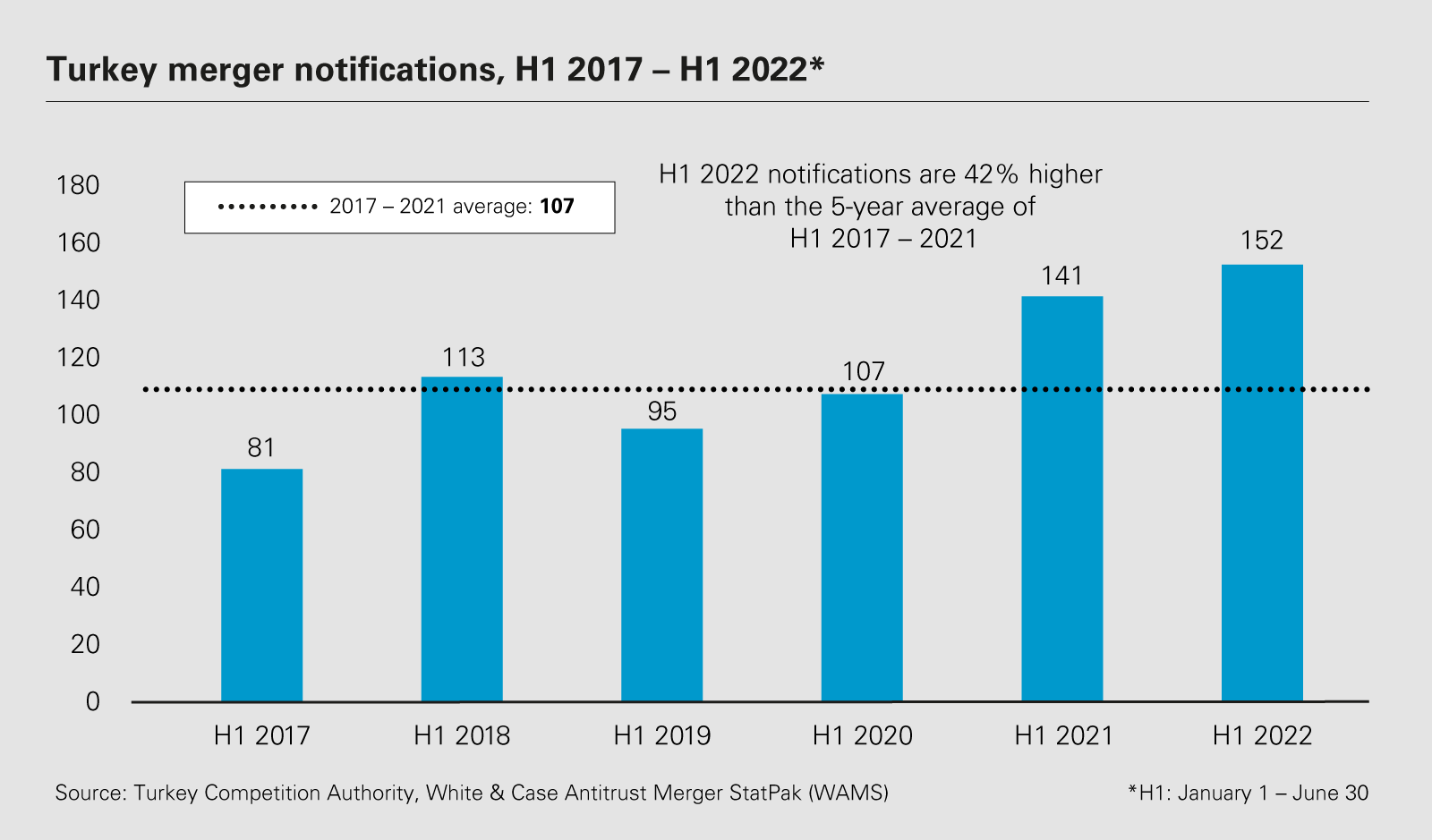

Merger control filings in Turkey in 2022 are keeping pace with 2021 merger filings and are expected to exceed 2021 filings by year-end 2022.2 From January 1, 2022–June 30, 2022, the Turkish Competition Authority (TCA) has reviewed 152 transactions, cleared without commitments 130 transactions, and found 20 transactions non-notifiable. The TCA only releases merger filing activity data biannually.

WAMS data show an approximate 8% increase in merger filing activity in H1 2022 (January 1, 2022-June 30, 2022) in Turkey, as compared to H1 2021. WAMS data also show an approximate 42% increase in H1 2022 merger filings, as compared to the average number of filings reported in the preceding five-year period (H1 2017–H1 2021).

These increases in 2022 merger filing activity in Turkey come in a year in which the TCA made significant changes to merger control rules and procedures. In 2022, the TCA: (i) increased the turnover threshold eightfold; (ii) revised the format and scope of the notification form, making it more burdensome for parties to complete, where there is an affected market; and (iii) removed the "technology entity" exception, meaning that any technology company would be subject to a merger control filing regardless of its turnover generated in Turkey.

Looking ahead: In light of the foregoing, merger filing activity in Turkey is expected to reach its peak by December 31, 2022 and is expected to continue to show rapid increases in terms of the number and value of notified transactions in 2023.

Merger Notifications in Australia Are 39% Above Historical Four-Year Average

The Australian Competition and Consumer Commission (ACCC) has assessed an increasing number of transactions, continuing a year-over-year upsurge. Merger notifications in Australia are up 39% above the four-year average of 2017 – 2021, reflecting the attractiveness of Australia as an investment destination. As a non-mandatory notification jurisdiction, the ACCC can become aware of a transaction via a direct approach by the merging parties under the informal clearance or authorization regimes, through other regulatory agencies, or through monitoring and intelligence. The majority (94%) of the 2021 – 2022 transactions were assessed through pre-assessment, however the number of complex mergers assessed through a public review also increased to 26, up from 22 the previous year.

Looking ahead: The ACCC has proposed significant merger reform in the last 12 months, namely a proposal to introduce a mandatory and suspensory merger clearance regime and to focus on transactions involving minority interests. If the ACCC is successful, it is expected that the number of notifications in Australia will increase significantly.

Saudi Arabia Merger Filings on Track for Double-Digit Spike in 2022 Over 2021

Since Saudi Arabia adopted a new merger control regime in late 2019, merger control filings have continued on an upward trend, and 2022 is on track to break yet another record. The Saudi Arabia General Authority for Competition (GAC) reported at least 143 filings during the first three quarters of 2022.3 The GAC has not published Q4 data yet, but based on current estimates, at least 337 total filings are forecasted for 2022. However, actual Q4 2022 figures will likely exceed that estimate, as the last quarter in any given year typically witnesses a flurry of deals before the end of the year. 2022 represents a 14% jump in merger filings as compared to 2021, where only 295 filings were reported, and 2022 is estimated to be at least 189% greater than the 5-year average of 2017-2021.

Looking ahead: The GAC's merger control activities in 2022 suggest more enforcement in 2023. This year, the GAC blocked its first deal on substantive grounds, based on vertical issues, and issued detailed Merger Review Guidelines to clarify the procedural aspects of merger filings and the substantive standards the GAC will apply to merger analysis. Further, the GAC has made process improvements in the merger filing and review process, leading to notably faster clearances during Q4 2022.

Egypt Adopts New Pre-Closing Merger Control Regime

On December 6, 2022, the Egyptian Parliament adopted legislative amendments that will transform the country’s merger control regime from one that requires only post-closing notifications into a pre-closing clearance jurisdiction. When the amendments go into effect, which is expected within a few weeks, they will apply new turnover thresholds and will focus on transactions where there is a change of control, among other changes. Under the new system, the Egyptian Competition Authority (ECA) will have 30 working days to review a transaction, which can be extended by another 15 working days. If the ECA identifies potential harm to competition, they would refer the transaction to a second review phase, which can last up to 60 working days (also subject to a potential extension of 15 working days). Notably, the new regime also introduces heightened gun-jumping fines. Failure to notify a reportable transaction would be subject to a fine between 1% and 10% of the value of the parties’ turnover or assets (whichever is highest), or a fixed amount between EGP 30 million to 500 million (approx. US$ 1.2 million to US$ 20.3 million) if the value of turnover or assets cannot be calculated.

Looking ahead: The new merger control regime is expected to result in more filings in Egypt. Although the new turnover thresholds should limit the scope of reportable transactions, it is still possible to trigger a filing requirement if only one of the parties has turnover or assets in Egypt, which would apply to many foreign-to-foreign transactions among major global businesses. Given the large potential fines adopted in the amendments, parties will be more likely to ensure compliance with the new regime. The ECA is also expected to ramp up enforcement under the new regime, particularly as the ECA has been working to bolster enforcement collaboration among competition authorities of the Middle East and Africa, among others. For example, in March 2022, the ECA led the effort to launch the Arab Competition Network, which includes 17 competition authorities from the region and aims to coordinate their enforcement efforts.

1 White & Case LLP is grateful for the contributions of Bullard Falla Ezcurra to WAMS.

2 The Turkish Competition Authority does not publish statistics on a yearly or monthly basis regarding the number of deals notified. The WAMS data referenced here concerns decisions.

3 Based on WAMS analysis and estimates, and assuming the last quarter of 2022 will report an average number of filings as compared to the first three quarters.

The WAMS team is comprised of White & Case's antitrust team, with particular contributions from J. Mark Gidley, George L. Paul, Katarzyna Czapracka, Strati Sakellariou-Witt, Tamer Nagy, Stefanie Benson, Belinda Harvey, Henri Capin Gally, Sezin Elcin Cengiz, Gabriela Baca, Joao Lacerda, Germán Ricardo Macías, Esma Akta, Anastasia Bodnar, Nina Frie, Daniel North, Ashley Stoner, Rucha Phadtare, Tony Lopez, and Nathan Martin.

White & Case means the international legal practice comprising White & Case LLP, a New York State registered limited liability partnership, White & Case LLP, a limited liability partnership incorporated under English law and all other affiliated partnerships, companies and entities.

This article is prepared for the general information of interested persons. It is not, and does not attempt to be, comprehensive in nature. Due to the general nature of its content, it should not be regarded as legal advice.

© 2022 White & Case LLP

View full image: US monthly merger notifications, 2021 vs. 2022* (PDF)

View full image: US monthly merger notifications, 2021 vs. 2022* (PDF)

View full image: US merger notifications, January – November 2017 – 2022 (PDF)

View full image: US merger notifications, January – November 2017 – 2022 (PDF)

View full image: EU merger notifications, January – November 2018 – 2022 (PDF)

View full image: EU merger notifications, January – November 2018 – 2022 (PDF)

View full image: EU merger notifications, 2012 – 2022* (PDF)

View full image: EU merger notifications, 2012 – 2022* (PDF)

View full image: Ukraine merger notifications, 2017 – 2022* (PDF)

View full image: Ukraine merger notifications, 2017 – 2022* (PDF)

View full image: Brazil merger notifications, January – November 2017 – 2022 (PDF)

View full image: Brazil merger notifications, January – November 2017 – 2022 (PDF)

View full image: Mexico merger notifications, 2014 – 2022* (PDF)

View full image: Mexico merger notifications, 2014 – 2022* (PDF)

View full image: Peru merger notifications, 2017 – 2022* (PDF)

View full image: Peru merger notifications, 2017 – 2022* (PDF)

View full image: Turkey merger notifications, 2013 – H1 2022 (PDF)

View full image: Turkey merger notifications, 2013 – H1 2022 (PDF)

View full image: Turkey merger notifications, H1 2017 – H1 2022* (PDF)

View full image: Turkey merger notifications, H1 2017 – H1 2022* (PDF)

View full image: Australia merger notifications, 2017 – 2022* (PDF)

View full image: Australia merger notifications, 2017 – 2022* (PDF)

View full image: Saudi Arabia merger notifications, 2017 – 2022* (PDF)

View full image: Saudi Arabia merger notifications, 2017 – 2022* (PDF)